Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Illustrate how the couple should go about generating their desired rental income stream whilst minimising duties payable and transaction costs. Show the duties that would

Illustrate how the couple should go about generating their desired rental income stream whilst minimising duties payable and transaction costs. Show the duties that would be payable in this manoeuvre.

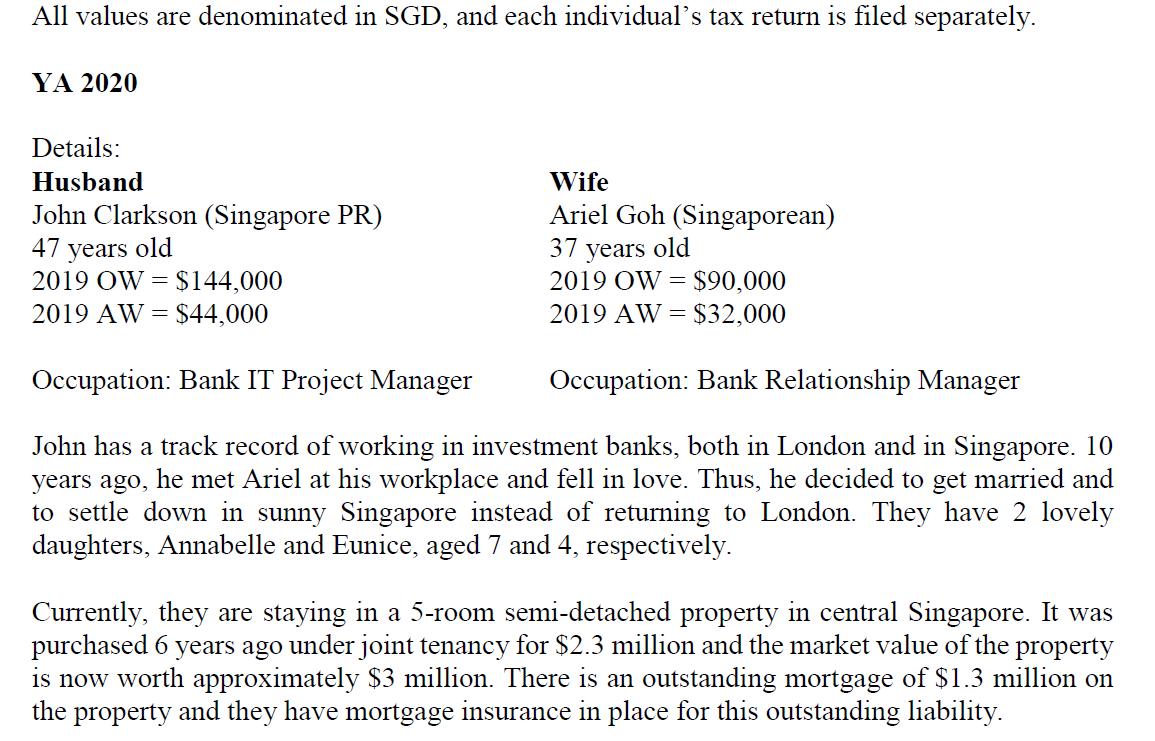

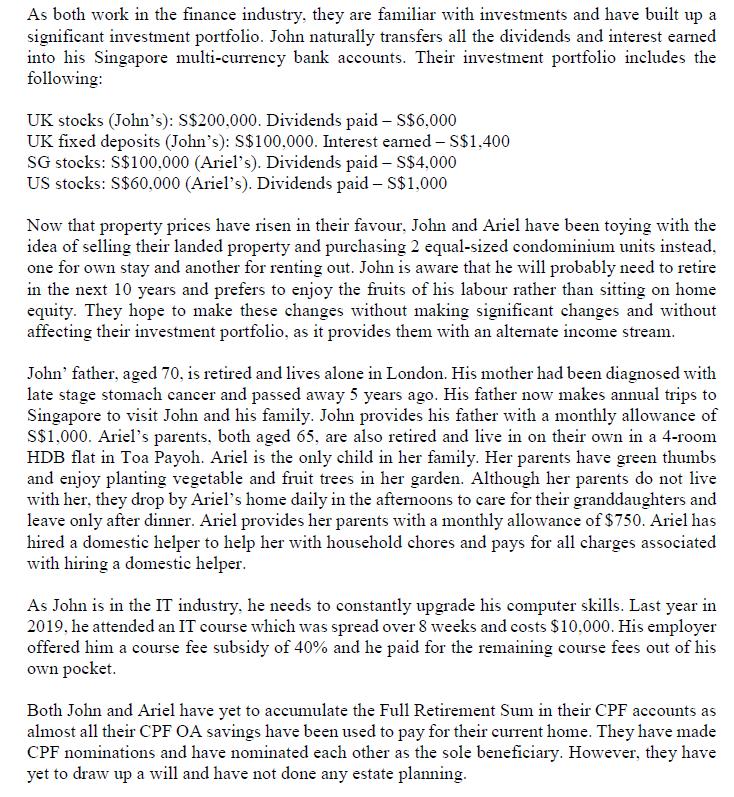

All values are denominated in SGD, and each individual's tax return is filed separately. YA 2020 Details: Husband John Clarkson (Singapore PR) 47 years old 2019 OW = $144,000 2019 AW = $44,000 Wife Ariel Goh (Singaporean) 37 years old 2019 OW $90,000 2019 AW = $32,000 = Occupation: Bank IT Project Manager Occupation: Bank Relationship Manager John has a track record of working in investment banks, both in London and in Singapore. 10 years ago, he met Ariel at his workplace and fell in love. Thus, he decided to get married and to settle down in sunny Singapore instead of returning to London. They have 2 lovely daughters, Annabelle and Eunice, aged 7 and 4, respectively. Currently, they are staying in a 5-room semi-detached property in central Singapore. It was purchased 6 years ago under joint tenancy for $2.3 million and the market value of the property is now worth approximately $3 million. There is an outstanding mortgage of $1.3 million on the property and they have mortgage insurance in place for this outstanding liability.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

If the couple sells their property and purchases two condominium units they will be liable for stamp duty on the purchase of the units The stamp duty ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started