Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Illustrated below is the investment and consumption schedule of an investor who earns a nominal rate of APR = 12% compounded quarterly on her

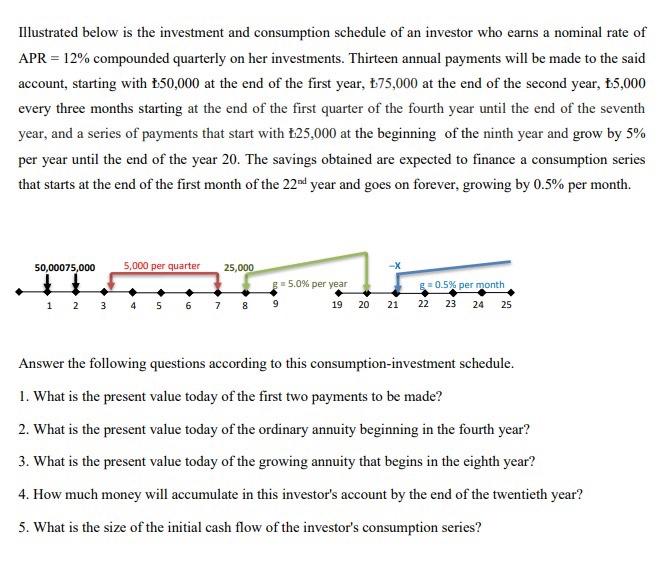

Illustrated below is the investment and consumption schedule of an investor who earns a nominal rate of APR = 12% compounded quarterly on her investments. Thirteen annual payments will be made to the said account, starting with 50,000 at the end of the first year, 75,000 at the end of the second year, 5,000 every three months starting at the end of the first quarter of the fourth year until the end of the seventh year, and a series of payments that start with 25,000 at the beginning of the ninth year and grow by 5% per year until the end of the year 20. The savings obtained are expected to finance a consumption series that starts at the end of the first month of the 22nd year and goes on forever, growing by 0.5% per month. 50,00075,000 12 5,000 per quarter 3 4 5 6 7 25,000 8 g= 5.0% per year 9 19 20 21 g=0.5% per month 22 23 24 25 Answer the following questions according to this consumption-investment schedule. 1. What is the present value today of the first two payments to be made? 2. What is the present value today of the ordinary annuity beginning in the fourth year? 3. What is the present value today of the growing annuity that begins in the eighth year? 4. How much money will accumulate in this investor's account by the end of the twentieth year? 5. What is the size of the initial cash flow of the investor's consumption series?

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 The present value today o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started