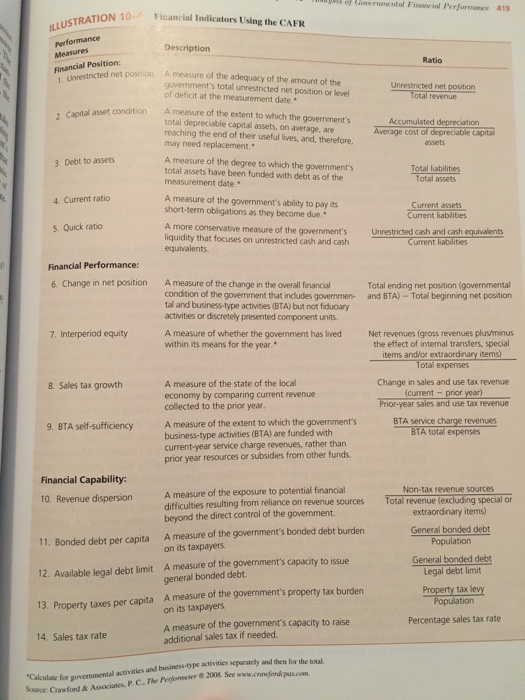

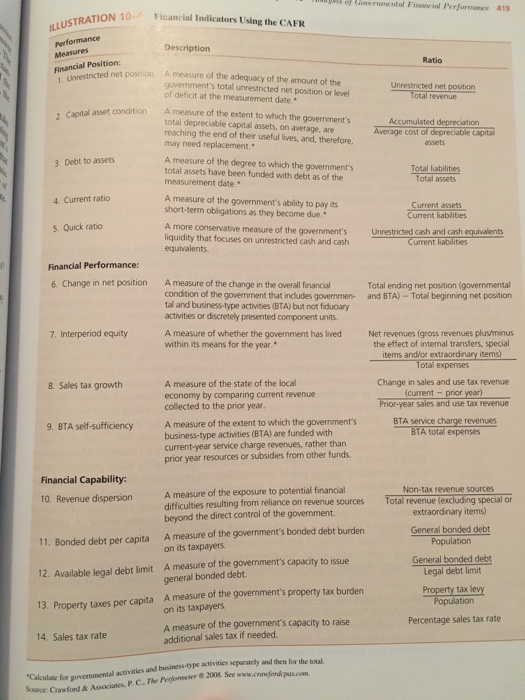

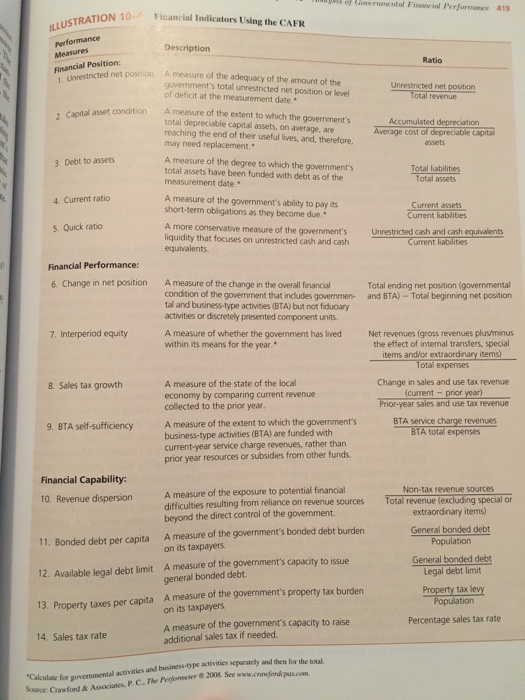

Illustration 10-4, adapted from Crawford and Associates, lists several ratios under the heading Financial Position. Which of the ratios listed most closely aligns with the GASB research study definition of financial position provided below? Explain why the ratios you selected align with the definition of financial position.

419 TION 10- Financial indicators Using the CAFR Position tricted net position A measure of the adequacy of the amount of the s total Unr estricted net position of deficit at net position or level the measurement date. capital asset condition A measure of the extent to which the government's total capital assets, on average, are reaching the end of their useful lives, and, therefore, A measure of the degree to which the government's total assets have been funded with debt as of the Total assets A measure of the government's ability to pay ts 4. Current ratio Current assets short-term obligations as they become due Current liabilities 5, Quick ratio A more conservative measure of the government's Unrestricted cash and cash equivalents liquidity that focuses on unrestricted cash and cash Current liabilities equivalents. Financial Performance: 6 Change in net position A measure of the change in the overall financial Total ending net position (governmental condition of the govemment that indudes governmen- and BTA) Total beginning net position tal and business-type activities (BTA) but not fiduciary activities or discretely presented component units Interperiod equity A measure of whether the government has lived Net revenues (gross revenues plusminus within its means for the year the effect of internal transfers, special items and or extraor Total expenses Change in sales and use tax revenue A measure of the state of the local 8. Sales tax growth economy by comparing current revenue collected to the prior year, Prior-year sales and use tax revenue A measure of the extent to which the government's BTA service 9, BTA self-sufficiency business-type activities (BTA) are funded with BTA total expenses service charge revenues, than prior year resources or subsidies from other funds. Financial Capability: A measure of the exposure to potential financial Non-tax revenue sources 10. Revenue dispersion difficulties resulting from reliance on revenue sources Total revenue (excluding special or beyond the direct control of the government. 11. Bonded debt per capita A measure of the government bonded debt burden on its taxpayers. General bonded debt 12. Available legal debt limit A measure of the government's capacity to issue general General bonded debt 13. Property taxes per capita A measure of the government's property tax burden Percentage sales tax rate A measure of the government's capacity to raise additional sales tax if needed. 14. Sales tax rate activities and business type activities separately and then for the total. 200s. See wwwarnefondTuscom