Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Illustration 21 Sugar Industries is planning to introduce a new product with projected life of 8 years. The project to be set up a backward

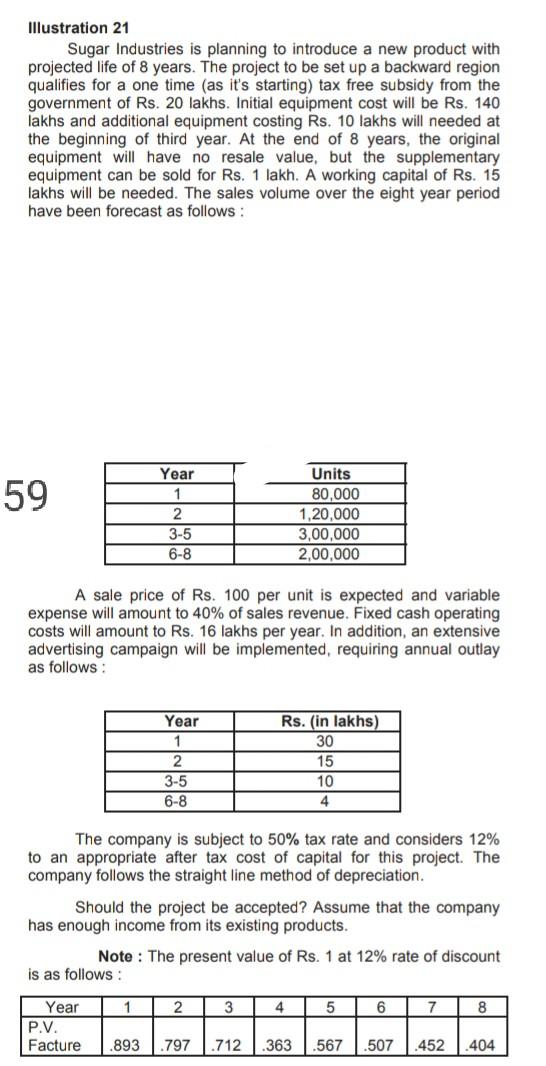

Illustration 21 Sugar Industries is planning to introduce a new product with projected life of 8 years. The project to be set up a backward region qualifies for a one time (as it's starting) tax free subsidy from the government of Rs. 20 lakhs. Initial equipment cost will be Rs. 140 lakhs and additional equipment costing Rs. 10 lakhs will needed at the beginning of third year. At the end of 8 years, the original equipment will have no resale value, but the supplementary equipment can be sold for Rs. 1 lakh. A working capital of Rs. 15 lakhs will be needed. The sales volume over the eight year period have been forecast as follows: 59 Year 1 2 3-5 6-8 Units 80,000 1,20,000 3,00,000 2,00,000 A sale price of Rs. 100 per unit is expected and variable expense will amount to 40% of sales revenue. Fixed cash operating costs will amount to Rs. 16 lakhs per year. In addition, an extensive advertising campaign will be implemented, requiring annual outlay as follows: Year 1 2 3-5 6-8 Rs. (in lakhs) 30 15 10 4 The company is subject to 50% tax rate and considers 12% to an appropriate after tax cost of capital for this project. The company follows the straight line method of depreciation. Should the project be accepted? Assume that the company has enough income from its existing products. Note: The present value of Rs. 1 at 12% rate of discount is as follows: 1 2 3 4 5 6 7 8 Year P.V. Facture 893 .797 .712 .363 567 .507 452 404

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started