Answered step by step

Verified Expert Solution

Question

1 Approved Answer

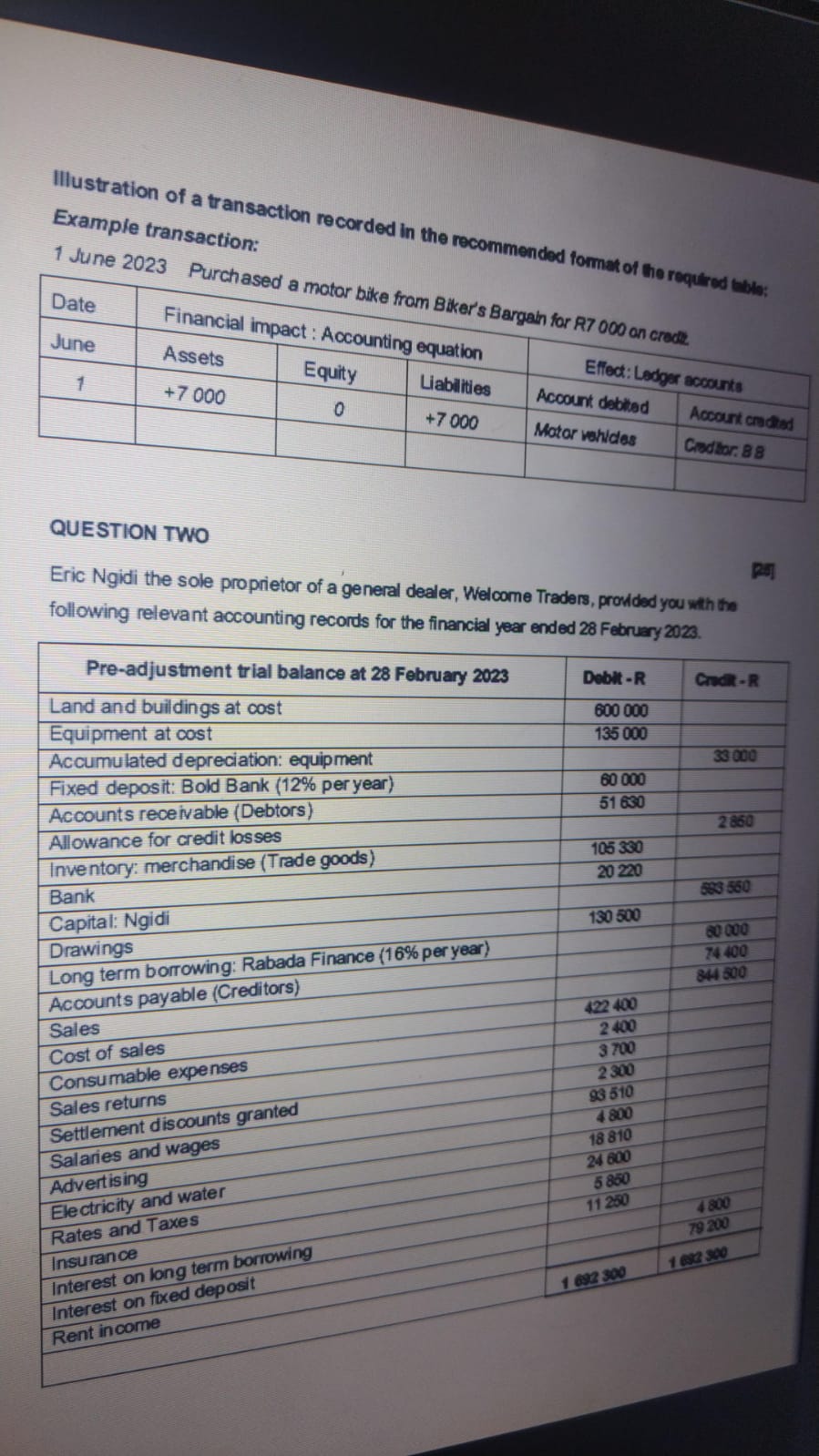

Illustration of a transaction recorded in the recommended format of the renus. Example transaction: 1 June 2023 Purchaen. QUESTION TWO Eric Ngidi the sole proprietor

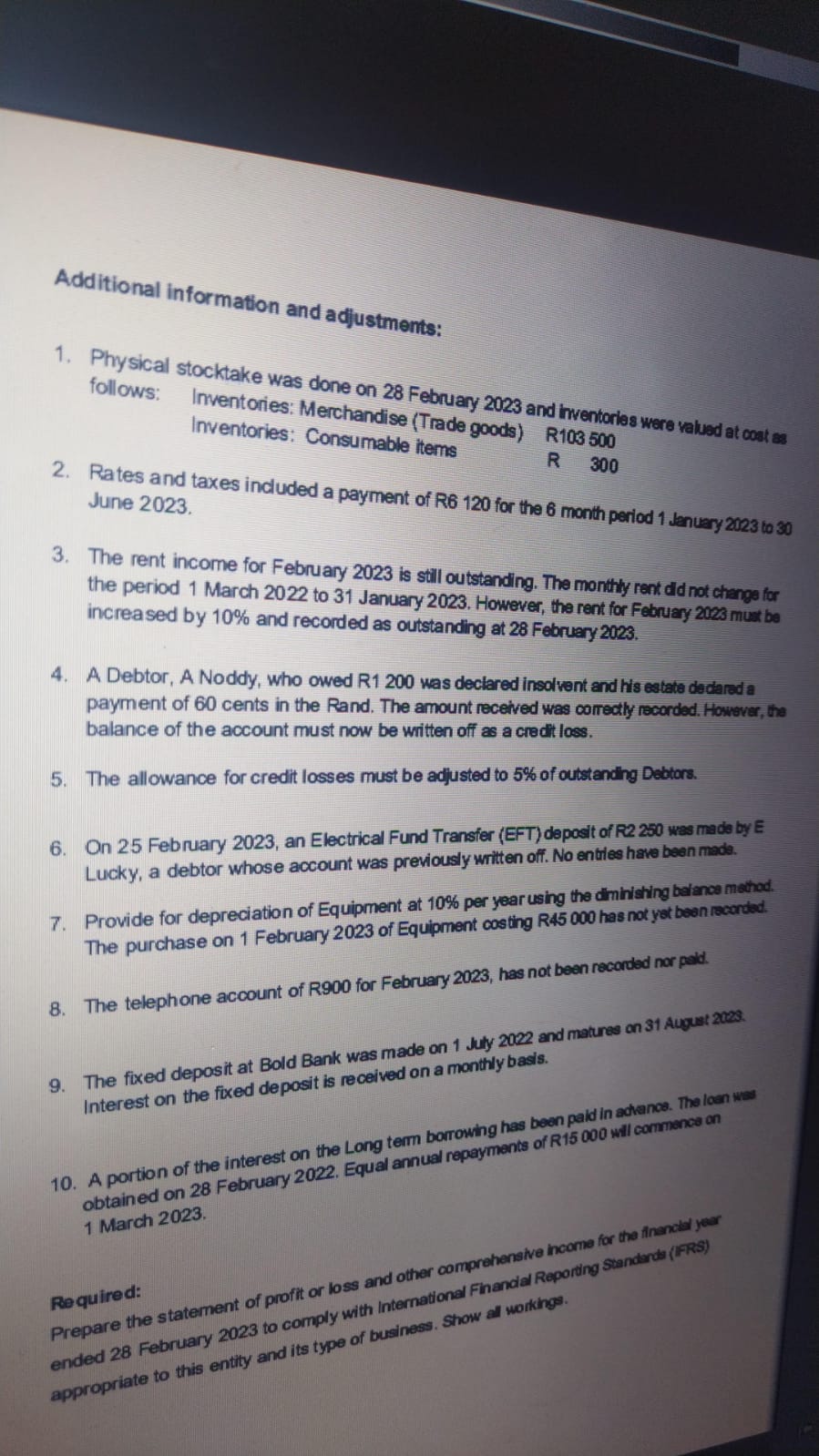

Illustration of a transaction recorded in the recommended format of the renus. Example transaction: 1 June 2023 Purchaen. QUESTION TWO Eric Ngidi the sole proprietor of a general dealer, Welcome Traders, provided you whth the following relevant accounting records for the financial year ended 28 Februev 2n23 Additional information and adjustments: 1. Physical stocktake was done on 28 February 2023 and imventories were valued at coat as follows: Inventories: Merchandise (Trade goods) R103500ConsumablethemsR300 Inventories: Consumable items 2. Rates and taxes included a payment of R6120 for the 6 month period 1 Jenuery 2023 to 30 June 2023. 3. The rent income for February 2023 is still outstanding. The monthly rent did not change for the period 1 March 2022 to 31 January 2023. However, the rent for February 2023 muxt be increased by 10% and recorded as outstanding at 28 February 2023 . 4. A Debtor, A Noddy, who owed R1 200 was dectared insolvent and his estate dedared a payment of 60 cents in the Rand. The amount received was comedly recorded. However, the balance of the account must now be written off a credit loss. 5. The allowance for credit losses must be adjusted to 5% of outstanding Debtors. 6. On 25 February 2023, an Electrical Fund Transfer (EFT) deposit of R2 250 wes made by E Lucky, a debtor whose account was previously written off. No entiles have been made. 7. Provide for depreciation of Equipment at 10% per year using the diministing balance mathod. The purchase on 1 February 2023 of Equipment costing R45 000 has not yot been reconded. 8. The telephone account of R900 for February 2023, has not been recorded nor pold. 9. The fixed deposit at Bold Bank was made on 1 July 2022 and matures on 31 Augut 2023. Interest on the fixed deposit is received on a monthly basis. 10. A portion of the interest on the Long term borrowing has been pald in actance. The loen was obtained on 28 February 2022. Equal annual repayments of R15000 will commencea on 1 March 2023. Required: Prepare the statement of profit or loss and other comprehensive hocme for the financid yed anded 28 February 2023 to comply with international Finandal Reporting standerita (FRS) antiv and its type of business. Show al workings

Illustration of a transaction recorded in the recommended format of the renus. Example transaction: 1 June 2023 Purchaen. QUESTION TWO Eric Ngidi the sole proprietor of a general dealer, Welcome Traders, provided you whth the following relevant accounting records for the financial year ended 28 Februev 2n23 Additional information and adjustments: 1. Physical stocktake was done on 28 February 2023 and imventories were valued at coat as follows: Inventories: Merchandise (Trade goods) R103500ConsumablethemsR300 Inventories: Consumable items 2. Rates and taxes included a payment of R6120 for the 6 month period 1 Jenuery 2023 to 30 June 2023. 3. The rent income for February 2023 is still outstanding. The monthly rent did not change for the period 1 March 2022 to 31 January 2023. However, the rent for February 2023 muxt be increased by 10% and recorded as outstanding at 28 February 2023 . 4. A Debtor, A Noddy, who owed R1 200 was dectared insolvent and his estate dedared a payment of 60 cents in the Rand. The amount received was comedly recorded. However, the balance of the account must now be written off a credit loss. 5. The allowance for credit losses must be adjusted to 5% of outstanding Debtors. 6. On 25 February 2023, an Electrical Fund Transfer (EFT) deposit of R2 250 wes made by E Lucky, a debtor whose account was previously written off. No entiles have been made. 7. Provide for depreciation of Equipment at 10% per year using the diministing balance mathod. The purchase on 1 February 2023 of Equipment costing R45 000 has not yot been reconded. 8. The telephone account of R900 for February 2023, has not been recorded nor pold. 9. The fixed deposit at Bold Bank was made on 1 July 2022 and matures on 31 Augut 2023. Interest on the fixed deposit is received on a monthly basis. 10. A portion of the interest on the Long term borrowing has been pald in actance. The loen was obtained on 28 February 2022. Equal annual repayments of R15000 will commencea on 1 March 2023. Required: Prepare the statement of profit or loss and other comprehensive hocme for the financid yed anded 28 February 2023 to comply with international Finandal Reporting standerita (FRS) antiv and its type of business. Show al workings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started