Question

Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit Question One (1) The budgeted income statement for one of the

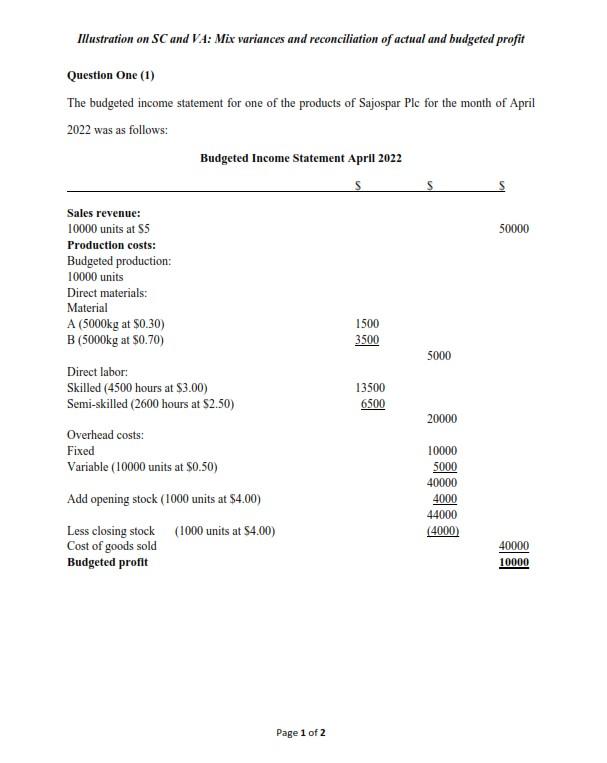

Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit Question One (1) The budgeted income statement for one of the products of Sajospar Plc for the month of April 2022 was as follows: Budgeted Income Statement April 2022 $ $ $ Sales revenue: 10000 units at $5 50000 Production costs: Budgeted production: 10000 units Direct materials: Material A (5000kg at $0.30) 1500 B (5000kg at $0.70) 3500 5000 Direct labor: Skilled (4500 hours at $3.00) 13500 Semi-skilled (2600 hours at $2.50) 6500 20000 Overhead costs: Fixed 10000 Variable (10000 units at $0.50) 5000 40000 Add opening stock (1000 units at $4.00) 4000 44000 Less closing stock (1000 units at $4.00)

(4000) Cost of goods sold 40000 Budgeted profit 10000

(4000) Cost of goods sold 40000 Budgeted profit 10000

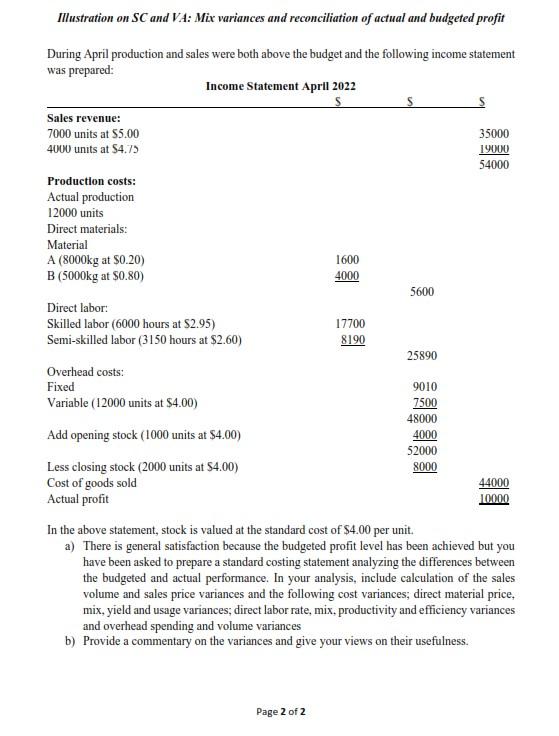

Page 1 of 2 Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit During April production and sales were both above the budget and the following income statement was prepared: Income Statement April 2022 $ $ $ Sales revenue: 7000 units at $5.00 35000 4000 units at $4.75 19000 54000 Production costs: Actual production 12000 units Direct materials: Material A (8000kg at $0.20) 1600 B (5000kg at $0.80) 4000 5600 Direct labor: Skilled labor (6000 hours at $2.95) 17700 Semi-skilled labor (3150 hours at $2.60) 8190 25890 Overhead costs: Fixed 9010 Variable (12000 units at $4.00) 7500 48000 Add opening stock (1000 units at $4.00) 4000 52000 Less closing stock (2000 units at $4.00) 8000 Cost of goods sold 44000 Actual profit 10000

In the above statement, stock is valued at the standard cost of $4.00 per unit. a) There is general satisfaction because the budgeted profit level has been achieved but you have been asked to prepare a standard costing statement analyzing the differences between the budgeted and actual performance. In your analysis, include calculation of the sales volume and sales price variances and the following cost variances; direct material price, mix, yield and usage variances; direct labor rate, mix, productivity and efficiency variances and overhead spending and volume variances b) Provide a commentary on the variances and give your views on their usefulness. Page 2 of 2

Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit Question One (1) The budgeted income statement for one of the products of Sajospar Plc for the month of April 2022 was as follows: Budgeted Income Statement April 2022 Sales revenue: 10000 units at $5 50000 Production costs: Budgeted production: 10000 units Direct materials: Material A (5000kg at $0.30) 1500 3500 B (5000kg at $0.70) Direct labor: Skilled (4500 hours at $3.00) 13500 Semi-skilled (2600 hours at $2.50) 6500 Overhead costs: Fixed Variable (10000 units at $0.50) Add opening stock (1000 units at $4.00) Less closing stock (1000 units at $4.00) Cost of goods sold Budgeted profit Page 1 of 2 5000 20000 10000 5000 40000 4000 44000 (4000) 40000 10000 Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit During April production and sales were both above the budget and the following income statement was prepared: Income Statement April 2022 S Sales revenue: 7000 units at $5.00 35000 19000 4000 units at $4.75 54000 Production costs: Actual production 12000 units Direct materials: Material A (8000kg at $0.20) 1600 B (5000kg at $0.80) 4000 5600 Direct labor: 17700 Skilled labor (6000 hours at $2.95) Semi-skilled labor (3150 hours at $2.60) 8190 25890 Overhead costs: Fixed 9010 Variable (12000 units at $4.00) 7500 48000 Add opening stock (1000 units at $4.00) 4000 52000 8000 Less closing stock (2000 units at $4.00) Cost of goods sold 44000 10000 Actual profit In the above statement, stock is valued at the standard cost of $4.00 per unit. a) There is general satisfaction because the budgeted profit level has been achieved but you have been asked to prepare a standard costing statement analyzing the differences between the budgeted and actual performance. In your analysis, include calculation of the sales volume and sales price variances and the following cost variances; direct material price, mix, yield and usage variances; direct labor rate, mix. productivity and efficiency variances and overhead spending and volume variances b) Provide a commentary on the variances and give your views on their usefulness. Page 2 of 2 Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit Question One (1) The budgeted income statement for one of the products of Sajospar Plc for the month of April 2022 was as follows: Budgeted Income Statement April 2022 Sales revenue: 10000 units at $5 50000 Production costs: Budgeted production: 10000 units Direct materials: Material A (5000kg at $0.30) 1500 3500 B (5000kg at $0.70) Direct labor: Skilled (4500 hours at $3.00) 13500 Semi-skilled (2600 hours at $2.50) 6500 Overhead costs: Fixed Variable (10000 units at $0.50) Add opening stock (1000 units at $4.00) Less closing stock (1000 units at $4.00) Cost of goods sold Budgeted profit Page 1 of 2 5000 20000 10000 5000 40000 4000 44000 (4000) 40000 10000 Illustration on SC and VA: Mix variances and reconciliation of actual and budgeted profit During April production and sales were both above the budget and the following income statement was prepared: Income Statement April 2022 S Sales revenue: 7000 units at $5.00 35000 19000 4000 units at $4.75 54000 Production costs: Actual production 12000 units Direct materials: Material A (8000kg at $0.20) 1600 B (5000kg at $0.80) 4000 5600 Direct labor: 17700 Skilled labor (6000 hours at $2.95) Semi-skilled labor (3150 hours at $2.60) 8190 25890 Overhead costs: Fixed 9010 Variable (12000 units at $4.00) 7500 48000 Add opening stock (1000 units at $4.00) 4000 52000 8000 Less closing stock (2000 units at $4.00) Cost of goods sold 44000 10000 Actual profit In the above statement, stock is valued at the standard cost of $4.00 per unit. a) There is general satisfaction because the budgeted profit level has been achieved but you have been asked to prepare a standard costing statement analyzing the differences between the budgeted and actual performance. In your analysis, include calculation of the sales volume and sales price variances and the following cost variances; direct material price, mix, yield and usage variances; direct labor rate, mix. productivity and efficiency variances and overhead spending and volume variances b) Provide a commentary on the variances and give your views on their usefulness. Page 2 of 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started