Answered step by step

Verified Expert Solution

Question

1 Approved Answer

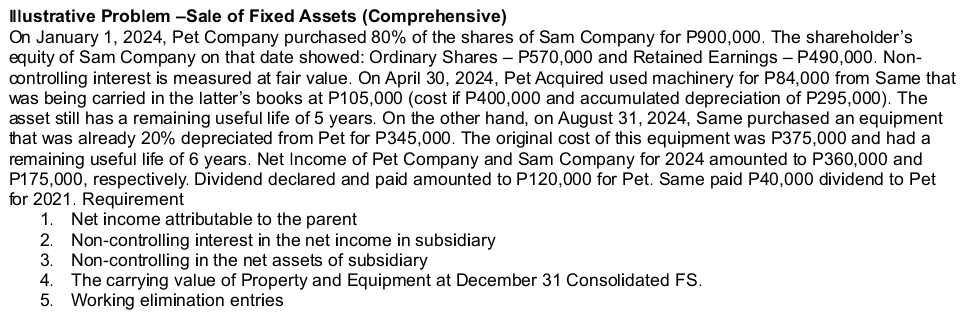

Illustrative Problem - Sale of Fixed Assets ( Comprehensive ) On January 1 , 2 0 2 4 , Pet Company purchased 8 0 %

Illustrative Problem Sale of Fixed Assets Comprehensive

On January Pet Company purchased of the shares of Sam Company for P The shareholder's

equity of Sam Company on that date showed: Ordinary Shares P and Retained Earnings P Non

controlling interest is measured at fair value. On April Pet Acquired used machinery for P from Same that

was being carried in the latter's books at Pcost if P and accumulated depreciation of P The

asset still has a remaining useful life of years. On the other hand, on August Same purchased an equipment

that was already depreciated from Pet for P The original cost of this equipment was P and had a

remaining useful life of years. Net Income of Pet Company and Sam Company for amounted to P and

P respectively. Dividend declared and paid amounted to P for Pet. Same paid P dividend to Pet

for Requirement

Net income attributable to the parent

Noncontrolling interest in the net income in subsidiary

Noncontrolling in the net assets of subsidiary

The carrying value of Property and Equipment at December Consolidated FS

Working elimination entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started