Answered step by step

Verified Expert Solution

Question

1 Approved Answer

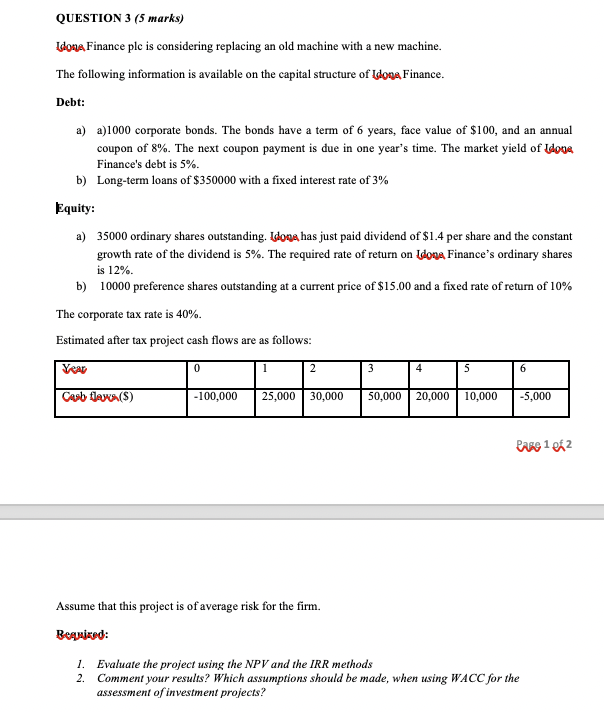

Ilowa Finance plc is considering replacing an old machine with a new machine. The following information is available on the capital structure of Idona Finance.

Ilowa Finance plc is considering replacing an old machine with a new machine. The following information is available on the capital structure of Idona Finance. Debt: a) a) 1000 corporate bonds. The bonds have a term of 6 years, face value of $100, and an annual coupon of 8%. The next coupon payment is due in one year's time. The market yield of doon Finance's debt is 5%. b) Long-term loans of $350000 with a fixed interest rate of 3% Equity: a) 35000 ordinary shares outstanding. Ilona has just paid dividend of $1.4 per share and the constant growth rate of the dividend is 5%. The required rate of return on Idona Finance's ordinary shares is 12%. b) 10000 preference shares outstanding at a current price of $15.00 and a fixed rate of return of 10% The corporate tax rate is 40%. Estimated after tax project cash flows are as follows: eare 1 of 2 Assume that this project is of average risk for the firm. Bequired: 1. Evaluate the project using the NPV and the IRR methods 2. Comment your results? Which assumptions should be made, when using WACC for the assessment of investment projects

Ilowa Finance plc is considering replacing an old machine with a new machine. The following information is available on the capital structure of Idona Finance. Debt: a) a) 1000 corporate bonds. The bonds have a term of 6 years, face value of $100, and an annual coupon of 8%. The next coupon payment is due in one year's time. The market yield of doon Finance's debt is 5%. b) Long-term loans of $350000 with a fixed interest rate of 3% Equity: a) 35000 ordinary shares outstanding. Ilona has just paid dividend of $1.4 per share and the constant growth rate of the dividend is 5%. The required rate of return on Idona Finance's ordinary shares is 12%. b) 10000 preference shares outstanding at a current price of $15.00 and a fixed rate of return of 10% The corporate tax rate is 40%. Estimated after tax project cash flows are as follows: eare 1 of 2 Assume that this project is of average risk for the firm. Bequired: 1. Evaluate the project using the NPV and the IRR methods 2. Comment your results? Which assumptions should be made, when using WACC for the assessment of investment projects Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started