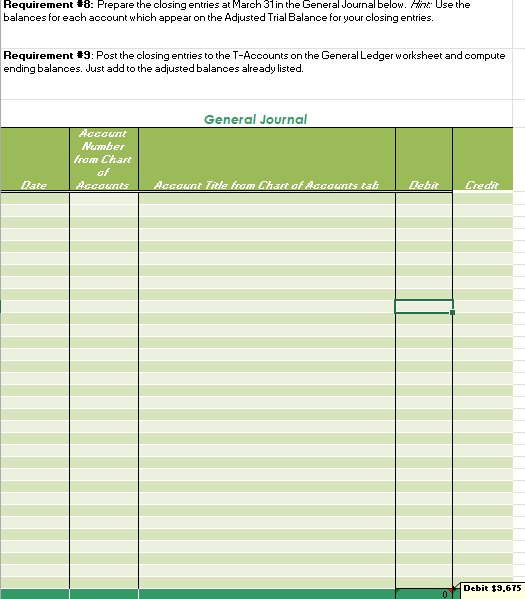

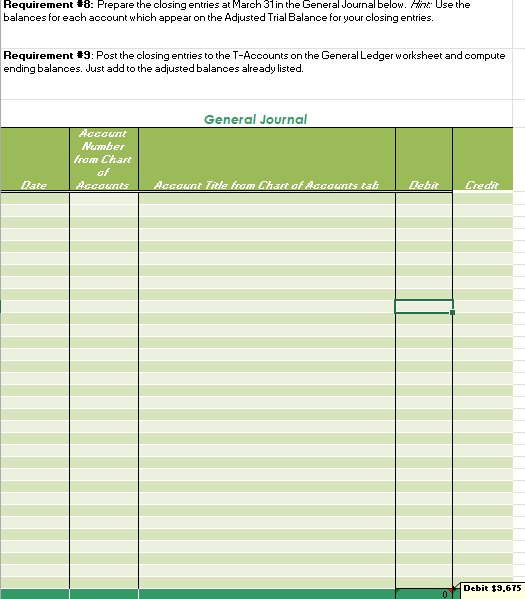

Im confused with the general journal requirements 8-9. please help

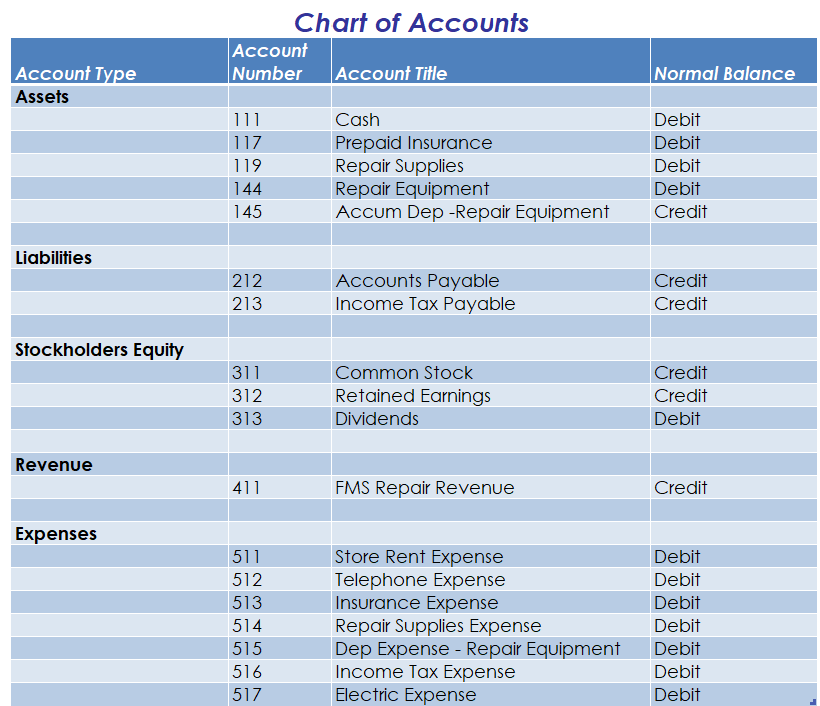

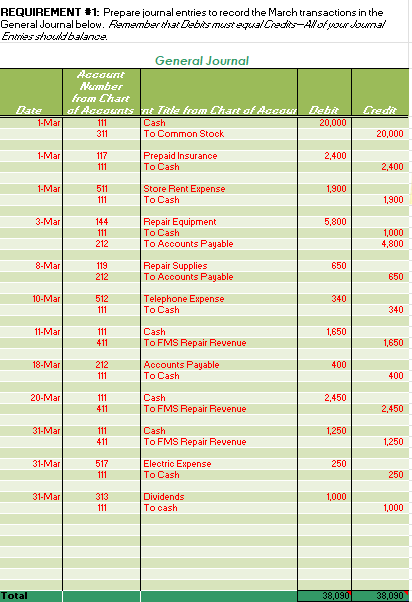

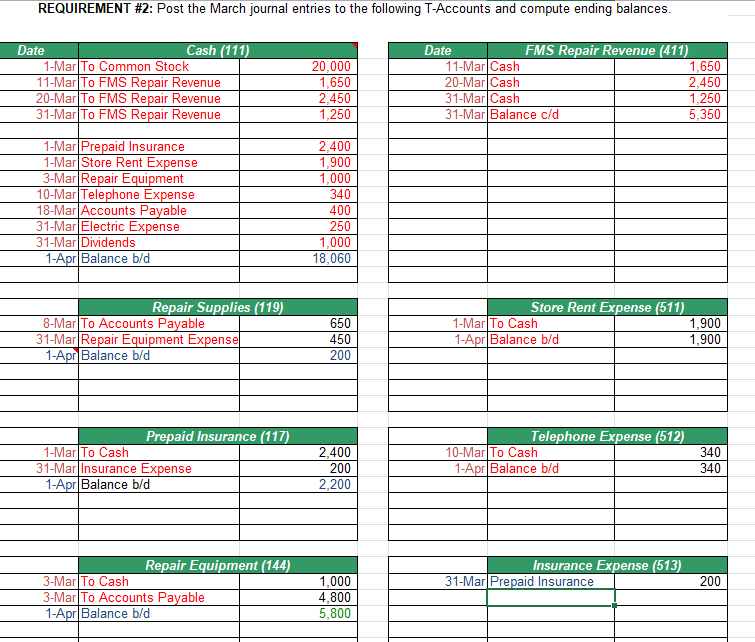

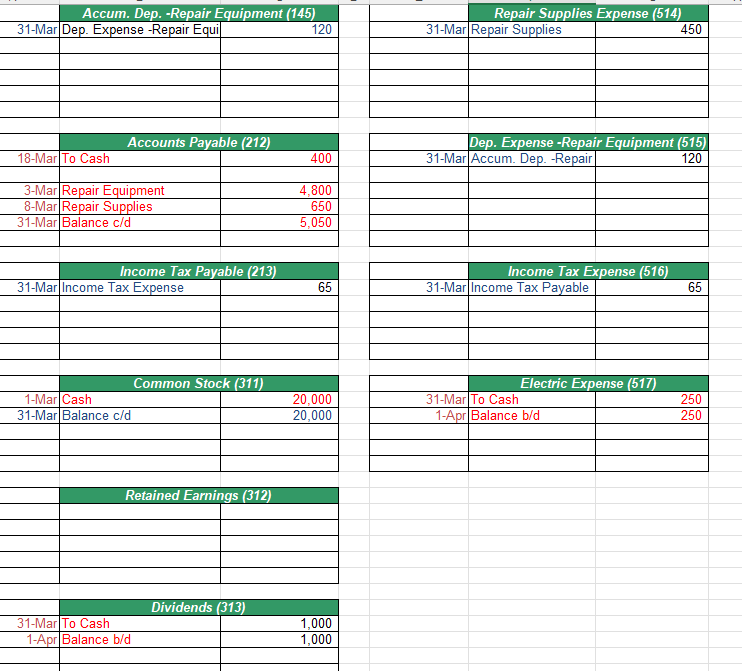

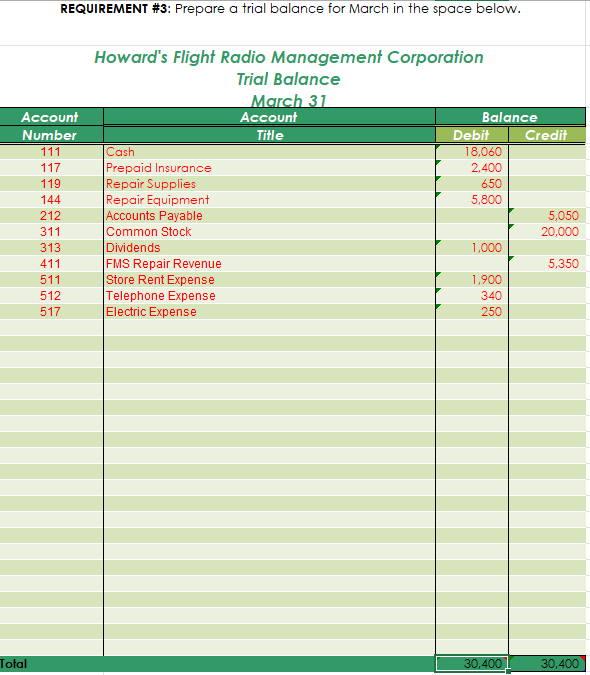

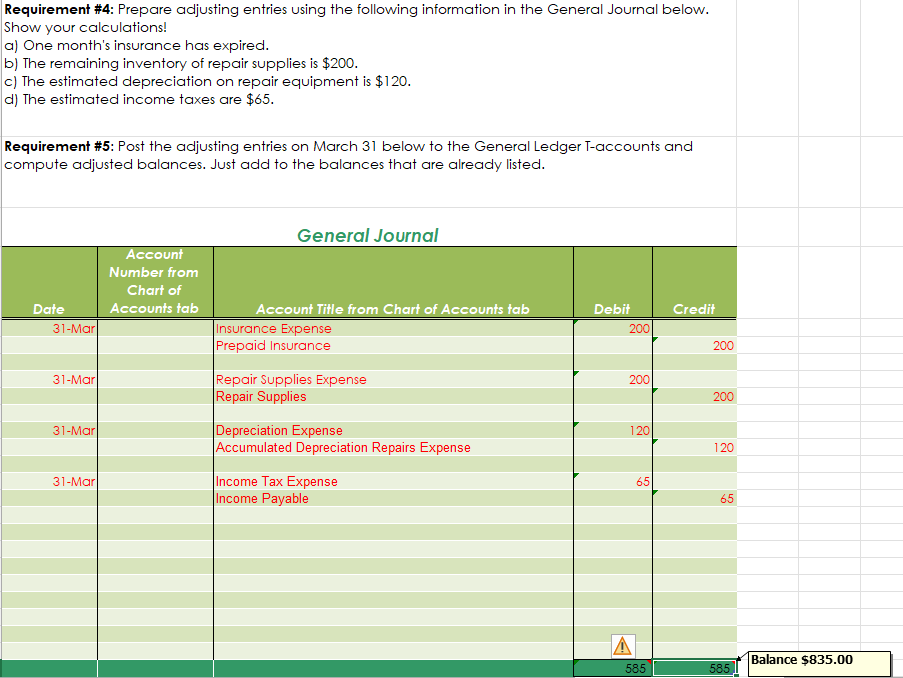

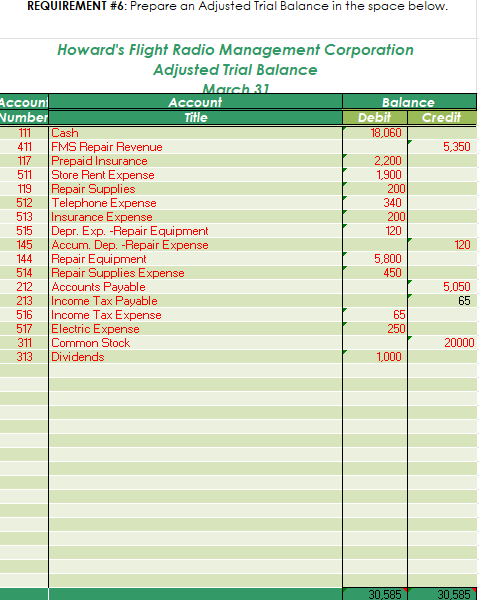

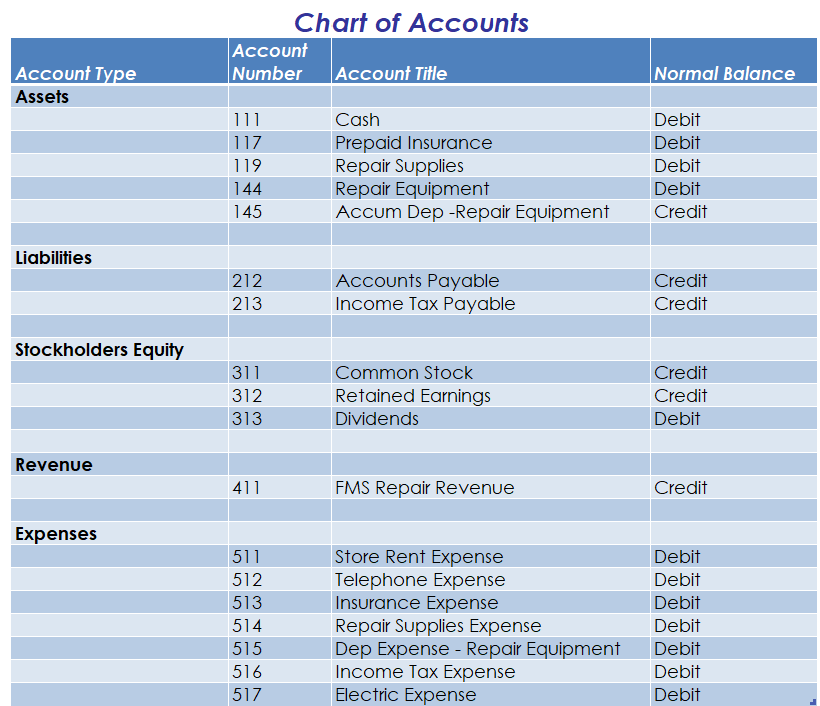

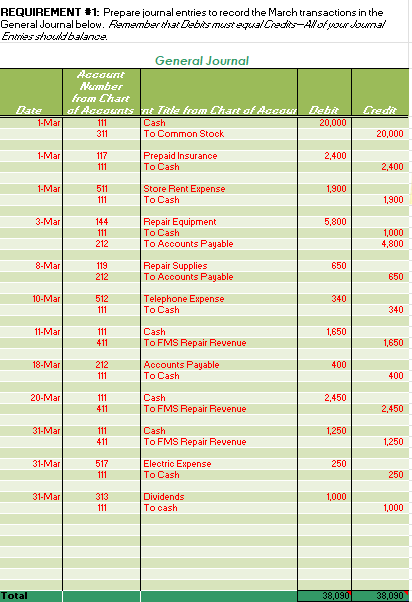

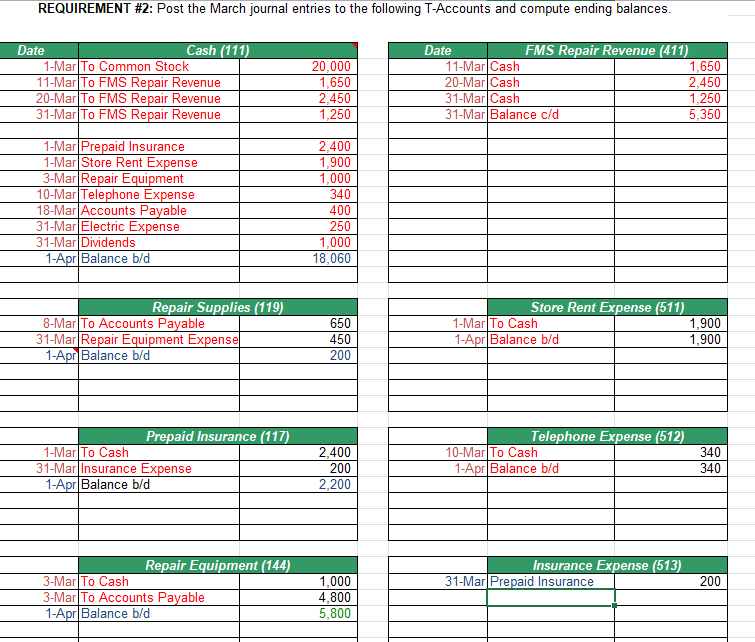

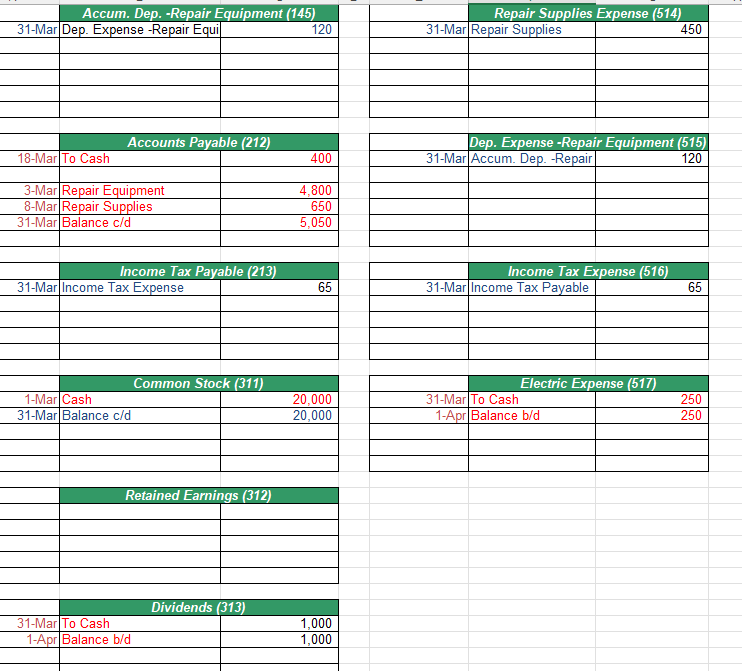

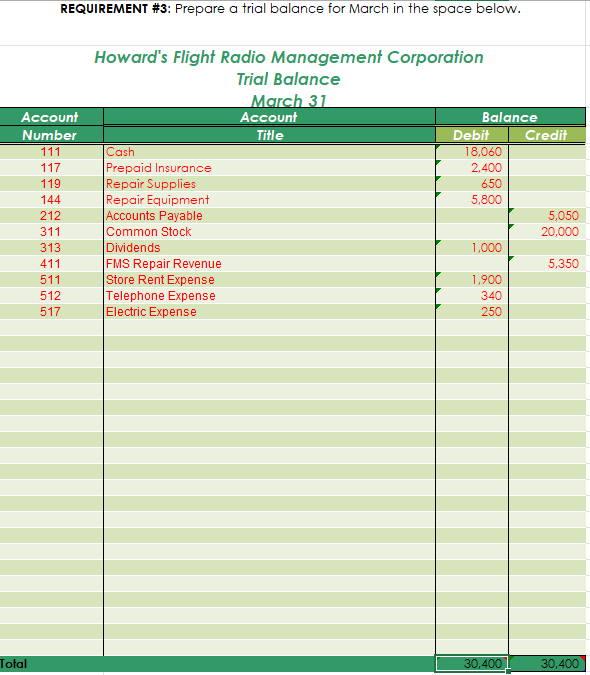

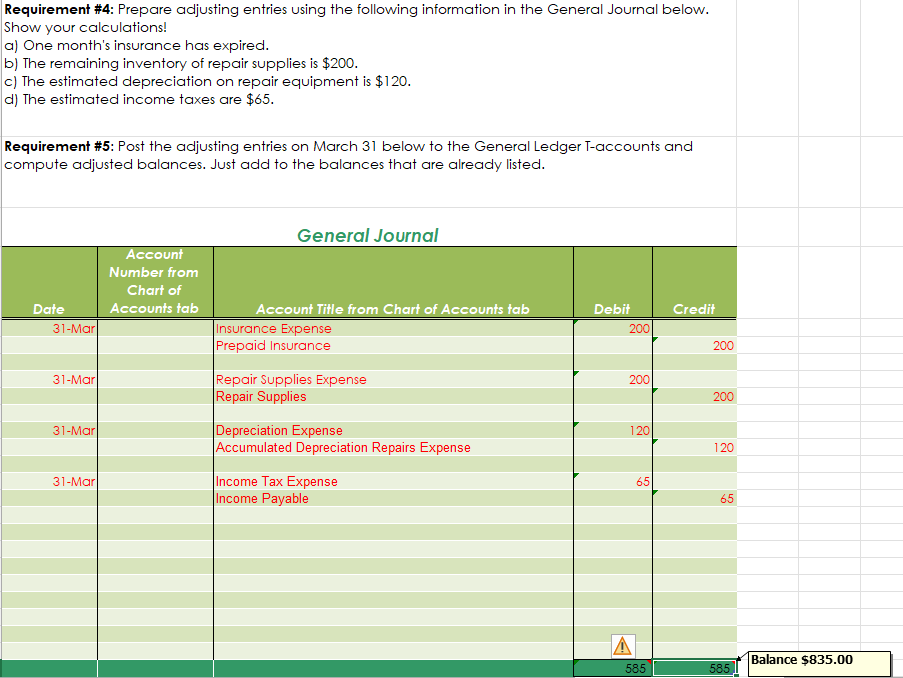

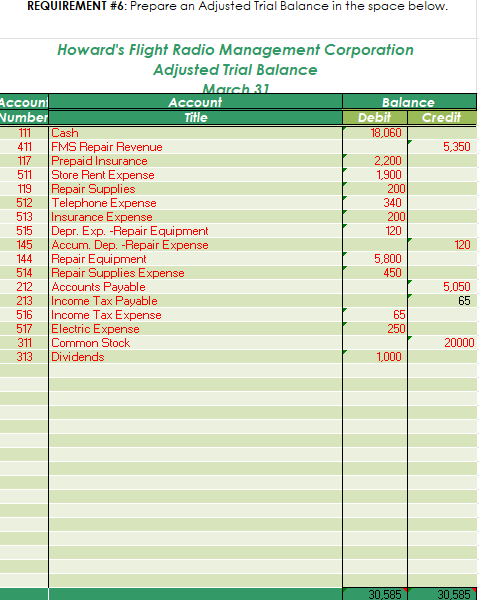

Account Type Assets Liabilities Stockholders Equity Revenue Expenses Chart of Accounts Account Title Cash Prepaid Insurance Repair Supplies Repair Equipment Accum Dep -Repair Equipment Accounts Payable Income Tax Payable Common Stock Retained Earnings Dividends FMS Repair Revenue Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income Tax Expense Electric Expense Account Number 111 117 119 144 145 212 213 311 312 313 411 511 512 513 514 515 516 517 Normal Balance Debit Debit Debit Debit Credit Credit Credit Credit Credit Debit Credit Debit Debit Debit Debit Debit Debit Debit REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. General Journal Account Number from Chart Date of Accounts Credit nt Title from Chart of Accoua Debit Cash 111 20,000 311 To Common Stock 117 Prepaid Insurance 2,400 111 To Cash 511 Store Rent Expense 1,900 111 To Cash 144 5,800 Repair Equipment To Cash 111 212 To Accounts Payable 119 Repair Supplies 650 212 To Accounts Payable 512 Telephone Expense 340 111 To Cash 111 Cash 1,650 411 To FMS Repair Revenue 212 Accounts Payable 400 111 To Cash 111 Cash 2,450 411 To FMS Repair Revenue 111 Cash 1,250 411 To FMS Repair Revenue 517 250 Electric Expense To Cash 111 313 Dividends To cash 111 Total 1-Mar 1-Mar 1-Mar 3-Mar 8-Mar 10-Mar 11-Mar 18-Mar 20-Mar 31-Mar 31-Mar 31-Mar 1,000 38,090 20,000 2,400 1,900 1,000 4,800 650 340 1,650 400 2,450 1,250 250 1,000 38,090 REQUIREMENT #2: Post the March journal entries to the following T-Accounts and compute ending balances. Date Cash (111) Date FMS Repair Revenue (411) 11-Mar Cash 20,000 1,650 20-Mar Cash 1-Mar To Common Stock 11-Mar To FMS Repair Revenue 20-Mar To FMS Repair Revenue 31-Mar To FMS Repair Revenue 2,450 31-Mar Cash 1,250 31-Mar Balance c/d 2.400 1,900 1,000 340 1-Mar Prepaid Insurance 1-Mar Store Rent Expense 3-Mar Repair Equipment 10-Mar Telephone Expense 18-Mar Accounts Payable 31-Mar Electric Expense 31-Mar Dividends 1-Apr Balance b/d 400 250 1,000 18,060 650 8-Mar To Accounts Payable 31-Mar Repair Equipment Expense 1-Apr Balance b/d 1-Mar To Cash 1-Apr Balance b/d 450 200 1-Mar To Cash 2,400 200 10-Mar To Cash 1-Apr Balance b/d 31-Mar Insurance Expense 1-Apr Balance b/d 2,200 3-Mar To Cash 31-Mar Prepaid Insurance 1,000 4,800 3-Mar To Accounts Payable 1-Apr Balance b/d 5,800 Repair Supplies (119) Prepaid Insuran (117) Repair Equipment (144) Store Rent Expense (511) Telephone Expense (512) Insurance Expense (513) 1,650 2,450 1,250 5,350 1,900 1,900 340 340 200 Accum. Dep. -Repair Equipment (145) 31-Mar Dep. Expense -Repair Equil 120 Accounts Payable (212) 18-Mar To Cash 400 4,800 3-Mar Repair Equipment 8-Mar Repair Supplies 31-Mar Balance c/d 650 5,050 Income Tax Payable (213) 31-Mar Income Tax Expense 65 Common Stock (311) 1-Mar Cash 31-Mar Balance c/d 20,000 20,000 Retained Earnings (312) Dividends (313) 31-Mar To Cash 1-Apr Balance b/d 1,000 1,000 Repair Supplies Expense (514) 31-Mar Repair Supplies 450 Dep. Expense -Repair Equipment (515) 31-Mar Accum. Dep. -Repair 120 Income Tax Expense (516) 31-Mar Income Tax Payable Electric Expense (517) 31-Mar To Cash 1-Apr Balance b/d 65 250 250 REQUIREMENT #3: Prepare a trial balance for March in the space below. Howard's Flight Radio Management Corporation Trial Balance March 31 Debit Cash Prepaid Insurance Repair Supplies Repair Equipment Accounts Payable Common Stock Dividends FMS Repair Revenue Store Rent Expense Telephone Expense Electric Expense Account Number 111 117 119 144 212 311 313 411 511 512 517 Total Account Title Balance 18,060 2,400 650 5,800 1,000 1,900 340 250 30,400 Credit 5,050 20,000 5,350 30,400 Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $120. d) The estimated income taxes are $65. Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Journal Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab Debit Credit 31-Mar 31-Mar 31-Mar 31-Mar Insurance Expense Prepaid Insurance Repair Supplies Expense Repair Supplies Depreciation Expense Accumulated Depreciation Repairs Expense Income Tax Expense Income Payable 200 200 120 65 A 585 200 200 120 65 5851 Balance $835.00 REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 Account Balance Title Debit Account Number 111 Cash 411 FMS Repair Revenue Prepaid Insurance 117 511 Store Rent Expense Repair Supplies 119 512 Telephone Expense 513 Insurance Expense 515 Depr. Exp. -Repair Equipment 145 Accum. Dep. -Repair Expense 144 Repair Equipment 514 Repair Supplies Expense 212 Accounts Payable 213 Income Tax Payable 516 Income Tax Expense 517 Electric Expense 311 Common Stock 313 Dividends 18,060 2,200 1,900 200 340 200 120 5,800 450 65 250 1,000 30,585 Credit 5,350 120 5,050 65 20000 30,585 Requirement #8: Prepare the closing entries at March 31 in the General Journal below. Hinne: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending balances. Just add to the adjusted balances already listed. General Journal Account Number from Chart of Date Accounts Account Title from Chart of Accounts tab Debit Credit Debit $3,675 0