I'm having a hard time in answering. :(

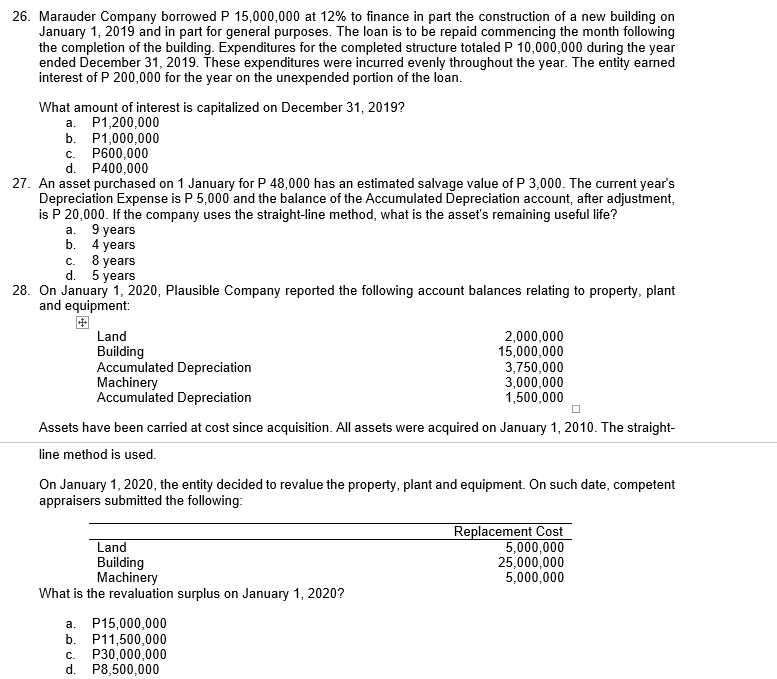

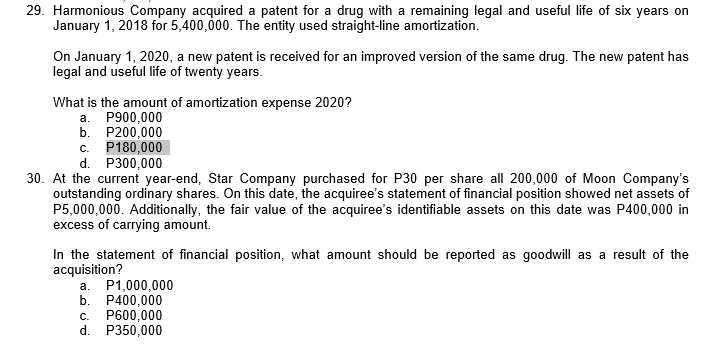

26. 2?. 28. Marauder Company borrowed P 15,000,000 at 12% to nance in part the constmction of a nevir building on January 1, 2019 and in part for general purposes. The loan is to be repaid commencing the month following the completion of the building. Expenditures for the completed structure totaled P 10,000,000 during the year ended December 31, 2019. These expenditures were incurred evenly throughout the year. The entity earned interest of P 200,000 for the year on the unexpended portion of the loan. What amount of interest is capitalized on December 31, 2019? a. P1,200,000 b. P1 ,0 00,000 c. P500000 cl. P400000 An asset purchased on 1 January for P 40,000 has an estimated salvage value of P 3,0 00. The current year's Depreciation Expense is P 5,000 and the balance of the Accumulated Depreciation account, after adjustment, is P 20,000. If the company uses the straight-line method, what is the asset's remaining useful life? a. 9 years b. 4 years c. 8 years d. 5 years On January 1, 2020, Plausible Company reported the following account balances relating to property, plant and equipment Land 2,000,000 Building 15,000,000 Accumulated Depreciation 3,750,000 Machinery 3,000,000 Accumulated Depreciation 1,500,000 I: Assets have been carried at cost since acquisition. All assets were acquired on January 1, 2010. The straight- line method is used. On January 1, 2020, the entity decided to revalue the property, plant and eg uipment. On such date, competent appraisers submitted the following: Replacement IDost Land 5,000,000 Building 25,000,000 Machinery 5,000,000 What is the revaluation surplus on January 1, 2020? a. P15,000,000 b. P11,500,000 c. P30,000,000 d. P8,500,000 29. Harmonious Company acquired a patent for a drug with a remaining legal and useful life of six years on January 1, 2018 for 5,400,000. The entity used straight-line amortization. On January 1, 2020, a new patent is received for an improved version of the same drug. The new patent has legal and useful life of twenty years. What is the amount of amortization expense 2020? a. P900,000 b. P200,000 C. P180,000 d. P300,000 30. At the current year-end, Star Company purchased for P30 per share all 200,000 of Moon Company's outstanding ordinary shares. On this date, the acquiree's statement of financial position showed net assets of P5,000,000. Additionally, the fair value of the acquiree's identifiable assets on this date was P400,000 in excess of carrying amount. In the statement of financial position, what amount should be reported as goodwill as a result of the acquisition? a. P1,000.000 b. P400,000 C. P600,000 d. P350,000