Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm having a hard time working through this written out. I need to use this formula but I am not sure exactly how to work

I'm having a hard time working through this written out. I need to use this formula but I am not sure exactly how to work through all the steps to get YTM and then move on from there to get the rest

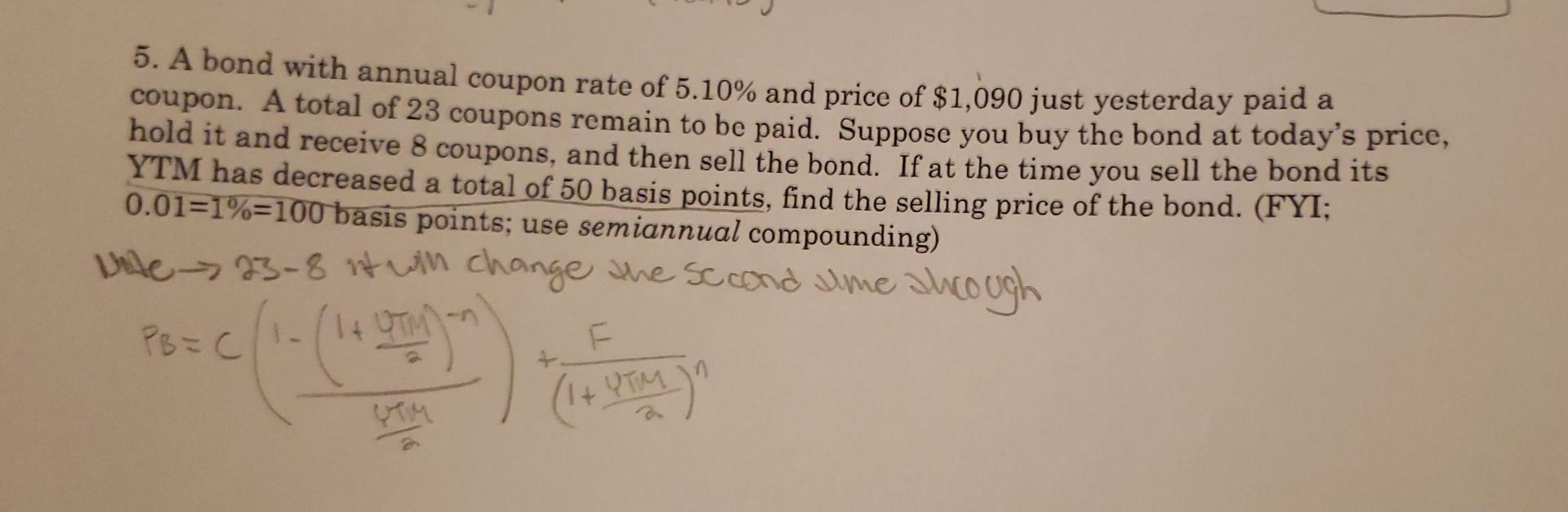

5. A bond with annual coupon rate of 5.10% and price of $1,090 just yesterday paid a coupon. A total of 23 coupons remain to be paid. Suppose you buy the bond at today's price, hold it and receive 8 coupons, and then sell the bond. If at the time you sell the bond its YTM has decreased a total of 50 basis points, find the selling price of the bond. (FYI; 0.01=1%=100 basis points; use semiannual compounding) Wote - 23-8 it will change the second time through a - 8 14 UTM PBICI F - YTM n ) bem All bonds in this homework have semi-annual compounding (m=2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started