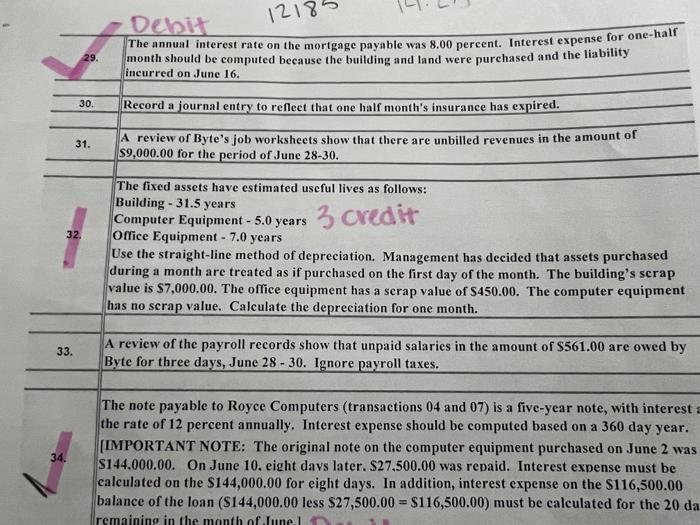

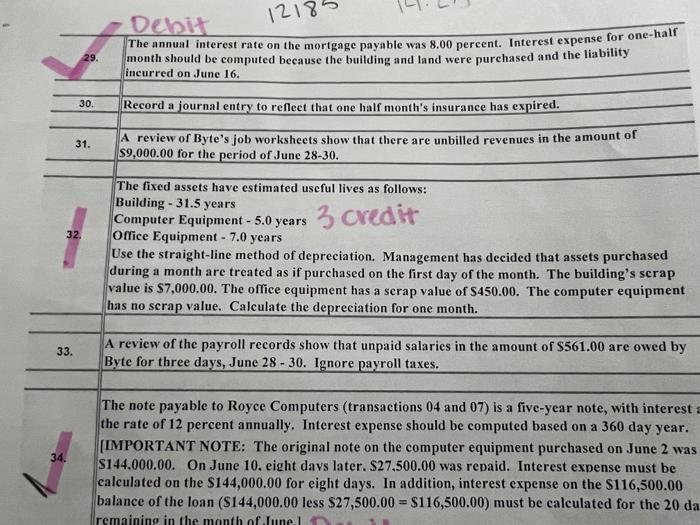

Im having a REALLY hard time with #32. Ive tried many of many diffrent things and the answers are still wrong. The information needed is on the second paper #32 and the third paper #10. PLEASE HELP!!!!

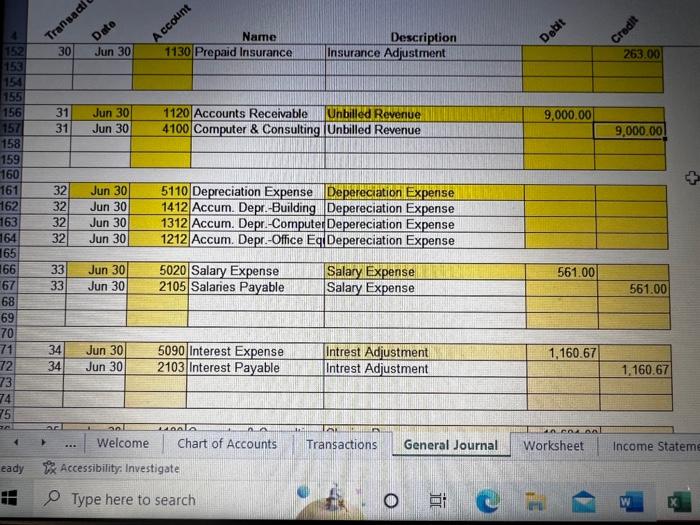

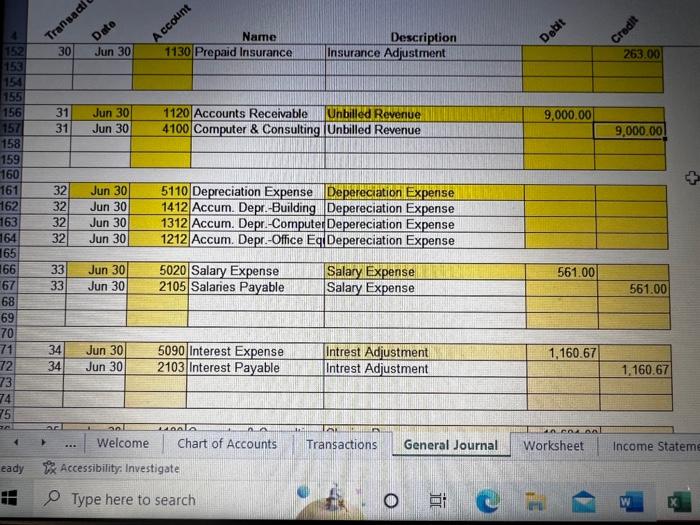

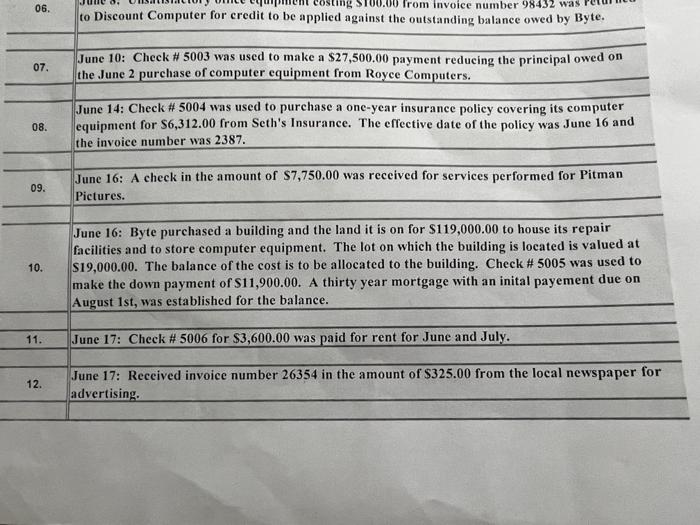

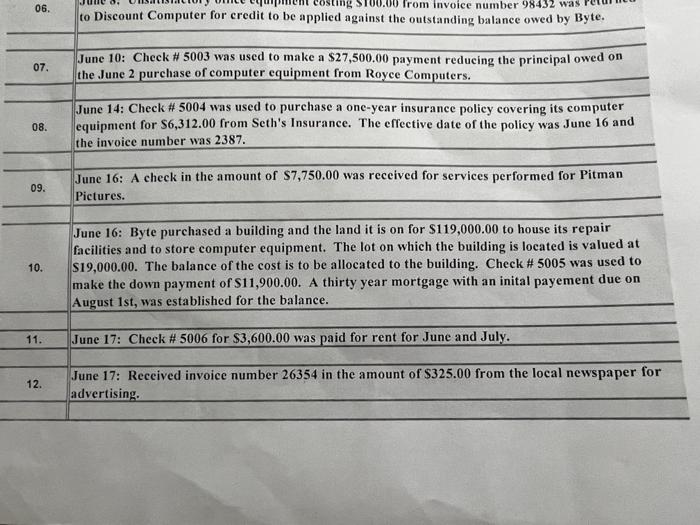

\begin{tabular}{|l|r|r|r|l|l|l|l|} \hline 156 & 31 & Jun 30 & 1120 & Accounts Receivable & Unbilled Revenue & 9.000.00 & \\ \hline 157 & 31 & Jun 30 & 4100 & Computer \& Consulting & Unbilled Revenue & 9,000.000 \\ \hline 158 & & & & & & & \\ \hline 159 & & & & & & & \\ \hline 160 & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline 161 & 32 & Jun 30 & 5110 & Depreciation Expense & Depereciation Expense & \\ \hline 162 & 32 & Jun 30 & 1412 & Accum. Depr.-Building & Depereciation Expense & \\ \hline 163 & 32 & Jun 30 & 1312 & Accum. Depr.-Computer Depereciation Expense \\ \hline 64 & 32 & Jun 30 & 1212 & Accum. Depr-Office Eq. Depereciation Expense & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} 70 & 34 & Jun 30 & 5090 & Interest Expense & Intrest Adjustment & 1,160.67 & \\ \hline 72 & 34 & Jun 30 & 2103 & Interest Payable & Intrest Adjustment & 1,160.67 \\ \hline 73 & & & & & & \\ \hline 74 & & & & & \\ \hline 75 & & & & \\ \hline \end{tabular} 4. Welcome Chart of Accounts Transactions General Journal Worksheet Income Statemen The note payable to Royce Computers (transactions 04 and 07 ) is a five-year note, with interest : the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$144.000.00. On June 10. eight davs later. \$27.500.00 was repaid. Interest expense must be calculated on the $144,000.00 for eight days. In addition, interest expense on the $116,500.00 balance of the loan ($144,000.00 less $27,500.00=$116,500.00) must be calculated for the 20 da to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Check #5003 was used to make a $27,500.00 payment reducing the principal owed on the June 2 purchase of computer equipment from Royce Computers. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for $6,312.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number was 2387. June 16: Byte purchased a building and the land it is on for $119,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at 10. S19,000.00. The balance of the cost is to be allocated to the building. Check #5005 was used to make the down payment of $11,900.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. 11. June 17: Check #5006 for $3,600.00 was paid for rent for June and July. 12. June 17: Received invoice number 26354 in the amount of $325.00 from the local newspaper for advertising. \begin{tabular}{|l|r|r|r|l|l|l|l|} \hline 156 & 31 & Jun 30 & 1120 & Accounts Receivable & Unbilled Revenue & 9.000.00 & \\ \hline 157 & 31 & Jun 30 & 4100 & Computer \& Consulting & Unbilled Revenue & 9,000.000 \\ \hline 158 & & & & & & & \\ \hline 159 & & & & & & & \\ \hline 160 & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline 161 & 32 & Jun 30 & 5110 & Depreciation Expense & Depereciation Expense & \\ \hline 162 & 32 & Jun 30 & 1412 & Accum. Depr.-Building & Depereciation Expense & \\ \hline 163 & 32 & Jun 30 & 1312 & Accum. Depr.-Computer Depereciation Expense \\ \hline 64 & 32 & Jun 30 & 1212 & Accum. Depr-Office Eq. Depereciation Expense & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} 70 & 34 & Jun 30 & 5090 & Interest Expense & Intrest Adjustment & 1,160.67 & \\ \hline 72 & 34 & Jun 30 & 2103 & Interest Payable & Intrest Adjustment & 1,160.67 \\ \hline 73 & & & & & & \\ \hline 74 & & & & & \\ \hline 75 & & & & \\ \hline \end{tabular} 4. Welcome Chart of Accounts Transactions General Journal Worksheet Income Statemen The note payable to Royce Computers (transactions 04 and 07 ) is a five-year note, with interest : the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$144.000.00. On June 10. eight davs later. \$27.500.00 was repaid. Interest expense must be calculated on the $144,000.00 for eight days. In addition, interest expense on the $116,500.00 balance of the loan ($144,000.00 less $27,500.00=$116,500.00) must be calculated for the 20 da to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Check #5003 was used to make a $27,500.00 payment reducing the principal owed on the June 2 purchase of computer equipment from Royce Computers. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for $6,312.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number was 2387. June 16: Byte purchased a building and the land it is on for $119,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at 10. S19,000.00. The balance of the cost is to be allocated to the building. Check #5005 was used to make the down payment of $11,900.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. 11. June 17: Check #5006 for $3,600.00 was paid for rent for June and July. 12. June 17: Received invoice number 26354 in the amount of $325.00 from the local newspaper for advertising