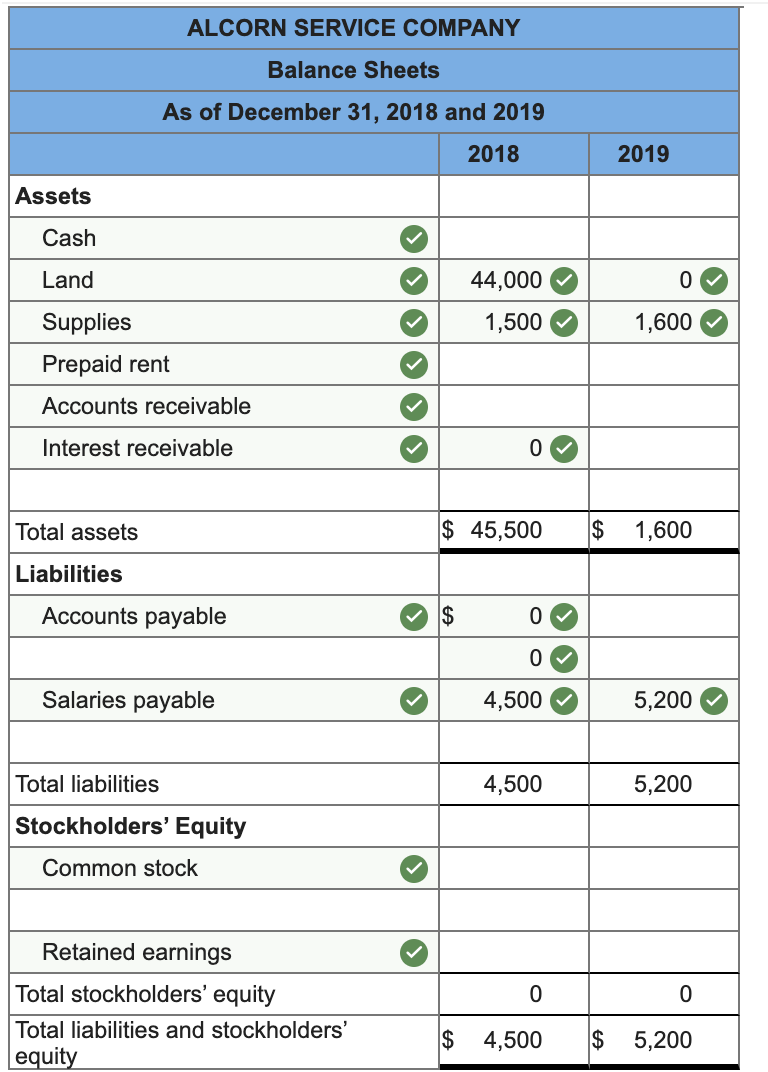

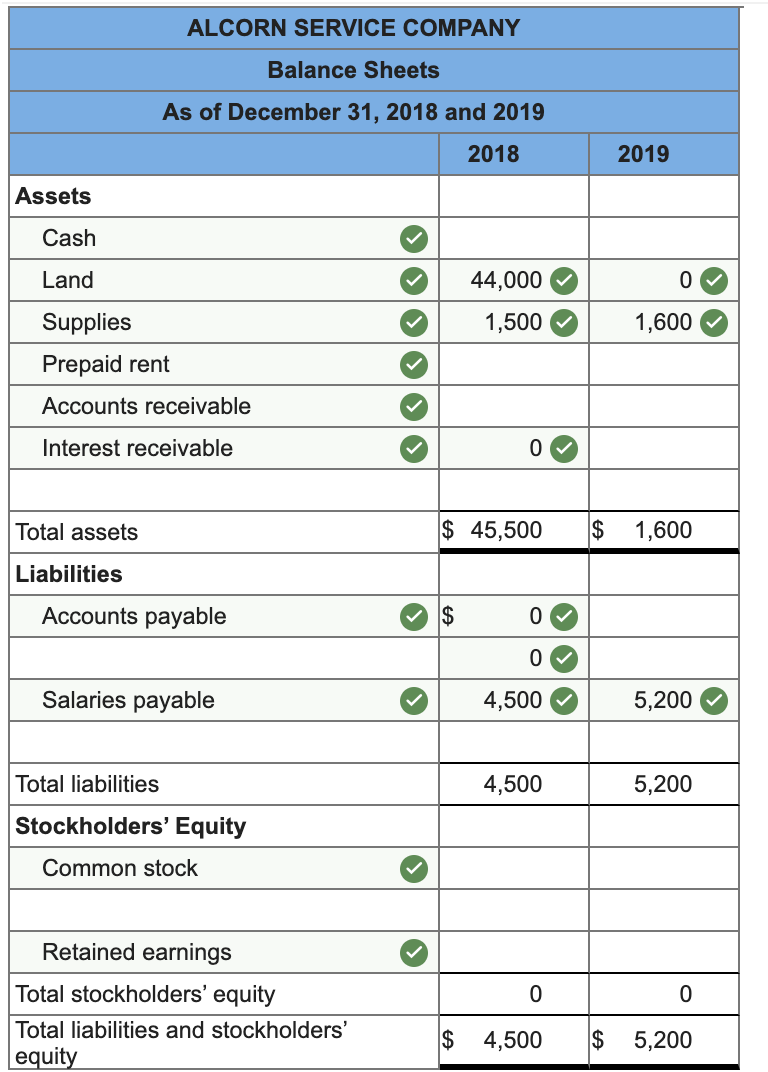

Im having trouble with this problem on the balance sheet

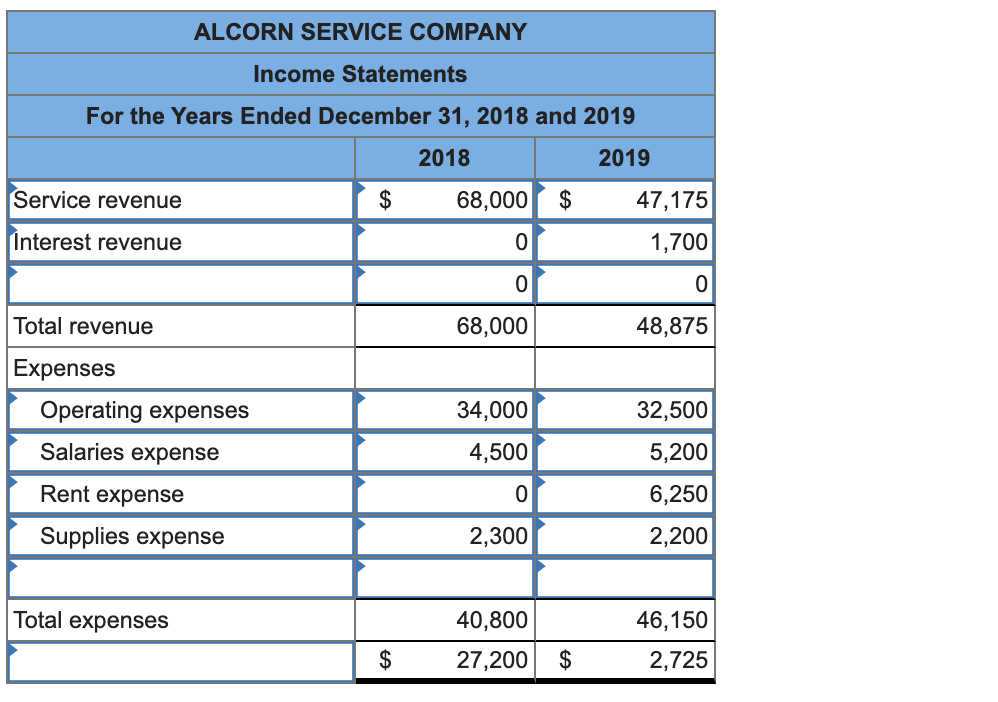

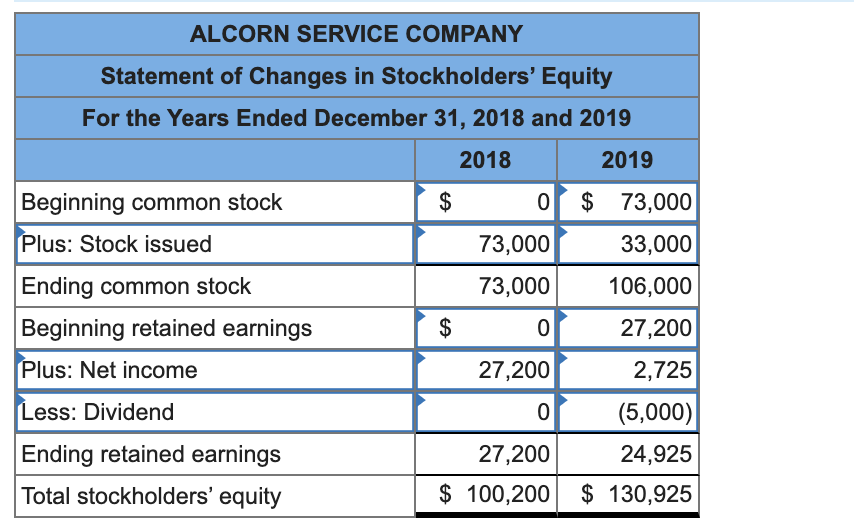

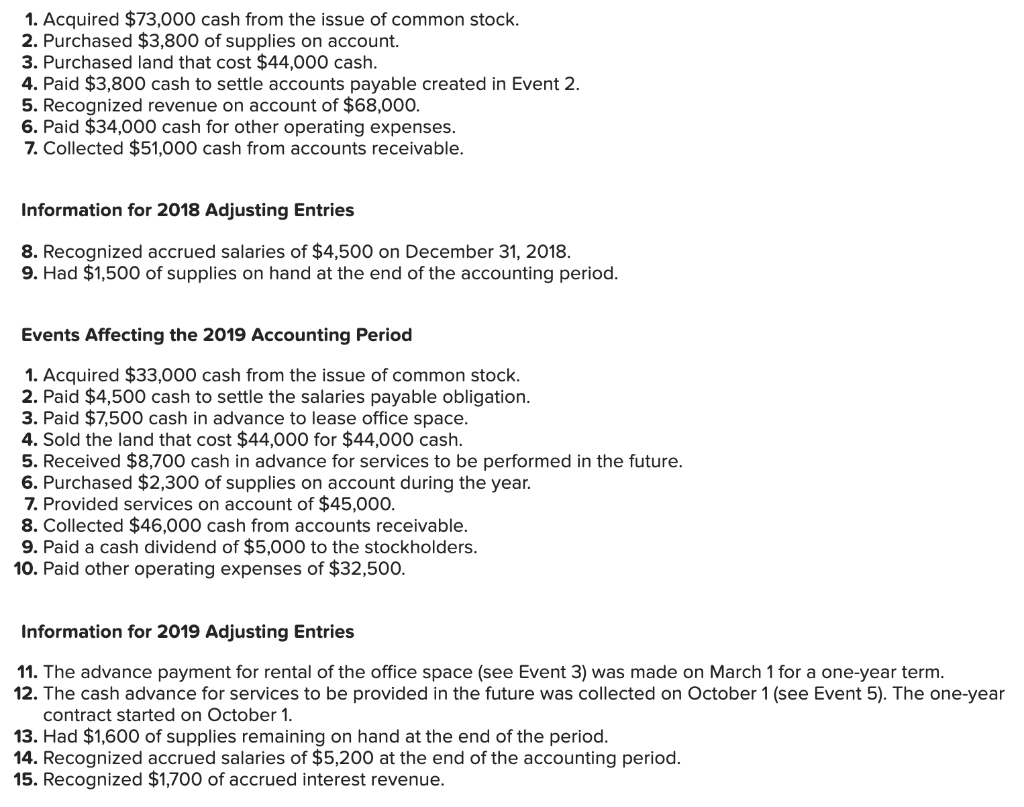

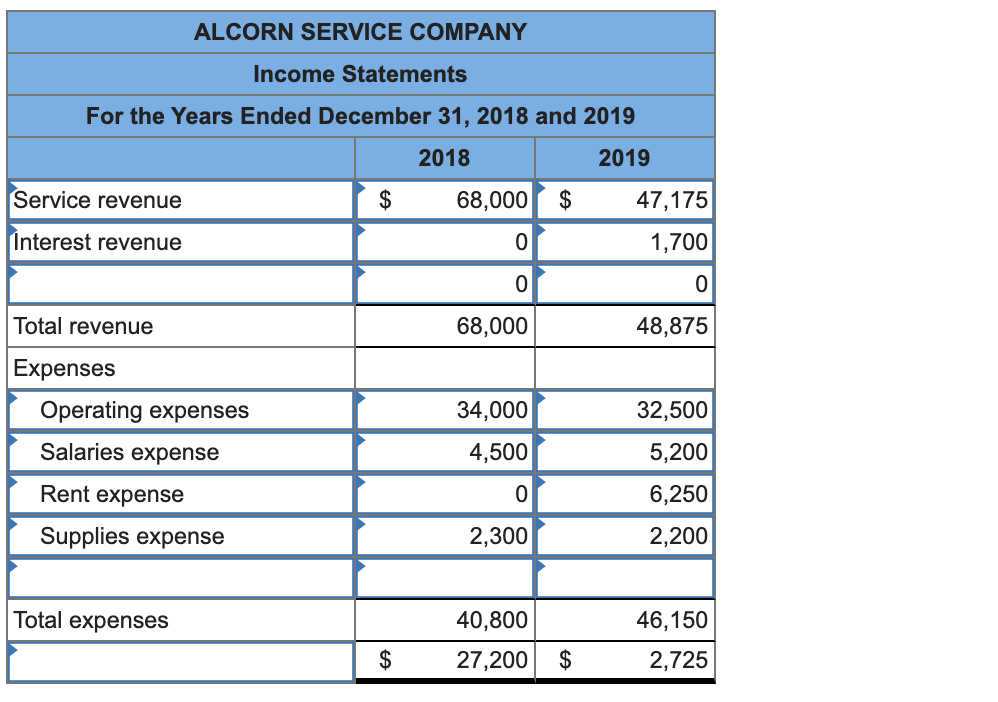

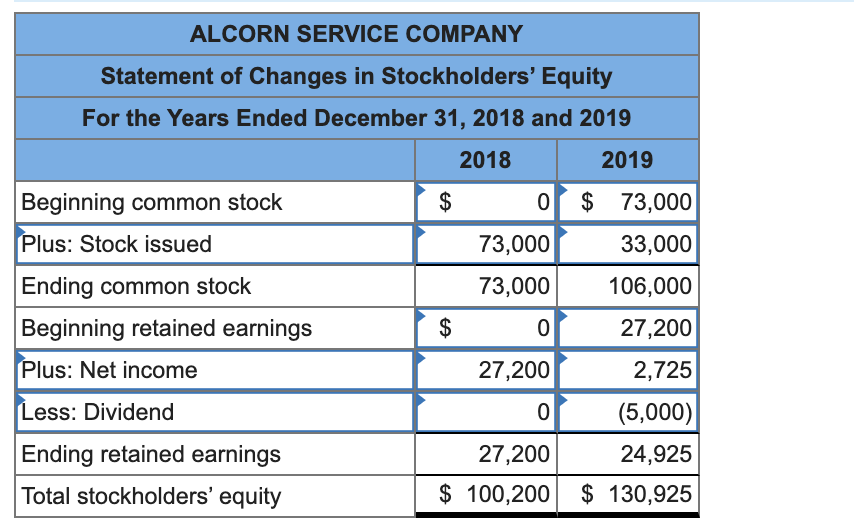

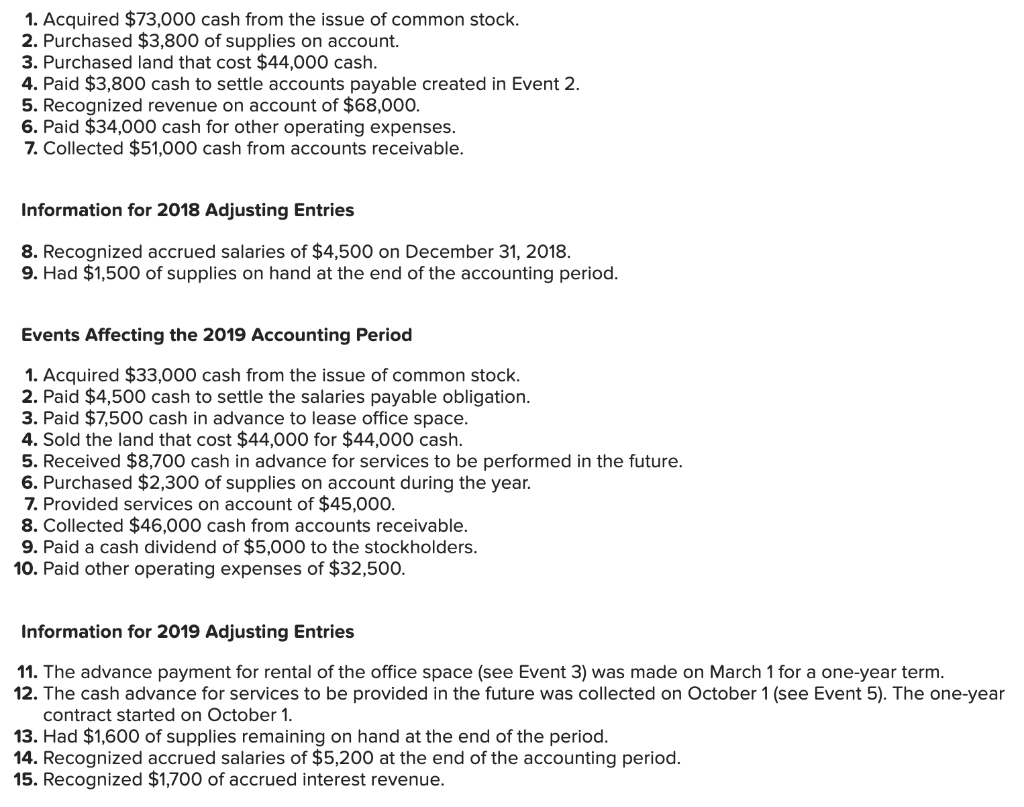

ALCORN SERVICE COMPANY Income Statements For the Years Ended December 31, 2018 and 2019 2018 2019 Service revenue $ 68,000 $ 47,175 1,700 Interest revenue 0 0 0 Total revenue 68,000 48,875 Expenses Operating expenses Salaries expense 32,500 34,000 4,500 5,200 Rent expense 0 6,250 Supplies expense 2,300 2,200 Total expenses 40,800 27,200 46,150 2,725 $ $ ALCORN SERVICE COMPANY Statement of Changes in Stockholders' Equity For the Years Ended December 31, 2018 and 2019 2018 2019 $ 0 $ 73,000 73,000 33,000 Beginning common stock Plus: Stock issued Ending common stock Beginning retained earnings Plus: Net income 73,000 106,000 $ 0 27,200 27,200 2,725 Less: Dividend 0 (5,000) 24,925 27,200 Ending retained earnings Total stockholders' equity $ 100,200 $ 130,925 ALCORN SERVICE COMPANY Balance Sheets As of December 31, 2018 and 2019 2018 2019 Assets Cash Land 0 44,000 1,500 1,600 Supplies Prepaid rent Accounts receivable Interest receivable 0 Total assets $ 45,500 $ 1,600 Liabilities Accounts payable $ 0 0 Salaries payable 4,500 5,200 Total liabilities 4,500 5,200 Stockholders' Equity Common stock 0 0 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 4,500 $ 5,200 1. Acquired $73,000 cash from the issue of common stock. 2. Purchased $3,800 of supplies on account. 3. Purchased land that cost $44,000 cash. 4. Paid $3,800 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $68,000. 6. Paid $34,000 cash for other operating expenses. 7. Collected $51,000 cash from accounts receivable. Information for 2018 Adjusting Entries 8. Recognized accrued salaries of $4,500 on December 31, 2018. 9. Had $1,500 of supplies on hand at the end of the accounting period. Events Affecting the 2019 Accounting Period 1. Acquired $33,000 cash from the issue of common stock. 2. Paid $4,500 cash to settle the salaries payable obligation. 3. Paid $7,500 cash in advance to lease office space. 4. Sold the land that cost $44,000 for $44,000 cash. 5. Received $8,700 cash in advance for services to be performed in the future. 6. Purchased $2,300 of supplies on account during the year. 7. Provided services on account of $45,000. 8. Collected $46,000 cash from accounts receivable. 9. Paid a cash dividend of $5,000 to the stockholders. 10. Paid other operating expenses of $32,500. Information for 2019 Adjusting Entries 11. The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term. 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year contract started on October 1. 13. Had $1,600 of supplies remaining on hand at the end of the period. 14. Recognized accrued salaries of $5,200 at the end of the accounting period. 15. Recognized $1,700 of accrued interest revenue