Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm looking for help on part b the second box Hector is in the 32% tax bracket. He acquired 10,000 shares of stock in Eclipse

I'm looking for help on part b the second box

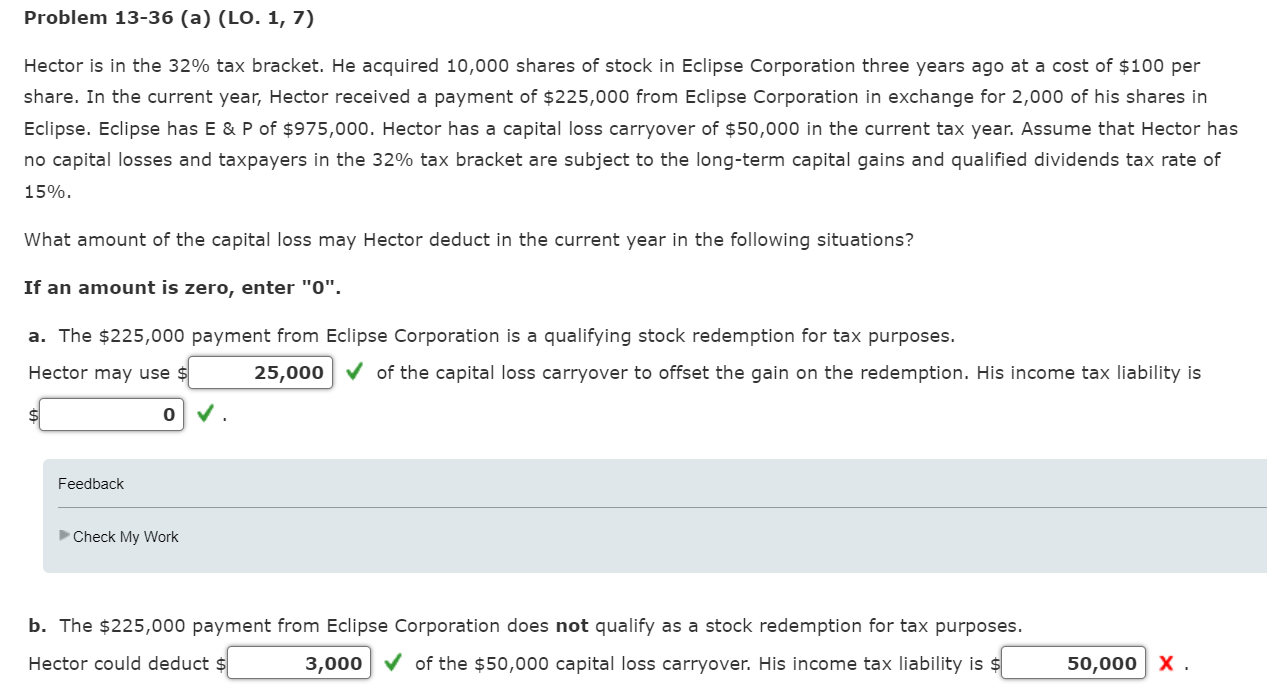

Hector is in the 32% tax bracket. He acquired 10,000 shares of stock in Eclipse Corporation three years ago at a cost of $100 per share. In the current year, Hector received a payment of $225,000 from Eclipse Corporation in exchange for 2,000 of his shares in Eclipse. Eclipse has E \& P of $975,000. Hector has a capital loss carryover of $50,000 in the current tax year. Assume that Hector has no capital losses and taxpayers in the 32% tax bracket are subject to the long-term capital gains and qualified dividends tax rate of 15%. What amount of the capital loss may Hector deduct in the current year in the following situations? If an amount is zero, enter " 0 ". a. The $225,000 payment from Eclipse Corporation is a qualifying stock redemption for tax purposes. Hector may use $ of the capital loss carryover to offset the gain on the redemption. His income tax liability is $. Feedback Check My Work b. The $225,000 payment from Eclipse Corporation does not qualify as a stock redemption for tax purposes. Hector could deduct $ of the $50,000 capital loss carryover. His income tax liability is s xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started