Question

I'm lost!!! Can someone please help me with this? Create information for the company of your dreams. Show five years of data. This is a

I'm lost!!! Can someone please help me with this?

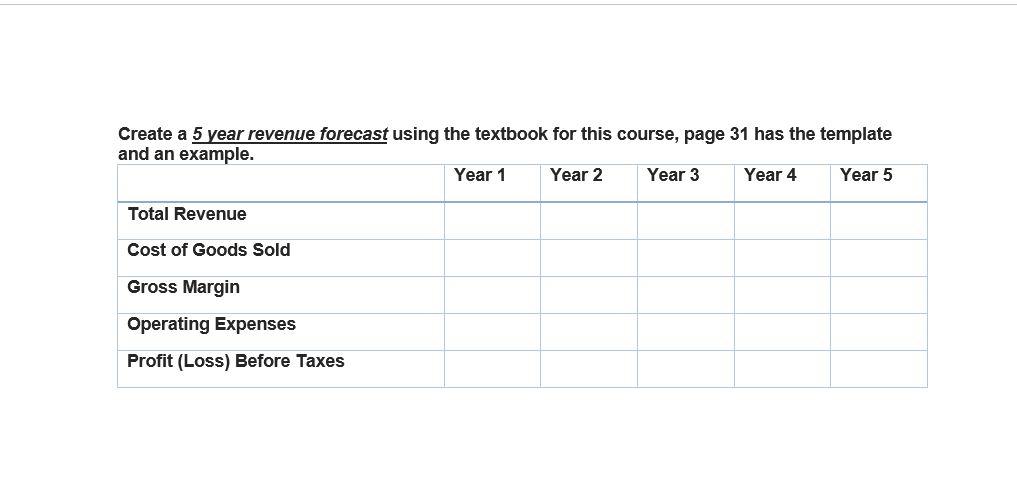

Create information for the company of your dreams. Show five years of data. This is a simple revenue forecast, Provide an explanation of what assumptions you use to come up with revenue, then explain how revenue will be adjusted for the next four years. This means provide the numbers you use to calculate revenue. Provide an explanation of what assumptions you use to come up with cost of goods sold (if used), and expenses for the first year. Then explain how COGS and expenses will be adjusted for the next four years. This means provide the numbers you use to calculate COGS and expenses. Make sure you address all the accounts required Revenue less Cost of Goods Sold (not required for service company) equals Gross Profit Margin less Operating Expenses equals Net Profit. Be consistent throughout the budget, display and explain your calculations (This means show your numbers).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started