Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im lost on how to do the blank questions i just need the gross margin question explained Fred's Canned Corn Emporium - A purveyor of

im lost on how to do the blank questions

i just need the gross margin question explained

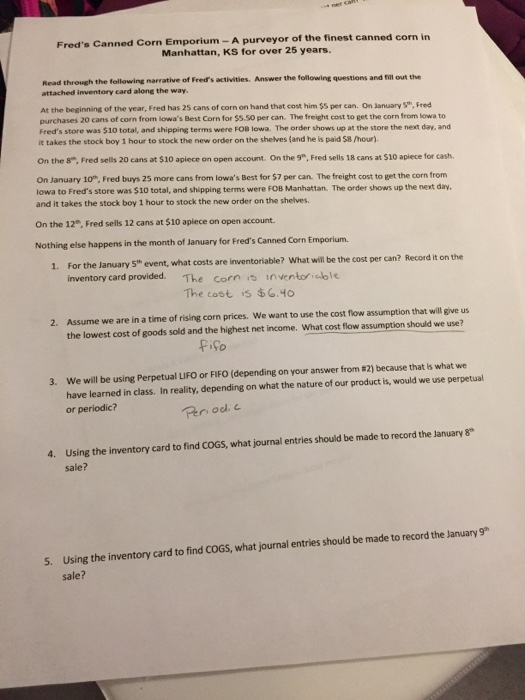

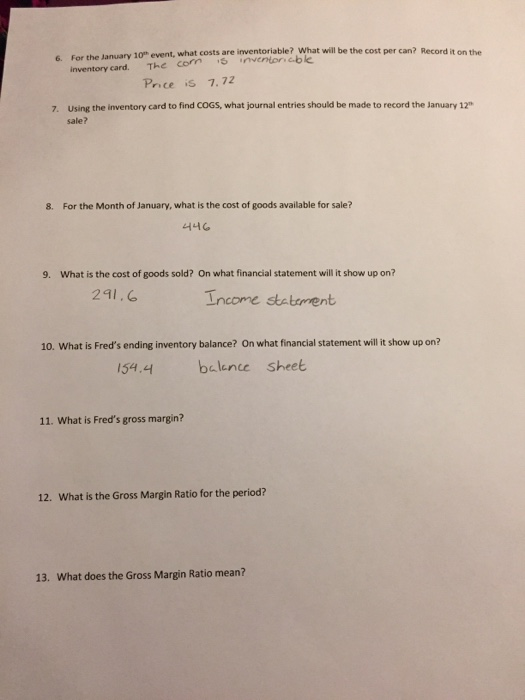

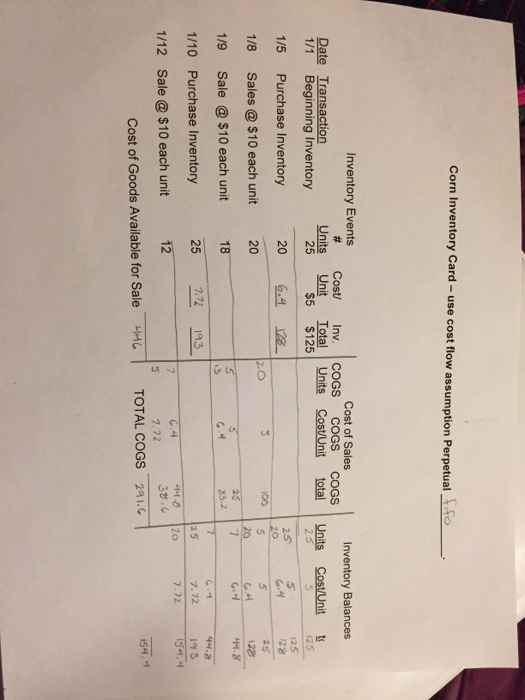

Fred's Canned Corn Emporium - A purveyor of the finest canned corn in Manhattan, KS for over 25 years. Read through the following narrative of Fred's activities. Answer the following questions and fill out the attached Inventory card along the way. At the beginning of the year, Fred has 25 cans of corn on hand that cost him $5 per can. On January Feed purchases 20 cans of corn from lowa's Best Corn for $5.50 per can. The freight cost to get the corn from lowa to Fred's store was $10 total, and shipping terms were FOB lowa. The order shows up at the store the next day, and it takes the stock boy 1 hour to stock the new order on the shelves (and he is paid 5B hour) On the 8. Fred sells 20 cans at $10 apiece on open account. On the 9", Fred sells 18 cans at $10 apiece for cash. On January 10, Fred buys 25 more cans from lowa's Best for $7 per can. The freight cost to get the corn from lowa to Fred's store was $10 total, and shipping terms were FOB Manhattan. The order shows up the next day, and it takes the stock boy 1 hour to stock the new order on the shelves. On the 12", Fred sells 12 cans at $10 aplece on open account. Nothing else happens in the month of January for Fred's Canned Corn Emporium. 1. For the January 5"event, what costs are inventoriable? What will be the cost per can? Record it on the inventory card provided. The cornis inventoriale The cost is $6.40 2. Assume we are in a time of rising corn prices. We want to use the cost flow assumption that will give us the lowest cost of goods sold and the highest net income. What cost flow assumption should we use? fifo 3. We will be using Perpetual LIFO or FIFO (depending on your answer from 12) because that is what we have learned in class. In reality, depending on what the nature of our product is, would we use perpetual or periodic? Periodic 4. Using the inventory card to find COGS, what journal entries should be made to record the January 8 sale? 5. Using the inventory card to find COGS, what journal entries should be made to record the January 9" sale? 6. For the Lanuary 10 event, what costs are inventoriable? What will be the cost per can? Record in the Inventory card. The com S v erionicole Price is 7.72 7. Using the inventory card to find COGS, what journal entries should be made to record the January 12 sale? 8. For the Month of January, what is the cost of goods available for sale? 446 9. What is the cost of goods sold? On what financial statement will it show up on? 291.6 Income statement 10. What is Fred's ending inventory balance? On what financial statement will it show up on? 154.4 balance sheet 11. What is Fred's gross margin? 12. What is the Gross Margin Ratio for the period? 13. What does the Gross Margin Ratio mean? Corn Inventory Card - use cost flow assumption Perpetual Inventory Events Date Transaction 1/1 Beginning Inventory Inventory Balances Units Cost/Unit to Cost Unit $5 Units 25 Cost of Sales Inv. COGS COGS COGS Total Units Cost/Unit total $125 1/5 Purchase Inventory 6.4 128 25 20 20 125 125 12% 25 128 44.8 20 100 1/8 Sales @ $10 each unit 1/9 Sale @ $10 each unit 1/10 Purchase Inventory 18 25 33 SNN TN 7.12 193 44.2 193 154.4 1/12 Sale @ $10 each unit 6.4 44.0 120 7.72 38.6 TOTAL COGS 291. 61 154.4 Cost of Goods Available for Sale HC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started