Answered step by step

Verified Expert Solution

Question

1 Approved Answer

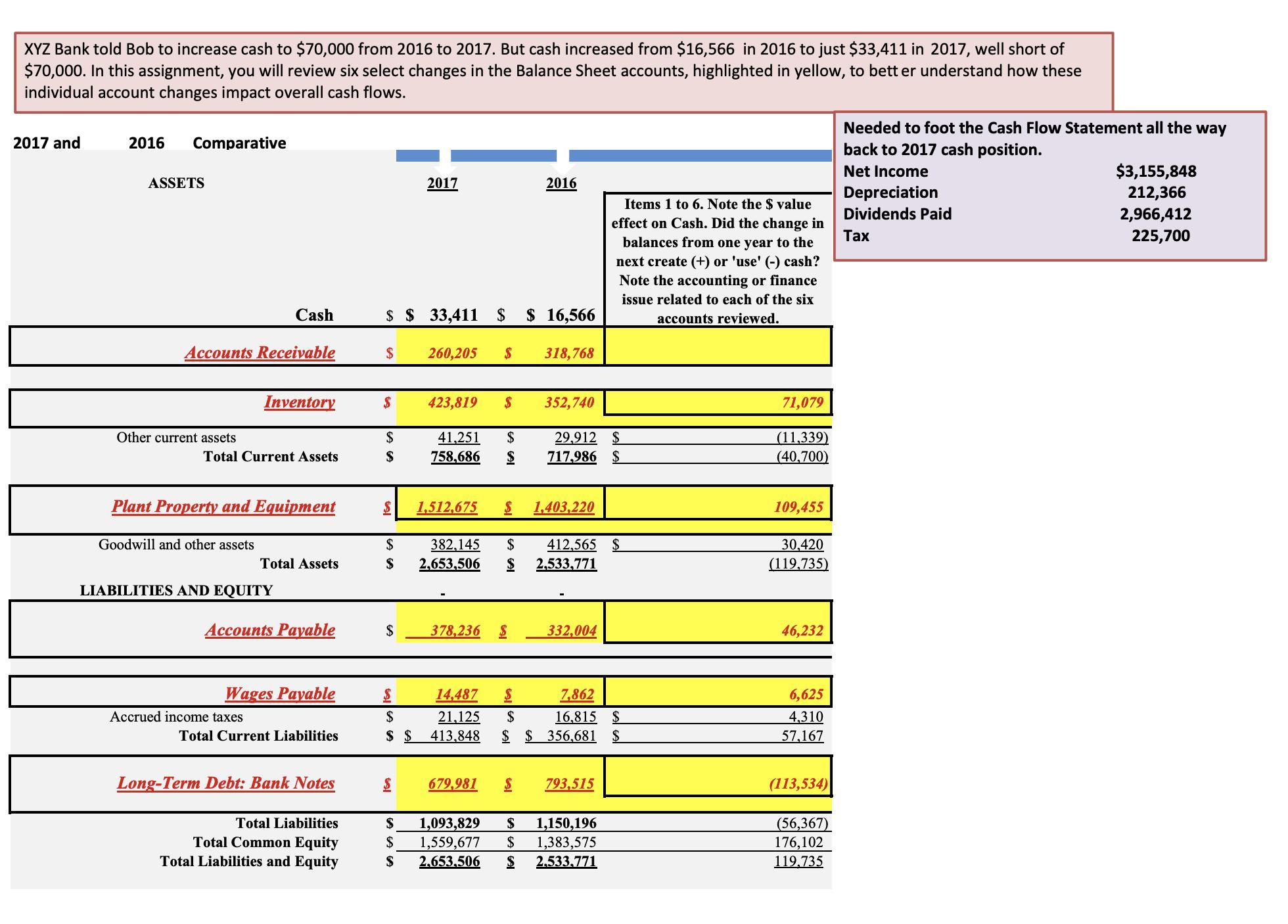

I'm needing the common size financial statements for the two years shown MT80 Unit 4 Assignment 2 CC&Rs for Bob Smith, Inc. During the original

I'm needing the common size financial statements for the two years shown

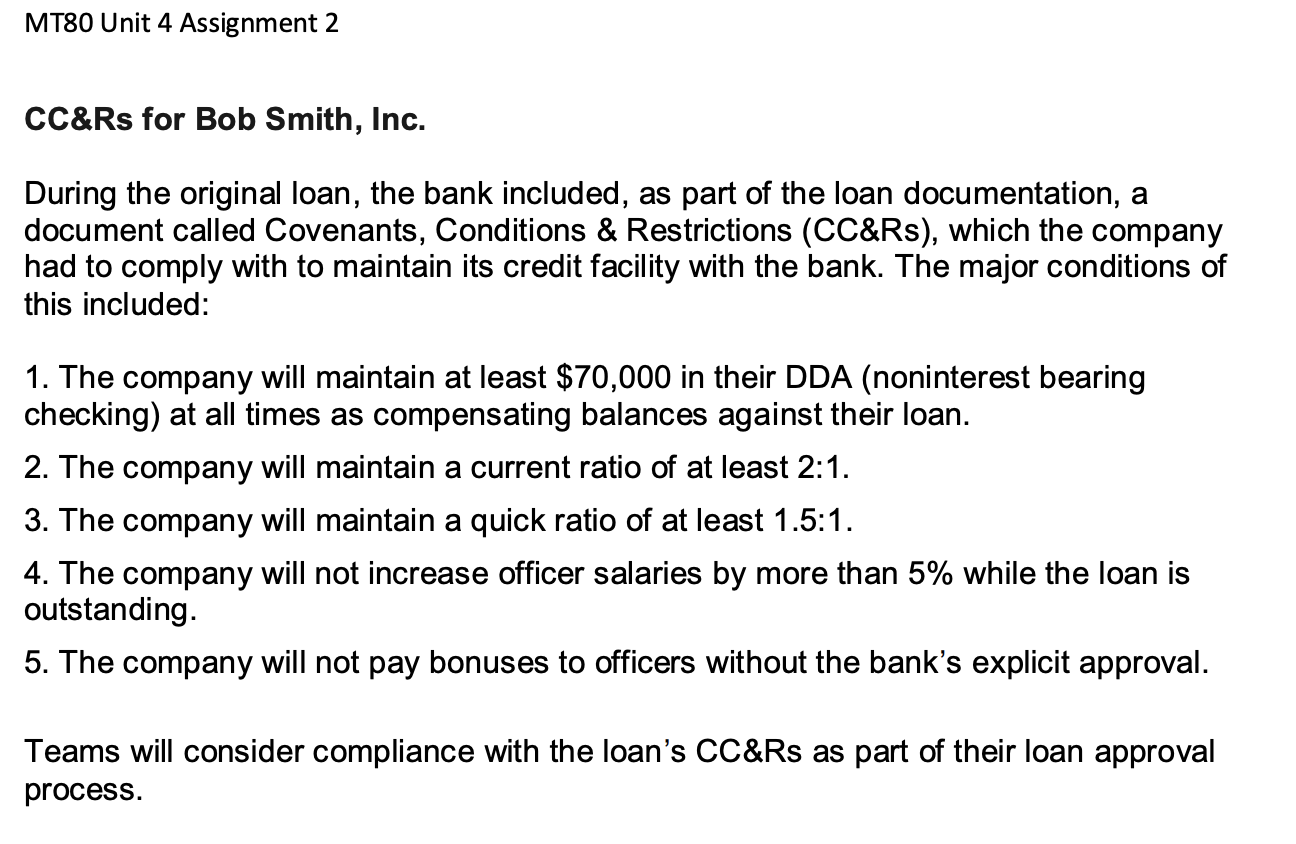

MT80 Unit 4 Assignment 2 CC&Rs for Bob Smith, Inc. During the original loan, the bank included, as part of the loan documentation, a document called Covenants, Conditions & Restrictions (CC&Rs), which the company had to comply with to maintain its credit facility with the bank. The major conditions of this included: 1. The company will maintain at least $70,000 in their DDA (noninterest bearing checking) at all times as compensating balances against their loan. 2. The company will maintain a current ratio of at least 2:1. 3. The company will maintain a quick ratio of at least 1.5:1. 4. The company will not increase officer salaries by more than 5% while the loan is outstanding. 5. The company will not pay bonuses to officers without the bank's explicit approval. Teams will consider compliance with the loan's CC&Rs as part of their loan approval process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CommonSize Financial Statements for Bob Smith Inc 2017 Account Amount Percentage ASSETS Cash 33411 126 Accounts Receivable 260205 980 Inventory 423819 1597 Other Current Assets 41251 156 Total Current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started