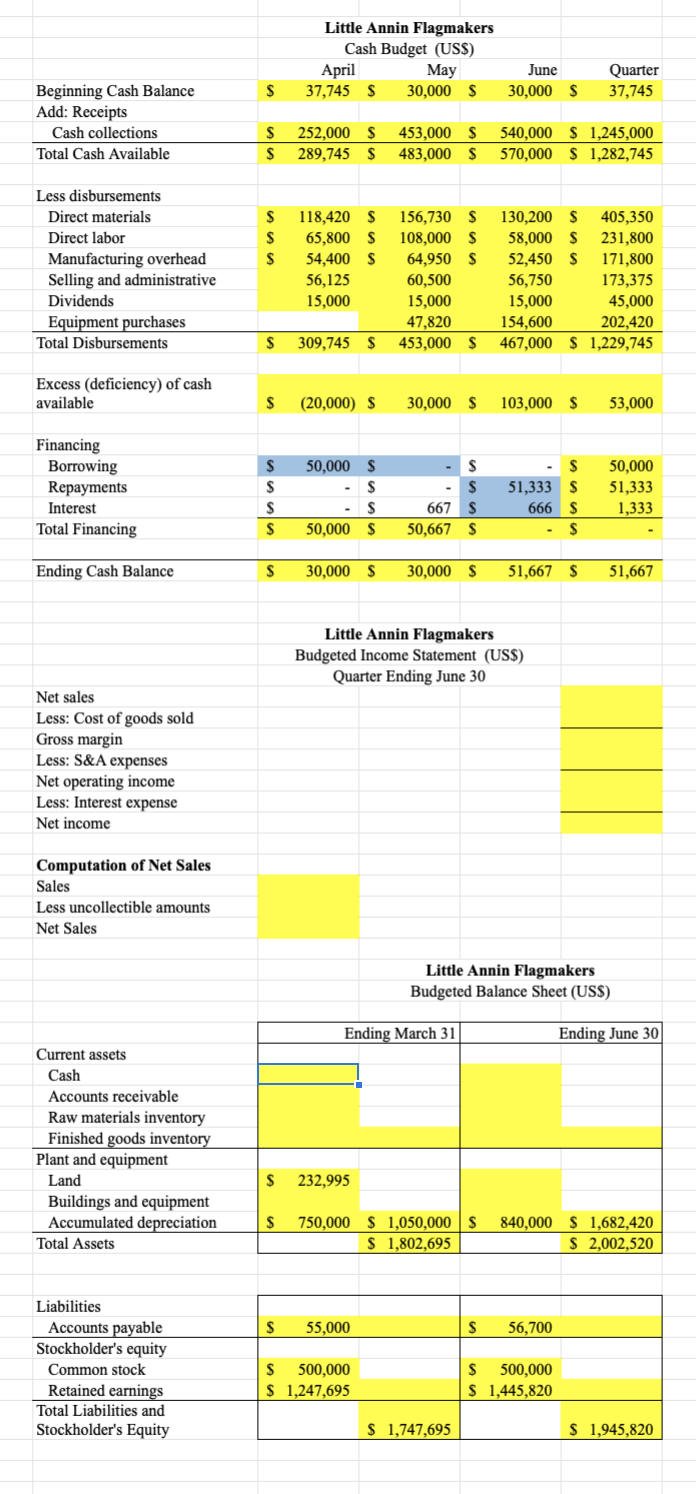

I'm not sure about my Cash Budget Section and I need help with the Budgeted income statement, as well as the Budgeted balance sheet. Thank you! Also here's this..

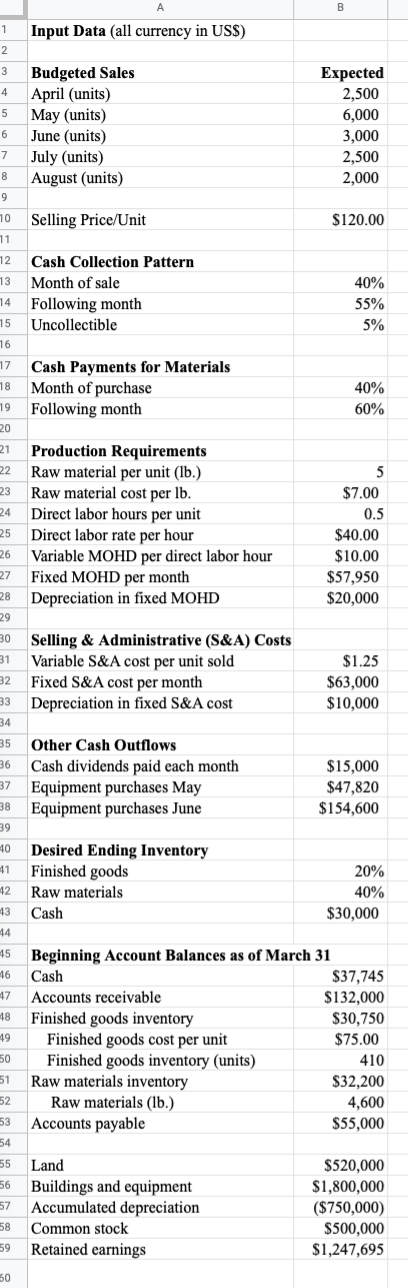

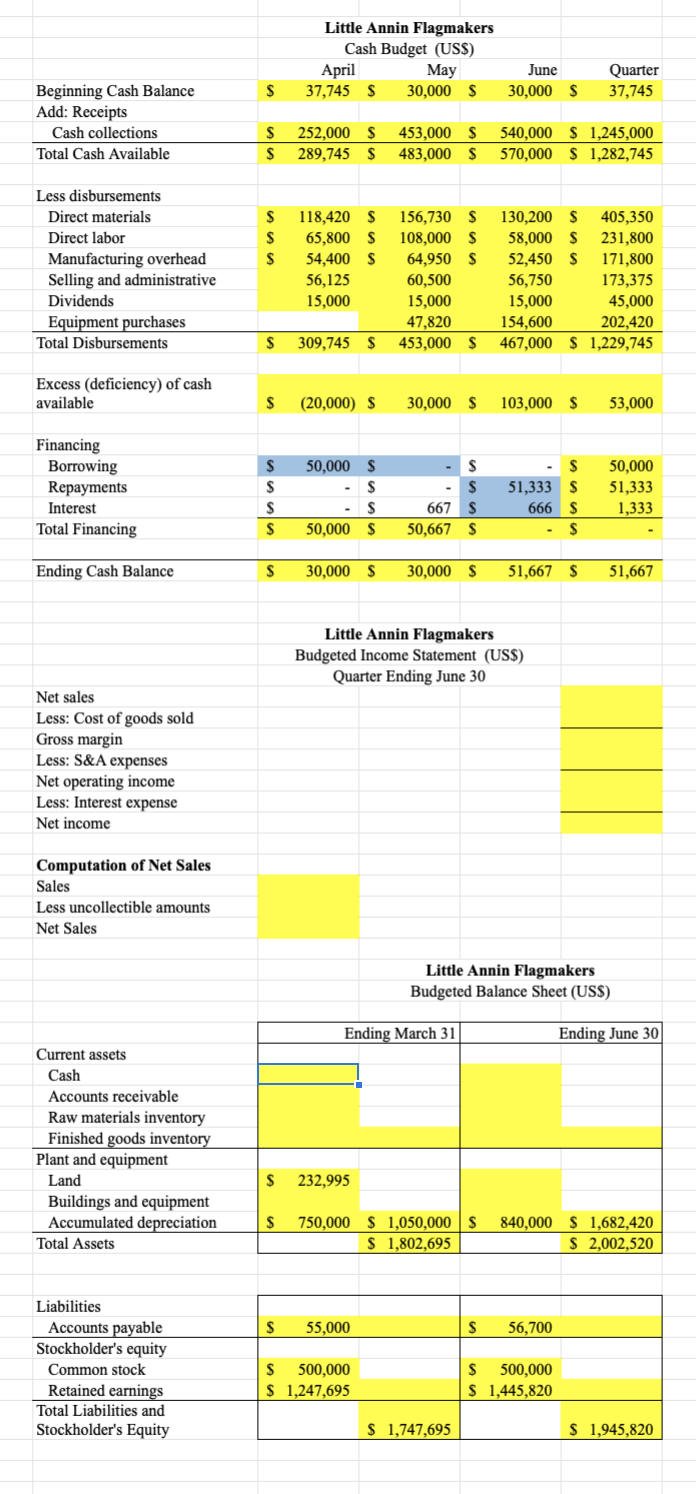

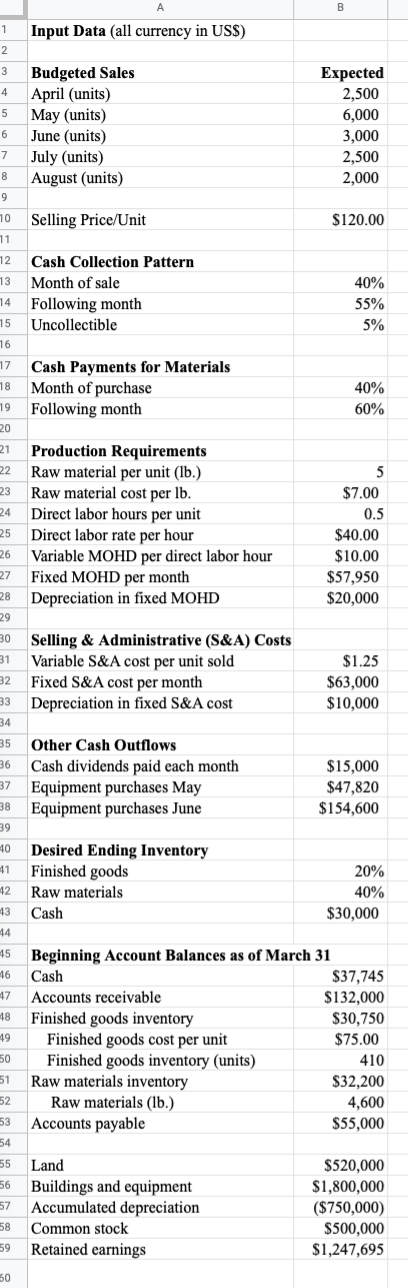

1. Using the data input provided (Exhibit 1), prepare LAFs master budgets in Excel. Do not hard-code numbers into the spreadsheet, except in the financing section of the cash budget.

2. Conduct a sensitivity analysis, decreasing sales 2%, 5%, and 10% for April through August. New sales levels are provided in Exhibit 2. Adjust the financing and cash needs at these new sales levels.

3. Determine a credit recommendation for Kent Bank, to lend or not. Be prepared to justify your credit decision.

4. Explain why the cash budget is more important to a bank than the accounting net income when determining a credit decision.

5. Explain why decreases in sales is examined in a sensitivity analysis for a credit decision

Little Annin Flagmakers Cash Budget (US$) April May 37,745 $ 30,000 $ June 30,000 $ Quarter 37,745 S Beginning Cash Balance Add: Receipts Cash collections Total Cash Available S $ 252,000 S 289,745 $ 453,000 $ 483,000 $ 540,000 $1,245,000 570,000 $1,282,745 S S S Less disbursements Direct materials Direct labor Manufacturing overhead Selling and administrative Dividends Equipment purchases Total Disbursements 118,420 S 65,800 S 54,400 $ 56,125 15,000 156,730 $ 108,000 $ 64,950 $ 60,500 15,000 47,820 453,000 $ 130,200 $ 405,350 58,000 $ 231,800 52,450 $ 171,800 56,750 173,375 15,000 45,000 154,600 202,420 467,000 $1,229,745 S 309,745 S Excess (deficiency) of cash available S (20,000) $ 30,000 $ 103,000 $ 53,000 S 50,000 S Financing Borrowing Repayments Interest Total Financing - S S S S S $ S S 667 S 50,667 $ S 51,333 $ 666 S S 50,000 51,333 1,333 50,000 Ending Cash Balance S 30,000 $ 30,000 $ 51,667 $ 51,667 Little Annin Flagmakers Budgeted Income Statement (US$) Quarter Ending June 30 Net sales Less: Cost of goods sold Gross margin Less: S&A expenses Net operating income Less: Interest expense Net income Computation of Net Sales Sales Less uncollectible amounts Net Sales Little Annin Flagmakers Budgeted Balance Sheet (US$) Ending March 31 Ending June 30 Current assets Cash Accounts receivable Raw materials inventory Finished goods inventory Plant and equipment Land Buildings and equipment Accumulated depreciation Total Assets $ 232,995 S 750,000 $ 1,050,000 $ $ 1,802,695 840,000 $1,682,420 $ 2,002,520 S 55,000 S 56,700 Liabilities Accounts payable Stockholder's equity Common stock Retained earnings Total Liabilities and Stockholder's Equity S 500,000 $ 1,247,695 $ 500,000 $ 1,445,820 $ 1,747,695 $ 1,945,820 Little Annin Flagmakers Cash Budget (US$) April May 37,745 $ 30,000 $ June 30,000 $ Quarter 37,745 S Beginning Cash Balance Add: Receipts Cash collections Total Cash Available S $ 252,000 S 289,745 $ 453,000 $ 483,000 $ 540,000 $1,245,000 570,000 $1,282,745 S S S Less disbursements Direct materials Direct labor Manufacturing overhead Selling and administrative Dividends Equipment purchases Total Disbursements 118,420 S 65,800 S 54,400 $ 56,125 15,000 156,730 $ 108,000 $ 64,950 $ 60,500 15,000 47,820 453,000 $ 130,200 $ 405,350 58,000 $ 231,800 52,450 $ 171,800 56,750 173,375 15,000 45,000 154,600 202,420 467,000 $1,229,745 S 309,745 S Excess (deficiency) of cash available S (20,000) $ 30,000 $ 103,000 $ 53,000 S 50,000 S Financing Borrowing Repayments Interest Total Financing - S S S S S $ S S 667 S 50,667 $ S 51,333 $ 666 S S 50,000 51,333 1,333 50,000 Ending Cash Balance S 30,000 $ 30,000 $ 51,667 $ 51,667 Little Annin Flagmakers Budgeted Income Statement (US$) Quarter Ending June 30 Net sales Less: Cost of goods sold Gross margin Less: S&A expenses Net operating income Less: Interest expense Net income Computation of Net Sales Sales Less uncollectible amounts Net Sales Little Annin Flagmakers Budgeted Balance Sheet (US$) Ending March 31 Ending June 30 Current assets Cash Accounts receivable Raw materials inventory Finished goods inventory Plant and equipment Land Buildings and equipment Accumulated depreciation Total Assets $ 232,995 S 750,000 $ 1,050,000 $ $ 1,802,695 840,000 $1,682,420 $ 2,002,520 S 55,000 S 56,700 Liabilities Accounts payable Stockholder's equity Common stock Retained earnings Total Liabilities and Stockholder's Equity S 500,000 $ 1,247,695 $ 500,000 $ 1,445,820 $ 1,747,695 $ 1,945,820