I'm not sure about the answers for these questions,however can you also explain why that answer is correct?

I'm not sure about the answers for these questions,however can you also explain why that answer is correct?

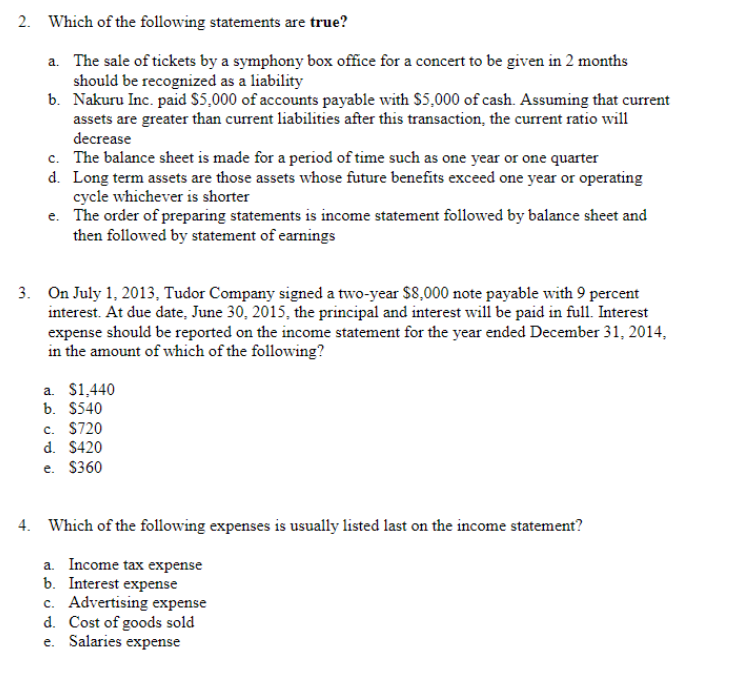

2. Which of the following statements are true? a. The sale of tickets by a symphony box office for a concert to be given in 2 months should be recognized as a liability b. Nakuru Inc. paid $5,000 of accounts payable with $5,000 of cash. Assuming that current assets are greater than current liabilities after this transaction, the current ratio will decrease c. The balance sheet is made for a period of time such as one year or one quarter d. Long term assets are those assets whose future benefits exceed one year or operating cycle whichever is shorter e. The order of preparing statements is income statement followed by balance sheet and then followed by statement of earnings 3. On July 1, 2013, Tudor Company signed a two-year $8,000 note payable with 9 percent interest. At due date, June 30, 2015, the principal and interest will be paid in full. Interest expense should be reported on the income statement for the year ended December 31, 2014, in the amount of which of the following? a. $1,440 b. $540 c. $720 d. $420 e. $360 4. Which of the following expenses is usually listed last on the income statement? a. Income tax expense b. Interest expense c. Advertising expense d. Cost of goods sold e. Salaries expense 2. Which of the following statements are true? a. The sale of tickets by a symphony box office for a concert to be given in 2 months should be recognized as a liability b. Nakuru Inc. paid $5,000 of accounts payable with $5,000 of cash. Assuming that current assets are greater than current liabilities after this transaction, the current ratio will decrease c. The balance sheet is made for a period of time such as one year or one quarter d. Long term assets are those assets whose future benefits exceed one year or operating cycle whichever is shorter e. The order of preparing statements is income statement followed by balance sheet and then followed by statement of earnings 3. On July 1, 2013, Tudor Company signed a two-year $8,000 note payable with 9 percent interest. At due date, June 30, 2015, the principal and interest will be paid in full. Interest expense should be reported on the income statement for the year ended December 31, 2014, in the amount of which of the following? a. $1,440 b. $540 c. $720 d. $420 e. $360 4. Which of the following expenses is usually listed last on the income statement? a. Income tax expense b. Interest expense c. Advertising expense d. Cost of goods sold e. Salaries expense

I'm not sure about the answers for these questions,however can you also explain why that answer is correct?

I'm not sure about the answers for these questions,however can you also explain why that answer is correct?