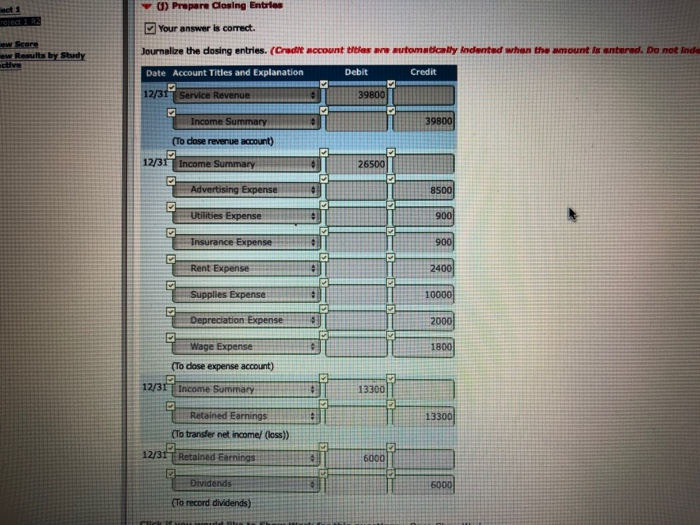

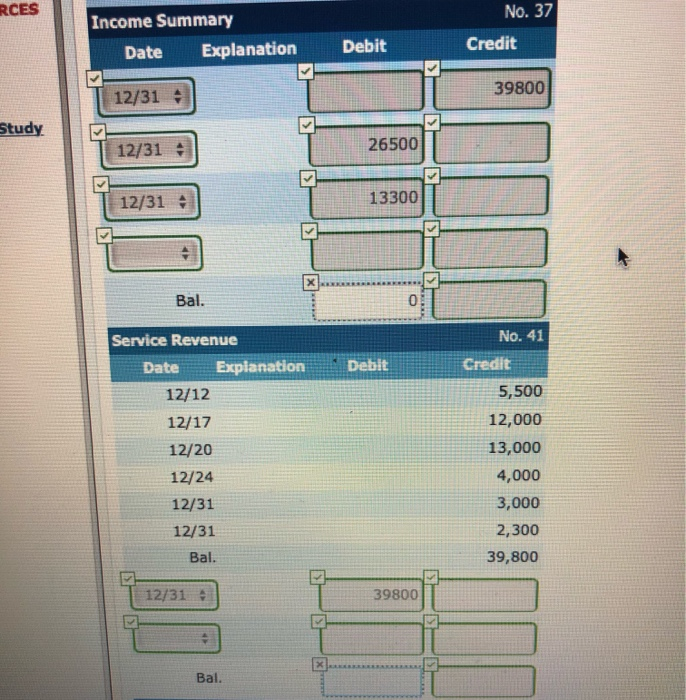

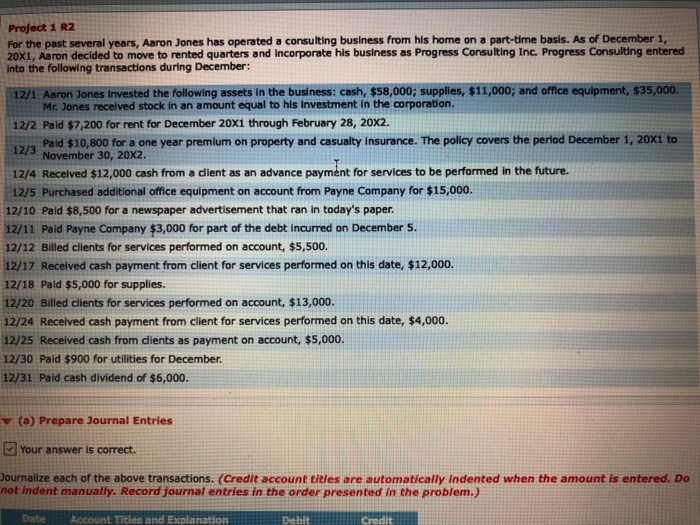

im not sure how to do this problem. It says that 13,300 and 0 are wrong for income summary balance. It says 0 is wrong for service revenue balance

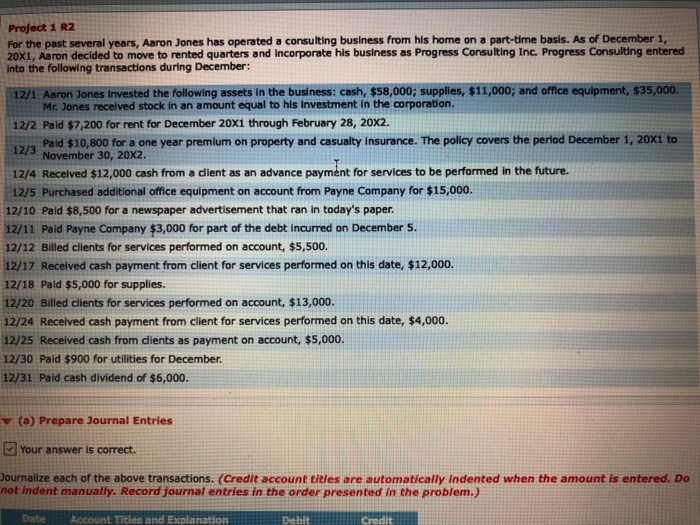

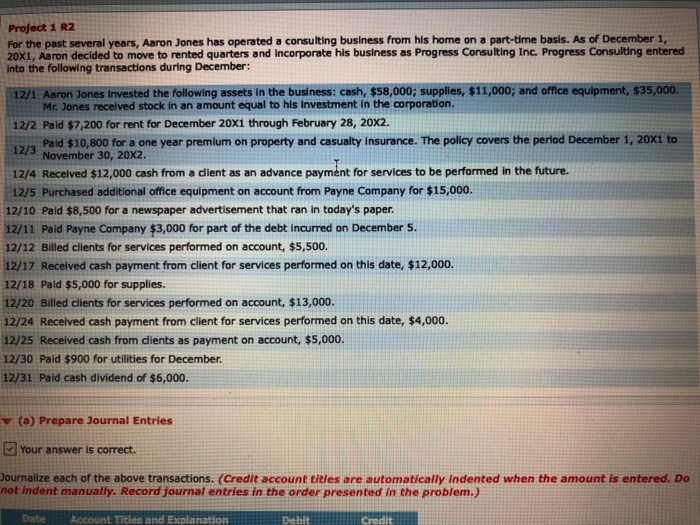

Project 1 R2 For the past several years, Aaron Jones has operated a consulting business from his home on a part-time basis. As of December 1. 20x1, Aaron decided to move to rented quarters and incorporate his business as Progress Consulting Inc. Progress Consulting entered into the following transactions during December: 21 Aaron Jones Invested the following assets in the business: cash, $58,000; supplies, $11,000; and office equipment, $35,000 Mr. Jones received stock in an amount equal to his investment in the corporation. 12/2 Pald $7,200 for rent for December 20x1 through February 28, 20x2. Paid $10,000 for a one year premium on property and casualty Insurance. The policy covers the period December 1, 20xi to 1215 November 30, 20X2. 12/4 Received $12,000 cash from a dient as an advance payment for services to be performed in the future. 12/5 Purchased additional office equipment on account from Payne Company for $15,000. 12/10 Paid $8,500 for a newspaper advertisement that ran in today's paper. 12/11 Pald Payne Company $3,000 for part of the debt incurred on December 5. 12/12 Billed clients for services performed on account, $5,500. 12/17 Received cash payment from client for services performed on this date, $12,000. 12/18 Paid $5,000 for supplies. 12/20 Billed clients for services performed on account, $13,000. 12/24 Received cash payment from client for services performed on this date, $4,000. 12/25 Received cash from dients as payment on account, $5,000. 12/30 Paid $900 for utilities for December 12/31 Paid cash dividend of $6,000. (a) Prepare Journal Entries Your answer is correct. Journalize each of the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Tities and Explanation Credit 0) Prepare Closing Entries Your answer is correct. Results by Study Journalize the desing entries. (Credit account tities are automatically indented when the amount is entered. Do not Inde Date Account Titles and Explanation Debit Credit 12/314 Service Revenue Income Summary (To dose revenue account) 12/31 Income Summary Advertising Expense = Utilities Expense == Insurance Expense Rent Expense 2400 = Supplies Expense = Depreciation Expense 10000 2000 1800 = Wage Expense = (To close expense account) 12/31 Income Summary = = Retained Earnings (To transfer net incomel (loss)) 12/31 Retained Earnings Dividends To record dividends) RCES Income Summary Date Explanation No. 37 Credit Debit 12/31 39800 Study 12/31 26500 12/31 13300 Bal. Debit Service Revenue Date Explanation 12/12 12/17 12/20 12/24 12/31 12/31 Bal. No. 41 Credit 5,500 12,000 13,000 4,000 3,000 2,300 39,800 39800 Bal