im not sure if i did #1, 2, 3 or 4 right. do you think you could doublevheck if i did them correct? thank you!

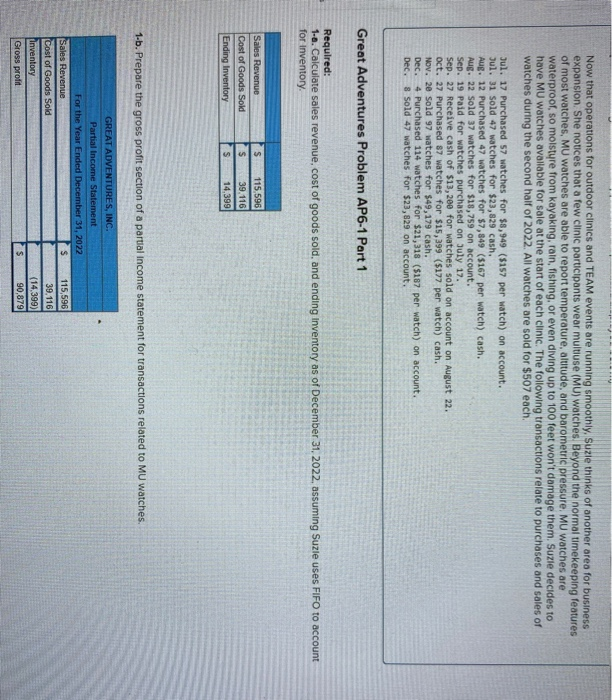

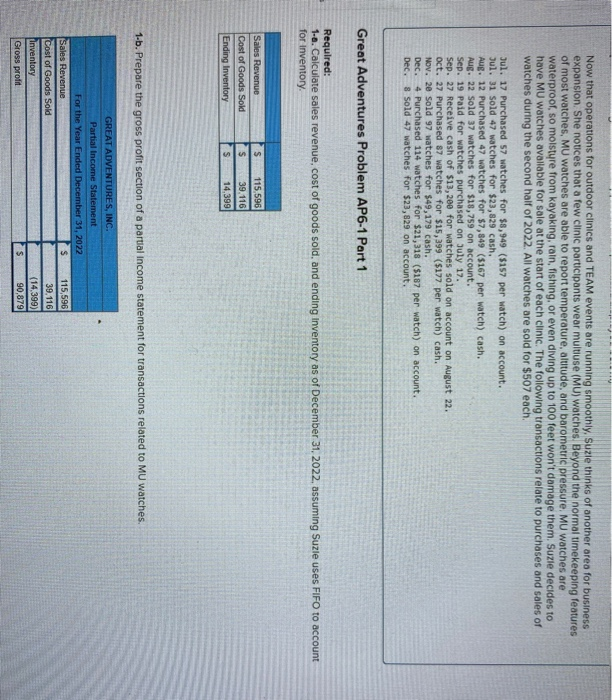

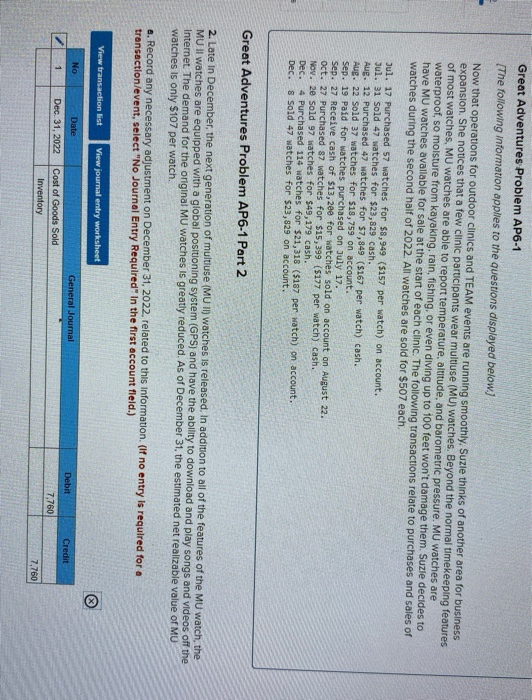

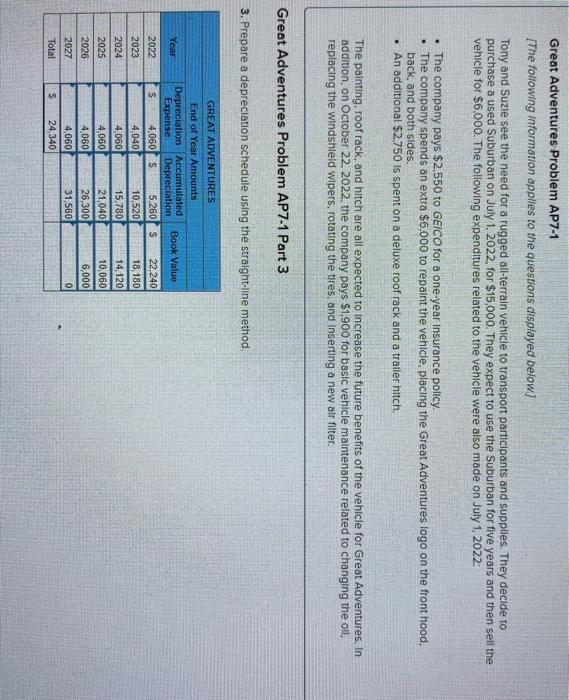

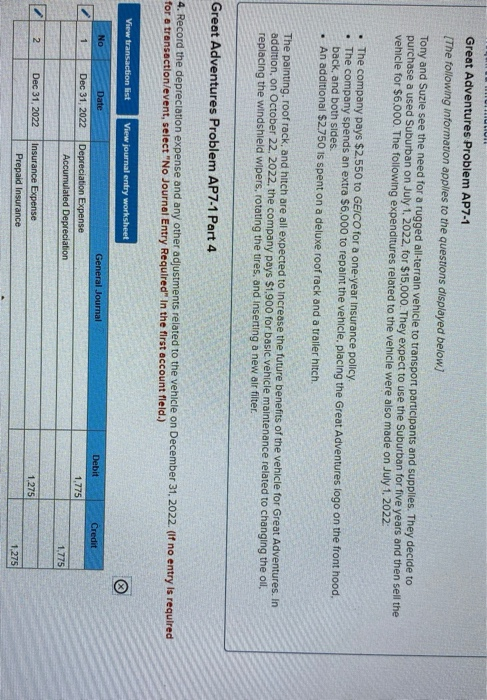

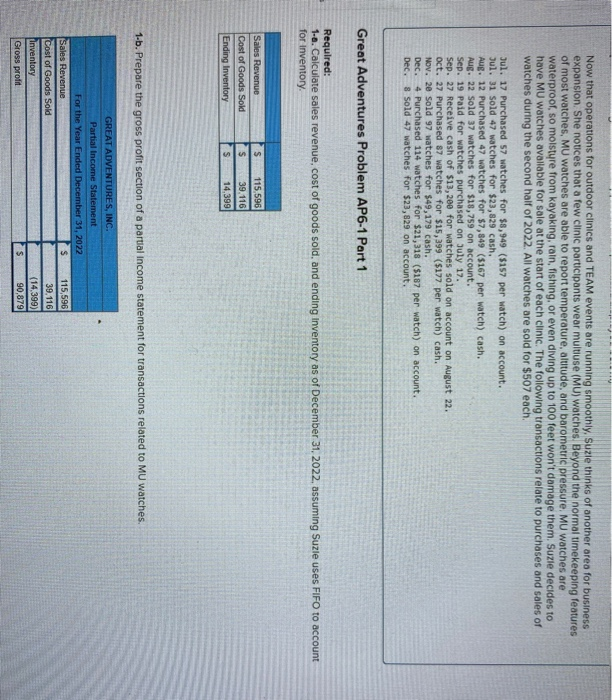

Now that operations for outdoor clinics and TEAM events are running smoothly, Suzie thinks of another area for business expansion. She notices that a few clinic participants wear multiuse (MU) watches Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, altitude, and barometric pressure MU watches are waterproof , so moisture from Kayaking, rain, fishing, or even diving up to 100 feet won't damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2022. All watches are sold for $507 each. Jul. 17 Purchased 57 watches for $8,949 ($157 per watch) on account. Jul. 31 sold 47 watches for $23,829 cash. Aug. 12 Purchased 47 watches for $7,849 (5167 per watch) cash. Aug. 22 Sold 37 watches for $13,759 on account. Sep. 19 paid for watches purchased on July 17. Sep. 27 Receive cash of $13, 200 for watches sold on account on August 22. oct. 27 Purchased 87 watches for $15,399 ($177 per watch) cash. Nov. 20 Sold 97 watches for $49,179 cash. Dec. 4 Purchased 114 watches for $21,318 ($187 per watch) on account. Dec. 8 Sold 47 watches for $23, 829 on account. Great Adventures Problem AP6-1 Part 1 Required: 1-a. Calculate sales revenue, cost of goods sold, and ending Inventory as of December 31, 2022, assuming Suzle uses FIFO to account for Inventory Sales Revenue Cost of Goods Sold Ending Inventory $ S $ 115.596 39.116 14.399 1-b. Prepare the gross profit section of a partial income statement for transactions related to MU watches. GREAT ADVENTURES, INC. Partial Income Statement For the Year Ended December 31, 2022 Sales Revenue $ Cost of Goods Sold Inventory Gross profit $ 115,596 39,116 (14.399) 90,879 Great Adventures Problem AP6-1 [The following information applies to the questions displayed below.) Now that operations for outdoor clinics and TEAM events are running smoothly. Suzie thinks of another area for business expansion. She notices that a few clinic participants wear multluse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, altitude, and barometric pressure. MU watches are waterproof, so moisture from Kayaking.rain, fishing, or even diving up to 100 feet won't damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2022. All watches are sold for $507 each Jul. 17 Purchased 57 watches for $8,949 ($157 per watch) on account. Jul. 31 Sold 47 watches for $23,829 cash. Aug. 12 Purchased 47 watches for $7,849 (5167 per watch) cash. Aug. 22 sold 37 watches for $18,759 on account. Sep. 19 Paid for watches purchased on July 17. Sep. 27 Receive cash of $13, 2ee for watches sold on account on August 22. oct. 27 Purchased 87 watches for $15,399 (5177 per watch) cash. Nov. 2e sold 97 watches for $49,179 cash. Dec. 4 Purchased 114 watches for $21,318 ($187 per watch) on account. Dec. 8 Sold 47 watches for $23,829 on account. Great Adventures Problem AP6-1 Part 2 2. Late in December, the next generation of multiuse (MU II) watches is released. In addition to all of the features of the MU watch the MU II watches are equipped with a global positioning system (GPS) and have the ability to download and play songs and videos off the Internet. The demand for the original MU watches is greatly reduced. As of December 31, the estimated net realizable value of MU watches is only $107 per watch. a. Record any necessary adjustment on December 31, 2022 related to this information. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list View journal entry worksheet Date General Journal Debit Credit 1 Dec 31, 2022 Cost of Goods Sold Inventory 7,760 7,760 Great Adventures Problem AP7-1 [The following information applies to the questions displayed below) Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $15,000. They expect to use the Suburban for five years and then sell the vehicle for $6,000. The following expenditures related to the vehicle were also made on July 1, 2022 The company pays $2,550 to GEICO for a one-year Insurance policy. The company spends an extra $6,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. . An additional $2.750 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022. the company pays $1.900 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Great Adventures Problem AP7-1 Part 3 3. Prepare a depreciation schedule using the straight-line method. Year 2022 2023 GREAT ADVENTURES End of Year Amounts Depreciation Accumulated Book Value Expense Depreciation s 4,0605 5,260 S 22.240 4,040 10,520 18,180 4,060 15,780 14,120 4,060 21,040 10,060 4,060 26,300 6,000 4,060 31,560 0 S 24,340 2024 2025 2026 2027 Total Great Adventures Problem AP7-1 [The following information applies to the questions displayed below) Tony and Suzle see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $15,000. They expect to use the Suburban for five years and then sell the vehicle for $6.000. The following expenditures related to the vehicle were also made on July 1, 2022 The company pays $2.550 to GEICO for a one-year Insurance policy. The company spends an extra $6,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. . An additional $2.750 is spent on a deluxe roof rack and a trailer hitch The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22. 2022, the company pays $1.900 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter Great Adventures Problem AP7-1 Part 4 4. Record the depreciation expense and any other adjustments related to the vehicle on December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Dec 31, 2022 Depreciation Expense Accumulated Depreciation 1,775 1.775 2 2 Dec 31, 2022 Insurance Expense Prepaid Insurance 1.275 1.275