Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im not sure what you mean? heres the question again 1. (a) (i) You run an Irish company which is an exporter to USA. You

im not sure what you mean? heres the question again

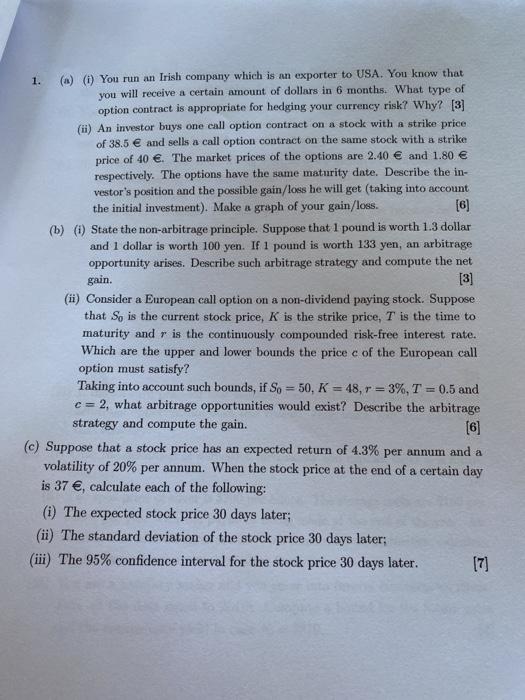

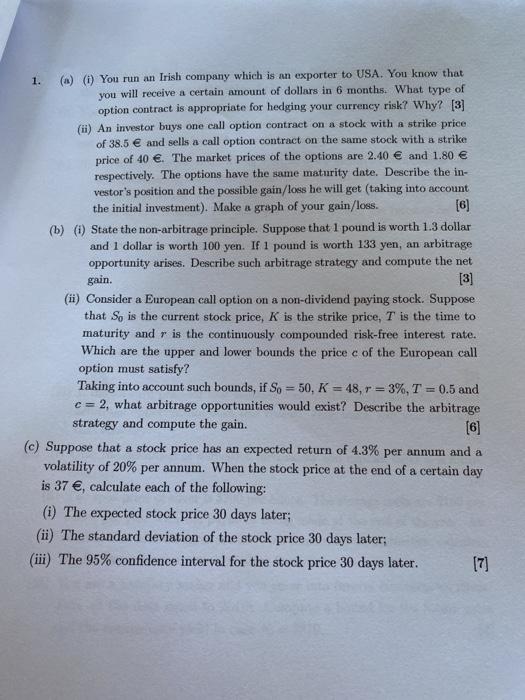

1. (a) (i) You run an Irish company which is an exporter to USA. You know that you will receive a certain amount of dollars in 6 months. What type of option contract is appropriate for hedging your currency risk? Why? [3] (ii) An investor buys one call option contract on a stock with a strike price of 38.5 and sells a call option contract on the same stock with a strike price of 40 . The market prices of the options are 2.40 and 1.80 respectively. The options have the same maturity date. Describe the in- vestor's position and the possible gain/loss he will get taking into account the initial investment). Make a graph of your gain/loss. (b) () State the non-arbitrage principle. Suppose that 1 pound is worth 1.3 dollar and 1 dollar is worth 100 yen. If 1 pound is worth 133 yen, an arbitrage opportunity arises. Describe such arbitrage strategy and compute the net gain [3] (ii) Consider a European call option on a non-dividend paying stock. Suppose that So is the current stock price, K is the strike price, T is the time to maturity and r is the continuously compounded risk-free interest rate. Which are the upper and lower bounds the price c of the European call option must satisfy? Taking into account such bounds, if So = 50, K = 18, r = 3%, T = 0.5 and c = 2, what arbitrage opportunities would exist? Describe the arbitrage strategy and compute the gain. (c) Suppose that a stock price has an expected return of 1.3% per annum and a volatility of 20% per annum. When the stock price at the end of a certain day is 37 , calculate each of the following: (1) The expected stock price 30 days later; (11) The standard deviation of the stock price 30 days later; (ii) The 95% confidence interval for the stock price 30 days later, [7] 1. (a) (6) You run an Irish company which is an exporter to USA. You know that you will receive a certain amount of dollars in 6 months. What type of option contract is appropriate for hedging your currency risk? Why? [3] (ii) An investor buys one call option contract on a stock with a strike price of 38.5 and sells a call option contract on the same stock with a strike price of 40 . The market prices of the options are 2.40 and 1.80 respectively. The options have the same maturity date. Describe the in- vestor's position and the possible gain/loss he will get taking into account the initial investment). Make a graph of your gain/loss. [6] (b) (i) State the non-arbitrage principle. Suppose that 1 pound is worth 1.3 dollar and 1 dollar is worth 100 yen. If 1 pound is worth 133 yen, an arbitrage opportunity arises. Describe such arbitrage strategy and compute the net gain. [3] (ii) Consider a European call option on a non-dividend paying stock. Suppose that So is the current stock price, K is the strike price, T is the time to maturity and r is the continuously compounded risk-free interest rate. Which are the upper and lower bounds the price c of the European call option must satisfy? Taking into account such bounds, if so = 50, K = 48, r = 3%, T = 0.5 and c=2, what arbitrage opportunities would exist? Describe the arbitrage strategy and compute the gain. [6] (c) Suppose that a stock price has an expected return of 4.3% per annum and a volatility of 20% per annum. When the stock price at the end of a certain day is 37 , calculate each of the following: (i) The expected stock price 30 days later; (ii) The standard deviation of the stock price 30 days later; (iii) The 95% confidence interval for the stock price 30 days later. [7]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started