Question: I'm not sure which table I need to use, FVAD or FVA or... On September 30, 2021, Ferguson Imports leased a warehouse. Terms of the

I'm not sure which table I need to use, FVAD or FVA or...

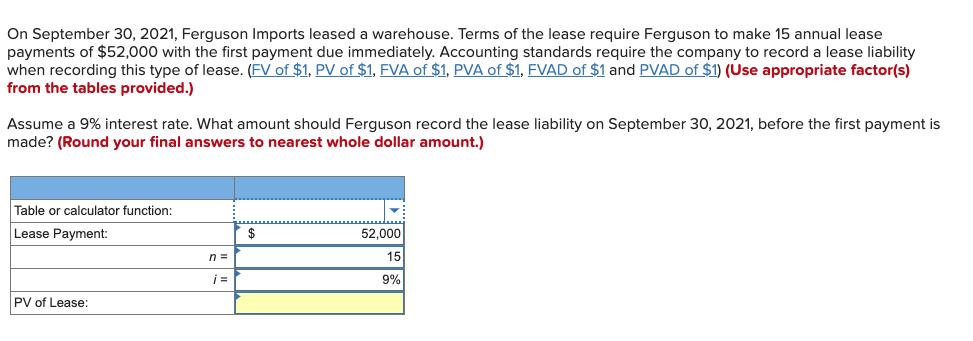

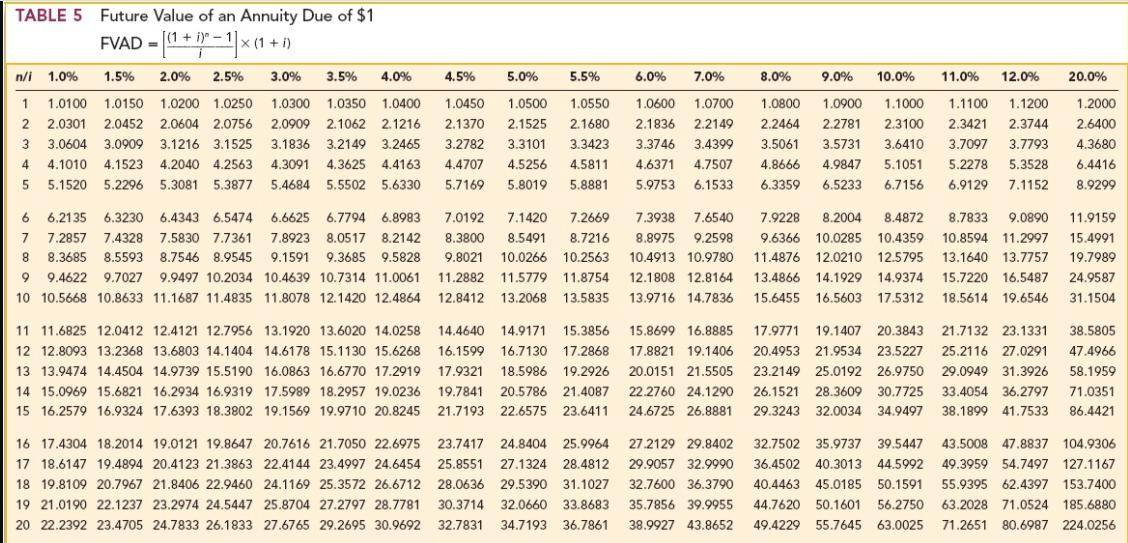

On September 30, 2021, Ferguson Imports leased a warehouse. Terms of the lease require Ferguson to make 15 annual lease payments of $52,000 with the first payment due immediately. Accounting standards require the company to record a lease liability when recording this type of lease. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Assume a 9% interest rate. What amount should Ferguson record the lease liability on September 30, 2021, before the first payment is made? (Round your final answers to nearest whole dollar amount.) Table or calculator function: Lease Payment: 2$ 52,000 n = 15 i = 9% PV of Lease:

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Present value interest factor annuity11inI i9 n15 ... View full answer

Get step-by-step solutions from verified subject matter experts