Question

Im practicing ERR and Incremental ERR but fail to get the right answers can you help me with my practice problems? Alphas External Rate of

Im practicing ERR and Incremental ERR but fail to get the right answers can you help me with my practice problems?

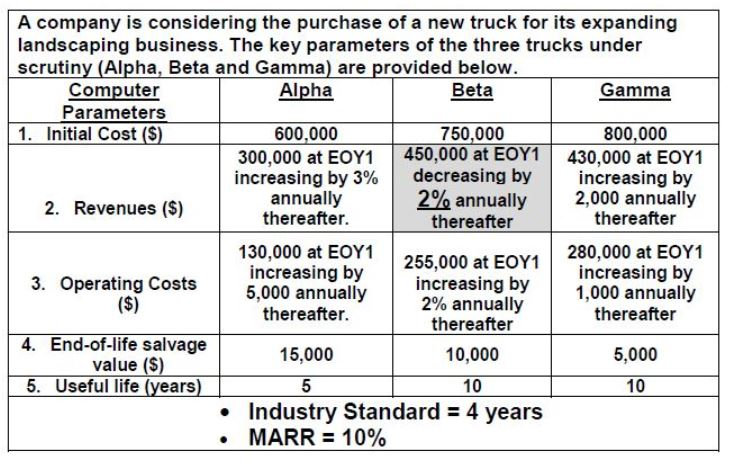

Alphas External Rate of Return (ERR) (second decimal; no rounding) is a) 12.88%; b) 13.38%; c) 13.86%; d) 14.17%. 20. Betas External Rate of Return (ERR) (second decimal; no rounding) is ECO 1192B (Fall 2017) First Assignments (Pink) Page 4 a) 11.15%; b) 11.71%; c) 11.98%; d) 12.17%. 21. The incremental External Rate of Return (ERR) between Alpha and Gamma (second decimal; no rounding) is a) 10.40%; b) 10.75%; c) 10.95%; d) 11.12%. 22. The incremental External Rate of Return (ERR) between Beta and Gamma (second decimal; no rounding) is a) 10.49%; b) 10.80%; c) 11.28%; d) 11.73%.

A company is considering the purchase of a new truck for its expanding landscaping business. The key parameters of the three trucks under scrutiny (Alpha, Beta and Gamma) are provided below Computer Parameters Alpha Beta Gamma Initia Cost 5! -3000 071 450,000001 430.00 0 20 2%annually | 2,000 annually 600,000 800,000 300,000 at EOY1 450,000 at EOY1 430,000 at EOY1 increasing by 3% | decreasing by increasing by 2. Revenues (S) annually thereafter. thereafter 280,000 at EOY1 1,000 annually thereafter 130,000 at EOY1 255,000 Eincreasing by increasing by 5,000 annually thereafter. 3. Operating Costs increasing by 2% annually thereafter thereafter 4. End-of-life salvage 15,000 5 10,000 5,000 10 value (S) 5. Useful life (years) 10 Industry Standard = 4 years . MARR= 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started