Answered step by step

Verified Expert Solution

Question

1 Approved Answer

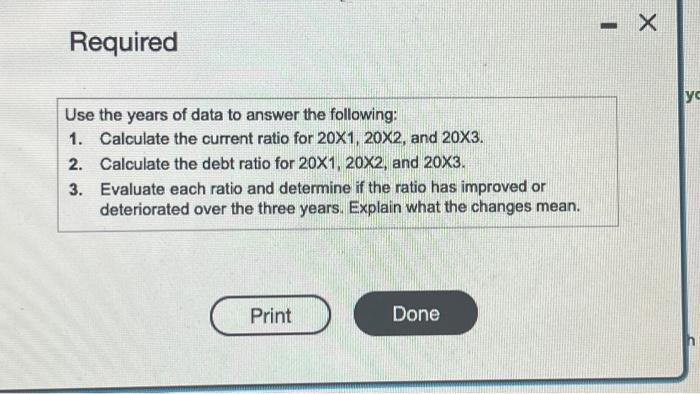

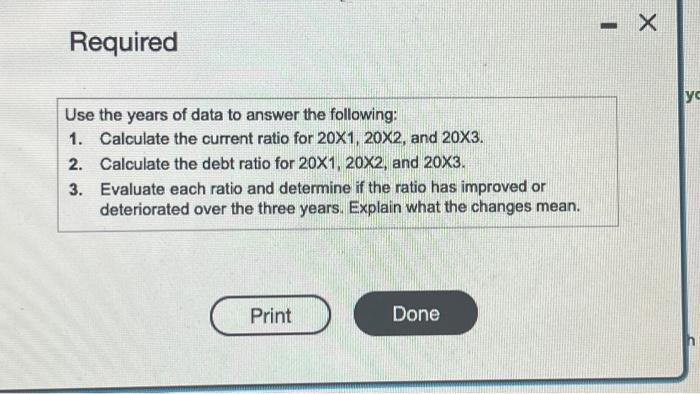

im really struggling on this please help! Required Use the years of data to answer the following: 1. Calculate the current ratio for 201,202, and

im really struggling on this please help!

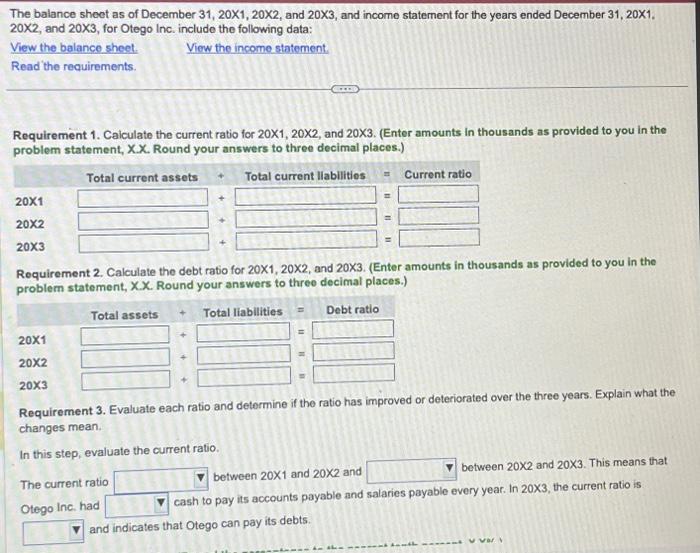

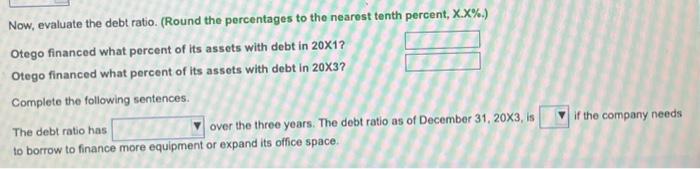

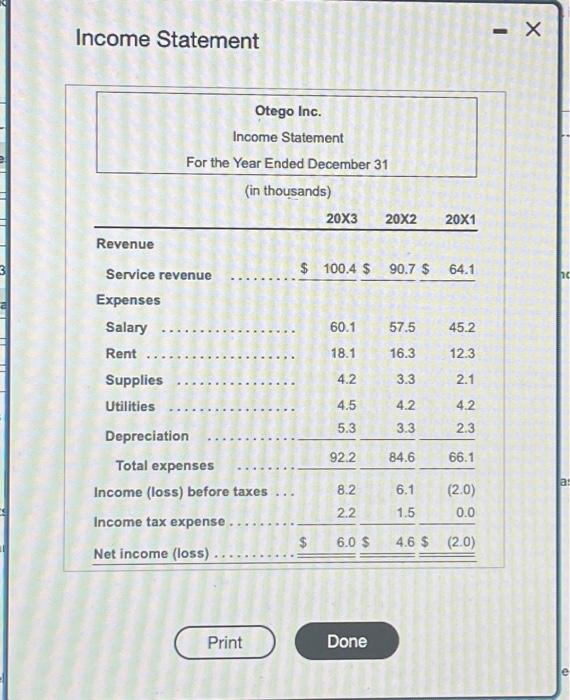

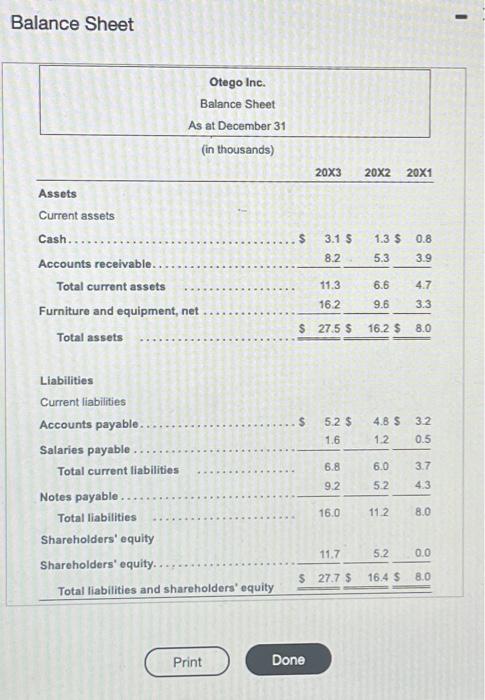

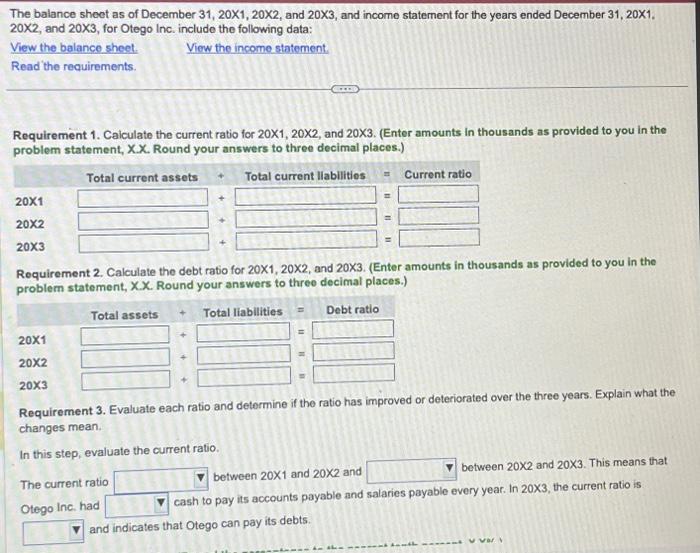

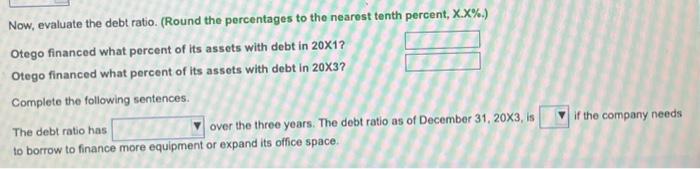

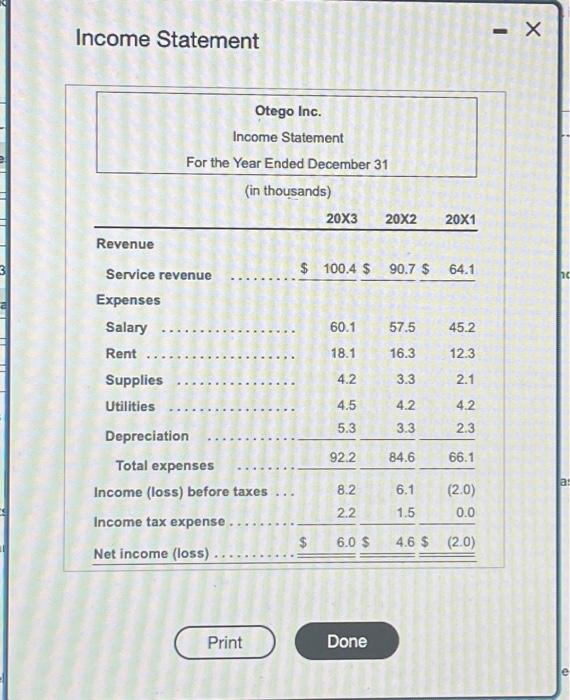

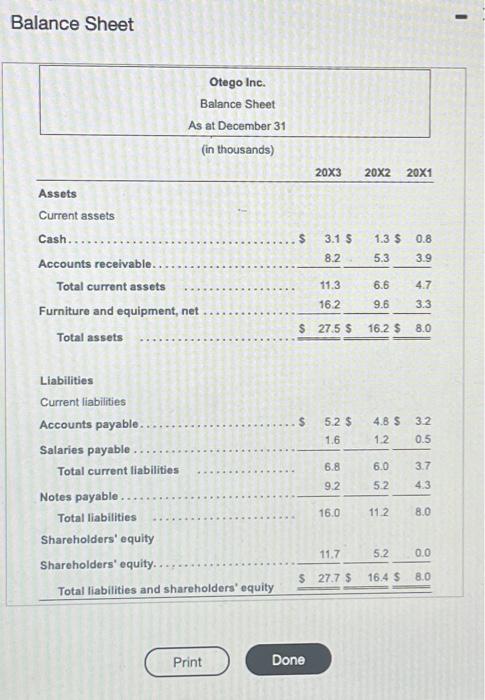

Required Use the years of data to answer the following: 1. Calculate the current ratio for 201,202, and 203. 2. Calculate the debt ratio for 201,202, and 203. 3. Evaluate each ratio and determine if the ratio has improved or deteriorated over the three years. Explain what the changes mean. Income Statement The balance sheet as of December 31,201,202, and 203, and income staternent for the years ended December 31,201. 202, and 203, for Otego Inc. include the following data: View the balance sheet. Read the requirements. Requirement 1. Caiculate the current ratio for 201,202, and 20X3. (Enter amounts in thousands as provided to you in the problem statement, X.X. Round your answers to three decimal places.) Requirement 2. Calculate the debt ratio for 201,202, and 203. (Enter amounts in thousands as provided to you in the problem statement, X.X. Round your answers to three decimal places.) Requirement 3. Evaluate each ratio and determine if the ratio has improved or deteriorated over the three years. Explain what the changes mean. In this step, evaluate the current ratio. The current ratio between 201 and 202 and between 202 and 203. This means that Otego Inc. had cash to pay its accounts payable and salaries payable every year. In 203, the current ratio is and indicates that Otego can pay its debts. Now, evaluate the debt ratio. (Round the percentages to the nearest tenth percent, X.X\%.) Otego financed what percent of its assets with debt in 201 ? Otego financed what percent of its assets with debt in 203 ? Complete the following sentences. The debt ratio has over the three years. The debt ratio as of December 31,203, is if the company needs to borrow to finance more equipment or expand its office space. Relonno Chont

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started