Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm still uncertain of what the journal entries are. Exercise 8-5 (Part Level Submission) Novak Company asks you to review its December 31, 2017, inventory

I'm still uncertain of what the journal entries are.

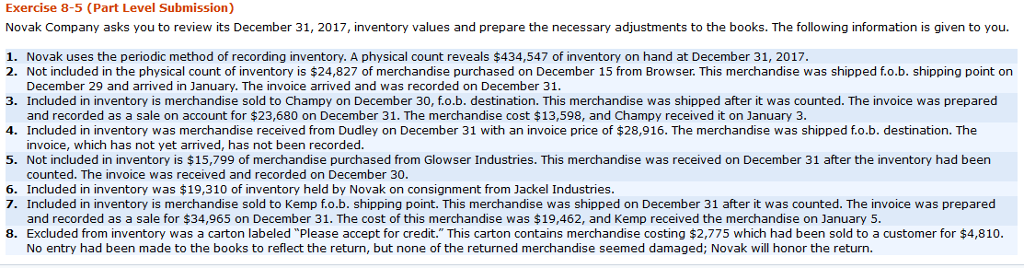

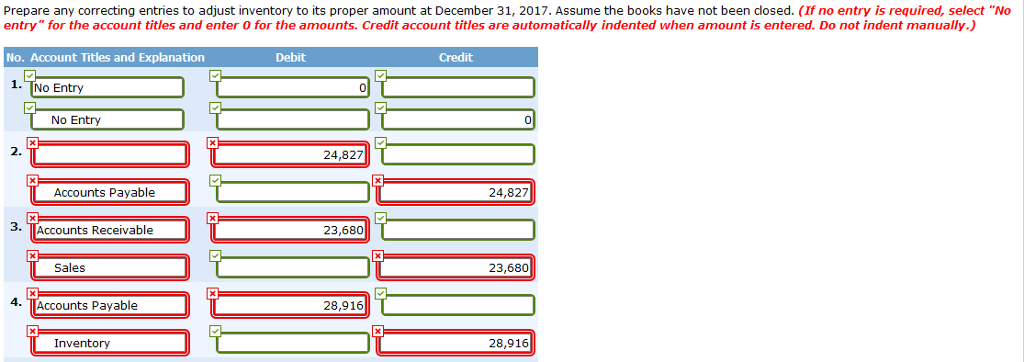

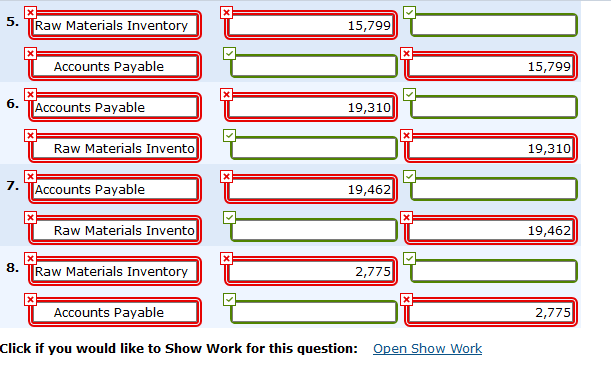

Exercise 8-5 (Part Level Submission) Novak Company asks you to review its December 31, 2017, inventory values and prepare the necessary adjustments to the books. The following information is given to you. 1. Novak uses the periodic method of recording inventory. A physical count reveals $434,547 of inventory on hand at December 31, 2017 2. Not included in the physical count of inventory is $24,827 of merchandise purchased on December 15 from Browser This merchandise was shipped fo.b. shipping point on December 29 and arrived in January. The invoice arrived and was recorded on December 31. 3. Included in inventory is merchandise sold to Champy on December 30, fo.b. destination. This merchandise was shipped after it was counted. The invoice was prepared and recorded as a sale on account for $23,680 on December 31. The merchandise cost $13,598, and Champy received it on January 3 4. Included in inventory was merchandise received from Dudley on December 31 with an invoice price of $28,916. The merchandise was shipped fo.b. destination. The invoice, which has not yet arrived, has not been recorded 5. Not included in inventory is $15,799 of merchandise purchased from Glowser Industries. This merchandise was received on December 31 after the inventory had been counted. The invoice was received and recorded on December 30 6. Included in inventory was $19,310 of inventory held by Novak on consignment from Jackel Industries. 7. Included in inventory is merchandise sold to Kemp fo.b. shipping point. This merchandise was shipped on December 31 after it was counted. The invoice was prepared and recorded as a sale for $34,965 on December 31. The cost of this merchandise was $19,462, and Kemp received the merchandise on January 5. 8. Excluded from inventory was a carton labeled "Please accept for credit." This carton contains merchandise costing $2,775 which had been sold to a customer for $4,810 No entry had been made to the books to reflect the return, but none of the returned merchandise seemed damaged; Novak will honor the returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started