Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im stuck on the last three Suppose that someone purchased 100 shares of Adobe System common stock for $6.75 per share right after Adobe's IPO.

im stuck on the last three

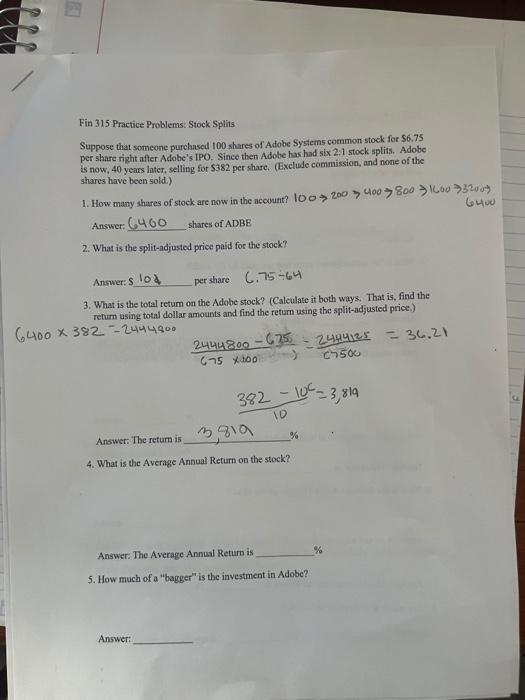

Suppose that someone purchased 100 shares of Adobe System common stock for $6.75 per share right after Adobe's IPO. Since then Adobe has had six 2:1 stock splits. Adobe is now, 40 years later, selling for $382 per share. (Exclude commission, and none of the shares have been sold)

1. How many shares of stock are now in the account?

2. What is the Split-Adjusted price paid from the stock

3. what is the total return on the Adobe Stock? (calculated both ways. That is, find the return using total dollar amounts and final return using the split adjusted price.)

4. what is the average annual return on the stock?

5. how much of a "bagger" is the investment in adobe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started