Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im submitting a different problem since the first one was missing information, disregard the old. attached is the new. Thank you for you help !

im submitting a different problem since the first one was missing information, disregard the old. attached is the new. Thank you for you help !

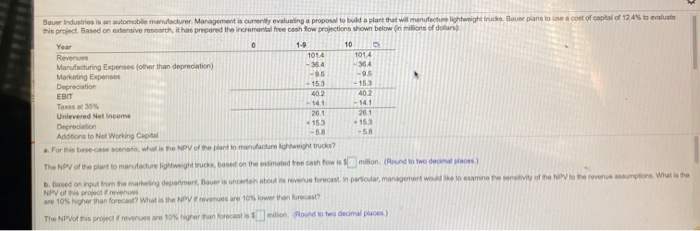

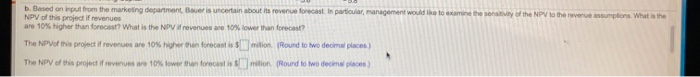

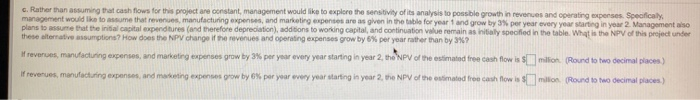

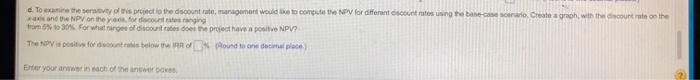

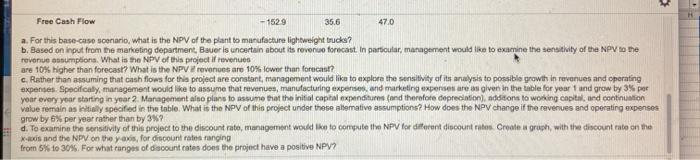

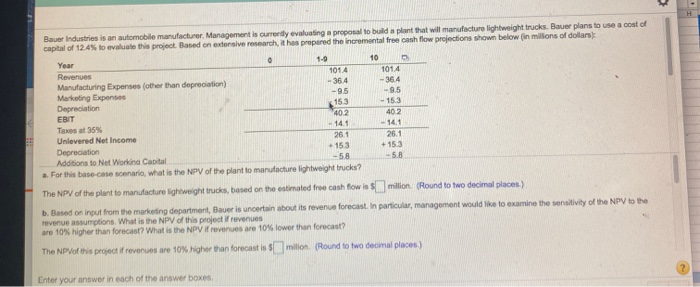

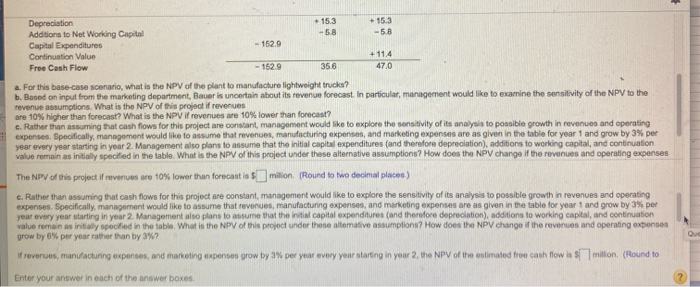

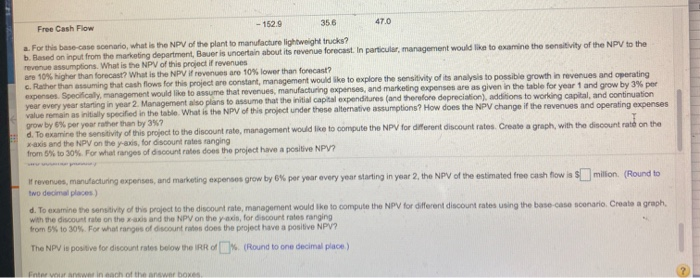

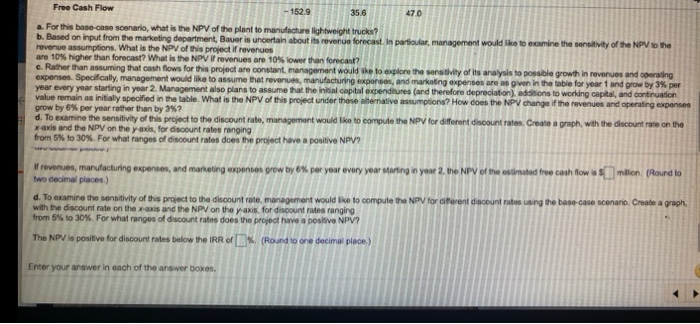

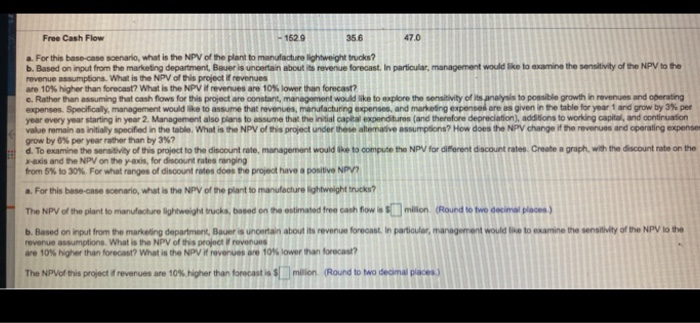

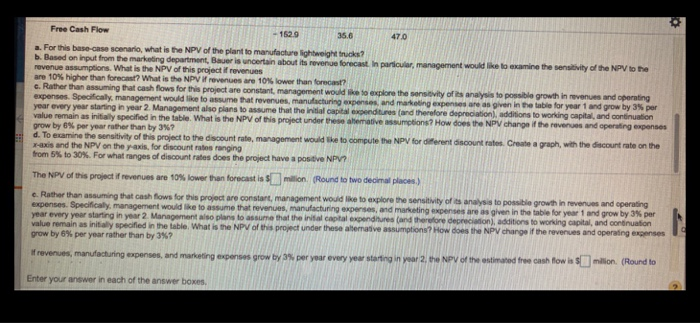

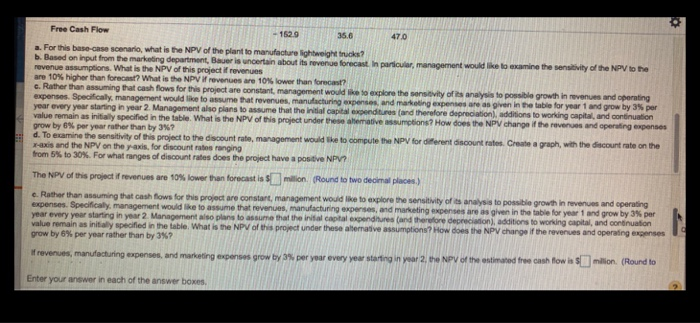

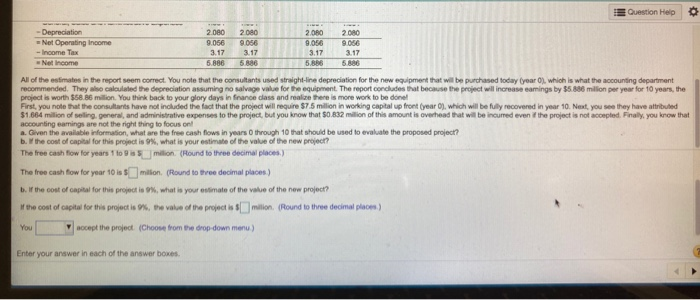

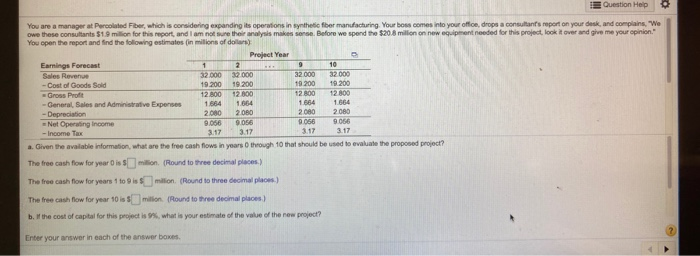

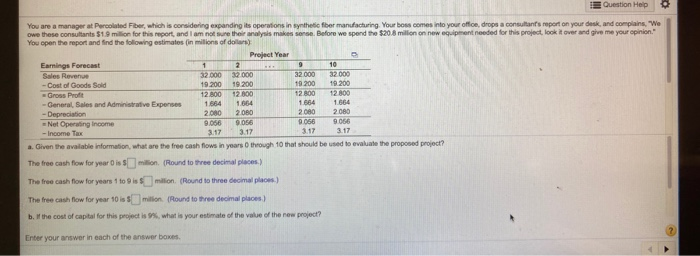

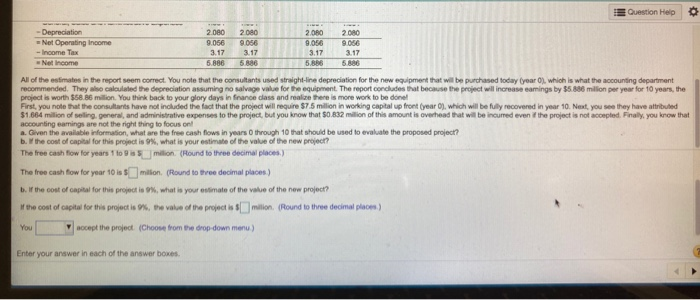

Bauer Industries is an automobile manufacturer Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks Bauplans to use a cost of capital of 12.4% to evaluate this project. Based on extensive research, it has prepared the incremental free ashow projections shown below On millions of dollars Revue Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EBIT Tax 35% Unlevered Net Income Depreciation Additions to Net Working Capital For is base-casescent, what is the NPV of the plant to mancare lightweight trucks? evity of the NAVO hrevenue assumptions What is the The NPV of the plant to manufacture lightweight trucks based on the m ed tre cash flow is million (Round to two decimal places) b. Based on input from the marketing deparment, Bauer is uncertain about even forecast in particular, management would like to camine the NPV of this project revenues are 10% higher than forca? What is the revenues are 10% lower forecast? million Round to two decim o s ) to higher can forecastis The NP of this project revenues b. Based on input from the marketing department Buis uncertain about its revenue forecast. In particular, management wou NPV of this project if revenues are 10% higher than forecast? What is the NPV revenue 10% lower than forecast? The NPVof this project of revenues are 10% higher than forecasti m ilion Round to two decimal places) The NPV of this project if revenus 10% lower than forecasti m ilion Round to wo decimal places) G. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses and marketing expenses are given in the table for year and grow by 3% per year every year starting in your 2 Management also plans to assume that the initial capital expendtures and therefore depreciation), additions to working capital and continuation value romain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 3%? If revenues, manufacturing expenses, and marketing expenses grow by 3% per your every year starting in year 2 the NPV of the estimated free cash flow is million Round to two decimal places) If revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated from cash flow is million (Round to decimal places) cenano Create a graph, with the court rate on the d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different count rates using the base-s xaxis and the NPV on the yard for discounts ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR X Round to one decimal place) Enter your answer in each of the answer box Free Cash Flow - 1529 35.6 47.0 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation), additions to working capital and continuation value remain asingly specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates Create a graph, with the discount rate on the x-axis and the NPV on the years, for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? Bauer Industries is an automobile manufacturer, Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.45 to evaluate this project. Based on extensive research has prepared the incremental free cash flow projections whown below in millions of dollars Revenues Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EBIT -95 153 Unlevered Net Income Depreciation 153 Addition to Net Working Capital -58 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? + 153 --58 The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is million (Round to two decimal places) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular, management would like to examine the sensitivity of the NPV to the revenue assumptions What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? The NP Vof this projectif revenues are 10% higher than forecast is milion (Round to two decimal places) Enter your answer in each of the answer boxes 15.3 15.3 -58 Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 35.6 470 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to assume that the initial capital expenditures (and therefore depreciation), addition to working capital and continuabon value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses The NPV of this project if revenues are 10% lower than forecastis million (Round to two decimal places) Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to me that the initial capital expenditures and therefore depreciation), addition to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? revenues, manufacturing expenses, and marketing expenses grow by 3% per year every year starting in your 2. the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes. Free Cash Flow 356 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation Valm is s ed in the What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 357 d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different discount rates. Create a graph with the discount rate on the xaxis and the NPV on the yaxis for discount rates ranging from 5% to 30%. For what range of discount rates does the project have a positive NPV? revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated free cash flow million (Round to two decimal places). d. To examine the sensitivity of this project to the discount management would like to compute the NPV for different discount rates using the base case scenario Create a graph, with the discount rate on the arts and the NPV on the para, for discourt rates ranging from 5 to 30%. For what range of discount is does the project have a positive NPV? The NPV is positive for discount rates below the IRR of Round to one decimal place) Free Cash Flow - 1529 3 5.6 a. For this buse-case scenario, what is the NPV of the plant to manufacture lightweight truck b. Based on input from the marketing department, Bauer is uncertain about its revenue forces in particular, of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast c. Rather than assuming that cash flows for this project are constant, management would like to explore the senstvity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as gven in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capitalecenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these wernative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 337 d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for rate on the and the NPV on the years for discount rates ranging from 5 to 30%. For what range of discount rates does the project have a positive NPV? revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in your 2. the NPV of the estimated free cash flow milion (Round to two decimal places) d. To examine the sensitivity of this project to the discount rate management would like to complete sease care a graph with the discount rate on the coas and the NPV on the yaxs for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of % (Round to one decimal pleon) Enter your answer in each of the answer boxes, Free Cash Flow - 1529 35.6 47.0 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV reverses are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation addition to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change of the revenue and operating expense grow by 6% per year rather than by 3%? d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates Create a grip with the discount rate on the x-axis and the NPV on the yaxis, for discount rates ranging from 5% to 30%. For what ranges of discount roles does the project have a positive NPV? For this bases senario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is milion (Round to two decimal places) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this projecte s are 10% ger than forecast? What is the NPV irreverse 10% lower than forecast The NPVof this project revenues are 10% higher than forecast is $ milion Round to two decimal places) Free Cash Flow 470 . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular management would e xamine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation additions to working capital and continuation value remain as initially specified in the table What is the NPV of this project under these aberrative cons? How does the NPV changed the revenues and operating expenses grow by 6% per year rather than by IN? d. To examine the sensitivity of this project to the discount rate, management would be to compute the NPV for different discount rates Create a graph, with the discourt rate on the axis and the NPV on the axis for discounts ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV of this projectif revenues are 10% lower than forecastis million Round to two decimal places e. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to assume that the infal capital expenditures (and therefore depreciation, additions to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expense grow by 6% per year rather than by 3%? revenues, manufacturing expenses and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes. Free Cash Flow -1529 . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular management work examine the sensitivity of the NPV to the evenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation, additions to working capital and continuation value remain as initially specified in the table What is the NPV of this project under the heative cons? How does the NPV changed the revenues and operating expenses grow by 6% per year rather than by ? d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different discount rates Create a graph, with the court rate on the axis and the NPV on the axis for discounts ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV of this projectif revenues are 10% lower than forecasti m illon. Round to two decimal places) c. Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are given in the table for years and grow by 3% per year every year starting in year 2 Management also plans to assume that the info captal expenditures and therefore depreciation additions to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change of the revenues and operating expense grow by 6% per year rather than by 3%? revenues, manufacturing expenses and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes Question Help You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic bor manufacturing Your boss comes into your offe, drops a consultant's report on your desk and complains, We owe these consultants 19 million for this report and I am not sure the analysis makes sense. Before we spend the $20.8 million on new win d ed for this project look over and give me your opinion." You open the report and find the following estimates in millions of dollars) Project Year Earinge Forecast 2 . Swes Revenge 32000 32000 32000 -Cost of Goods Sold 19 200 200 19 200 -Gross Profit 12700 12800 2800 12800 - General Sales and Adr ve Expenses 1664 1664 - Depreciation 2.080 2080 2080 Net Operating income 9.056 9056 9.066 9066 -Income Tax 3.173 17 Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed proje The free cash flow for year is The free cash flow for years to s The tree cash flow for year 10 i 5 b. the cost of capital for this min (Round to the decimal places) m ilion (Round to three decimal places) milion (Round to three decimal places) is what is your state of the value of the new project? Enter your answer in each of the answer boxes Question Help Net Operating income All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year), which is what the accounting department recommended. They also calculated the depreciation assuming no salvage value for the equipment. The report concludes that because the project will increase amings by $5.886 million per year for 10 years, the project is worth $58.86 million. You think back to your glory days in france dass and realize there is more work to be donel First, you note that the consultants have not included the fact that the project will require $7.5 million in working capital up front year), which will be fully recovered in year 10. Next, you see they have attributed $1.664 million of selling general, and administrative expenses to the project, but you know that $0.832 million of this amount is overhead that will be incurred even the project is not accepted. Finally, you know that accounting samnings are not the right thing to focus on a. Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? b. W the cost of capital for this project is 9%, what is your estimate of the value of the new project? The free cash flow for years 1 to 9 million (Round to three decimal places) The free cash flow for year 10 is million (Round to three decimal places) bs. If the cost of capital for this project is what is your state of the value of the new project? if the cost of capital for this project is the value of the project is s milion (Round to three decimal places) You nocept the project (Choose from the drop down menu) Enter your answer in each of the answer boxes Bauer Industries is an automobile manufacturer Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks Bauplans to use a cost of capital of 12.4% to evaluate this project. Based on extensive research, it has prepared the incremental free ashow projections shown below On millions of dollars Revue Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EBIT Tax 35% Unlevered Net Income Depreciation Additions to Net Working Capital For is base-casescent, what is the NPV of the plant to mancare lightweight trucks? evity of the NAVO hrevenue assumptions What is the The NPV of the plant to manufacture lightweight trucks based on the m ed tre cash flow is million (Round to two decimal places) b. Based on input from the marketing deparment, Bauer is uncertain about even forecast in particular, management would like to camine the NPV of this project revenues are 10% higher than forca? What is the revenues are 10% lower forecast? million Round to two decim o s ) to higher can forecastis The NP of this project revenues b. Based on input from the marketing department Buis uncertain about its revenue forecast. In particular, management wou NPV of this project if revenues are 10% higher than forecast? What is the NPV revenue 10% lower than forecast? The NPVof this project of revenues are 10% higher than forecasti m ilion Round to two decimal places) The NPV of this project if revenus 10% lower than forecasti m ilion Round to wo decimal places) G. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses and marketing expenses are given in the table for year and grow by 3% per year every year starting in your 2 Management also plans to assume that the initial capital expendtures and therefore depreciation), additions to working capital and continuation value romain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 3%? If revenues, manufacturing expenses, and marketing expenses grow by 3% per your every year starting in year 2 the NPV of the estimated free cash flow is million Round to two decimal places) If revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated from cash flow is million (Round to decimal places) cenano Create a graph, with the court rate on the d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different count rates using the base-s xaxis and the NPV on the yard for discounts ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR X Round to one decimal place) Enter your answer in each of the answer box Free Cash Flow - 1529 35.6 47.0 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation), additions to working capital and continuation value remain asingly specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates Create a graph, with the discount rate on the x-axis and the NPV on the years, for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? Bauer Industries is an automobile manufacturer, Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.45 to evaluate this project. Based on extensive research has prepared the incremental free cash flow projections whown below in millions of dollars Revenues Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EBIT -95 153 Unlevered Net Income Depreciation 153 Addition to Net Working Capital -58 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? + 153 --58 The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is million (Round to two decimal places) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular, management would like to examine the sensitivity of the NPV to the revenue assumptions What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? The NP Vof this projectif revenues are 10% higher than forecast is milion (Round to two decimal places) Enter your answer in each of the answer boxes 15.3 15.3 -58 Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 35.6 470 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to assume that the initial capital expenditures (and therefore depreciation), addition to working capital and continuabon value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses The NPV of this project if revenues are 10% lower than forecastis million (Round to two decimal places) Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to me that the initial capital expenditures and therefore depreciation), addition to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? revenues, manufacturing expenses, and marketing expenses grow by 3% per year every year starting in your 2. the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes. Free Cash Flow 356 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation Valm is s ed in the What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 357 d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different discount rates. Create a graph with the discount rate on the xaxis and the NPV on the yaxis for discount rates ranging from 5% to 30%. For what range of discount rates does the project have a positive NPV? revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated free cash flow million (Round to two decimal places). d. To examine the sensitivity of this project to the discount management would like to compute the NPV for different discount rates using the base case scenario Create a graph, with the discount rate on the arts and the NPV on the para, for discourt rates ranging from 5 to 30%. For what range of discount is does the project have a positive NPV? The NPV is positive for discount rates below the IRR of Round to one decimal place) Free Cash Flow - 1529 3 5.6 a. For this buse-case scenario, what is the NPV of the plant to manufacture lightweight truck b. Based on input from the marketing department, Bauer is uncertain about its revenue forces in particular, of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast c. Rather than assuming that cash flows for this project are constant, management would like to explore the senstvity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as gven in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capitalecenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these wernative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 337 d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for rate on the and the NPV on the years for discount rates ranging from 5 to 30%. For what range of discount rates does the project have a positive NPV? revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in your 2. the NPV of the estimated free cash flow milion (Round to two decimal places) d. To examine the sensitivity of this project to the discount rate management would like to complete sease care a graph with the discount rate on the coas and the NPV on the yaxs for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of % (Round to one decimal pleon) Enter your answer in each of the answer boxes, Free Cash Flow - 1529 35.6 47.0 a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV reverses are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation addition to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change of the revenue and operating expense grow by 6% per year rather than by 3%? d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates Create a grip with the discount rate on the x-axis and the NPV on the yaxis, for discount rates ranging from 5% to 30%. For what ranges of discount roles does the project have a positive NPV? For this bases senario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is milion (Round to two decimal places) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this projecte s are 10% ger than forecast? What is the NPV irreverse 10% lower than forecast The NPVof this project revenues are 10% higher than forecast is $ milion Round to two decimal places) Free Cash Flow 470 . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular management would e xamine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation additions to working capital and continuation value remain as initially specified in the table What is the NPV of this project under these aberrative cons? How does the NPV changed the revenues and operating expenses grow by 6% per year rather than by IN? d. To examine the sensitivity of this project to the discount rate, management would be to compute the NPV for different discount rates Create a graph, with the discourt rate on the axis and the NPV on the axis for discounts ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV of this projectif revenues are 10% lower than forecastis million Round to two decimal places e. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2 Management also plans to assume that the infal capital expenditures (and therefore depreciation, additions to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expense grow by 6% per year rather than by 3%? revenues, manufacturing expenses and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes. Free Cash Flow -1529 . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular management work examine the sensitivity of the NPV to the evenue assumptions. What is the NPV of this project revenues are 10% higher than forecast? What is the NPV revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures and therefore depreciation, additions to working capital and continuation value remain as initially specified in the table What is the NPV of this project under the heative cons? How does the NPV changed the revenues and operating expenses grow by 6% per year rather than by ? d. To examine the sensitivity of this project to the discount rate management would like to compute the NPV for different discount rates Create a graph, with the court rate on the axis and the NPV on the axis for discounts ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV? The NPV of this projectif revenues are 10% lower than forecasti m illon. Round to two decimal places) c. Rather than assuming that cash flows for this project are constant management would like to explore the sensitivity of analysis to possible growth in revenues and operating expenses. Specifically management would like to assume that revenues, manufacturing expenses, and marketing expenses are given in the table for years and grow by 3% per year every year starting in year 2 Management also plans to assume that the info captal expenditures and therefore depreciation additions to working capital and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change of the revenues and operating expense grow by 6% per year rather than by 3%? revenues, manufacturing expenses and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is million (Round to Enter your answer in each of the answer boxes Question Help You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic bor manufacturing Your boss comes into your offe, drops a consultant's report on your desk and complains, We owe these consultants 19 million for this report and I am not sure the analysis makes sense. Before we spend the $20.8 million on new win d ed for this project look over and give me your opinion." You open the report and find the following estimates in millions of dollars) Project Year Earinge Forecast 2 . Swes Revenge 32000 32000 32000 -Cost of Goods Sold 19 200 200 19 200 -Gross Profit 12700 12800 2800 12800 - General Sales and Adr ve Expenses 1664 1664 - Depreciation 2.080 2080 2080 Net Operating income 9.056 9056 9.066 9066 -Income Tax 3.173 17 Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed proje The free cash flow for year is The free cash flow for years to s The tree cash flow for year 10 i 5 b. the cost of capital for this min (Round to the decimal places) m ilion (Round to three decimal places) milion (Round to three decimal places) is what is your state of the value of the new project? Enter your answer in each of the answer boxes Question Help Net Operating income All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year), which is what the accounting department recommended. They also calculated the depreciation assuming no salvage value for the equipment. The report concludes that because the project will increase amings by $5.886 million per year for 10 years, the project is worth $58.86 million. You think back to your glory days in france dass and realize there is more work to be donel First, you note that the consultants have not included the fact that the project will require $7.5 million in working capital up front year), which will be fully recovered in year 10. Next, you see they have attributed $1.664 million of selling general, and administrative expenses to the project, but you know that $0.832 million of this amount is overhead that will be incurred even the project is not accepted. Finally, you know that accounting samnings are not the right thing to focus on a. Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? b. W the cost of capital for this project is 9%, what is your estimate of the value of the new project? The free cash flow for years 1 to 9 million (Round to three decimal places) The free cash flow for year 10 is million (Round to three decimal places) bs. If the cost of capital for this project is what is your state of the value of the new project? if the cost of capital for this project is the value of the project is s milion (Round to three decimal places) You nocept the project (Choose from the drop down menu) Enter your answer in each of the answer boxes **The firms income tax rate can be calculated as: (income Tax Paid)/(Net Operating Income)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started