Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm supposed to use the NIKE stock information from yahoo finance but am having trouble coming up with how to calculate every cell in 2018

I'm supposed to use the NIKE stock information from yahoo finance but am having trouble coming up with how to calculate every cell in 2018

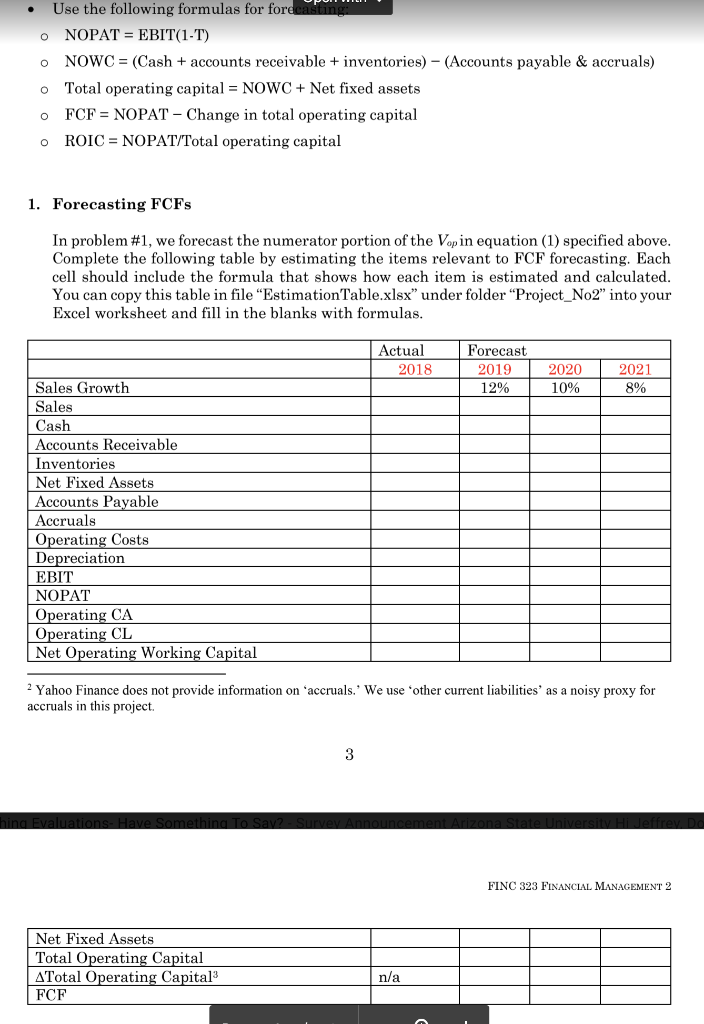

Use the following formulas for forecasting O NOPAT = EBIT(1-T) O NOWC = (Cash + accounts receivable + inventories) - (Accounts payable & accruals) Total operating capital = NOWC + Net fixed assets o FCF = NOPAT - Change in total operating capital o ROIC = NOPAT/Total operating capital 1. Forecasting FCFs In problem #1, we forecast the numerator portion of the Vapin equation (1) specified above. Complete the following table by estimating the items relevant to FCF forecasting. Each cell should include the formula that shows how each item is estimated and calculated. You can copy this table in file "Estimation Table.xlsx" under folder "Project_No2" into your Excel worksheet and fill in the blanks with formulas. Actual 2018 Forecast 2019 12% 2020 10% 2021 8% Sales Growth Sales Cash Accounts Receivable Inventories Net Fixed Assets Accounts Payable Accruals Operating Costs Depreciation | EBIT NOPAT Operating CA Operating CL Net Operating Working Capital 2 Yahoo Finance does not provide information on 'accruals.' We use other current liabilities' as a noisy proxy for accruals in this project. hina Evaluations Have Something To Sav2_Survey Announcement Arizona State University Hi Jeffrey. Do FINC 323 FINANCIAL MANAGEMENT 2 Net Fixed Assets Total Operating Capital ATotal Operating Capital FCF Use the following formulas for forecasting O NOPAT = EBIT(1-T) O NOWC = (Cash + accounts receivable + inventories) - (Accounts payable & accruals) Total operating capital = NOWC + Net fixed assets o FCF = NOPAT - Change in total operating capital o ROIC = NOPAT/Total operating capital 1. Forecasting FCFs In problem #1, we forecast the numerator portion of the Vapin equation (1) specified above. Complete the following table by estimating the items relevant to FCF forecasting. Each cell should include the formula that shows how each item is estimated and calculated. You can copy this table in file "Estimation Table.xlsx" under folder "Project_No2" into your Excel worksheet and fill in the blanks with formulas. Actual 2018 Forecast 2019 12% 2020 10% 2021 8% Sales Growth Sales Cash Accounts Receivable Inventories Net Fixed Assets Accounts Payable Accruals Operating Costs Depreciation | EBIT NOPAT Operating CA Operating CL Net Operating Working Capital 2 Yahoo Finance does not provide information on 'accruals.' We use other current liabilities' as a noisy proxy for accruals in this project. hina Evaluations Have Something To Sav2_Survey Announcement Arizona State University Hi Jeffrey. Do FINC 323 FINANCIAL MANAGEMENT 2 Net Fixed Assets Total Operating Capital ATotal Operating Capital FCFStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started