I'm trying these with a friend, but still can't make it through. I would appreciate if anyone can help asap. even if you don't know whole things, partly also would be great, Thank you.

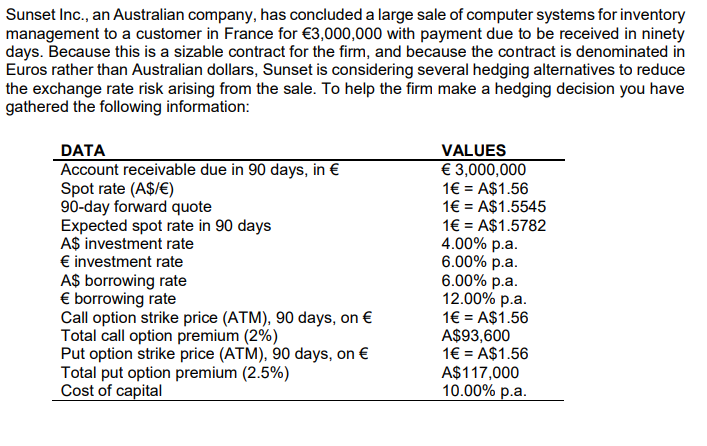

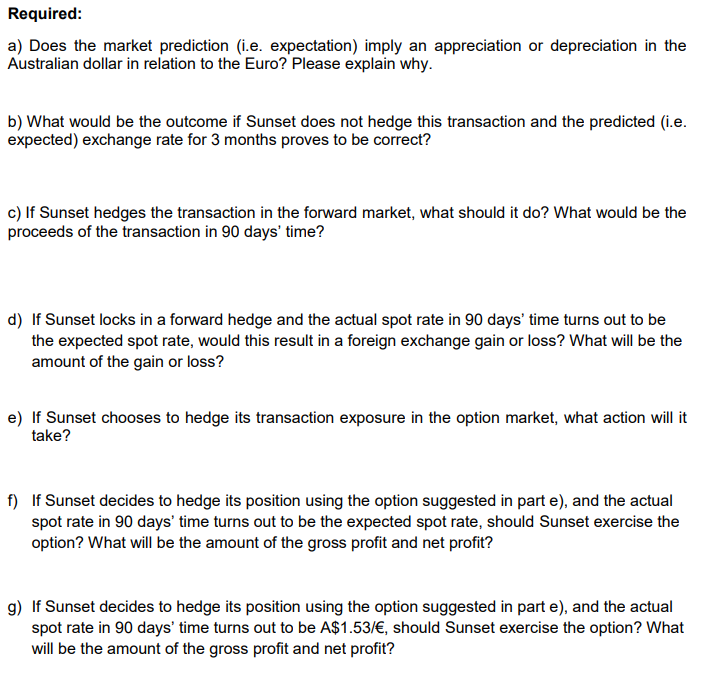

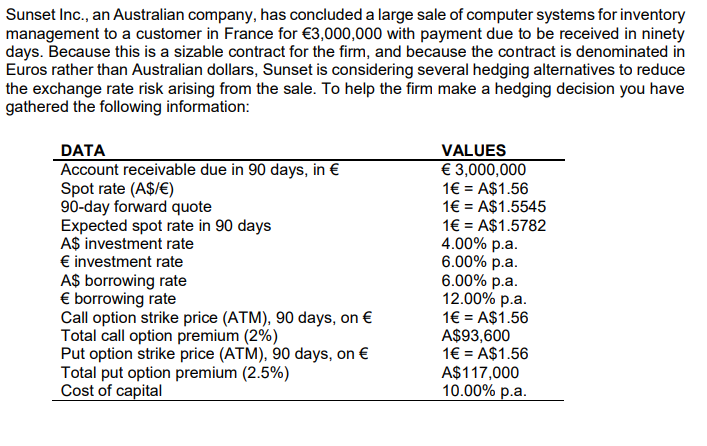

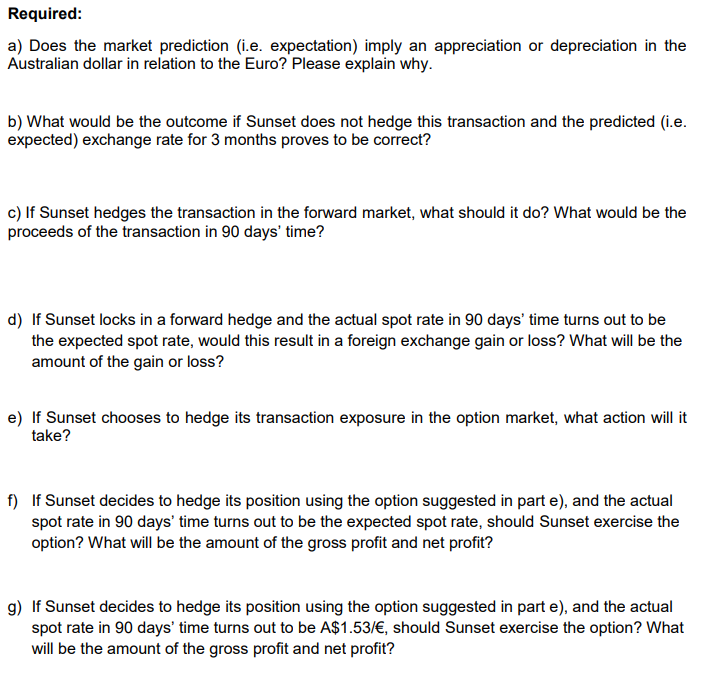

Sunset Inc., an Australian company, has concluded a large sale of computer systems for inventory management to a customer in France for 3,000,000 with payment due to be received in ninety days. Because this is a sizable contract for the firm, and because the contract is denominated in Euros rather than Australian dollars, Sunset is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the following information: DATA Account receivable due in 90 days, in Spot rate (A$/) 90-day forward quote Expected spot rate in 90 days A$ investment rate investment rate A$ borrowing rate borrowing rate Call option strike price (ATM), 90 days, on Total call option premium (2%) Put option strike price (ATM), 90 days, on Total put option premium (2.5%) Cost of capital VALUES 3,000,000 1 = A$1.56 1 = A$1.5545 1 = A$1.5782 4.00% p.a. 6.00% p.a. 6.00% p.a. 12.00% p.a. 1 = A$1.56 A$93,600 1 = A$1.56 A$117,000 10.00% p.a. Required: a) Does the market prediction (i.e. expectation) imply an appreciation or depreciation in the Australian dollar in relation to the Euro? Please explain why. b) What would be the outcome if Sunset does not hedge this transaction and the predicted (i.e. expected) exchange rate for 3 months proves to be correct? c) If Sunset hedges the transaction in the forward market, what should it do? What would be the proceeds of the transaction in 90 days' time? d) If Sunset locks in a forward hedge and the actual spot rate in 90 days' time turns out to be the expected spot rate, would this result in a foreign exchange gain or loss? What will be the amount of the gain or loss? e) If Sunset chooses to hedge its transaction exposure in the option market, what action will it take? f) If Sunset decides to hedge its position using the option suggested in parte), and the actual spot rate in 90 days' time turns out to be the expected spot rate, should Sunset exercise the option? What will be the amount of the gross profit and net profit? g) If Sunset decides to hedge its position using the option suggested in parte), and the actual spot rate in 90 days' time turns out to be A$1.53/, should Sunset exercise the option? What will be the amount of the gross profit and net profit