Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Im Version A (Sukhpreet Singh ... Saved Su Home Insert Layout References Review View Help Table Edit Times New Ro... 12 B 1 U Ou

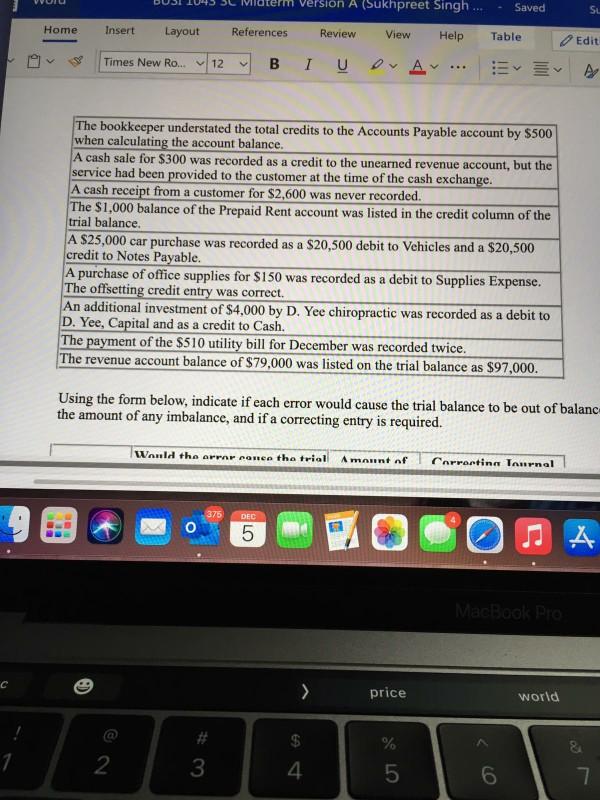

Im Version A (Sukhpreet Singh ... Saved Su Home Insert Layout References Review View Help Table Edit Times New Ro... 12 B 1 U Ou Av ... The bookkeeper understated the total credits to the Accounts Payable account by $500 when calculating the account balance. A cash sale for $300 was recorded as a credit to the unearned revenue account, but the service had been provided to the customer at the time of the cash exchange. A cash receipt from a customer for $2,600 was never recorded. The $1,000 balance of the Prepaid Rent account was listed in the credit column of the trial balance. A $25,000 car purchase was recorded as a $20,500 debit to Vehicles and a $20,500 credit to Notes Payable. A purchase of office supplies for $150 was recorded as a debit to Supplies Expense. The offsetting credit entry was correct. An additional investment of $4.000 by D. Yee chiropractic was recorded as a debit to D. Yee, Capital and as a credit to Cash. The payment of the $510 utility bill for December was recorded twice. The revenue account balance of $79,000 was listed on the trial balance as $97,000. Using the form below, indicate if each error would cause the trial balance to be out of balanc the amount of any imbalance, and if a correcting entry is required. Would the error once the trial A mannt of Corrortin Tournal 375 DEC 5 4 MacBook Pro ) > price world # $ % 1 2 3 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started