Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael purchased the shares in ABC Pty Ltd below. On 8 February 2020 Michael sold all of his ABC Ltd shares for $7,800. He

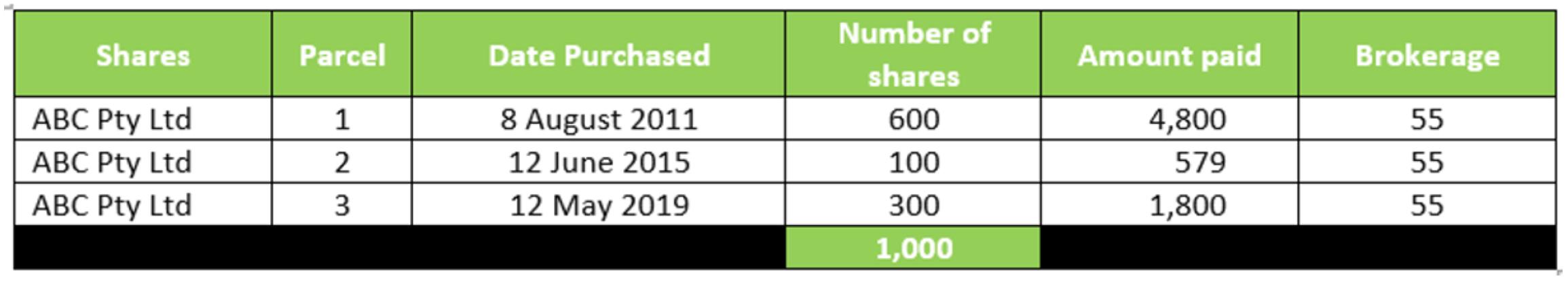

Michael purchased the shares in ABC Pty Ltd below. On 8 February 2020 Michael sold all of his ABC Ltd shares for $7,800. He paid $220 brokerage on the sale. Calculate Michael's capital gain and determine what he will include at Item 18 of his tax return. Number of Shares Dete Purchad Amount paid Broerg Item 18H 456 Item 18A 383 Item 18V 0 theres ABC Pty Ltd ABC Pty Ltd 8 August 2011 12 lune 2015 4,800 100 579 55 12 May 2019 300 55 100 Item 18H 327 Item 18A 174 Item 18V 0 Item 18H 481 Item 18A 174 Item 18V 0 Item 18H 543 Item 18A 174 Item 18V 0 Hint: 1 Correct answer (s) Number of Shares Parcel Date Purchased Amount paid Brokerage shares ABC Pty Ltd 1 8 August 2011 600 4,800 55 ABC Pty Ltd 2 12 June 2015 100 579 55 ABC Pty Ltd 3 12 May 2019 300 1,800 55 1,000

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Item 18H 543 Item 18A 174 Item 18V 0 While capital gains are generally associated with stocks and fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started