Answered step by step

Verified Expert Solution

Question

1 Approved Answer

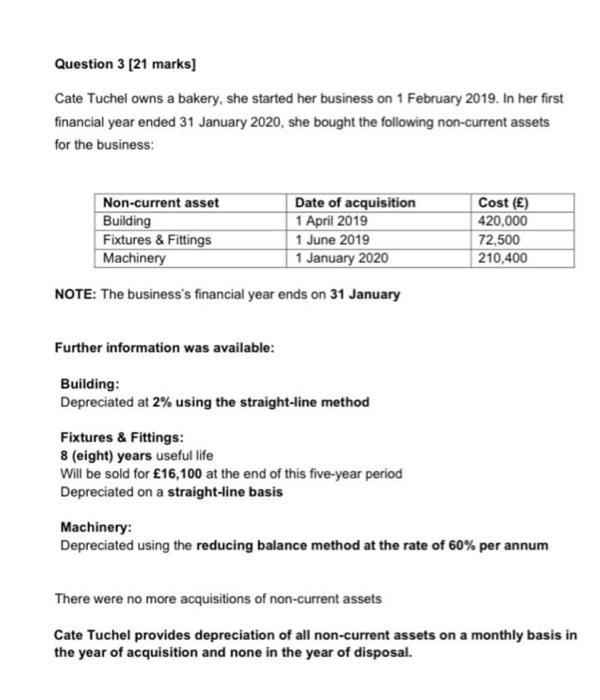

Question 3 [21 marks] Cate Tuchel owns a bakery, she started her business on 1 February 2019. In her first financial year ended 31

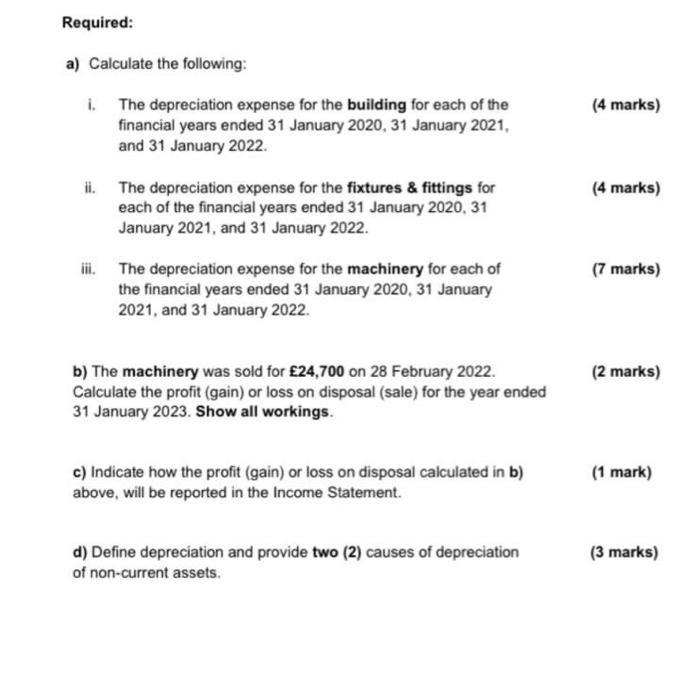

Question 3 [21 marks] Cate Tuchel owns a bakery, she started her business on 1 February 2019. In her first financial year ended 31 January 2020, she bought the following non-current assets for the business: Date of acquisition 1 April 2019 1 June 2019 1 January 2020 NOTE: The business's financial year ends on 31 January Non-current asset Building Fixtures & Fittings Machinery Further information was available: Building: Depreciated at 2% using the straight-line method Fixtures & Fittings: 8 (eight) years useful life Will be sold for 16,100 at the end of this five-year period Depreciated on a straight-line basis Cost () 420,000 72,500 210,400 Machinery: Depreciated using the reducing balance method at the rate of 60% per annum There were no more acquisitions of non-current assets Cate Tuchel provides depreciation of all non-current assets on a monthly basis in the year of acquisition and none in the year of disposal. Required: a) Calculate the following: i. The depreciation expense for the building for each of the financial years ended 31 January 2020, 31 January 2021, and 31 January 2022. ii. The depreciation expense for the fixtures & fittings for each of the financial years ended 31 January 2020, 31 January 2021, and 31 January 2022. The depreciation expense for the machinery for each of the financial years ended 31 January 2020, 31 January 2021, and 31 January 2022. b) The machinery was sold for 24,700 on 28 February 2022. Calculate the profit (gain) or loss on disposal (sale) for the year ended 31 January 2023. Show all workings. c) Indicate how the profit (gain) or loss on disposal calculated in b) above, will be reported in the Income Statement. d) Define depreciation and provide two (2) causes of depreciation of non-current assets. (4 marks) (4 marks) (7 marks) (2 marks) (1 mark) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started