Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The owner/operator of the Cigarette and Liquor Warehouse Store plans to adjust the computer system to allow him to skim cash from the

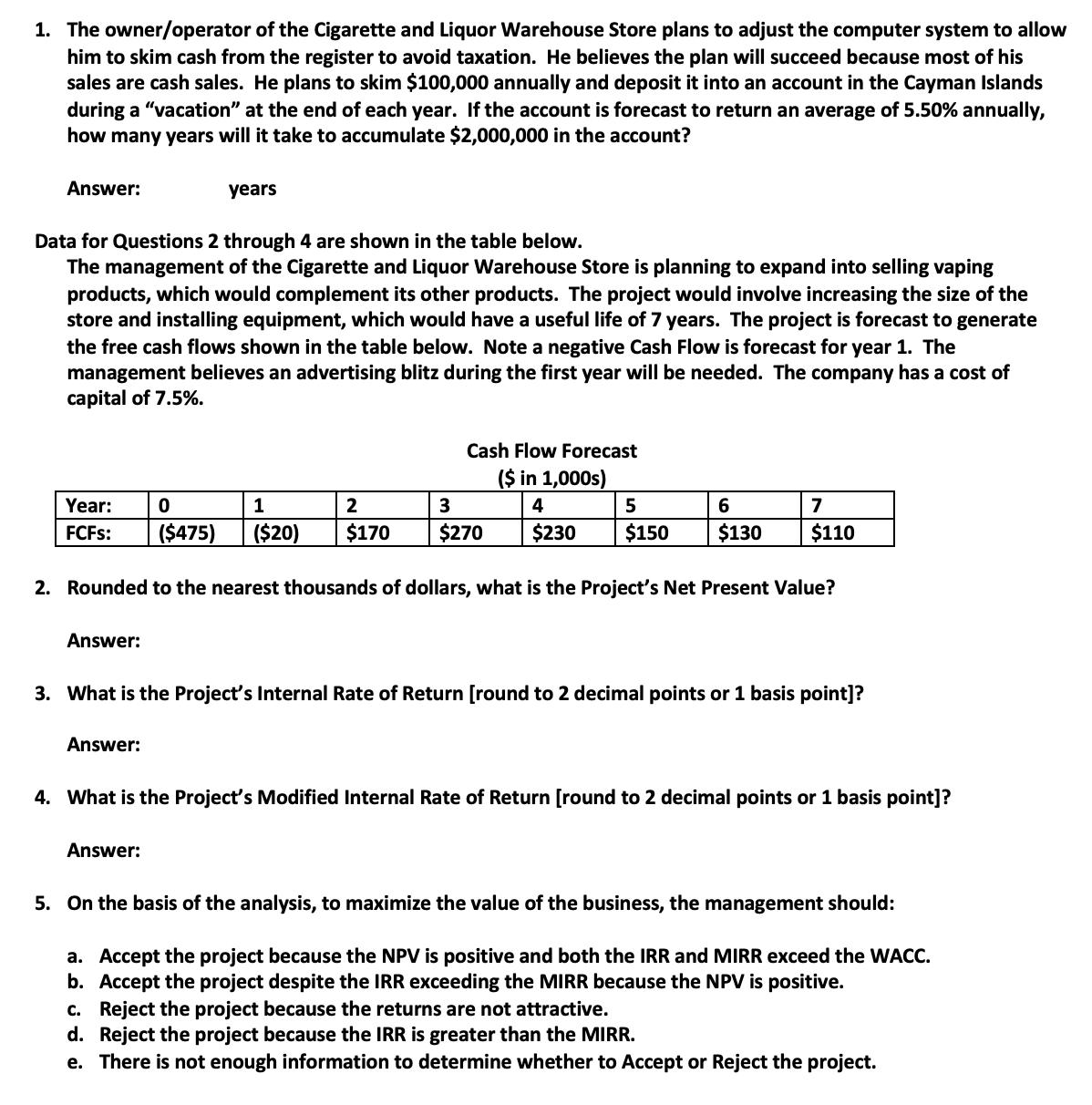

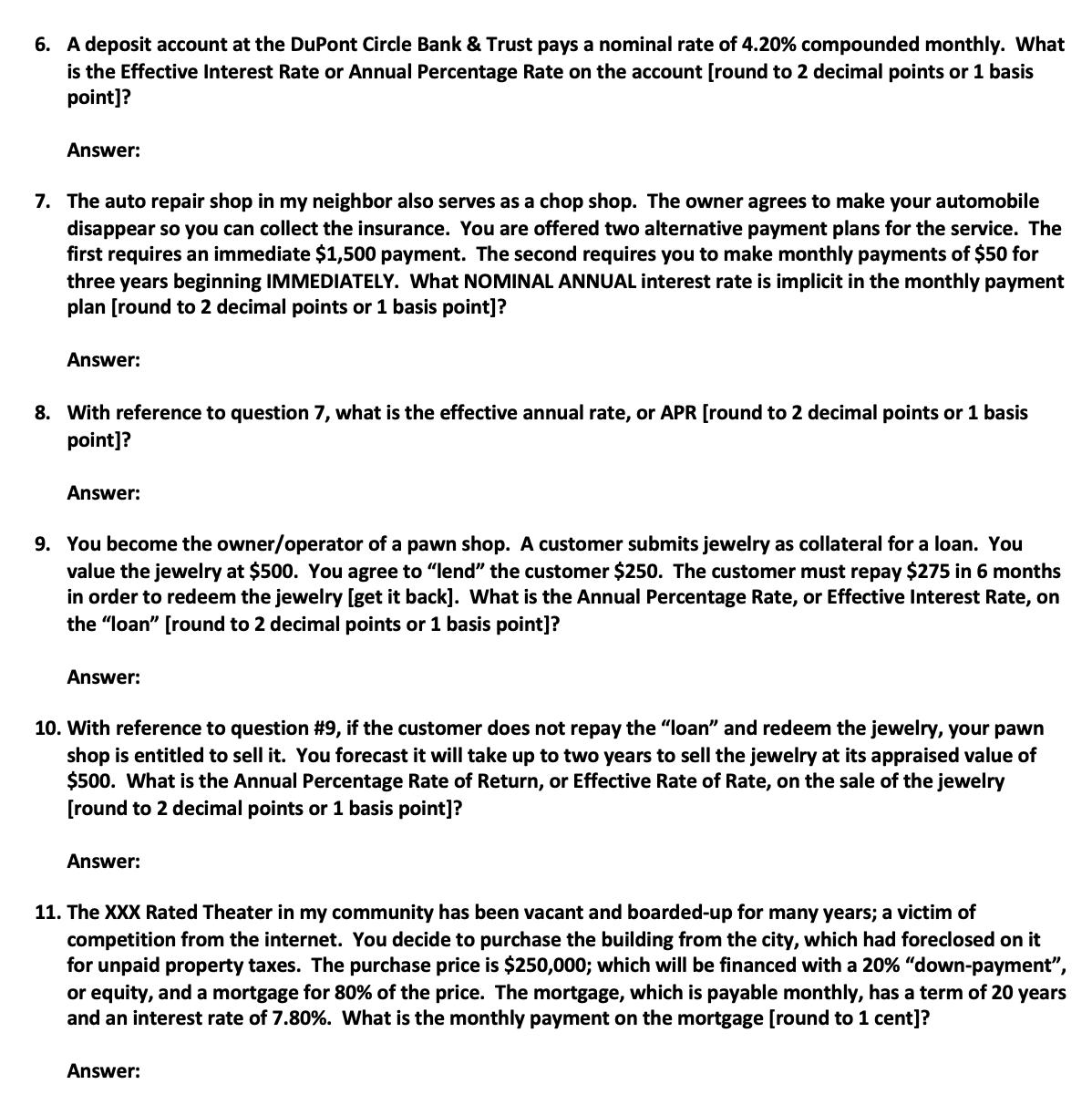

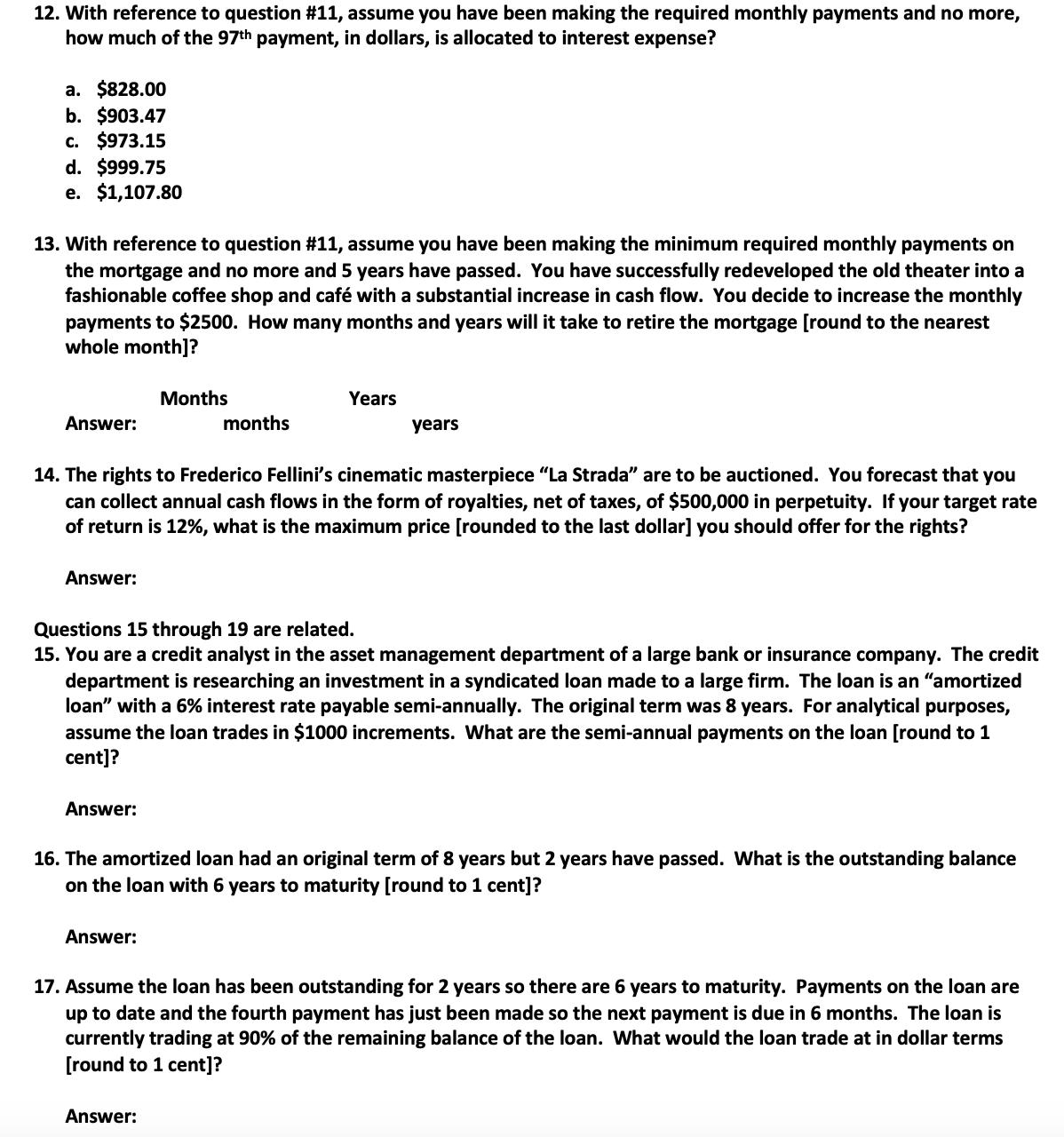

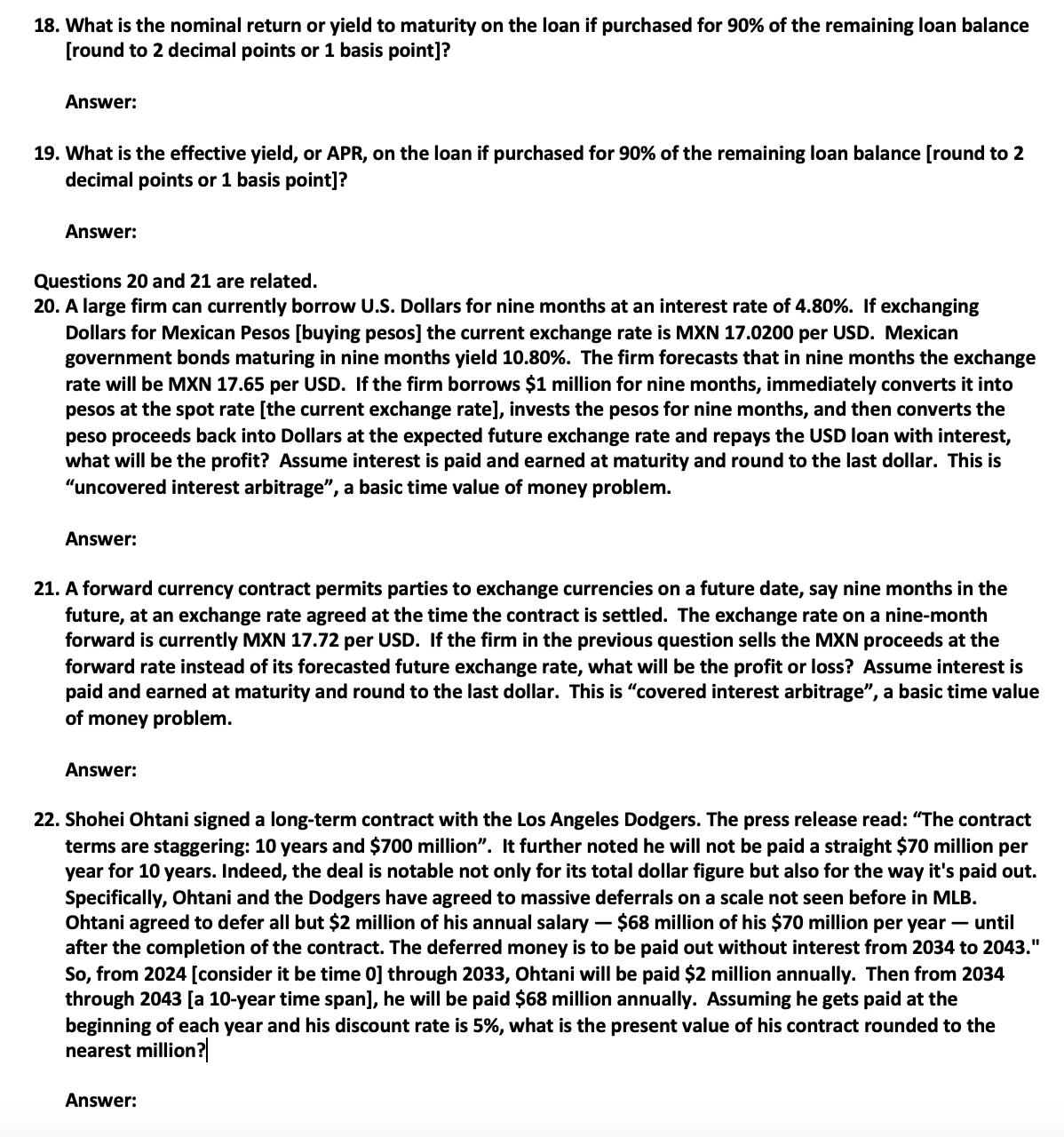

1. The owner/operator of the Cigarette and Liquor Warehouse Store plans to adjust the computer system to allow him to skim cash from the register to avoid taxation. He believes the plan will succeed because most of his sales are cash sales. He plans to skim $100,000 annually and deposit it into an account in the Cayman Islands during a "vacation" at the end of each year. If the account is forecast to return an average of 5.50% annually, how many years will it take to accumulate $2,000,000 in the account? Answer: years Data for Questions 2 through 4 are shown in the table below. The management of the Cigarette and Liquor Warehouse Store is planning to expand into selling vaping products, which would complement its other products. The project would involve increasing the size of the store and installing equipment, which would have a useful life of 7 years. The project is forecast to generate the free cash flows shown in the table below. Note a negative Cash Flow is forecast for year 1. The management believes an advertising blitz during the first year will be needed. The company has a cost of capital of 7.5%. Cash Flow Forecast ($ in 1,000s) Year: 0 1 FCFS: ($475) ($20) 2 $170 3 4 5 6 7 $270 $230 $150 $130 $110 2. Rounded to the nearest thousands of dollars, what is the Project's Net Present Value? Answer: 3. What is the Project's Internal Rate of Return [round to 2 decimal points or 1 basis point]? Answer: 4. What is the Project's Modified Internal Rate of Return [round to 2 decimal points or 1 basis point]? Answer: 5. On the basis of the analysis, to maximize the value of the business, the management should: a. Accept the project because the NPV is positive and both the IRR and MIRR exceed the WACC. b. Accept the project despite the IRR exceeding the MIRR because the NPV is positive. c. Reject the project because the returns are not attractive. d. Reject the project because the IRR is greater than the MIRR. e. There is not enough information to determine whether to Accept or Reject the project. 6. A deposit account at the DuPont Circle Bank & Trust pays a nominal rate of 4.20% compounded monthly. What is the Effective Interest Rate or Annual Percentage Rate on the account [round to 2 decimal points or 1 basis point]? Answer: 7. The auto repair shop in my neighbor also serves as a chop shop. The owner agrees to make your automobile disappear so you can collect the insurance. You are offered two alternative payment plans for the service. The first requires an immediate $1,500 payment. The second requires you to make monthly payments of $50 for three years beginning IMMEDIATELY. What NOMINAL ANNUAL interest rate is implicit in the monthly payment plan [round to 2 decimal points or 1 basis point]? Answer: 8. With reference to question 7, what is the effective annual rate, or APR [round to 2 decimal points or 1 basis point]? Answer: 9. You become the owner/operator of a pawn shop. A customer submits jewelry as collateral for a loan. You value the jewelry at $500. You agree to "lend" the customer $250. The customer must repay $275 in 6 months in order to redeem the jewelry [get it back]. What is the Annual Percentage Rate, or Effective Interest Rate, on the "loan" [round to 2 decimal points or 1 basis point]? Answer: 10. With reference to question #9, if the customer does not repay the "loan" and redeem the jewelry, your pawn shop is entitled to sell it. You forecast it will take up to two years to sell the jewelry at its appraised value of $500. What is the Annual Percentage Rate of Return, or Effective Rate of Rate, on the sale of the jewelry [round to 2 decimal points or 1 basis point]? Answer: 11. The XXX Rated Theater in my community has been vacant and boarded-up for many years; a victim of competition from the internet. You decide to purchase the building from the city, which had foreclosed on it for unpaid property taxes. The purchase price is $250,000; which will be financed with a 20% "down-payment", or equity, and a mortgage for 80% of the price. The mortgage, which is payable monthly, has a term of 20 years and an interest rate of 7.80%. What is the monthly payment on the mortgage [round to 1 cent]? Answer: 12. With reference to question #11, assume you have been making the required monthly payments and no more, how much of the 97th payment, in dollars, is allocated to interest expense? a. $828.00 b. $903.47 c. $973.15 d. $999.75 e. $1,107.80 13. With reference to question #11, assume you have been making the minimum required monthly payments on the mortgage and no more and 5 years have passed. You have successfully redeveloped the old theater into a fashionable coffee shop and caf with a substantial increase in cash flow. You decide to increase the monthly payments to $2500. How many months and years will it take to retire the mortgage [round to the nearest whole month]? Months Years Answer: months years 14. The rights to Frederico Fellini's cinematic masterpiece "La Strada" are to be auctioned. You forecast that you can collect annual cash flows in the form of royalties, net of taxes, of $500,000 in perpetuity. If your target rate of return is 12%, what is the maximum price [rounded to the last dollar] you should offer for the rights? Answer: Questions 15 through 19 are related. 15. You are a credit analyst in the asset management department of a large bank or insurance company. The credit department is researching an investment in a syndicated loan made to a large firm. The loan is an "amortized loan" with a 6% interest rate payable semi-annually. The original term was 8 years. For analytical purposes, assume the loan trades in $1000 increments. What are the semi-annual payments on the loan [round to 1 cent]? Answer: 16. The amortized loan had an original term of 8 years but 2 years have passed. What is the outstanding balance on the loan with 6 years to maturity [round to 1 cent]? Answer: 17. Assume the loan has been outstanding for 2 years so there are 6 years to maturity. Payments on the loan are up to date and the fourth payment has just been made so the next payment is due in 6 months. The loan is currently trading at 90% of the remaining balance of the loan. What would the loan trade at in dollar terms [round to 1 cent]? Answer: 18. What is the nominal return or yield to maturity on the loan if purchased for 90% of the remaining loan balance [round to 2 decimal points or 1 basis point]? Answer: 19. What is the effective yield, or APR, on the loan if purchased for 90% of the remaining loan balance [round to 2 decimal points or 1 basis point]? Answer: Questions 20 and 21 are related. 20. A large firm can currently borrow U.S. Dollars for nine months at an interest rate of 4.80%. If exchanging Dollars for Mexican Pesos [buying pesos] the current exchange rate is MXN 17.0200 per USD. Mexican government bonds maturing in nine months yield 10.80%. The firm forecasts that in nine months the exchange rate will be MXN 17.65 per USD. If the firm borrows $1 million for nine months, immediately converts it into pesos at the spot rate [the current exchange rate], invests the pesos for nine months, and then converts the peso proceeds back into Dollars at the expected future exchange rate and repays the USD loan with interest, what will be the profit? Assume interest is paid and earned at maturity and round to the last dollar. This is "uncovered interest arbitrage", a basic time value of money problem. Answer: 21. A forward currency contract permits parties to exchange currencies on a future date, say nine months in the future, at an exchange rate agreed at the time the contract is settled. The exchange rate on a nine-month forward is currently MXN 17.72 per USD. If the firm in the previous question sells the MXN proceeds at the forward rate instead of its forecasted future exchange rate, what will be the profit or loss? Assume interest is paid and earned at maturity and round to the last dollar. This is "covered interest arbitrage", a basic time value of money problem. Answer: 22. Shohei Ohtani signed a long-term contract with the Los Angeles Dodgers. The press release read: "The contract terms are staggering: 10 years and $700 million". It further noted he will not be paid a straight $70 million per year for 10 years. Indeed, the deal is notable not only for its total dollar figure but also for the way it's paid out. Specifically, Ohtani and the Dodgers have agreed to massive deferrals on a scale not seen before in MLB. Ohtani agreed to defer all but $2 million of his annual salary -$68 million of his $70 million per year - until after the completion of the contract. The deferred money is to be paid out without interest from 2034 to 2043." So, from 2024 [consider it be time 0] through 2033, Ohtani will be paid $2 million annually. Then from 2034 through 2043 [a 10-year time span], he will be paid $68 million annually. Assuming he gets paid at the beginning of each year and his discount rate is 5%, what is the present value of his contract rounded to the nearest million? Answer: Questions 23 through 27 are related. 23. A Wall Street Journal article titled "China's Foreign-Exchange Reserves Drop Below $3 Trillion, Near Six-Year Low" states the international reserves held by China's central bank decreased by $12.3 billion in January. According to one of the charts, reserves decreased at an average monthly rate of $33 billion over the past 2.5 years so the outflow slowed. If the bank can earn an annual return of 4.50% on its reserves and reserves continue to decrease at a monthly rate of $12.3 billion, how many months and years will it be until the reserves are down to $1 trillion? You can do this problem on the calculator but prove it with an Excel spreadsheet. 24. Months: Number of Years: 25. If outflows continue at $12.3 billon per month, what nominal interest rate or return must the central bank earn on its reserves to stabilize the balance at $3 trillion? Show the basic work and round to one basis point. Traditional Rate or Yield to Maturity: 26. If outflows continue at $12.3 billon per month, what effective interest rate or return must the central bank earn on its reserves to stabilize the balance at $3 trillion? Show the basic work and round to one basis point. APR or Effective Return: 27. If the reserve outflow increases to $33 billion per month, how many months will it be until the reserves are down to $1 trillion? Assume the bank can earn an annual return of 4.50% on its reserves. Number of Months:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

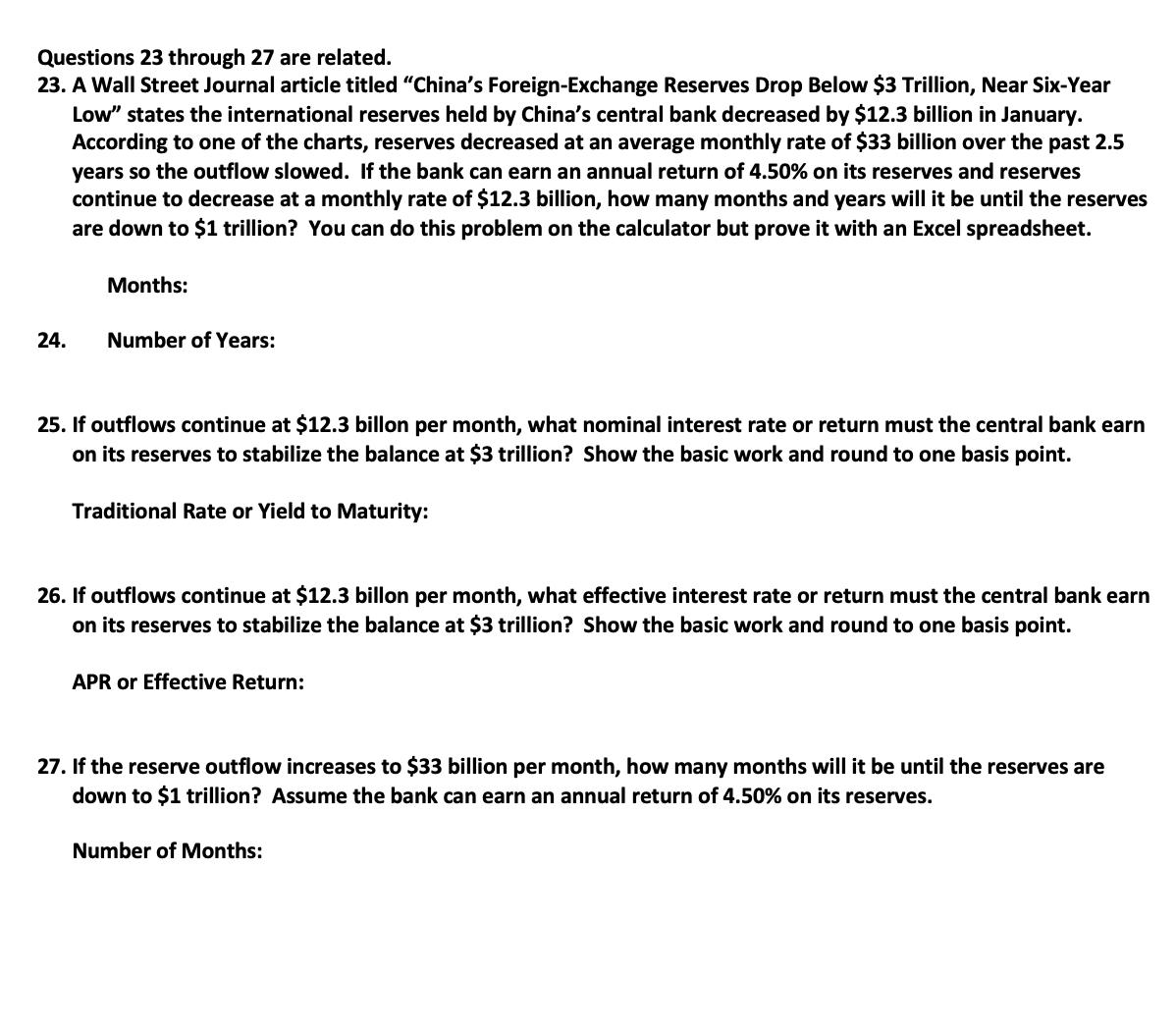

Get Started