Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. The new model known as Current Expected Credit Loss (CECL) differs from the traditional model of estimating losses from uncollectible accounts in that:

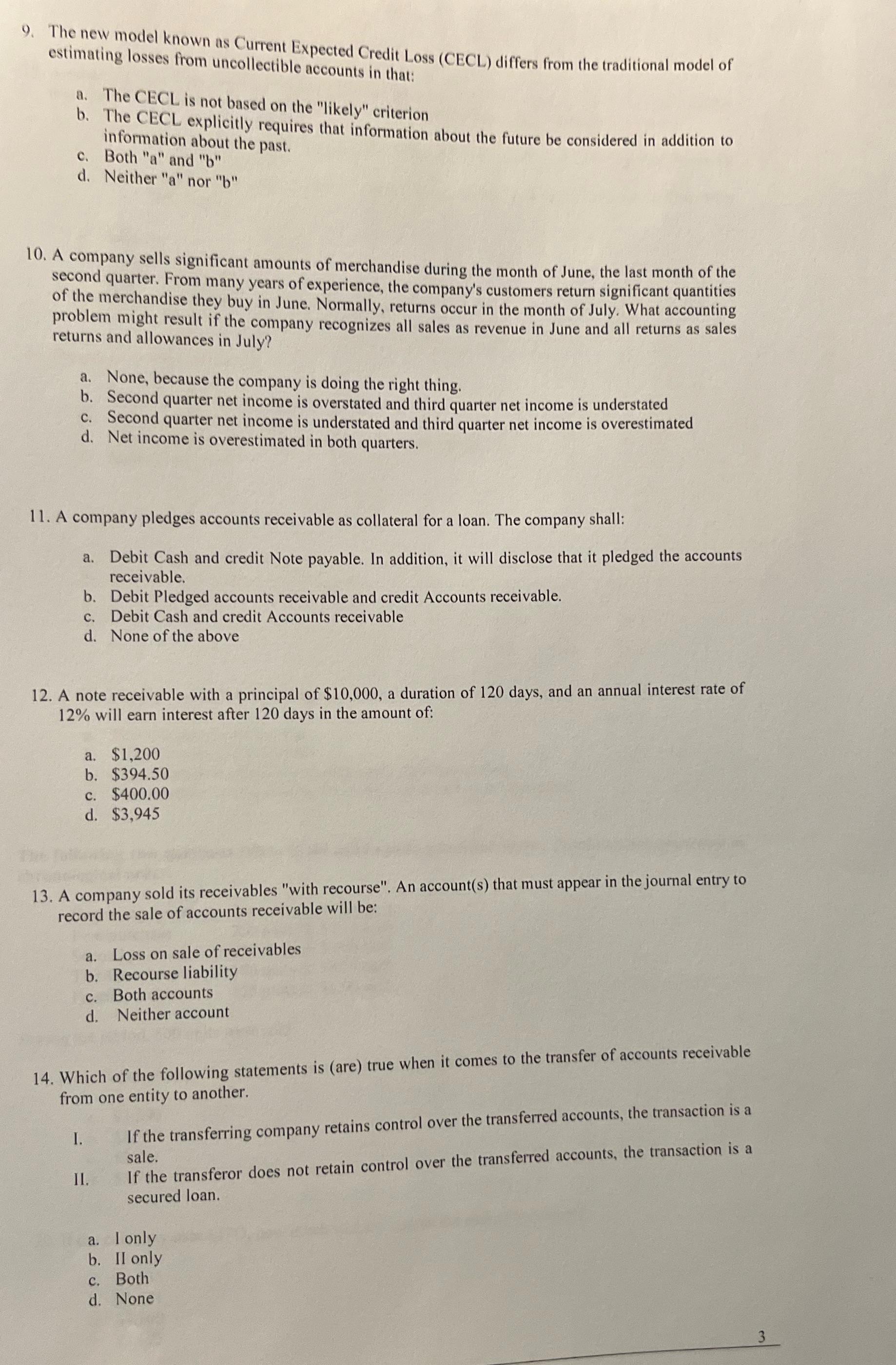

9. The new model known as Current Expected Credit Loss (CECL) differs from the traditional model of estimating losses from uncollectible accounts in that: a. The CECL is not based on the "likely" criterion b. The CECL explicitly requires that information about the future be considered in addition to information about the past. c. Both "a" and "b" d. Neither "a" nor "b" 10. A company sells significant amounts of merchandise during the month of June, the last month of the second quarter. From many years of experience, the company's customers return significant quantities of the merchandise they buy in June. Normally, returns occur in the month of July. What accounting problem might result if the company recognizes all sales as revenue in June and all returns as sales returns and allowances in July? a. None, because the company is doing the right thing. b. Second quarter net income is overstated and third quarter net income is understated c. Second quarter net income is understated and third quarter net income is overestimated d. Net income is overestimated in both quarters. 11. A company pledges accounts receivable as collateral for a loan. The company shall: a. Debit Cash and credit Note payable. In addition, it will disclose that it pledged the accounts receivable. b. Debit Pledged accounts receivable and credit Accounts receivable. c. Debit Cash and credit Accounts receivable d. None of the above 12. A note receivable with a principal of $10,000, a duration of 120 days, and an annual interest rate of 12% will earn interest after 120 days in the amount of: a. $1,200 b. $394.50 c. $400.00 d. $3,945 13. A company sold its receivables "with recourse". An account(s) that must appear in the journal entry to record the sale of accounts receivable will be: a. Loss on sale of receivables C. b. Recourse liability d. Neither account Both accounts 14. Which of the following statements is (are) true when it comes to the transfer of accounts receivable from one entity to another. I. If the transferring company retains control over the transferred accounts, the transaction is a sale. II. If the transferor does not retain control over the transferred accounts, the transaction is a secured loan. a. I only b. II only c. Both d. None 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started