Question

Activity 3: Discussion of incremental cash ?ows [20 min] Break out into groups of 4?5 and consider one of the following scenarios: Scenario 1: Apple

Activity 3: Discussion of incremental cash ?ows [20 min] Break out into groups of 4?5 and consider one of the following scenarios: Scenario 1: Apple just released the new iPhone 15. Imagine your group had been part of the management team that sat in a conference room 18 months ago and was tasked to weigh the ?nancial costs and bene?ts of bringing to market the new model for the company. Scenario 2: In 2019, Rio Tinto started work on developing a new iron ore mine at Gudai-Darri some 1500 km away from Perth. Imagine your group had been part of the management team that sat in a conference room a few year prior to that date working through the details of the massive upfront investment to make the mine operational as well as faciliating the subsequent production that started in 2022 and is expected to go on for 40 years. 01: Define the boundaries of the project. What is part of the project, what is part of the existing company? What broad stepsfactivities are involved in this project over the lifetime of the project? 02: Systematically work through the different stages of the project. For each stage, work out the different types of incremental cash flows that will likely arise and brie?y describe them. No calculations or numbers are required, but be diligent in thinking through: a) what initial costs are involved and b) what types of effects on the rest of the company can arise from these projects. [15 min] Groups report their ?ndings to the rest of the class. Do not try to discuss every single ICF you identified. Focus on a few that you found interesting or challenging. Cash flows in a typical project The diagram shows some typical cash flows in project analysis and their timing. Initial outlay Ongoing cash flows Terminal cash flows , Purchase Incremental equipment revenue , Initial development Incremental costs costs Taxes Increase in net working Change in net working Decrease in net working capital (increase capital (Change in capital (decrease inventories, raw inventories, raw inventories, raw materials, etc.) materials, accounts materials, etc.) receivable and payable) Sale of equipment (net of any taxes) Shutdown costs r _/_J

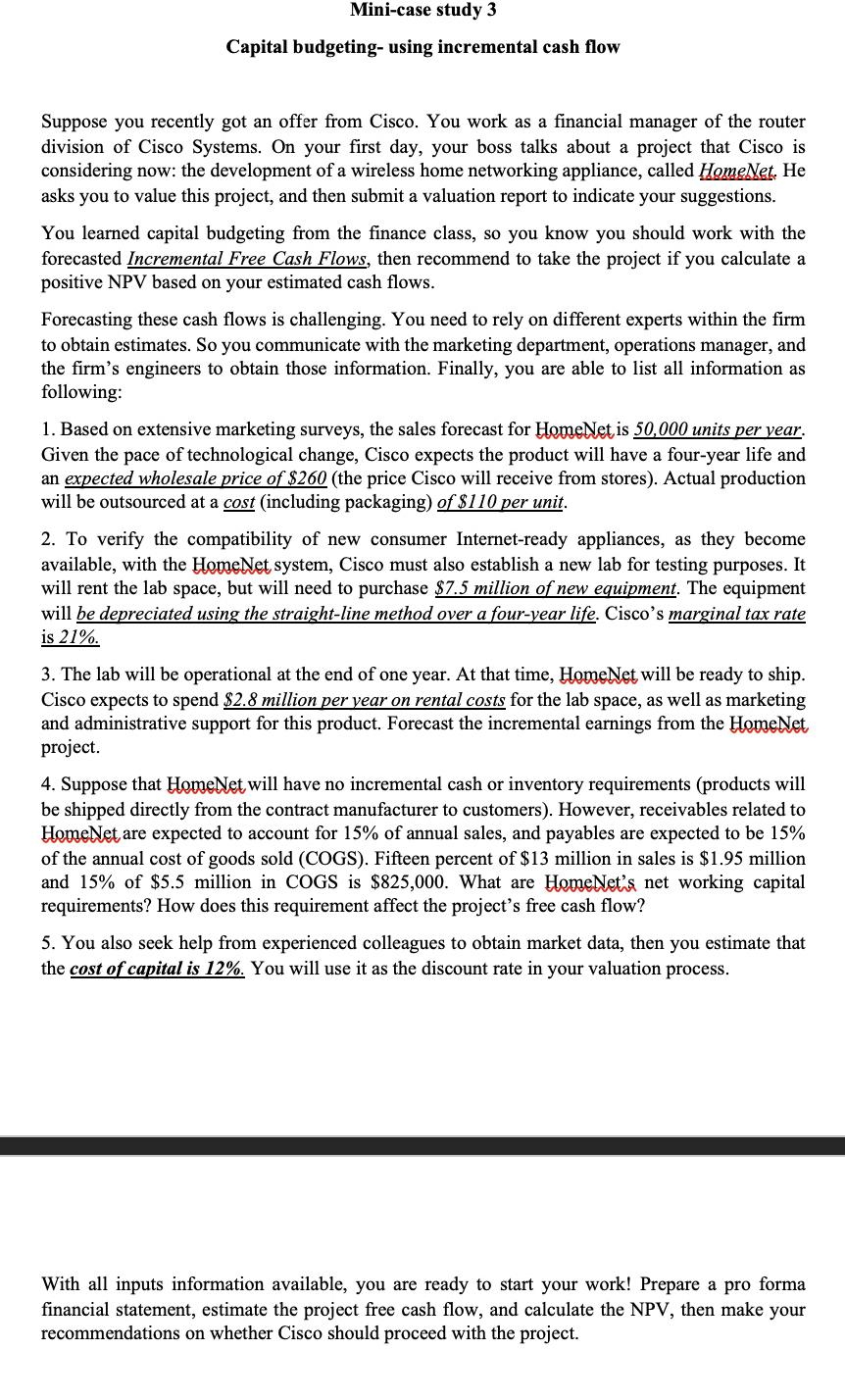

Mini-case study 3 Capital budgeting- using incremental cash flow Suppose you recently got an offer from Cisco. You work as a financial manager of the router division of Cisco Systems. On your first day, your boss talks about a project that Cisco is considering now: the development of a wireless home networking appliance, called HomeNet. He asks you to value this project, and then submit a valuation report to indicate your suggestions. You learned capital budgeting from the finance class, so you know you should work with the forecasted Incremental Free Cash Flows, then recommend to take the project if you calculate a positive NPV based on your estimated cash flows. Forecasting these cash flows is challenging. You need to rely on different experts within the firm to obtain estimates. So you communicate with the marketing department, operations manager, and the firm's engineers to obtain those information. Finally, you are able to list all information as following: 1. Based on extensive marketing surveys, the sales forecast for HomeNet is 50,000 units per year. Given the pace of technological change, Cisco expects the product will have a four-year life and an expected wholesale price of $260 (the price Cisco will receive from stores). Actual production will be outsourced at a cost (including packaging) of $110 per unit. 2. To verify the compatibility of new consumer Internet-ready appliances, as they become available, with the HomeNet system, Cisco must also establish a new lab for testing purposes. It will rent the lab space, but will need to purchase $7.5 million of new equipment. The equipment will be depreciated using the straight-line method over a four-year life. Cisco's marginal tax rate is 21% 3. The lab will be operational at the end of one year. At that time, HomeNet will be ready to ship. Cisco expects to spend $2.8 million per year on rental costs for the lab space, as well as marketing and administrative support for this product. Forecast the incremental earnings from the HomeNet project. 4. Suppose that HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). However, receivables related to HomeNet are expected to account for 15% of annual sales, and payables are expected to be 15% of the annual cost of goods sold (COGS). Fifteen percent of $13 million in sales is $1.95 million and 15% of $5.5 million in COGS is $825,000. What are HomeNet's net working capital requirements? How does this requirement affect the project's free cash flow? 5. You also seek help from experienced colleagues to obtain market data, then you estimate that the cost of capital is 12%. You will use it as the discount rate in your valuation process. With all inputs information available, you are ready to start your work! Prepare a pro forma financial statement, estimate the project free cash flow, and calculate the NPV, then make your recommendations on whether Cisco should proceed with the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started