Answered step by step

Verified Expert Solution

Question

1 Approved Answer

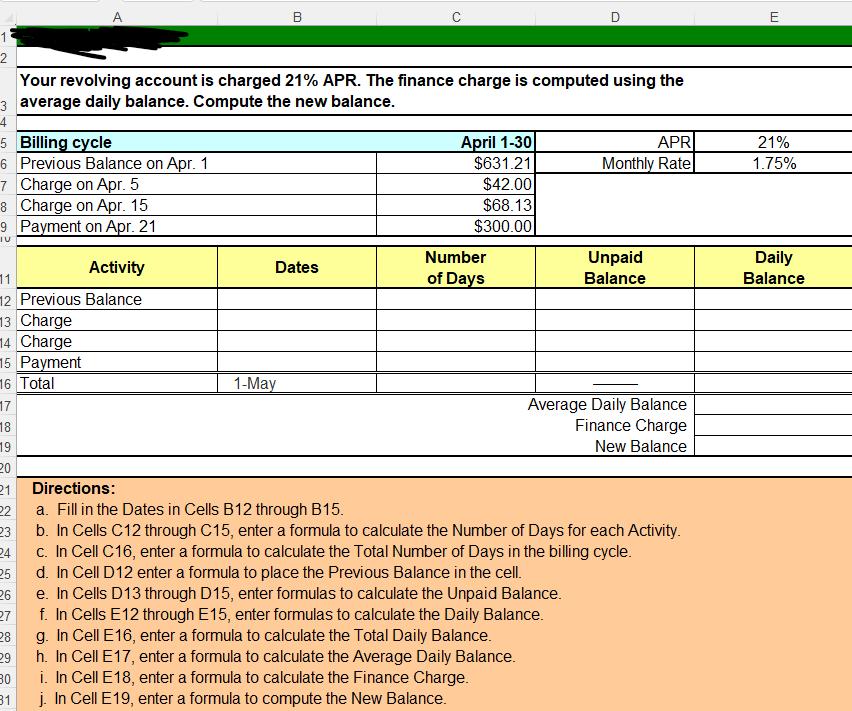

B D E Your revolving account is charged 21% APR. The finance charge is computed using the average daily balance. Compute the new balance. Billing

Billing cycle April 1-30 APR 21% Previous Balance on Apr. 1 $631.21 Monthly Rate 1.75% Charge on Apr. 5 $42.00 Charge on Apr. 15 $68.13 Payment

on Apr. 21 $300.00 Number Unpaid Daily Activity Dates of Days Balance Balance 2 Previous Balance Charge 4 Charge Payment Total 1...

Please help with formulas needed, to check my work.

12 A B E Your revolving account is charged 21% APR. The finance charge is computed using the 3 average daily balance. Compute the new balance. 4 5 Billing cycle 6 Previous Balance on Apr. 1 7 Charge on Apr. 5 8 Charge on Apr. 15 9 Payment on Apr. 21 IU 11 Activity 12 Previous Balance 13 Charge 14 Charge 15 Payment 16 Total 17 18 1-May April 1-30 $631.21 APR 21% Monthly Rate 1.75% $42.00 $68.13 $300.00 Number Dates of Days Unpaid Balance Daily Balance Average Daily Balance Finance Charge New Balance 19 20 21 Directions: 22 a. Fill in the Dates in Cells B12 through B15. 23 24 b. In Cells C12 through C15, enter a formula to calculate the Number of Days for each Activity. c. In Cell C16, enter a formula to calculate the Total Number of Days in the billing cycle. 25 d. In Cell D12 enter a formula to place the Previous Balance in the cell. 26 e. In Cells D13 through D15, enter formulas to calculate the Unpaid Balance. 27 f. In Cells E12 through E15, enter formulas to calculate the Daily Balance. 28 g. In Cell E16, enter a formula to calculate the Total Daily Balance. 29 h. In Cell E17, enter a formula to calculate the Average Daily Balance. 30 i. In Cell E18, enter a formula to calculate the Finance Charge. 31 j. In Cell E19, enter a formula to compute the New Balance.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Heres a revised version of the formulas for the given scenario a Fill in the Dates in Cells B12 thro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started