Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My Sac State | Sacramento State X Topic: W8 Reading Homework 7 (Section 4.1) Homework 7 (Section 4.1) - Ma x webassign.net/web/Student/Assignment-Responses/submit?dep=33983821&tags=autosave#Q5 5. [0/1

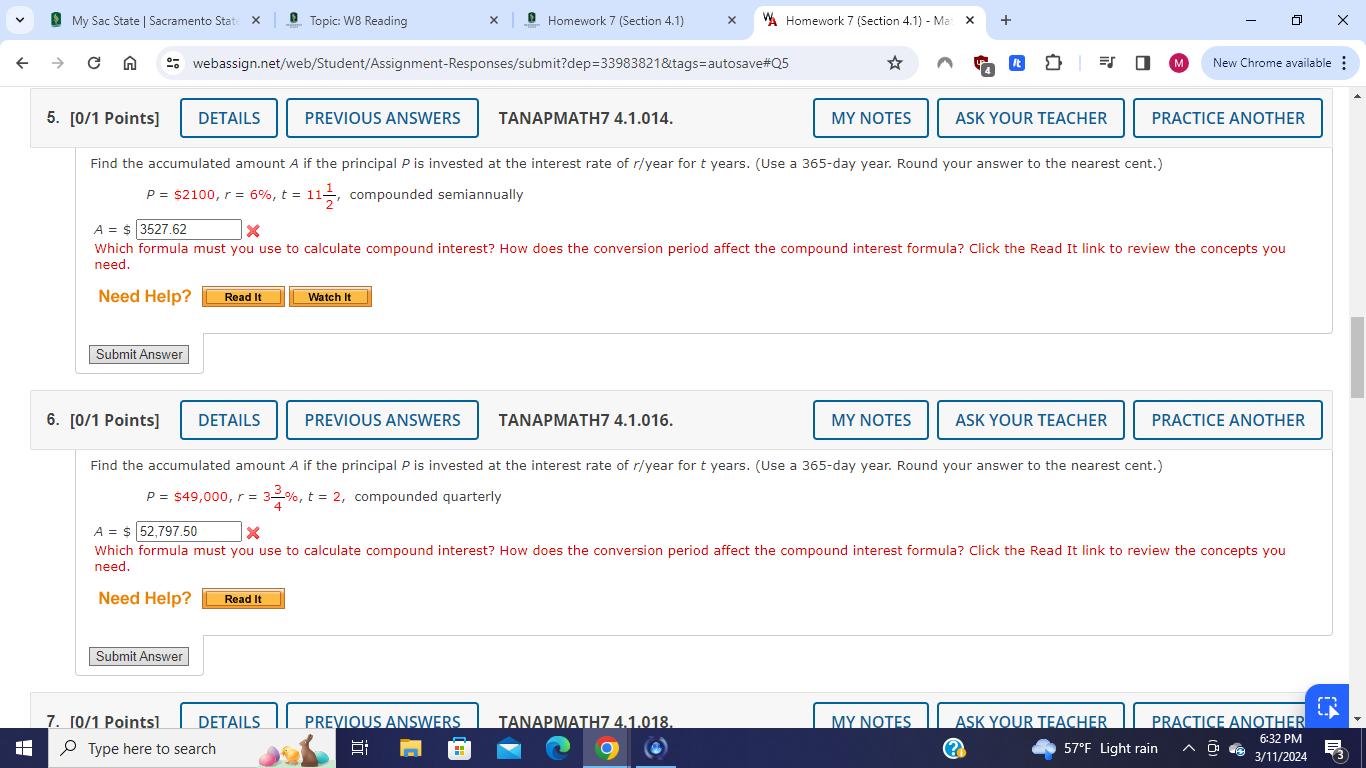

My Sac State | Sacramento State X Topic: W8 Reading Homework 7 (Section 4.1) Homework 7 (Section 4.1) - Ma x webassign.net/web/Student/Assignment-Responses/submit?dep=33983821&tags=autosave#Q5 5. [0/1 Points] H DETAILS PREVIOUS ANSWERS TANAPMATH7 4.1.014. MY NOTES ASK YOUR TEACHER M New Chrome available PRACTICE ANOTHER Find the accumulated amount A if the principal P is invested at the interest rate of r/year for t years. (Use a 365-day year. Round your answer to the nearest cent.) P = $2100, r = 6%, t = 11, compounded semiannually A = $ 3527.62 Which formula must you use to calculate compound interest? How does the conversion period affect the compound interest formula? Click the Read It link to review the concepts you need. Need Help? Read It Watch It Submit Answer 6. [0/1 Points] DETAILS PREVIOUS ANSWERS TANAPMATH7 4.1.016. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Find the accumulated amount A if the principal P is invested at the interest rate of r/year for t years. (Use a 365-day year. Round your answer to the nearest cent.) P = $49,000, r = 33%, t = 2, compounded quarterly A = $ 52,797.50 4 Which formula must you use to calculate compound interest? How does the conversion period affect the compound interest formula? Click the Read It link to review the concepts you need. Need Help? Read It Submit Answer DETAILS PREVIOUS ANSWERS TANAPMATH7 4.1.018. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER E ? 57F Light rain 6:32 PM 3/11/2024 7. 10/1 Points] Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started