Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company NKE Most Recent Fiscal Year 2019 Period Y Scale to 1,000,000 Fiscal Year 2019 2018 2017 2016 2015 [Revenue] 39117 36397 34350 32376 30601

Now change the company ticker in cell B1 to COST (Costco), your spreadsheet should automatically re-fill all numbers from Costco's income statement. Do you observe a similar trend for Costco regarding this item you identified in part a?

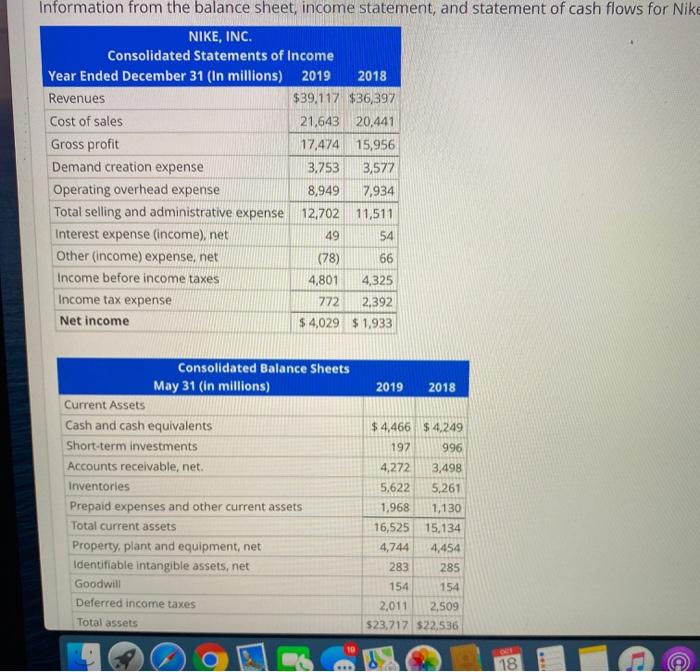

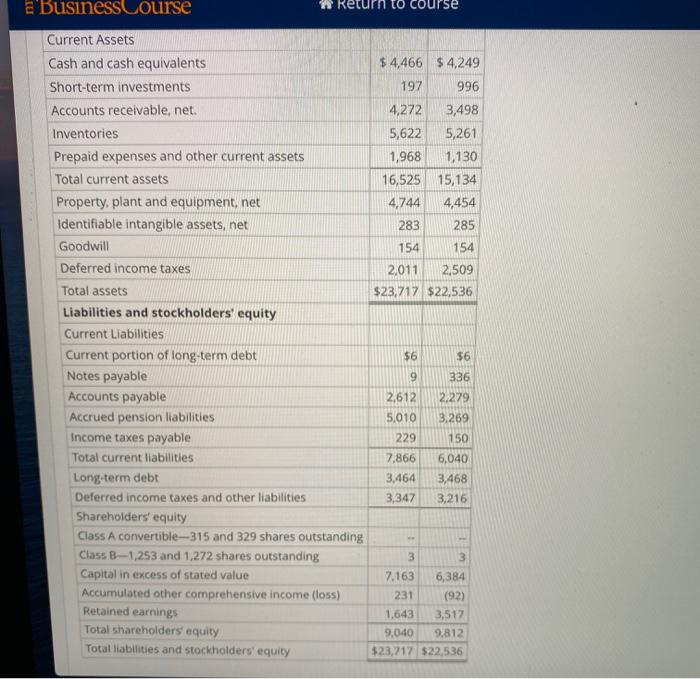

Information from the balance sheet, income statement, and statement of cash flows for Nike NIKE, INC. Consolidated Statements of Income Year Ended December 31 (In millions) 2019 2018 Revenues $39,117 $36,397 Cost of sales 21,643 20,441 Gross profit 17,474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $4,029 $1,933 Consolidated Balance Sheets May 31 (in millions) Current Assets Cash and cash equivalents Short-term investments Accounts receivable, net. Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Identifiable intangible assets, net Goodwill Deferred income taxes Total assets 2019 2018 $ 4,466 $4,249 197 996 4,272 3,498 5,622 5,261 1,968 1,130 16,525 15,134 4,744 4,454 283 285 154 154 2,011 2,509 $23,717 $22,536 18 ***

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To answer the question regarding observing a similar trend for Costco regarding the item identified ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started