Answered step by step

Verified Expert Solution

Question

1 Approved Answer

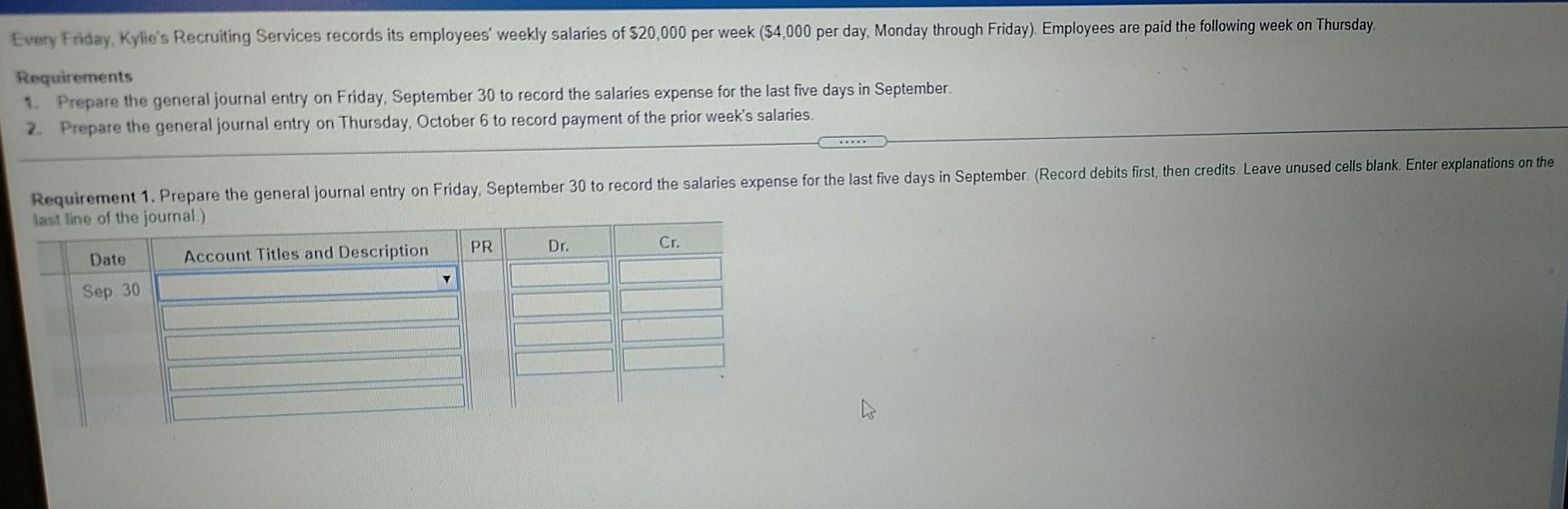

Every Friday, Kylie's Recruiting Services records its employees' weekly salaries of $20,000 per week ($4,000 per day, Monday through Friday). Employees are paid the following

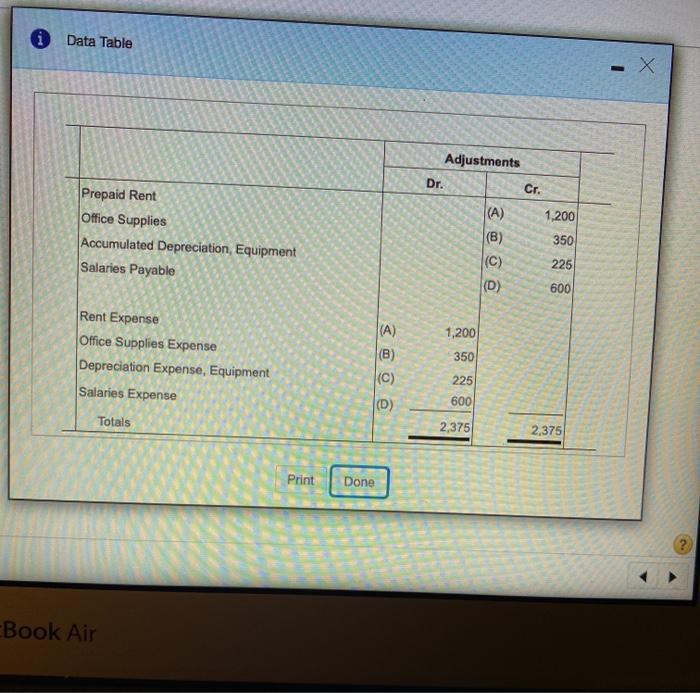

Every Friday, Kylie's Recruiting Services records its employees' weekly salaries of $20,000 per week ($4,000 per day, Monday through Friday). Employees are paid the following week on Thursday. Requirements 1. Prepare the general journal entry on Friday, September 30 to record the salaries expense for the last five days in September. 2. Prepare the general journal entry on Thursday, October 6 to record payment of the prior week's salaries. Requirement 1. Prepare the general journal entry on Friday, September 30 to record the salaries expense for the last five days in September. (Record debits first, then credits. Leave unused cells blank. Enter explanations on the last line of the journal.) Date Sep. 30 Account Titles and Description PR Dr. Cr.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the revenue recognized from gift cards during fiscal year 2020 for Best Buy we need to look at the information provided Unfortunately the specific revenue recognized from gift cards is no...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started