Question

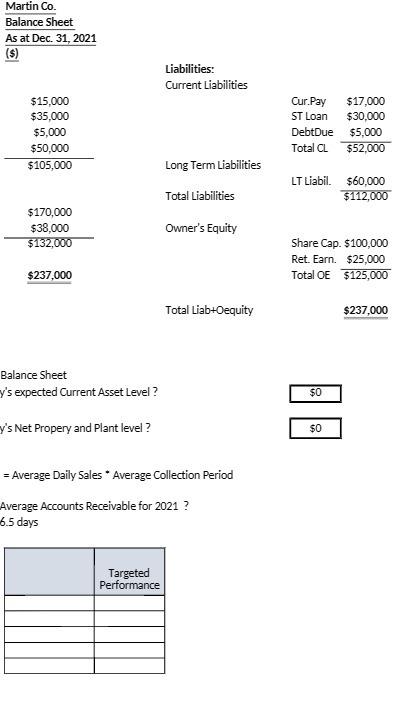

Martin Co. Balance Sheet As at Dec. 31, 2021 ($) Liabilities: Current Liabilities $15,000 Cur.Pay $17,000 $35,000 ST Loan $30,000 $5,000 DebtDue $5,000 $50,000 Total

Martin Co. Balance Sheet As at Dec. 31, 2021 ($) Liabilities: Current Liabilities $15,000 Cur.Pay $17,000 $35,000 ST Loan $30,000 $5,000 DebtDue $5,000 $50,000 Total CL $52,000 $105,000 Long Term Liabilities LT Liabil $60,000 Total Liabilities $112,000 $170,000 $38,000 Owner's Equity $132,000 Share Cap. $100,000 Ret. Earn. $25,000 $237,000 Total OE $125,000 Total Liab+0equity $237,000 Balance Sheet y's expected Current Asset Level ? $0 /'s Net Propery and Plant level ? $0 = Average Daily Sales * Average Collection Period Average Accounts Receivable for 2021 ? 6.5 days Targeted Performance

Martin Co. Balance Sheet As at Dec. 31, 2021 ($) Liabilities: Current Liabilities $15,000 Cur.Pay $17,000 $35,000 ST Loan $30,000 $5,000 DebtDue $5,000 $50,000 Total CL $52,000 $105,000 Long Term Liabilities LT Liabil. $60,000 Total Liabilities $112,000 $170,000 $38,000 $132,000 Owner's Equity Share Cap. $100,000 $237,000 Ret. Earn. $25,000 Total OE $125,000 Total Liab+Oequity $237,000 Balance Sheet y's expected Current Asset Level? y's Net Propery and Plant level? = Average Daily Sales Average Collection Period Average Accounts Receivable for 2021 ? 6.5 days Targeted Performance $0 $0

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the information provided the balance sheet for Martin Co as at December 31 2021 is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started