Answered step by step

Verified Expert Solution

Question

1 Approved Answer

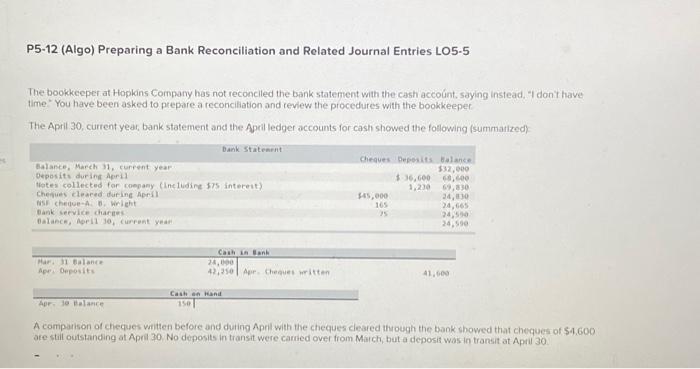

P5-12 (Algo) Preparing a Bank Reconciliation and Related Journal Entries LO5-5 The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash

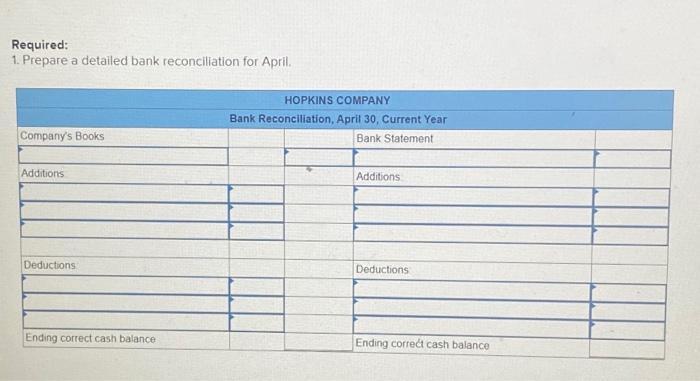

P5-12 (Algo) Preparing a Bank Reconciliation and Related Journal Entries LO5-5 The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead. "I don't have time. You have been asked to prepare a reconciliation and review the procedures with the bookkeeper The April 30, current year, bank statement and the April ledger accounts for cash showed the following (summarized) Balance, March 31, current year - bank Statement Deposits during April Notes collected for company (including $75 interest) Cheques cleared during April NSF cheque-A. B. Wright Bank service charges) Balance, April 30, current year. Mar 31 Balance Ape Deposits Cash in Bank 24,000 42,250 Apr. Cheques written Cheques Deposits Balance $32,000 $ 36,600 60,600 1,230 69,830 $45,000 165 24,830 24,665 25 24,590 24,590 41,600 Apr. 10 Balance Cash on Hand 150 A comparison of cheques written before and during April with the cheques cleared through the bank showed that cheques of $4.600 are still outstanding at April 30. No deposits in transit were carried over from March, but a deposit was in transit at April 30

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each step in detail and provide solutions for the bank reconciliation and related journal entries 1 Adjust Bank Statement Balance Add Deposits in transit April deposits not shown on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started