Answered step by step

Verified Expert Solution

Question

1 Approved Answer

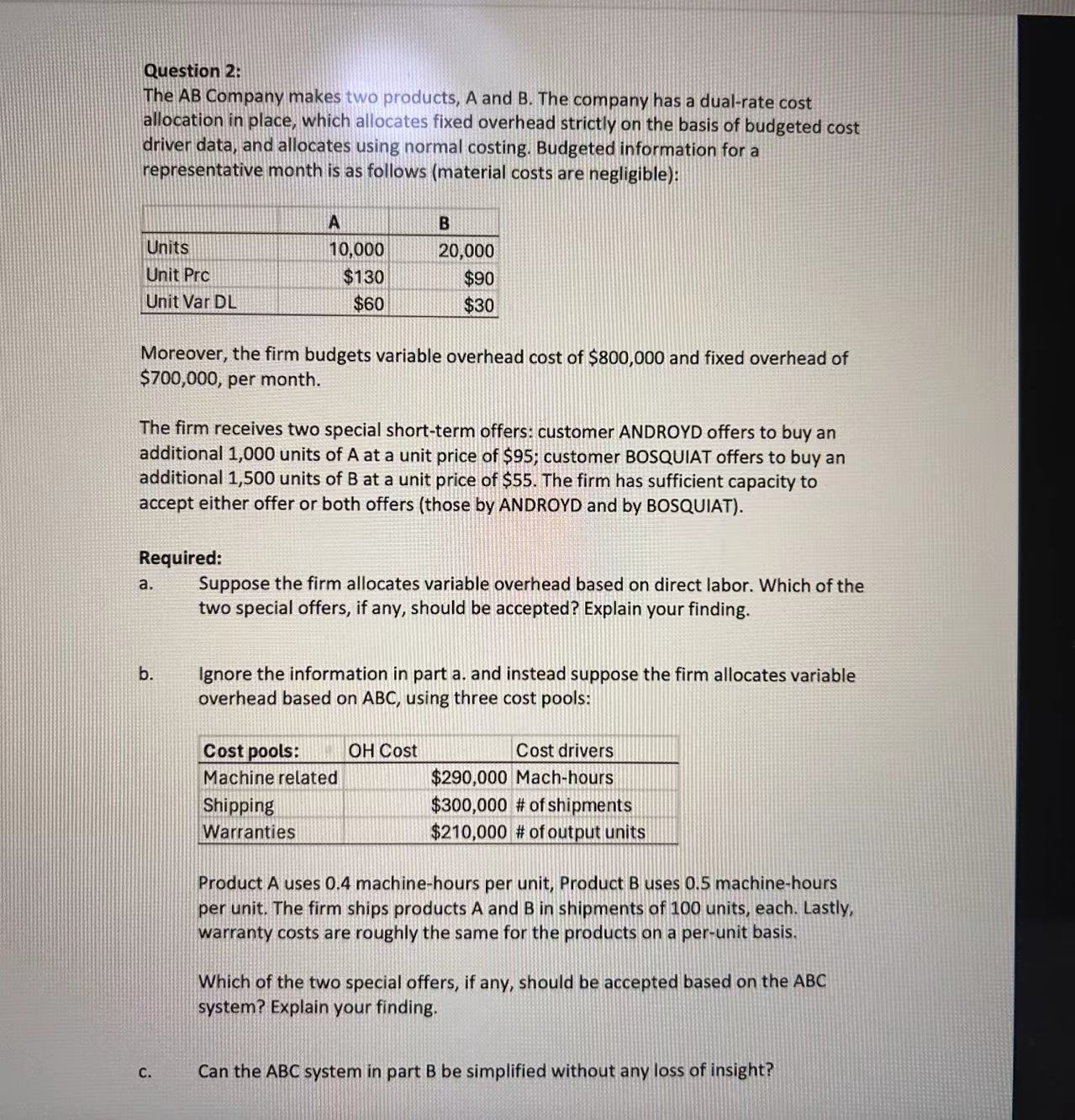

Question 2: The AB Company makes two products, A and B. The company has a dual-rate cost allocation in place, which allocates fixed overhead

Question 2: The AB Company makes two products, A and B. The company has a dual-rate cost allocation in place, which allocates fixed overhead strictly on the basis of budgeted cost driver data, and allocates using normal costing. Budgeted information for a representative month is as follows (material costs are negligible): A Units Unit Prc Unit Var DL B 10,000 20,000 $90 $30 $130 $60 Moreover, the firm budgets variable overhead cost of $800,000 and fixed overhead of $700,000, per month. The firm receives two special short-term offers: customer ANDROYD offers to buy an additional 1,000 units of A at a unit price of $95; customer BOSQUIAT offers to buy an additional 1,500 units of B at a unit price of $55. The firm has sufficient capacity to accept either offer or both offers (those by ANDROYD and by BOSQUIAT). Required: a. b. Suppose the firm allocates variable overhead based on direct labor. Which of the two special offers, if any, should be accepted? Explain your finding. Ignore the information in part a. and instead suppose the firm allocates variable overhead based on ABC, using three cost pools: Cost pools: OH Cost Cost drivers Machine related $290,000 Mach-hours Shipping Warranties $300,000 # of shipments $210,000 # of output units C. Product A uses 0.4 machine-hours per unit, Product B uses 0.5 machine-hours per unit. The firm ships products A and B in shipments of 100 units, each. Lastly, warranty costs are roughly the same for the products on a per-unit basis. Which of the two special offers, if any, should be accepted based on the ABC system? Explain your finding. Can the ABC system in part B be simplified without any loss of insight?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started