Question

Image transcription text Scott invests primarily in residential property which is rented to tenants to derive assessable income. He generally has to borrow money from

Image transcription text

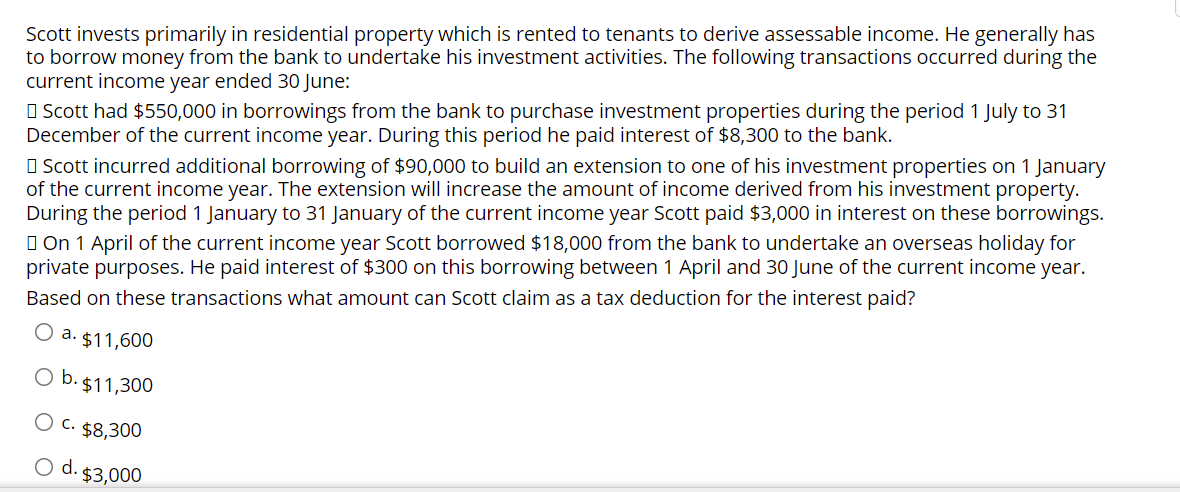

Scott invests primarily in residential property which is rented to tenants to derive assessable income. He generally has to borrow money from the bank to undertake his investment activities. The following transactions occurred during the current income year ended 30June: I] Scott had $550,000 in borrowings from the bank to purchase investment properties during the period 1 July to 31 December of the current income year. During this period he paid interest of $8,300 to the bank. I] Scott incurred additional borrowing of $90,000 to build an extension to one of his investment properties on 1 January of the current income year. The extension will increase the amount of income derived from his investment property. During the period 1 January to 31 January of the current income year Scott paid $3,000 in interest on these borrowings. I] On 1 April of the current income year Scott borrowed $18,000 from the bank to undertake an overseas holiday for private purposes. He paid interest of $300 on this borrowing between 1 April and 3OJune of the current income year. Based on these transactions what amount can Scott claim as a tax deduction for the interest paid? 0 a- $11,600 0 It"$11,300 O C- $3,300 0 d- $3,000

Scott invests primarily in residential property which is rented to tenants to derive assessable income. He generally has to borrow money from the bank to undertake his investment activities. The following transactions occurred during the current income year ended 30 June: Scott incurred additional borrowing of $90,000 to build an extension to one of his investment properties on 1 January of the current income year. The extension will increase the amount of income derived from his investment property. During the period 1 January to 31 January of the current income year Scott paid $3,000 in interest on these borrowings. On 1 April of the current income year Scott borrowed $18,000 from the bank to undertake an overseas holiday for private purposes. He paid interest of $300 on this borrowing between 1 April and 30 June of the current income year. Based on these transactions what amount can Scott claim as a tax deduction for the interest paid? O a. $11,600 O b. $11,300 O c. $8,300 O d. $3,000 Scott had $550,000 in borrowings from the bank to purchase investment properties during the period 1 July to 31 December of the current income year. During this period he paid interest of $8,300 to the bank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Scott can claim a tax deduction for the interest paid on the borrowings used for investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started