Answered step by step

Verified Expert Solution

Question

1 Approved Answer

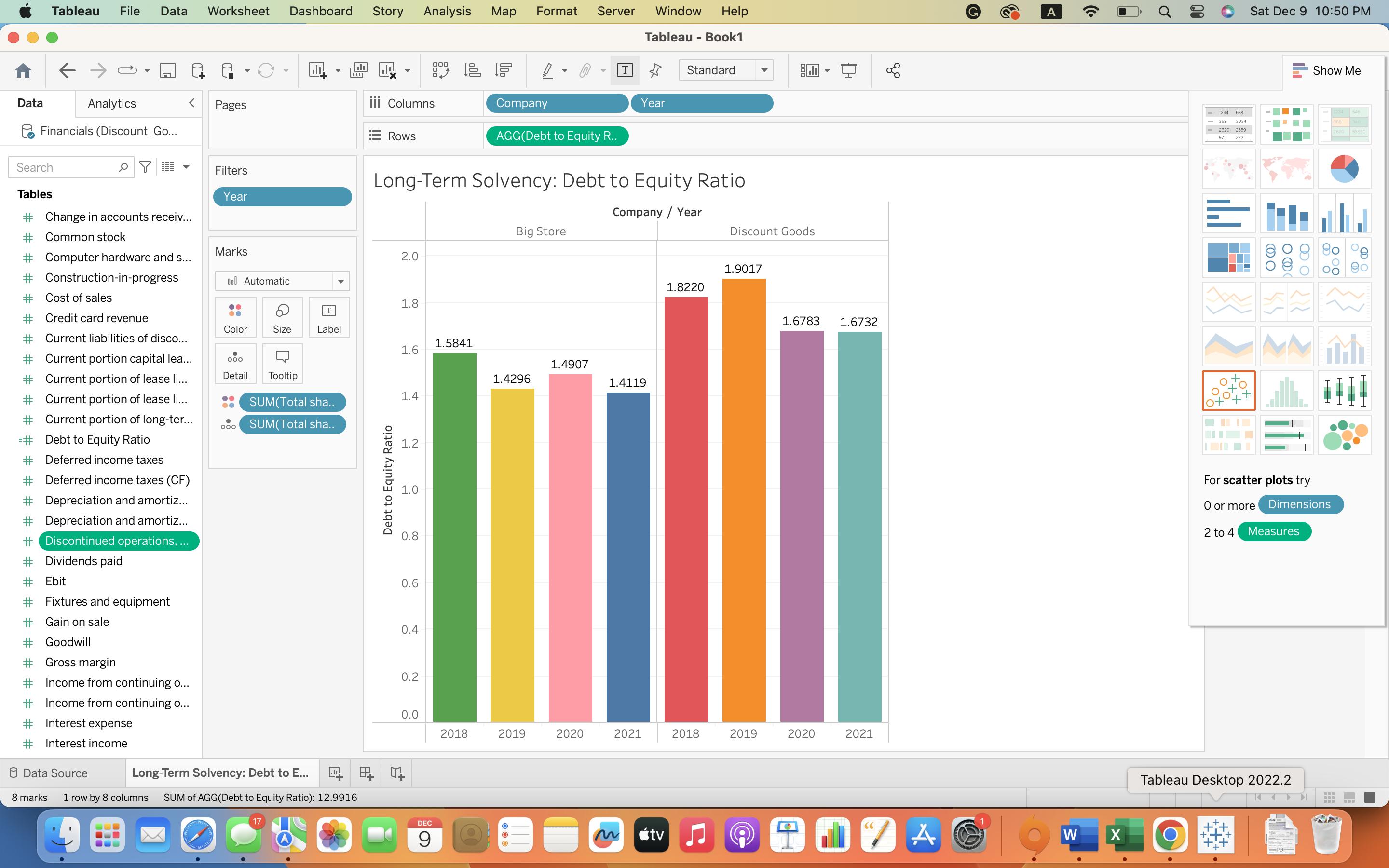

Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the debt to equity ratio? Based

- Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the debt to equity ratio?

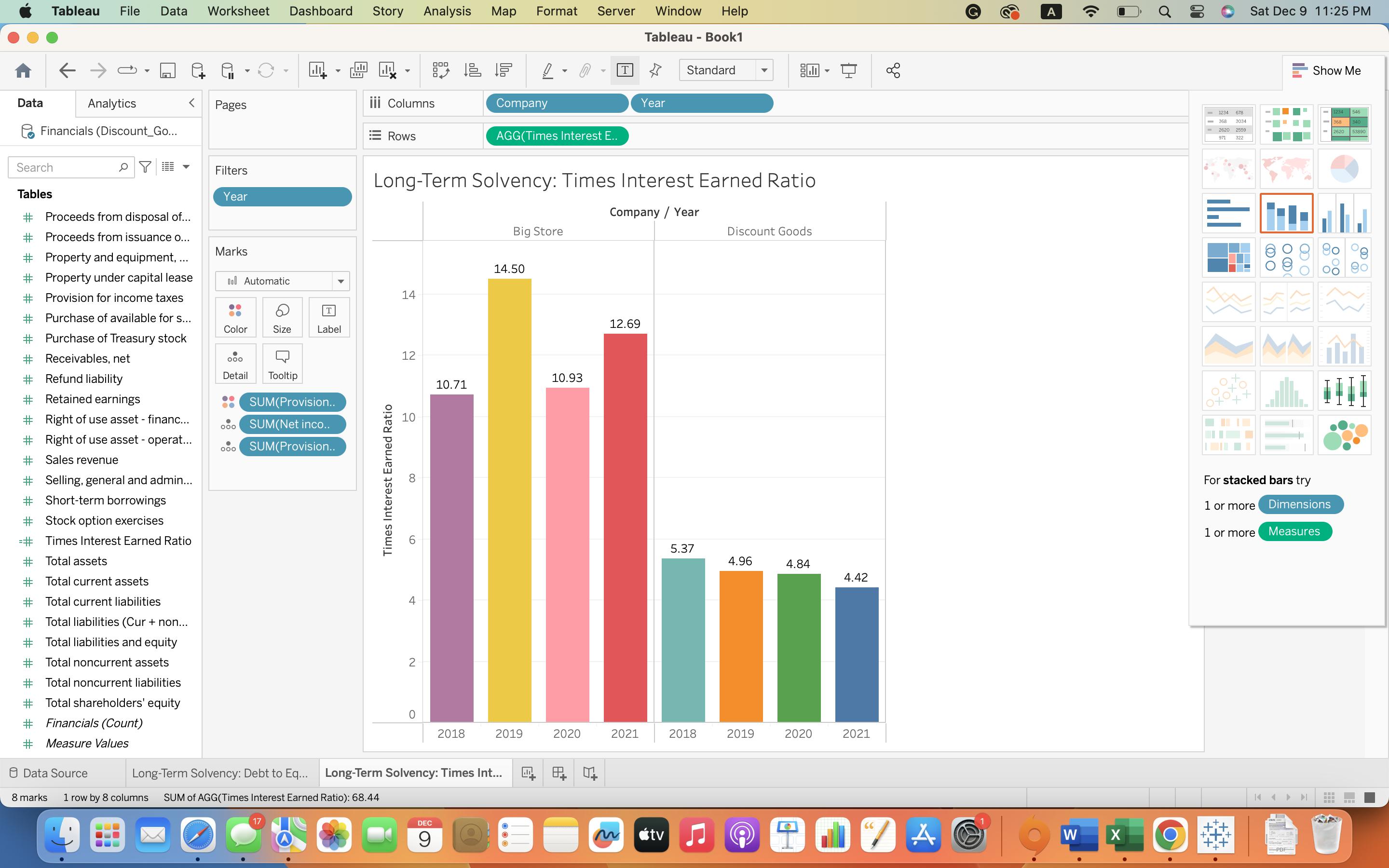

- Based solely on the Times Interest Earned ratio, do both companies appear to be equally able to meet their debt obligations?

- Is the margin of safety provided to creditors by Discount Goods improving or declining in recent years as measured by the average times interest earned ratio?

Data Tableau File Data Worksheet Dashboard Story Analysis Map Format Server Window Help Tableau-Book1 Analytics Financials (Discount_Go... > iii Columns Pages 000 Company Year Rows AGG(Times Interest E.. Standard Search O Y Filters Long-Term Solvency: Times Interest Earned Ratio Tables Year # Proceeds from disposal of... # Proceeds from issuance o... # Property and equipment, ... # Property under capital lease Provision for income taxes Big Store Company/Year Discount Goods Marks 14.50 Do Automatic 14 144 T # Purchase of available for s... 12.69 Color Size Label # Purchase of Treasury stock # Receivables, net 12 ooo # Refund liability Detail Tooltip 10.93 10.71 # Retained earnings # Right of use asset - financ... 000 SUM(Provision.. SUM(Net inco.. # Right of use asset - operat... Sales revenue 000 SUM(Provision.. # Selling, general and admin... #Short-term borrowings # Stock option exercises =# Times Interest Earned Ratio # Total assets # Total current assets # Total current liabilities Total liabilities (Cur + non... #Total liabilities and equity Times Interest Earned Ratio 10 10 00 5.37 4.96 4.84 4.42 4 # Total noncurrent assets # Total noncurrent liabilities #Total shareholders' equity #Financials (Count) # Measure Values Data Source 8 marks Long-Term Solvency: Debt to Eq... 2 0 2018 2019 2020 2021 2018 2019 2020 2021 Long-Term Solvency: Times Int... 4 4 1 row by 8 columns SUM of AGG(Times Interest Earned Ratio): 68.44 17 DEC 9 M PDF www

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started