Answered step by step

Verified Expert Solution

Question

1 Approved Answer

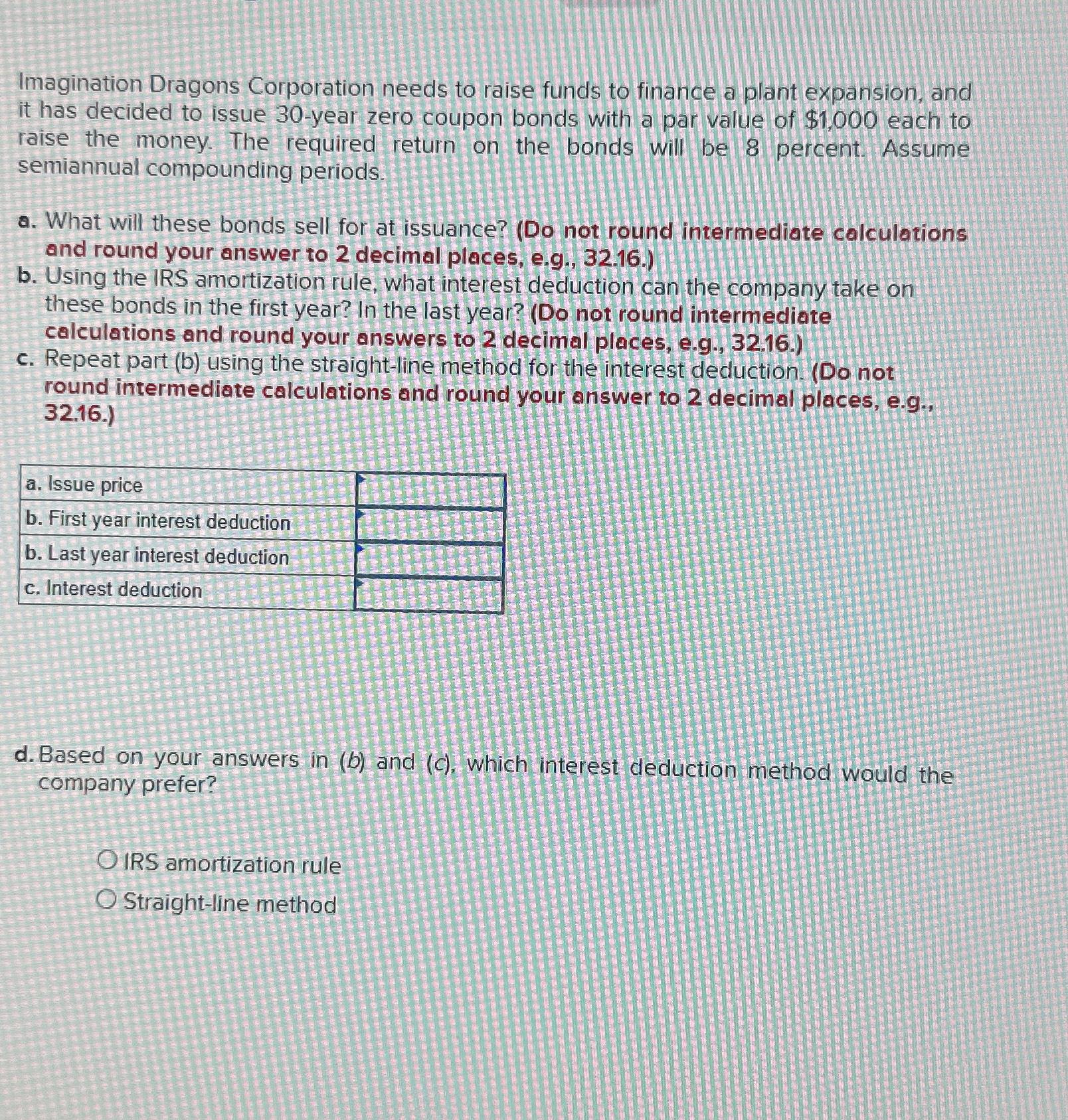

Imagination Dragons Corporation needs to raise funds to finance a plant expansion, and it has decided to issue 3 0 - year zero coupon bonds

Imagination Dragons Corporation needs to raise funds to finance a plant expansion, and it has decided to issue year zero coupon bonds with a par value of $ each to raise the money. The required return on the bonds will be percent. Assume semiannual compounding periods.

a What will these bonds sell for at issuance? Do not round intermediate calculations and round your answer to decimal places, eg

b Using the IRS amortization rule, what interest deduction can the company take on these bonds in the first year? In the last year? Do not round intermediate calculations and round your answers to decimal places, eg

c Repeat part b using the straightline method for the interest deduction. Do not round intermediate calculations and round your answer to decimal places, eg

tablea Issue price,b First year interest deduction,b Last year interest deduction,c Interest deduction,

d Based on your answers in b and c which interest deduction method would the company prefer?

IRS amortization rule

Straightline method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started