Imagine being an advisor to Hank Harris. What would you suggest should be Seller Labs' competitive strategy going forward?

(Please use the case study below to answer the question in two-three paragraphs)

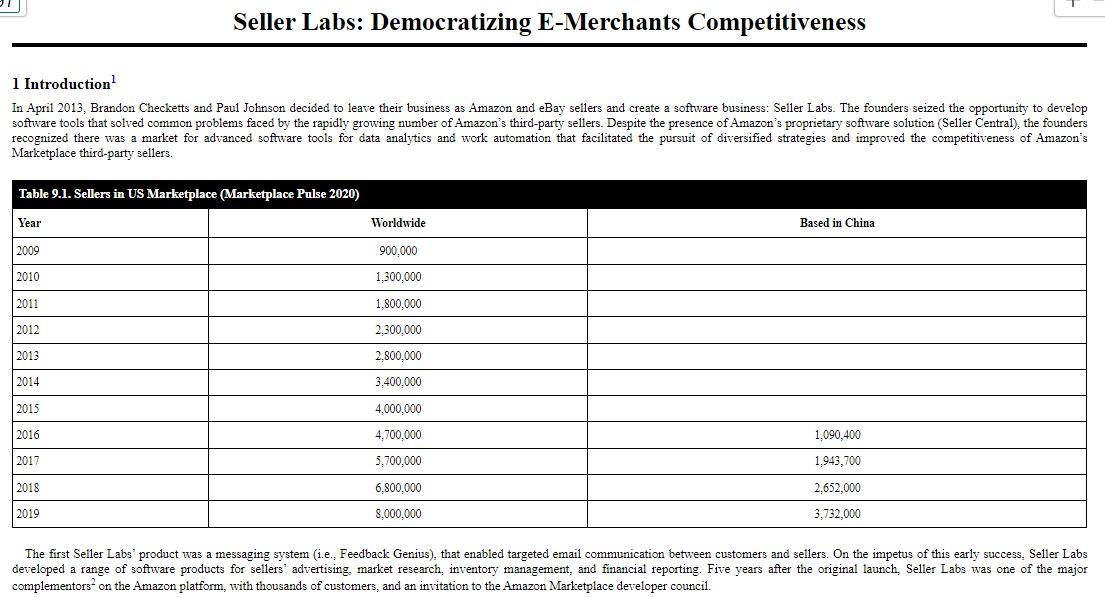

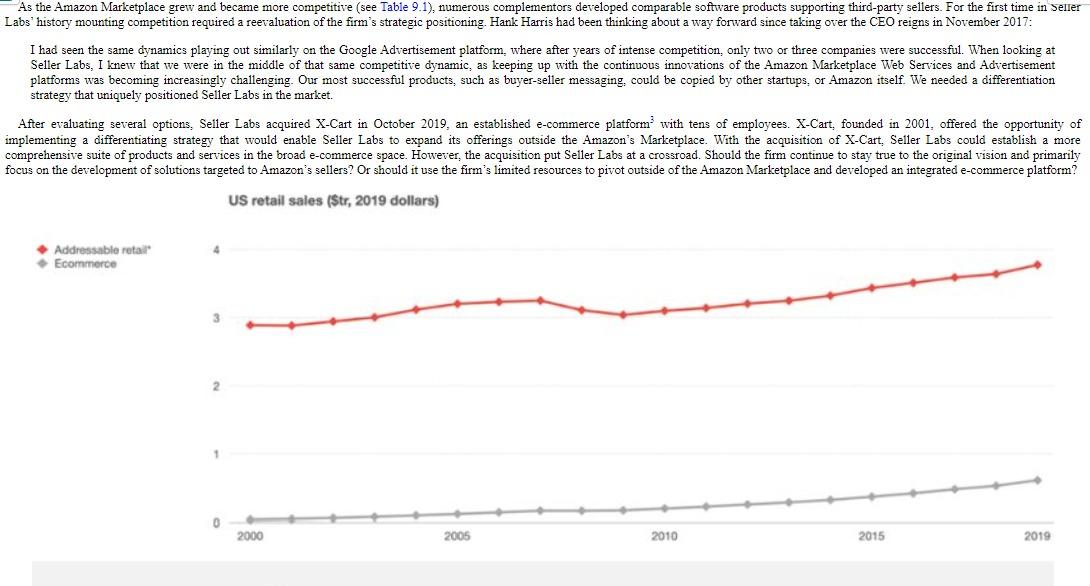

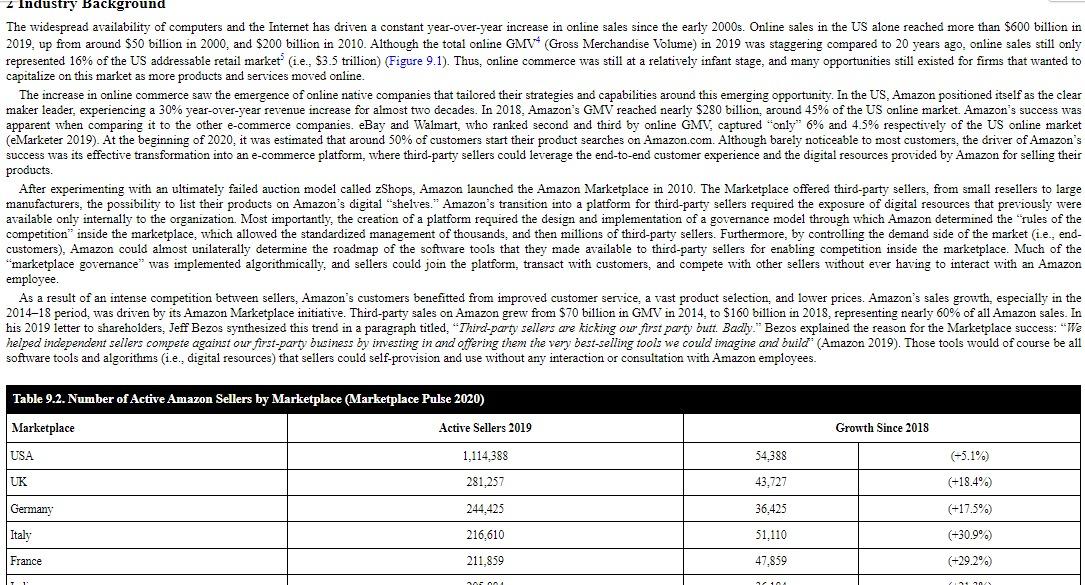

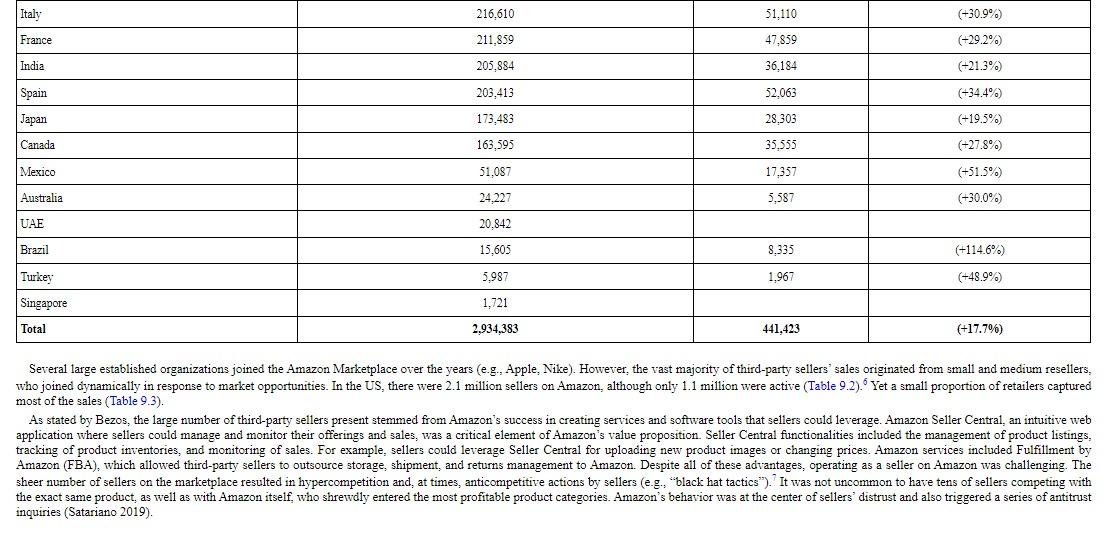

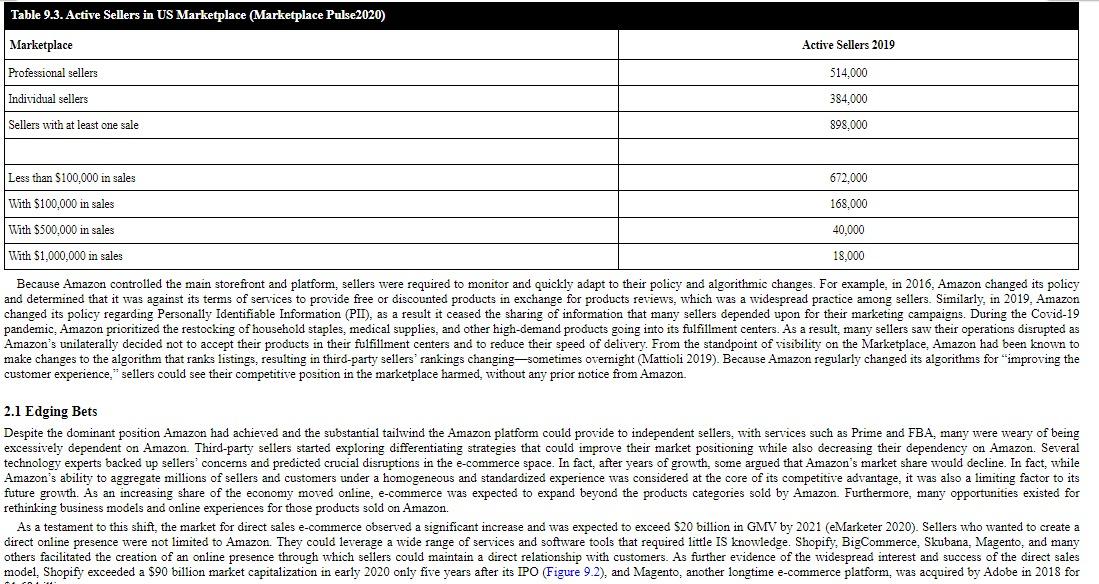

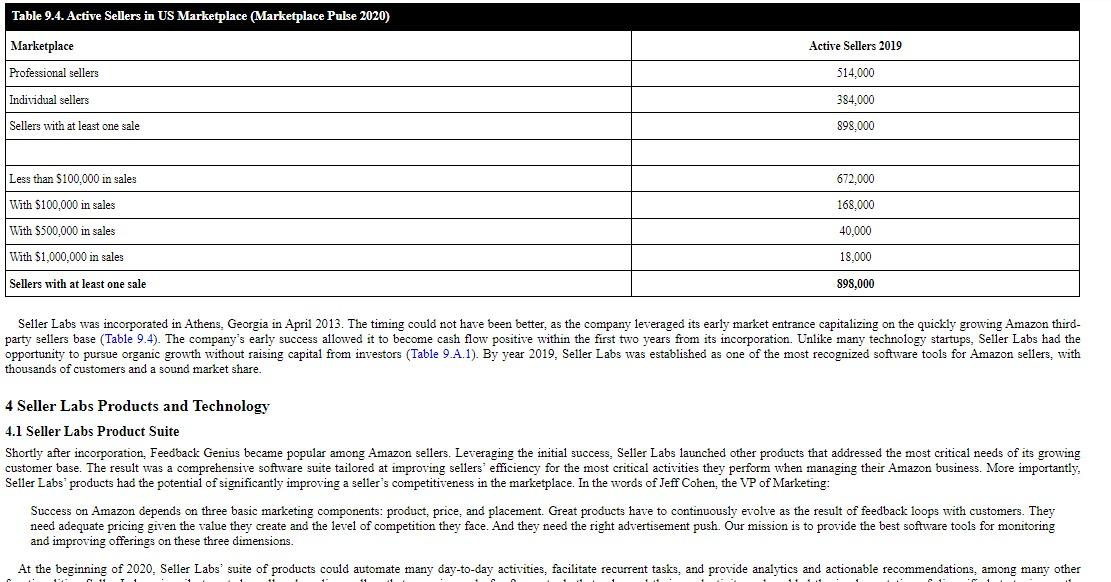

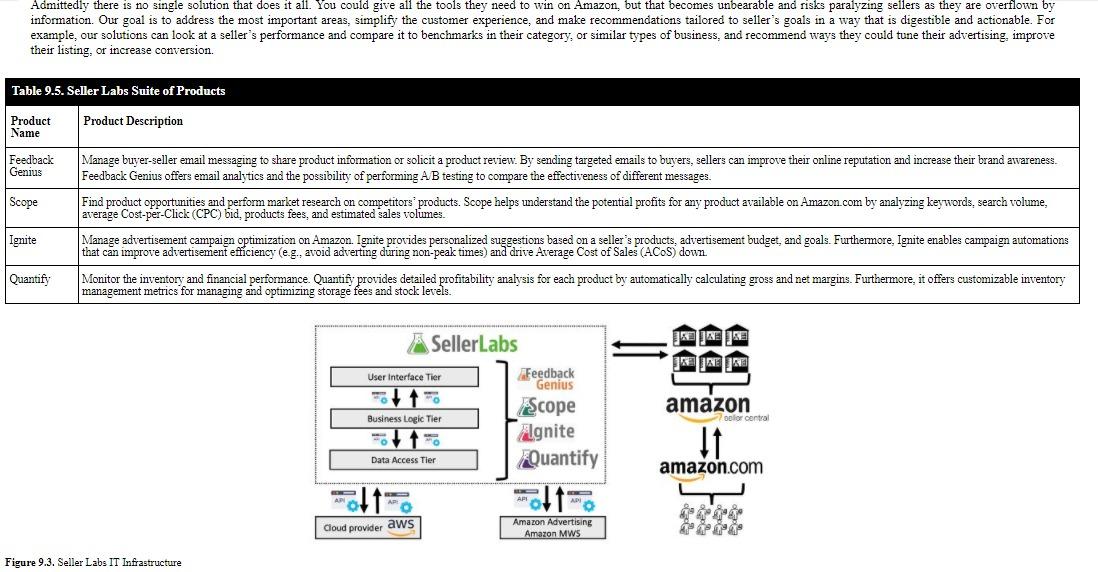

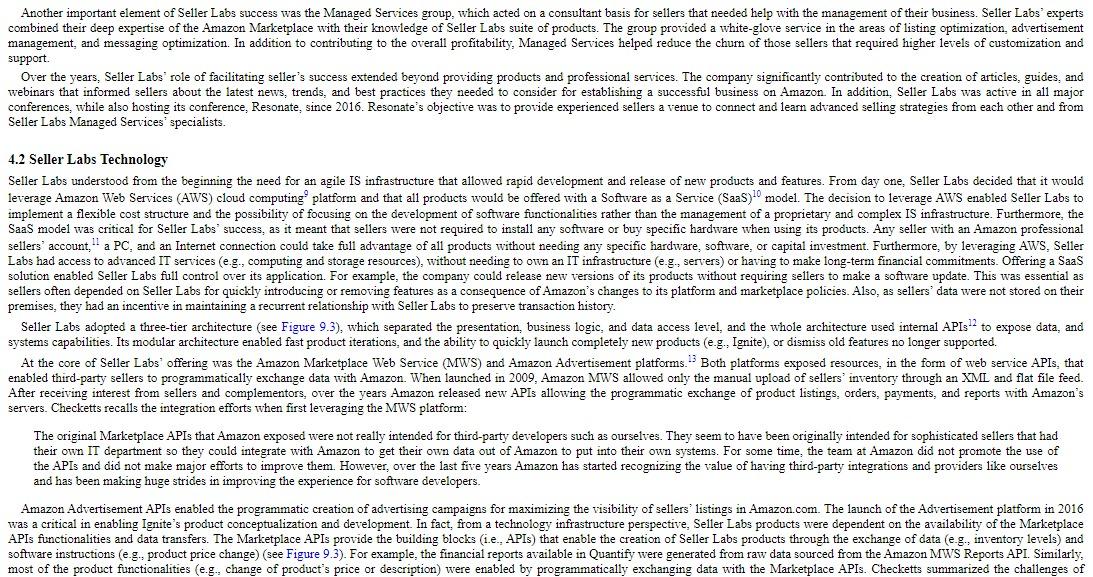

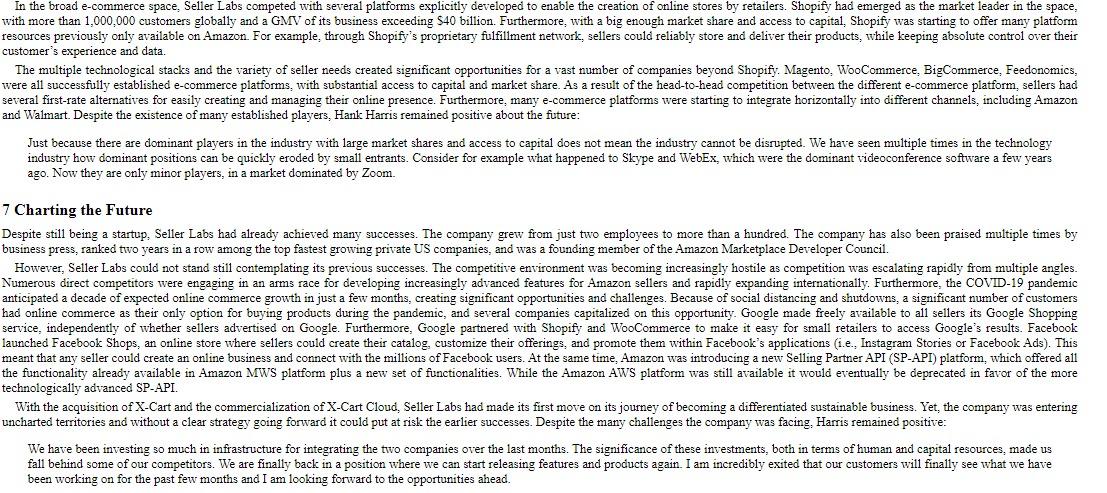

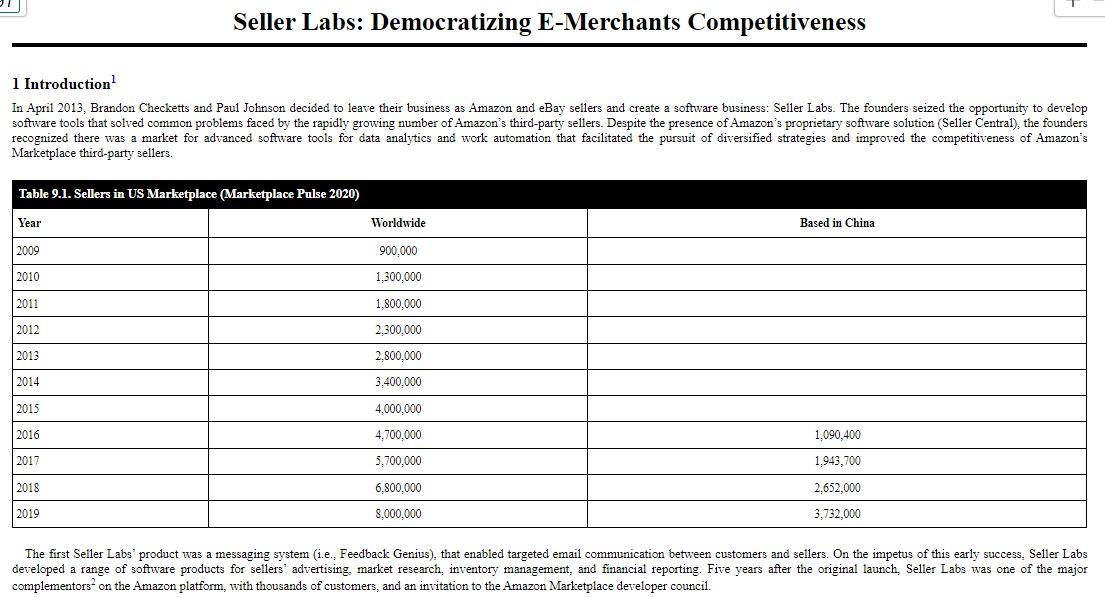

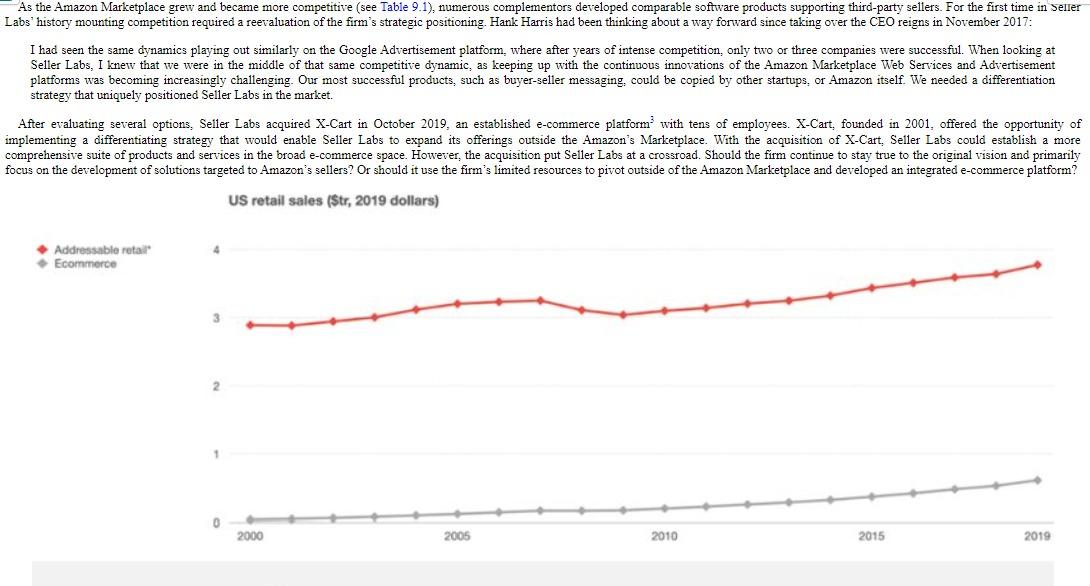

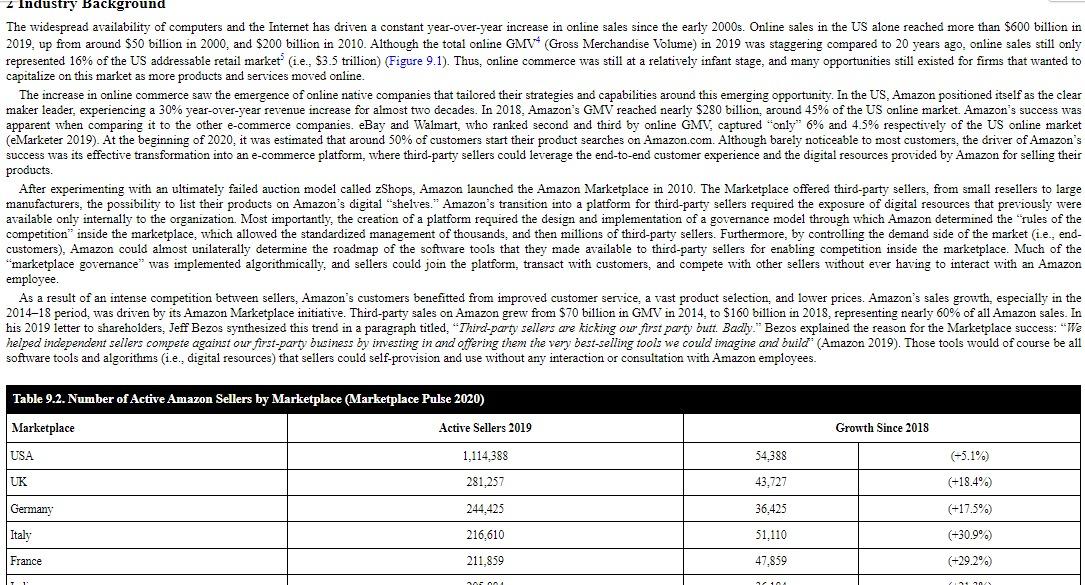

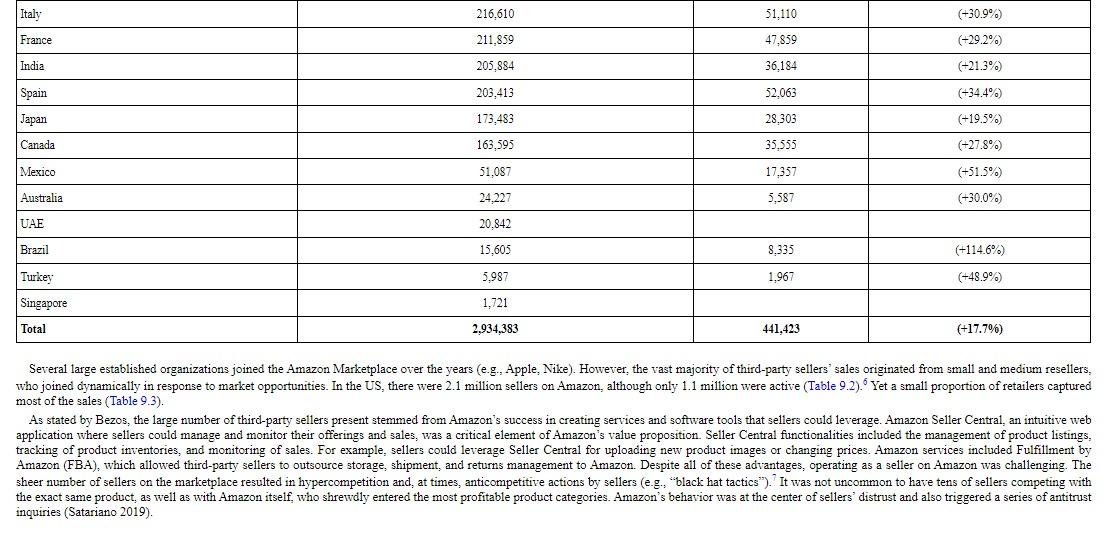

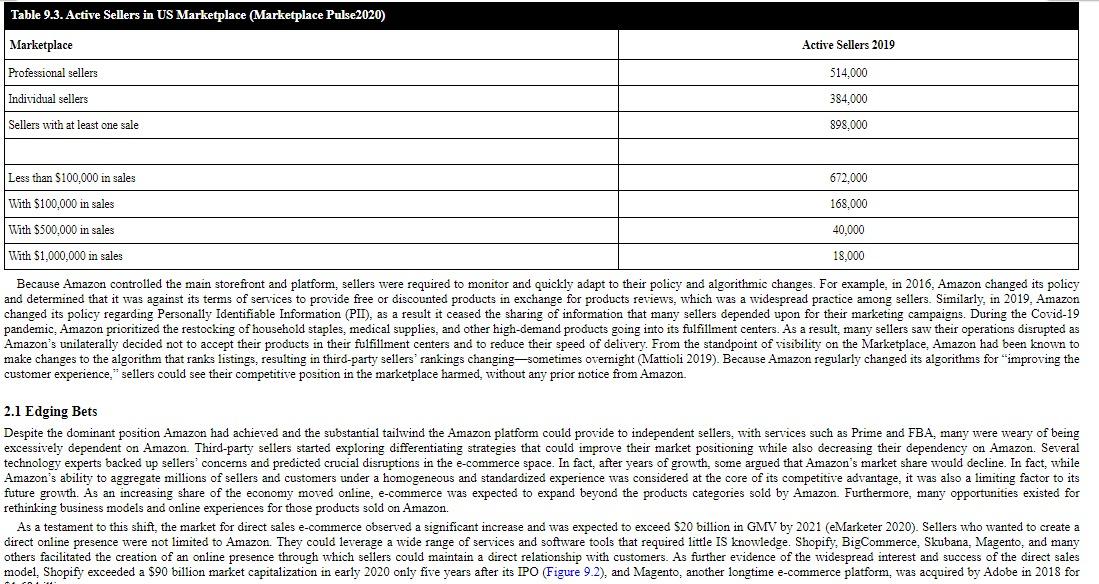

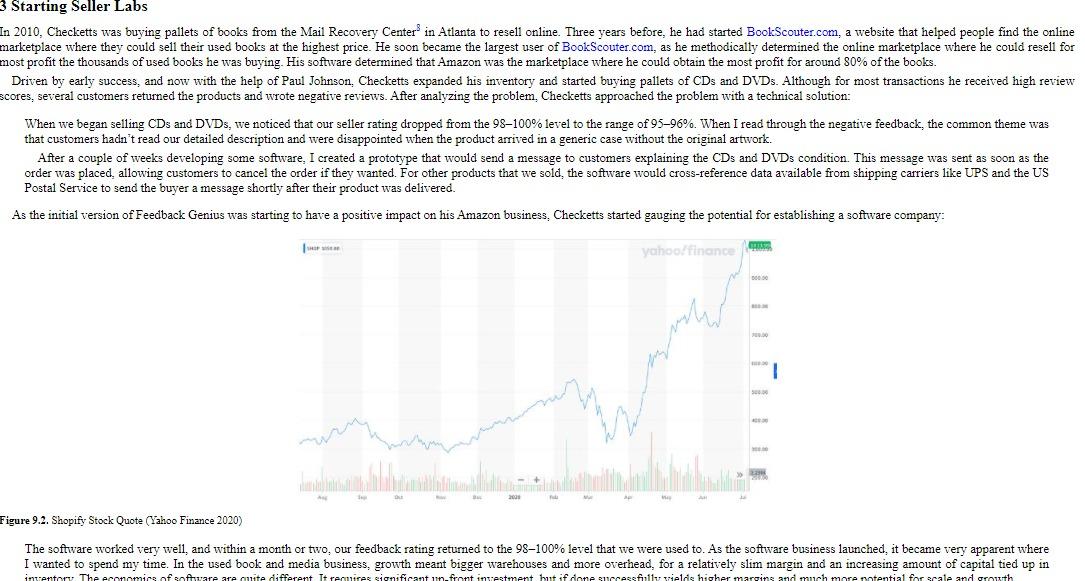

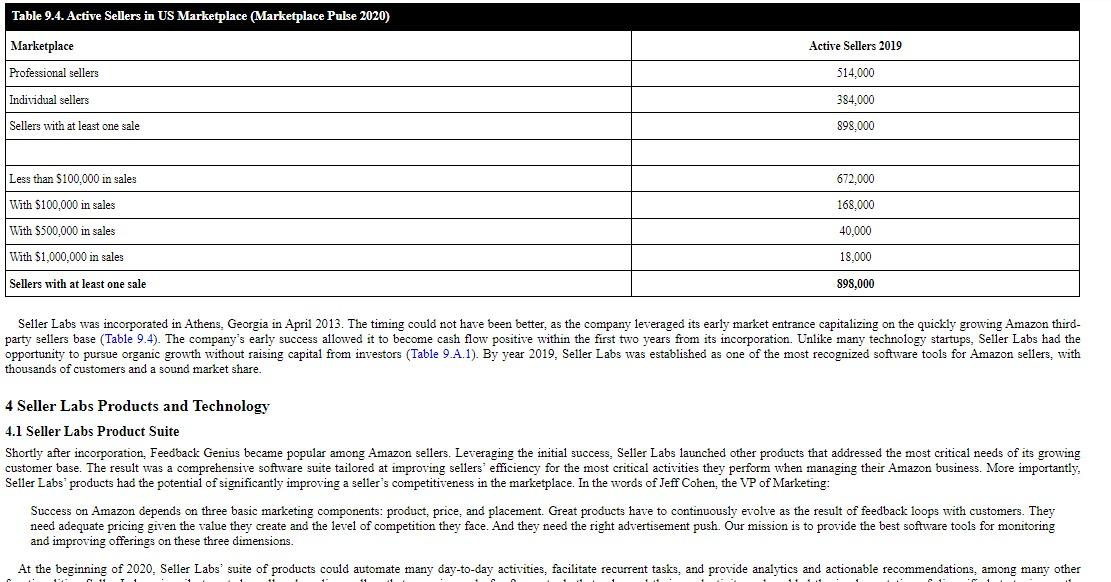

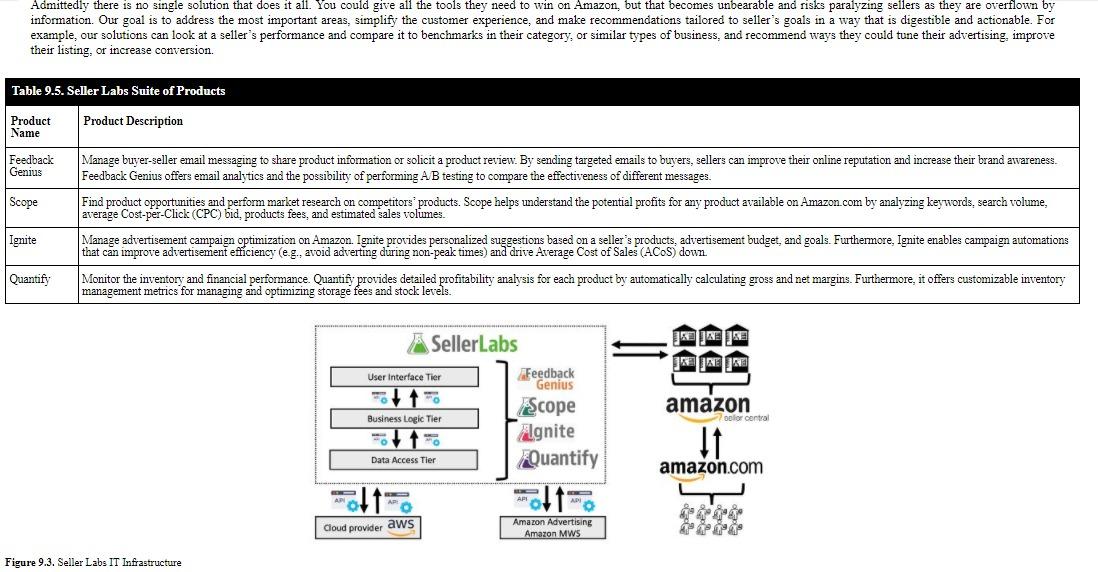

Seller Labs: Democratizing E-Merchants Competitiveness 1 Introduction In April 2013, Brandon Checketts and Paul Johnson decided to leave their business as Amazon and eBay sellers and create a software business: Seller Labs. The founders seized the opportunity to develop software tools that solved common problems faced by the rapidly growing number of Amazon's third-party sellers. Despite the presence of Amazon's proprietary software solution (Seller Central), the founders recognized there was a market for advanced software tools for data analytics and work automation that facilitated the pursuit of diversified strategies and improved the competitiveness of Amazon's Marketplace third-party sellers. Table 9.1. Sellers in US Marketplace (Marketplace Pulse 2020) Year Worldwide Based in China 2009 900.000 2010 1,300,000 2011 1,800,000 2012 2.300,000 2013 2,800,000 2014 3,400,000 2015 4,000,000 2016 4,700,000 1,090,400 2017 5,700,000 1,943,700 2018 6,800,000 2.652,000 2019 8,000,000 3,732,000 The first Seller Labs' product was a messaging system (1.e., Feedback Genius), that enabled targeted email communication between customers and sellers. On the impetus of this early success. Seller Labs developed a range of software products for sellers' advertising, market research, inventory management, and financial reporting. Five years after the original launch. Seller Labs was one of the major complementors on the Amazon platform, with thousands of customers, and an invitation to the Amazon Marketplace developer council. As the Amazon Marketplace grew and became more competitive (see Table 9.1), numerous complementors developed comparable software products supporting third-party sellers. For the first time in Seller Labs' history mounting competition required a reevaluation of the firm's strategic positioning. Hank Harris had been thinking about a way forward since taking over the CEO reigns in November 2017: I had seen the same dynamics playing out similarly on the Google Advertisement platform, where after years of intense competition, only two or three companies were successful. When looking at Seller Labs, I knew that we were in the middle of that same competitive dynamic, as keeping up with the continuous innovations of the Amazon Marketplace Web Services and Advertisement platforms was becoming increasingly challenging. Our most successful products, such as buyer-seller messaging, could be copied by other startups, or Amazon itself. We needed a differentiation strategy that uniquely positioned Seller Labs in the market. After evaluating several options, Seller Labs acquired X-Cart in October 2019, an established e-commerce platform with tens of employees. X-Cart, founded in 2001, offered the opportunity of implementing a differentiating strategy that would enable Seller Labs to expand its offerings outside the Amazon's Marketplace. With the acquisition of X-Cart. Seller Labs could establish a more comprehensive suite of products and services in the broad e-commerce space. However, the acquisition put Seller Labs at a crossroad. Should the firm continue to stay true to the original vision and primarily focus on the development of solutions targeted to Amazon's sellers? Or should it use the firm's limited resources to pivot outside of the Amazon Marketplace and developed an integrated e-commerce platform? US retail sales (Str, 2019 dollars) Addressable retail Ecommerce 1 2000 2005 2010 2015 2019 apparent Industry Background The widespread availability of computers and the Internet has driven a constant year-over-year increase in online sales since the early 2000s. Online sales in the US alone reached more than $600 billion in 2019. up from around $50 billion in 2000, and $200 billion in 2010. Although the total online GMV* (Gross Merchandise Volume) in 2019 was staggering compared to 20 years ago, online sales still only represented 16% of the US addressable retail market (1.e., $3.5 trillion) (Figure 9.1). Thus, online commerce was still at a relatively infant stage, and many opportunities still existed for firms that wanted to capitalize on this market as more products and services moved online. The increase in online commerce saw the emergence of online native companies that tailored their strategies and capabilities around this emerging opportunity. In the US, Amazon positioned itself as the clear maker leader, experiencing a 30% year-over-year revenue increase for almost two decades. In 2018. Amazon's GMV reached nearly $280 billion, around 45% of the US online market. Amazon's success was when comparing it to the other e-commerce companies. eBay and Walmart, who ranked second and third by online GMV, captured "only" 6% and 4.5% respectively of the US online market (eMarketer 2019). At the beginning of 2020, it was estimated that around 50% of customers start their product searches on Amazon.com. Although barely noticeable to most customers, the driver of Amazon's success was its effective transformation into an e-commerce platform, where third-party sellers could leverage the end-to-end customer experience and the digital resources provided by Amazon for selling their products. After experimenting with an ultimately failed auction model called Shops, Amazon launched the Amazon Marketplace in 2010. The Marketplace offered third-party sellers, from small resellers to large manufacturers, the possibility to list their products on Amazon's digital shelves." Amazon's transition into a platform for third-party sellers required the exposure of digital resources that previously were available only internally to the organization. Most importantly, the creation of a platform required the design and implementation of a governance model through which Amazon determined the "rules of the competition" inside the marketplace, which allowed the standardized management of thousands, and then millions of third-party sellers. Furthermore, by controlling the demand side of the market (i.e., end- customers), Amazon could almost unilaterally determine the roadmap of the software tools that they made available to third-party sellers for enabling competition inside the marketplace. Much of the "marketplace governance was implemented algorithmically, and sellers could join the platform, transact with customers, and compete with other sellers without ever having to interact with an Amazon employee As a result of an intense competition between sellers, Amazon's customers benefitted from improved customer service, a vast product selection, and lower prices. Amazon's sales growth, especially in the 201418 period, was driven by its Amazon Marketplace initiative. Third-party sales on Amazon grew from $70 billion in GMV in 2014. $160 billion in 2018, representing nearly 60% of all Amazon sales. In his 2019 letter to shareholders, Jeff Bezos synthesized this trend in a paragraph titled, Third-party sellers are kicking our first party butt. Badly." Bezos explained the reason for the Marketplace success: "We helped independent sellers compete against our first-party business by investing in and offering them the very best-selling tools we could imagine and build" (Amazon 2019). Those tools would of course be all software tools and algorithms (i.e., digital resources) that sellers could self-provision and use without any interaction or consultation with Amazon employees. Table 9.2. Number of Active Amazon Sellers by Marketplace (Marketplace Pulse 2020) Marketplace Active Sellers 2019 Growth Since 2018 USA 1,114,388 54,388 (-5.1%) UK 281,257 43.727 (+18.4%) Germany 244,425 36.425 (+17.5%) Italy 216.610 51.110 (+30.9%) France 211,859 47.859 (+29.2%) - 2010 20 Italy 216.610 51.110 (+30.9%) France 211,859 47.859 (+29.2 India 205,884 36,184 (+21.3%) Spain 203.413 52,063 (+34.49 Japan 173,483 28,303 (+19.5 Canada 163,595 35,555 (+27.8%) Mexico 51,087 17,357 (+51.5 Australia 24,227 5,587 (+30.0%) UAE 20,842 Brazil 15,605 8.335 (+114.6%) Turkey 5,987 1,967 (+48.9% Singapore 1,721 Total 2.934,383 441,423 (+17.7%) Several large established organizations joined the Amazon Marketplace over the years (e.g., Apple, Nike). However, the vast majority of third-party sellers sales originated from small and medium resellers, who joined dynamically in response to market opportunities. In the US, there were 2.1 million sellers on Amazon, although only 1.1 million were active (Table 9.2). Yet a small proportion of retailers captured most of the sales (Table 9.3). As stated by Bezos, the large number of third-party sellers present stemmed from Amazon's success in creating services and software tools that sellers could leverage. Amazon Seller Central, an intuitive web application where sellers could manage and monitor their offerings and sales, was a critical element of Amazon's value proposition Seller Central functionalities included the management of product listings. tracking of product inventories, and monitoring of sales. For example, sellers could leverage Seller Central for uploading new product images or changing prices. Amazon services included Fulfillment by Amazon (FBA), which allowed third-party sellers to outsource storage, shipment, and returns management to Amazon. Despite all of these advantages, operating as a seller on Amazon was challenging. The sheer number of sellers on the marketplace resulted in hypercompetition and, at times, anticompetitive actions by sellers (eg., black hat tactics). It was not uncommon to have tens of sellers competing with the exact same product, as well as with Amazon itself, who shrewdly entered the most profitable product categories. Amazon's behavior was at the center of sellers' distrust and also triggered a series of antitrust inquiries (Satariano 2019). Table 9.3. Active Sellers in US Marketplace (Marketplace Pulse2020) Marketplace Active Sellers 2019 Professional sellers 514.000 Individual sellers 384,000 Sellers with at least one sale 898.000 Less than $100.000 in sales 672,000 With $100.000 in sales 168,000 With $500,000 in sales 40,000 With $1,000,000 in sales 18.000 Because Amazon controlled the main storefront and platform, sellers were required to monitor and quickly adapt to their policy and algorithmic changes. For example, in 2016, Amazon changed its policy and determined that it was against its terms of services to provide free or discounted products in exchange for products reviews, which was a widespread practice among sellers. Similarly, in 2019. Amazon changed its policy regarding Personally Identifiable Information (PII), as a result it ceased the sharing of information that many sellers depended upon for their marketing campaigns. During the Covid-19 pandemic. Amazon prioritized the restocking of household staples, medical supplies, and other high-demand products going into its fulfillment centers. As a result, many sellers saw their operations disrupted as Amazon's unilaterally decided not to accept their products in their fulfillment centers and to reduce their speed of delivery. From the standpoint of visibility on the Marketplace, Amazon had been known to make changes to the algorithm that ranks listings, resulting in third-party sellers' rankings changingsometimes overnight (Mattioli 2019). Because Amazon regularly changed its algorithms for "improving the customer experience," sellers could see their competitive position in the marketplace harmed, without any prior notice from Amazon. 2.1 Edging Bets Despite the dominant position Amazon had achieved and the substantial tailwind the Amazon platform could provide to independent sellers, with services such as Prime and FBA, many were weary of being excessively dependent on Amazon. Third-party sellers started exploring differentiating strategies that could improve their market positioning while also decreasing their dependency on Amazon. Several technology experts backed up seller concerns and predicted crucial disruptions in the e-commerce space. In fact, after years of growth, some argued Amazon's market share woul In Amazon's ability to aggregate millions of sellers and customers under a homogeneous and standardized experience was considered at the core of its competitive advantage, it was also a limiting factor to its future growth. As an increasing share of the economy moved online, e-commerce was expected to expand beyond the products categories sold by Amazon. Furthermore, many opportunities existed for rethinking business models and online experiences for those products sold on Amazon. As a testament to this shift, the market for direct sales e-commerce observed a significant increase and was expected to exceed $20 billion in GMV by 2021 (Marketer 2020). Sellers who wanted to create a direct online presence were not limited to Amazon. They could leverage a wide range of services and software tools that required little Is knowledge Shopify: BigCommerce. Skubana. Magento, and many others facilitated the creation of an online presence through which sellers could maintain a direct relationship with customers. As further evidence of the widespread interest and success of the direct sales model, Shopify exceeded a $90 billion market capitalization in early 2020 only five years after its IPO (Figure 9.2), and Magento, another longtime e-commerce platform, was acquired by Adobe in 2018 for 3 Starting Seller Labs In 2010, Checketts was buying pallets of books from the Mail Recovery Center in Atlanta to resell online. Three years before, he had started BookScouter.com, a website that helped people find the online marketplace where they could sell their used books at the highest price. He soon became the largest user of BookScouter.com, as he methodically determined the online marketplace where he could resell for most profit the thousands of used books he was buying. His software determined that Amazon was the marketplace where he could obtain the most profit for around 80% of the books. Driven by early success, and now with the help of Paul Johnson. Checketts expanded his inventory and started buying pallets of CDs and DVDs. Although for most transactions he received high review scores, several customers returned the products and wrote negative reviews. After analyzing the problem. Checketts approached the problem with a technical solution: When we began selling CDs and DVDs, we noticed that our seller rating dropped from the 98-100% level to the range of 9596%. When I read through the negative feedback, the common theme was that customers hadn't read our detailed description and were disappointed when the product arrived in a generic case without the original artwork. After a couple of weeks developing some software. I created a prototype that would send a message to customers explaining the CDs and DVDs condition. This message was sent as soon as the order was placed, allowing customers to cancel the order if they wanted. For other products that we sold, the software would cross-reference data available from shipping carriers like UPS and the US Postal Service to send the buyer a message shortly after their product was delivered. As the initial version of Feedback Genius was starting to have a positive impact on his Amazon business. Checketts started gauging the potential for establishing a software company: yahoo finance 000 1 Figure 9.2. Shopify Stock Quote (Yahoo Finance 2020) The software worked very well, and within a month or two, our feedback rating returned to the 98-100% level that we were used to. As the software business launched, it became very apparent where I wanted to spend my time. In the used book and media business, growth meant bigger warehouses and more overhead, for a relatively slim margin and an increasing amount of capital tied up in intentory The economics of software are quite different It recuires sanificant un front insrestent but if done necessfullyields higher margins and much more potential for scale and growth Table 9.4. Active Sellers in US Marketplace (Marketplace Pulse 2020) Active Sellers 2019 Marketplace Professional sellers 514.000 Individual sellers 384,000 Sellers with at least one sale 898,000 Less than $100,000 in sales 672,000 With $100.000 in sales 168.000 40,000 With $500,000 in sales With $1,000,000 in sales 18,000 Sellers with at least one sale 898,000 Seller Labs was incorporated in Athens, Georgia in April 2013. The timing could not have been better, as the company leveraged its early market entrance capitalizing on the quickly growing Amazon third- party sellers base (Table 9.4). The company's early success allowed it to become cash flow positive within the first two years from its incorporation. Unlike many technology startups, Seller Labs had the opportunity to pursue organic growth without raising capital from investors (Table 9.A.1). By year 2019, Seller Labs was established as one of the most recognized software tools for Amazon sellers, with thousands of customers and a sound market share. 4 Seller Labs Products and Technology 4.1 Seller Labs Product Suite Shortly after incorporation, Feedback Genius became popular among Amazon sellers. Leveraging the initial success, Seller Labs launched other products that addressed the most critical needs of its growing customer base. The result was a comprehensive software suite tailored at improving seilers' efficiency for the most critical activities they perform when managing their Amazon business. More importantly, Seller Labs' products had the potential of significantly improving a seller's competitiveness in the marketplace. In the words of Jeff Cohen, the VP of Marketing: Success on Amazon depends on three basic marketing components: product, price, and placement. Great products have to continuously evolve as the result of feedback loops with customers. They need adequate pricing given the value they create and the level of competition they face. And they need the right advertisement push. Our mission is to provide the best software tools for monitoring and improving offerings on these three dimensions. At the beginning of 2020. Seller Labs' suite of products could automate many day-to-day activities, facilitate recurrent tasks, and provide analytics and actionable recommendations, among many other au 11 11 Admittedly there is no single solution that does it all. You could give all the tools they need to win on Amazon, but that becomes unbearable and risks paralyzing sellers as they are overflown by information. Our goal is to address the most important areas, simplify the customer experience, and make recommendations tailored to seller's goals in a way that is digestible and actionable. For example, our solutions can look at a seller's performance and compare it to benchmarks in their category, or similar types of business, and recommend ways they could tune their advertising, improve their listing, or increase conversion. Table 9.5. Seller Labs Suite of Products Product Name Product Description Feedback Genius Scope Manage buyer-seller email messaging to share product information or solicit a product review. By sending targeted emails to buyers, sellers can improve their online reputation and increase their brand awareness. Feedback Genius offers email analytics and the possibility of performing A B testing to compare the effectiveness of different messages. Find product opportunities and perform market research on competitors products. Scope helps understand the potential profits for any product available on Amazon.com by analyzing keywords, search volume, average Cost-per-Click (CPC) bid, products fees, and estimated sales volumes. Manage advertisement campaign optimization on Amazon Ignite provides personalized suggestions based on a seller's products, advertisement budget, and goals. Furthermore, Ignite enables campaign automations that can improve advertisement efficiency (eg., avoid adverting during non-peak times) and drive Average Cost of Sales (ACS) down. Monitor the inventory and financial performance. Quantify provides detailed profitability analysis for each product by automatically calculating gross and net margins. Furthermore, it offers customizable inventory management metrics for managing and optimizing storage fees and stock levels. Ignite Quantify S JAEJO SellerLabs User Interface Tier Feedback Genius Scope Business Logic Tier Ignite Data Access Tier Quantify amazon bolo central 11 amazon.com ME Cloud provider aws Amazon Advertising Amazon MWS Figure 9.3. Seller Labs IT Infrastructure Another important element of Seller Labs success was the Managed Services group, which acted on a consultant basis for sellers that needed help with the management of their business. Seller Labs' experts combined their deep expertise of the Amazon Marketplace with their knowledge of Seller Labs suite of products. The group provided a white-glove service in the areas of listing optimization, advertisement management, and messaging optimization. In addition to contributing to the overall profitability, Managed Services helped reduce the churn of those sellers that required higher levels of customization and support. Over the years, Seller Labs' role of facilitating seller's success extended beyond providing products and professional services. The company significantly contributed to the creation of articles, guides, and webinars that informed sellers about the latest news, trends, and best practices they needed to consider for establishing a successful business on Amazon. In addition, Seller Labs was active in all major conferences, while also hosting its conference, Resonate, since 2016. Resonate's objective was to provide experienced sellers a venue to connect and learn advanced selling strategies from each other and from Seller Labs Managed Services' specialists. 4.2 Seller Labs Technology Seller Labs understood from the beginning the need for an agile IS infrastructure that allowed rapid development and release of new products and features. From day one, Seller Labs decided that it would leverage Amazon Web Services (AWS) cloud computing platform and that all products would be offered with a Software as a Service (SaaS). model. The decision to leverage AWS enabled Seller Labs to implement a flexible cost structure and the possibility of focusing on the development of software functionalities rather than the management of a proprietary and complex IS infrastructure. Furthermore, the SaaS model was critical for Seller Labs success, as it meant that sellers were not required to install any software or buy specific hardware when using its products. Any seller with an Amazon professional sellers' account," a PC, and an Internet connection could take full advantage of all products without needing any specific hardware, software, or capital investment. Furthermore, by leveraging AWS, Seller Labs had access to advanced IT services (e.g., computing and storage resources), without needing to own an IT infrastructure (eg, servers) or having to make long-term financial commitments. Offering a SaaS solution enabled Seller Labs full control over its application. For example, the company could release new versions of its products without requiring sellers to make a software update. This was essential as sellers often depended on Seller Labs for quickly introducing or removing features as a consequence of Amazon's changes to its platform and marketplace policies. Also, as sellers data were not stored on their premises, they had an incentive in maintaining a recurrent relationship with Seller Labs to preserve transaction history. Seller Labs adopted a three-tier architecture (see Figure 9.3), which separated the presentation, business logic, and data access level, and the whole architecture used internal APIs 12 to expose data, and systems capabilities. Its modular architecture enabled fast product iterations, and the ability to quickly launch completely new products (e.g.Ignite), or dismiss old features no longer supported. At the core of Seller Labs' offering was the Amazon Marketplace Web Service (MWS) and Amazon Advertisement platforms. Both platforms exposed resources, in the form of web service APIs, that enabled third-party sellers to programmatically exchange data with Amazon. When launched in 2009, Amazon MWS allowed only the manual upload of sellers' inventory through an XML and flat file feed. After receiving interest from sellers and complementors, over the years Amazon released new APIs allowing the programmatic exchange of product listings, orders, payments, and reports with Amazon's servers. Checketts recalls the integration efforts when first leveraging the MWS platform: The original Marketplace APIs that Amazon exposed were not really intended for third-party developers such as ourselves. They seem to have been originally intended for sophisticated sellers that had their own IT department so they could integrate with Amazon to get their own data out of Amazon to put into their own systems. For some time, the team at Amazon did not promote the use of the APIs and did not make major efforts to improve them. However, over the last five years Amazon has started recognizing the value of having third-party integrations and providers like ourselves and has been making huge strides in improving the experience for software developers. Amazon Advertisement APIs enabled the programmatic creation of advertising campaigns for maximizing the visibility of sellers listings in Amazon.com. The launch of the Advertisement platform in 2016 was a critical in enabling Ignite's product conceptualization and development. In fact, from a technology infrastructure perspective. Seller Labs products were dependent on the availability of the Marketplace APIs functionalities and data transfers. The Marketplace APIs provide the building blocks (1.e.. APIs) that enable the creation of Seller Labs products through the exchange of data (eg., inventory levels) and software instructions (e. g., product price change) (see Figure 9.3). For example, the financial reports available in Quantify were generated from raw data sourced from the Amazon MWS Reports API. Similarly, most of the product functionalities (e.g., change of product's price or description) were enabled by programmatically exchanging data with the Marketplace APIs. Checketts summarized the challenges of working with the Amazon's Marketplace APIs: One of the challenges we now face that the pace of innovation at Amazon, especially in Advertising, is quite rapid. Every quarter new APIs and important functionality is released, requiring updates to our software to keep up. For some features, competitors have been able to adopt new functionality before us, keeping us in our toes. 5 X-Cart Acquisition X-Cart was a Russian-based startup that developed the first downloadable PHP MySQL shopping cart platform in 2001. When first released, it was one of the leading solutions that enabled the creation of an e-commerce store by sellers. Despite its early entrance into the market, the company never became a market leader. Over the years. X-Cart lost its early advantage as other companies challenged its position (eg, Magento), and its business model remained anchored to a one-time license fee. For almost two decades, X-Cart earned a significant portion of its revenue by providing customization and maintenance services for those sellers that wanted to create an e-commerce store based on the X-Cart platform. X-Cart economics and organizational incentives were strongly influenced by the service group within the company. As a consequence, their product roadmap could not evolve as the product advancements of its competitors. Despite the many challenges faced by X-Cart, it had significant growth potential. Its e-commerce platform was broad and all-inclusive, as it comprised all the functionalities needed for creating an e- commerce storefront: store builder, product listings management, designs optimized for search engines, and the compatibility with over 120 different payment gateways." By adopting X-Cart, a seller could create a full-fledge independent e-commerce presence. More importantly, X-Cart was architected as a platform, thus enabling the creation of add-ons (1.e. software extensions) that could increase functionalities to the core product. For example, the Google Ads add-on enabled the advertisement of seiler products on Google Shopping, YouTube, and Gmail. Similarly, DHL integration enabled the inclusion of real-time shipping quotes and the comparison of different delivery methods. X-Cart had tens of add-ons for a wide range of purposes, such as order fulfillment, shipment, marketing, and tax management. The X-Cart platform was adopted by more than 35,000 customers worldwide over the years. However, due to the one-time license model, a significant number of these customers were not recurrent, and did not interact with the company on an ongoing basis. In fact, many of X-Cart customers were small or medium business that entirely hosted and managed their e-commerce stores on-premise without ever interacting with X-Cart. As the company prepared for releasing a cloud-based version of X-Cart with a SaaS model. Harris reflected on the challenges and opportunities of the acquisition: The acquisition presented many challenges in terms of reorganizing and integrating our different business models, technological stacks, and organizational culture. However, I do think that X-Cart is a critical piece of the puzzle to become a diversified and sustainable company. The release of X-Cart Cloud is a first step in the journey for achieving that diversification. In many ways, X-Cart is simply another marketplace that we can provide to our customers and with the release of the first cloud-based version of it we can now facilitate its adoption 6 Competition The competitive environment of software tools for Amazon sellers was mounting. At the same time, the acquisition of X-Cart expanded Seller Labs' competitive territory to the entire e-commerce space. As a consequence, Seller Labs faced increasing competition from multiple fronts. The number of startups offering software tools for Amazon sellers was substantial. The market was crowded with small and medium-sized firms providing products and services comparable to those of Seller Labs. While some firms only focused on specific products (e.g., keyword optimization), or particular regions or countries (e.g., Europe, China), each competitor presented a potential threat to Seller Labs. However, the biggest threat for Seller Labs was three existing companies that could potentially imitate their entire product suite and steal market share (see Table 9.A 2. and Table 9.A.4 for a comparison). Furthermore, as some of its competitors had access to venture capital funding, they could make significant investments in improving their products and market penetration Sellics, a major competitor based in the Bay Area, raised Series A funding of $10 million in September 2019, signaling major plans to expand its current offerings. The increased competition created an arms race for developing new features and products, or rapidly imitating the ones introduced by direct competitors. Furthermore, some competitors were also starting to pursue diversification strategies by expanding their offerings to other marketplaces, such as Walmart, eBay, and Target. In the broad e-commerce space, Seller Labs competed with several platforms explicitly developed to enable the creation of online stores by retailers. Shopify had emerged as the market leader in the space, with more than 1,000,000 customers globally and a GMV of its business exceeding $40 billion. Furthermore, with a big enough market share and access to capital, Shopify was starting to offer many platform In the broad e-commerce space. Seller Labs competed with several platforms explicitly developed to enable the creation of online stores by retailers. Shopify had emerged as the market leader in the space, e- with more than 1,000,000 customers globally and a GMV of its business exceeding S40 billion. Furthermore, with a big enough market share and access to capital, Shopify was starting to offer many platform resources previously only available on Amazon For example, through Shopify's proprietary fulfillment network, sellers could reliably store and deliver their products, while keeping absolute control over their customer's experience and data. The multiple technological stacks and the variety of seller needs created significant opportunities for a vast number of companies beyond Shopify. Magento, WooCommerce, BigCommerce, Feedonomics, were all successfully established e-commerce platforms, with substantial access to capital and market share. As a result of the head-to-head competition between the different e-commerce platform, sellers had several first-rate alternatives for easily creating and managing their online presence. Furthermore, many e-commerce platforms were starting to integrate horizontally into different channels, including Amazon and Walmart. Despite the existence of many established players, Hank Harris remained positive about the future: Just because there are dominant players in the industry with large market shares and access to capital does not mean the industry cannot be disrupted. We have seen multiple times in the technology industry how dominant positions can be quickly eroded by small entrants. Consider for example what happened to Skype and WebEx, which were the dominant videoconference software a few years ago. Now they are only minor players, in a market dominated by Zoom. 7 Charting the Future Despite still being a startup, Seller Labs had already achieved many successes. The company grew from just two employees to more than a hundred. The company has also been praised multiple times by business press, ranked two years in a row among the top fastest growing private US companies, and was a founding member of the Amazon Marketplace Developer Council. However, Seller Labs could not stand still contemplating its previous successes. The competitive environment was becoming increasingly hostile as competition was escalating rapidly from multiple angles. Numerous direct competitors were engaging in an arms race for developing increasingly advanced features for Amazon sellers and rapidly expanding internationally. Furthermore, the COVID-19 pandemic anticipated a decade of expected online commerce growth in just a few months, creating significant opportunities and challenges. Because of social distancing and shutdowns, a significant number of customers had online commerce as their only option for buying products during the pandemic, and several companies capitalized on this opportunity. Google made freely available to all sellers its Google Shopping service, independently of whether sellers advertised on Google. Furthermore, Google partnered with Shopify and WooCommerce to make it easy for small retailers to access Google's results. Facebook launched Facebook Shops, an online store where sellers could create their catalog, customize their offerings, and promote them within Facebook's applications (i... Instagram Stories or Facebook Ads). This meant that any seller could create an online business and connect with the millions of Facebook users. At the same time, Amazon was introducing a new Selling Partner API (SP-API) platform, which offered all the functionality already available in Amazon MWS platform plus a new set of functionalities. While the Amazon AWS platform was still available it would eventually be deprecated in favor of the more technologically advanced SP-API. With the acquisition of X-Cart and the commercialization of X-Cart Cloud, Seller Labs had made its first move on its journey of becoming a differentiated sustainable business. Yet, the company was entering uncharted territories and without a clear strategy going forward it could put at risk the earlier successes. Despite the many challenges the company was facing. Harris remained positive: We have been investing so much in infrastructure for integrating the two companies over the last months. The significance of these investments, both in terms of human and capital resources, made us fall behind some of our competitors. We are finally back in a position where we can start releasing features and products again. I am incredibly exited that our customers will finally see what we have I been working on for the past few months and I am looking forward to the opportunities ahead. Seller Labs: Democratizing E-Merchants Competitiveness 1 Introduction In April 2013, Brandon Checketts and Paul Johnson decided to leave their business as Amazon and eBay sellers and create a software business: Seller Labs. The founders seized the opportunity to develop software tools that solved common problems faced by the rapidly growing number of Amazon's third-party sellers. Despite the presence of Amazon's proprietary software solution (Seller Central), the founders recognized there was a market for advanced software tools for data analytics and work automation that facilitated the pursuit of diversified strategies and improved the competitiveness of Amazon's Marketplace third-party sellers. Table 9.1. Sellers in US Marketplace (Marketplace Pulse 2020) Year Worldwide Based in China 2009 900.000 2010 1,300,000 2011 1,800,000 2012 2.300,000 2013 2,800,000 2014 3,400,000 2015 4,000,000 2016 4,700,000 1,090,400 2017 5,700,000 1,943,700 2018 6,800,000 2.652,000 2019 8,000,000 3,732,000 The first Seller Labs' product was a messaging system (1.e., Feedback Genius), that enabled targeted email communication between customers and sellers. On the impetus of this early success. Seller Labs developed a range of software products for sellers' advertising, market research, inventory management, and financial reporting. Five years after the original launch. Seller Labs was one of the major complementors on the Amazon platform, with thousands of customers, and an invitation to the Amazon Marketplace developer council. As the Amazon Marketplace grew and became more competitive (see Table 9.1), numerous complementors developed comparable software products supporting third-party sellers. For the first time in Seller Labs' history mounting competition required a reevaluation of the firm's strategic positioning. Hank Harris had been thinking about a way forward since taking over the CEO reigns in November 2017: I had seen the same dynamics playing out similarly on the Google Advertisement platform, where after years of intense competition, only two or three companies were successful. When looking at Seller Labs, I knew that we were in the middle of that same competitive dynamic, as keeping up with the continuous innovations of the Amazon Marketplace Web Services and Advertisement platforms was becoming increasingly challenging. Our most successful products, such as buyer-seller messaging, could be copied by other startups, or Amazon itself. We needed a differentiation strategy that uniquely positioned Seller Labs in the market. After evaluating several options, Seller Labs acquired X-Cart in October 2019, an established e-commerce platform with tens of employees. X-Cart, founded in 2001, offered the opportunity of implementing a differentiating strategy that would enable Seller Labs to expand its offerings outside the Amazon's Marketplace. With the acquisition of X-Cart. Seller Labs could establish a more comprehensive suite of products and services in the broad e-commerce space. However, the acquisition put Seller Labs at a crossroad. Should the firm continue to stay true to the original vision and primarily focus on the development of solutions targeted to Amazon's sellers? Or should it use the firm's limited resources to pivot outside of the Amazon Marketplace and developed an integrated e-commerce platform? US retail sales (Str, 2019 dollars) Addressable retail Ecommerce 1 2000 2005 2010 2015 2019 apparent Industry Background The widespread availability of computers and the Internet has driven a constant year-over-year increase in online sales since the early 2000s. Online sales in the US alone reached more than $600 billion in 2019. up from around $50 billion in 2000, and $200 billion in 2010. Although the total online GMV* (Gross Merchandise Volume) in 2019 was staggering compared to 20 years ago, online sales still only represented 16% of the US addressable retail market (1.e., $3.5 trillion) (Figure 9.1). Thus, online commerce was still at a relatively infant stage, and many opportunities still existed for firms that wanted to capitalize on this market as more products and services moved online. The increase in online commerce saw the emergence of online native companies that tailored their strategies and capabilities around this emerging opportunity. In the US, Amazon positioned itself as the clear maker leader, experiencing a 30% year-over-year revenue increase for almost two decades. In 2018. Amazon's GMV reached nearly $280 billion, around 45% of the US online market. Amazon's success was when comparing it to the other e-commerce companies. eBay and Walmart, who ranked second and third by online GMV, captured "only" 6% and 4.5% respectively of the US online market (eMarketer 2019). At the beginning of 2020, it was estimated that around 50% of customers start their product searches on Amazon.com. Although barely noticeable to most customers, the driver of Amazon's success was its effective transformation into an e-commerce platform, where third-party sellers could leverage the end-to-end customer experience and the digital resources provided by Amazon for selling their products. After experimenting with an ultimately failed auction model called Shops, Amazon launched the Amazon Marketplace in 2010. The Marketplace offered third-party sellers, from small resellers to large manufacturers, the possibility to list their products on Amazon's digital shelves." Amazon's transition into a platform for third-party sellers required the exposure of digital resources that previously were available only internally to the organization. Most importantly, the creation of a platform required the design and implementation of a governance model through which Amazon determined the "rules of the competition" inside the marketplace, which allowed the standardized management of thousands, and then millions of third-party sellers. Furthermore, by controlling the demand side of the market (i.e., end- customers), Amazon could almost unilaterally determine the roadmap of the software tools that they made available to third-party sellers for enabling competition inside the marketplace. Much of the "marketplace governance was implemented algorithmically, and sellers could join the platform, transact with customers, and compete with other sellers without ever having to interact with an Amazon employee As a result of an intense competition between sellers, Amazon's customers benefitted from improved customer service, a vast product selection, and lower prices. Amazon's sales growth, especially in the 201418 period, was driven by its Amazon Marketplace initiative. Third-party sales on Amazon grew from $70 billion in GMV in 2014. $160 billion in 2018, representing nearly 60% of all Amazon sales. In his 2019 letter to shareholders, Jeff Bezos synthesized this trend in a paragraph titled, Third-party sellers are kicking our first party butt. Badly." Bezos explained the reason for the Marketplace success: "We helped independent sellers compete against our first-party business by investing in and offering them the very best-selling tools we could imagine and build" (Amazon 2019). Those tools would of course be all software tools and algorithms (i.e., digital resources) that sellers could self-provision and use without any interaction or consultation with Amazon employees. Table 9.2. Number of Active Amazon Sellers by Marketplace (Marketplace Pulse 2020) Marketplace Active Sellers 2019 Growth Since 2018 USA 1,114,388 54,388 (-5.1%) UK 281,257 43.727 (+18.4%) Germany 244,425 36.425 (+17.5%) Italy 216.610 51.110 (+30.9%) France 211,859 47.859 (+29.2%) - 2010 20 Italy 216.610 51.110 (+30.9%) France 211,859 47.859 (+29.2 India 205,884 36,184 (+21.3%) Spain 203.413 52,063 (+34.49 Japan 173,483 28,303 (+19.5 Canada 163,595 35,555 (+27.8%) Mexico 51,087 17,357 (+51.5 Australia 24,227 5,587 (+30.0%) UAE 20,842 Brazil 15,605 8.335 (+114.6%) Turkey 5,987 1,967 (+48.9% Singapore 1,721 Total 2.934,383 441,423 (+17.7%) Several large established organizations joined the Amazon Marketplace over the years (e.g., Apple, Nike). However, the vast majority of third-party sellers sales originated from small and medium resellers, who joined dynamically in response to market opportunities. In the US, there were 2.1 million sellers on Amazon, although only 1.1 million were active (Table 9.2). Yet a small proportion of retailers captured most of the sales (Table 9.3). As stated by Bezos, the large number of third-party sellers present stemmed from Amazon's success in creating services and software tools that sellers could leverage. Amazon Seller Central, an intuitive web application where sellers could manage and monitor their offerings and sales, was a critical element of Amazon's value proposition Seller Central functionalities included the management of product listings. tracking of product inventories, and monitoring of sales. For example, sellers could leverage Seller Central for uploading new product images or changing prices. Amazon services included Fulfillment by Amazon (FBA), which allowed third-party sellers to outsource storage, shipment, and returns management to Amazon. Despite all of these advantages, operating as a seller on Amazon was challenging. The sheer number of sellers on the marketplace resulted in hypercompetition and, at times, anticompetitive actions by sellers (eg., black hat tactics). It was not uncommon to have tens of sellers competing with the exact same product, as well as with Amazon itself, who shrewdly entered the most profitable product categories. Amazon's behavior was at the center of sellers' distrust and also triggered a series of antitrust inquiries (Satariano 2019). Table 9.3. Active Sellers in US Marketplace (Marketplace Pulse2020) Marketplace Active Sellers 2019 Professional sellers 514.000 Individual sellers 384,000 Sellers with at least one sale 898.000 Less than $100.000 in sales 672,000 With $100.000 in sales 168,000 With $500,000 in sales 40,000 With $1,000,000 in sales 18.000 Because Amazon controlled the main storefront and platform, sellers were required to monitor and quickly adapt to their policy and algorithmic changes. For example, in 2016, Amazon changed its policy and determined that it was against its terms of services to provide free or discounted products in exchange for products reviews, which was a widespread practice among sellers. Similarly, in 2019. Amazon changed its policy regarding Personally Identifiable Information (PII), as a result it ceased the sharing of information that many sellers depended upon for their marketing campaigns. During the Covid-19 pandemic. Amazon prioritized the restocking of household staples, medical supplies, and other high-demand products going into its fulfillment centers. As a result, many sellers saw their operations disrupted as Amazon's unilaterally decided not to accept their products in their fulfillment centers and to reduce their speed of delivery. From the standpoint of visibility on the Marketplace, Amazon had been known to make changes to the algorithm that ranks listings, resulting in third-party sellers' rankings changingsometimes overnight (Mattioli 2019). Because Amazon regularly changed its algorithms for "improving the customer experience," sellers could see their competitive position in the marketplace harmed, without any prior notice from Amazon. 2.1 Edging Bets Despite the dominant position Amazon had achieved and the substantial tailwind the Amazon platform could provide to independent sellers, with services such as Prime and FBA, many were weary of being excessively dependent on Amazon. Third-party sellers started exploring differentiating strategies that could improve their market positioning while also decreasing their dependency on Amazon. Several technology experts backed up seller concerns and predicted crucial disruptions in the e-commerce space. In fact, after years of growth, some argued Amazon's market share woul In Amazon's ability to aggregate millions of sellers and customers under a homogeneous and standardized experience was considered at the core of its competitive advantage, it was also a limiting factor to its future growth. As an increasing share of the economy moved online, e-commerce was expected to expand beyond the products categories sold by Amazon. Furthermore, many opportunities existed for rethinking business models and online experiences for those products sold on Amazon. As a testament to this shift, the market for direct sales e-commerce observed a significant increase and was expected to exceed $20 billion in GMV by 2021 (Marketer 2020). Sellers who wanted to create a direct online presence were not limited to Amazon. They could leverage a wide range of services and software tools that required little Is knowledge Shopify: BigCommerce. Skubana. Magento, and many others facilitated the creation of an online presence through which sellers could maintain a direct relationship with customers. As further evidence of the widespread interest and success of the direct sales model, Shopify exceeded a $90 billion market capitalization in early 2020 only five years after its IPO (Figure 9.2), and Magento, another longtime e-commerce platform, was acquired by Adobe in 2018 for 3 Starting Seller Labs In 2010, Checketts was buying pallets of books from the Mail Recovery Center in Atlanta to resell online. Three years before, he had started BookScouter.com, a website that helped people find the online marketplace where they could sell their used books at the highest price. He soon became the largest user of BookScouter.com, as he methodically determined the online marketplace where he could resell for most profit the thousands of used books he was buying. His software determined that Amazon was the marketplace where he could obtain the most profit for around 80% of the books. Driven by early success, and now with the help of Paul Johnson. Checketts expanded his inventory and started buying pallets of CDs and DVDs. Although for most transactions he received high review scores, several customers returned the products and wrote negative reviews. After analyzing the problem. Checketts approached the problem with a technical solution: When we began selling CDs and DVDs, we noticed that our seller rating dropped from the 98-100% level to the range of 9596%. When I read through the negative feedback, the common theme was that customers hadn't read our detailed description and were disappointed when the product arrived in a generic case without the original artwork. After a couple of weeks developing some software. I created a prototype that would send a message to customers explaining the CDs and DVDs condition. This message was sent as soon as the order was placed, allowing customers to cancel the order if they wanted. For other products that we sold, the software would cross-reference data available from shipping carriers like UPS and the US Postal Service to send the buyer a message shortly after their product was delivered. As the initial version of Feedback Genius was starting to have a positive impact on his Amazon business. Checketts started gauging the potential for establishing a software company: yahoo finance 000 1 Figure 9.2. Shopify Stock Quote (Yahoo Finance 2020) The software worked very well, and within a month or two, our feedback rating returned to the 98-100% level that we were used to. As the software business launched, it became very apparent where I wanted to spend my time. In the used book and media business, growth meant bigger warehouses and more overhead, for a relatively slim margin and an increasing amount of capital tied up in intentory The economics of software are quite different It recuires sanificant un front insrestent but if done necessfullyields higher margins and much more potential for scale and growth Table 9.4. Active Sellers in US Marketplace (Marketplace Pulse 2020) Active Sellers 2019 Marketplace Professional sellers 514.000 Individual sellers 384,000 Sellers with at least one sale 898,000 Less than $100,000 in sales 672,000 With $100.000 in sales 168.000 40,000 With $500,000 in sales With $1,000,000 in sales 18,000 Sellers with at least one sale 898,000 Seller Labs was incorporated in Athens, Georgia in April 2013. The timing could not have been better, as the company leveraged its early market entrance capitalizing on the quickly growing Amazon third- party sellers base (Table 9.4). The company's early success allowed it to become cash flow positive within the first two years from its incorporation. Unlike many technology startups, Seller Labs had the opportunity to pursue organic growth without raising capital from investors (Table 9.A.1). By year 2019, Seller Labs was established as one of the most recognized software tools for Amazon sellers, with thousands of customers and a sound market share. 4 Seller Labs Products and Technology 4.1 Seller Labs Product Suite Shortly after incorporation, Feedback Genius became popular among Amazon sellers. Leveraging the initial success, Seller Labs launched other products that addressed the most critical needs of its growing customer base. The result was a comprehensive software suite tailored at improving seilers' efficiency for the most critical activities they perform when managing their Amazon business. More importantly, Seller Labs' products had the potential of significantly improving a seller's competitiveness in the marketplace. In the words of Jeff Cohen, the VP of Marketing: Success on Amazon depends on three basic marketing components: product, price, and placement. Great products have to continuously evolve as the result of feedback loops with customers. They need adequate pricing given the value they create and the level of competition they face. And they need the right advertisement push. Our mission is to provide the best software tools for monitoring and improving offerings on these three dimensions. At the beginning of 2020. Seller Labs' suite of products could automate many day-to-day activities, facilitate recurrent tasks, and provide analytics and actionable recommendations, among many other au 11 11 Admittedly there is no single solution that does it all. You could give all the tools they need to win on Amazon, but that becomes unbearable and risks paralyzing sellers as they are overflown by information. Our goal is to address the most important areas, simplify the customer experience, and make recommendations tailored to seller's goals in a way that is digestible and actionable. For example, our solutions can look at a seller's performance and compare it to benchmarks in their category, or similar types of business, and recommend ways they could tune their advertising, improve their listing, or increase conversion. Table 9.5. Seller Labs Suite of Products Product Name Product Description Feedback Genius Scope Manage buyer-seller email messaging to share product information or solicit a product review. By sending targeted emails to buyers, sellers can improve their online reputation and increase their brand awareness. Feedback Genius offers email analytics and the possibility of performing A B testing to compare the effectiveness of different messages. Find product opportunities and perform market research on competitors products. Scope helps understand the potential profits for any product available on Amazon.com by analyzing keywords, search volume, average Cost-per-Click (CPC) bid, products fees, and estimated sales volumes. Manage advertisement campaign optimization on Amazon Ignite provides personalized suggestions based on a seller's products, advertisement budget, and goals. Furthermore, Ignite enables campaign automations that can improve advertisement efficiency (eg., avoid adverting during non-peak times) and drive Average Cost of Sales (ACS) down. Monitor the inventory and financial performance. Quantify provides detailed profitability analysis for each product by automatically calculating gross and net margins. Furthermore, it offers customizable inventory management metrics for managing and optimizing storage fees and stock levels. Ignite Quantify S JAEJO SellerLabs User Interface Tier Feedback Genius Scope Business Logic Tier Ignite Data Access Tier Quantify amazon bolo central 11 amazon.com ME Cloud provider aws Amazon Advertising Amazon MWS Figure 9.3. Seller Labs IT Infrastructure Another important element of Seller Labs success was the Managed Services group, which acted on a consultant basis for sellers that needed help with the management of their business. Seller Labs' experts combined their deep expertise of the Amazon Marketplace with their knowledge of Seller Labs suite of products. The group provided a white-glove service in the areas of listing optimization, advertisement management, and messaging optimization. In addition to contributing to the overall profitability, Managed Services helped reduce the churn of those sellers that required higher levels of customization and support. Over the years, Seller Labs' role of facilitating seller's success extended beyond providing products and professional services. The company significantly contributed to the creation of articles, guides, and webinars that informed sellers about the latest news, trends, and best practices they needed to consider for establishing a successful business on Amazon. In addition, Seller Labs was active in all major conferences, while also hosting its conference, Resonate, since 2016. Resonate's objective was to provide experienced sellers a venue to connect and learn advanced selling strategies from each other and from Seller Labs Managed Services' specialists. 4.2 Seller Labs Technology Seller Labs understood from the beginning the need for an agile IS infrastructure that allowed rapid development and release of new products and features. From day one, Seller Labs decided that it would leverage Amazon Web Services (AWS) cloud computing platform and that all products would be offered with a Software as a Service (SaaS). model. The decision to leverage AWS enabled Seller Labs to implement a flexible cost structure and the possibility of focusing on the development of software functionalities rather than the management of a proprietary and complex IS infrastructure. Furthermore, the SaaS model was critical for Seller Labs success, as it meant that sellers were not required to install any software or buy specific hardware when using its products. Any seller with an Amazon professional sellers' account," a PC, and an Internet connection could take full advantage of all products without needing any specific hardware, software, or capital investment. Furthermore, by leveraging AWS, Seller Labs had access to advanced IT services (e.g., computing and storage resources), without needing to own an IT infrastructure (eg, servers) or having to make long-term financial commitments. Offering a SaaS solution enabled Seller Labs full control over its application. For example, the company could release new versions of its products without requiring sellers to make a software update. This was essential as sellers often depended on Seller Labs for quickly introducing or removing features as a consequence of Amazon's changes to its platform and marketplace policies. Also, as sellers data were not stored on their premises, they had an incentive in maintaining a recurrent relationship with Seller Labs to preserve transaction history. Seller Labs adopted a three-tier architecture (see Figure 9.3), which separated the presentation, business logic, and data access level, and the whole architecture used internal APIs 12 to expose data, and systems capabilities. Its modular architecture enabled fast product iterations, and the ability to quickly launch completely new products (e.g.Ignite), or dismiss old features no longer supported. At the core of Seller Labs' offering was the Amazon Marketplace Web Service (MWS) and Amazon Advertisement platforms. Both platforms exposed resources, in the form of web service APIs, that enabled third-party sellers to programmatically exchange data with Amazon. When launched in 2009, Amazon MWS allowed only the manual upload of sellers' inventory through an XML and flat file feed. After receiving interest from sellers and complementors, over the years Amazon released new APIs allowing the programmatic exchange of product listings, orders, payments, and reports with Amazon's servers. Checketts recalls the integration efforts when first leveraging the MWS platform: The original Marketplace APIs that Amazon exposed were not really intended for third-party developers such as ourselves. They seem to have been originally intended for sophisticated sellers that had their own IT department so they could integrate with Amazon to get their own data out of Amazon to put into their own systems. For some time, the team at Amazon did not promote the use of the APIs and did not make major efforts to improve them. However, over the last five years Amazon has started recognizing the value of having third-party integrations and providers like ourselves and has been making huge strides in improving the experience for software developers. Amazon Advertisement APIs enabled the programmatic creation of advertising campaigns for maximizing the visibility of sellers listings in Amazon.com. The launch of the Advertisement platform in 2016 was a critical in enabling Ignite's product conceptualization and development. In fact, from a technology infrastructure perspective. Seller Labs products were dependent on the availability of the Marketplace APIs functionalities and data transfers. The Marketplace APIs provide the building blocks (1.e.. APIs) that enable the creation of Seller Labs products through the exchange of data (eg., inventory levels) and software instructions (e. g., product price change) (see Figure 9.3). For example, the financial reports available in Quantify were generated from raw data sourced from the Amazon MWS Reports API. Similarly, most of the product functionalities (e.g., change of product's price or description) were enabled by programmatically exchanging data with the Marketplace APIs. Checketts summarized the challenges of working with the Amazon's Marketplace APIs: One of the challenges we now face that the pace of innovation at Amazon, especially in Advertising, is quite rapid. Every quarter new APIs and important functionality is released, requiring updates to our software to keep up. For some features, competitors have been able to adopt new functionality before