Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine it is currently the first day of 2019. The corporate tax rate is 40% and the WACC is estimated to be 13% pa.

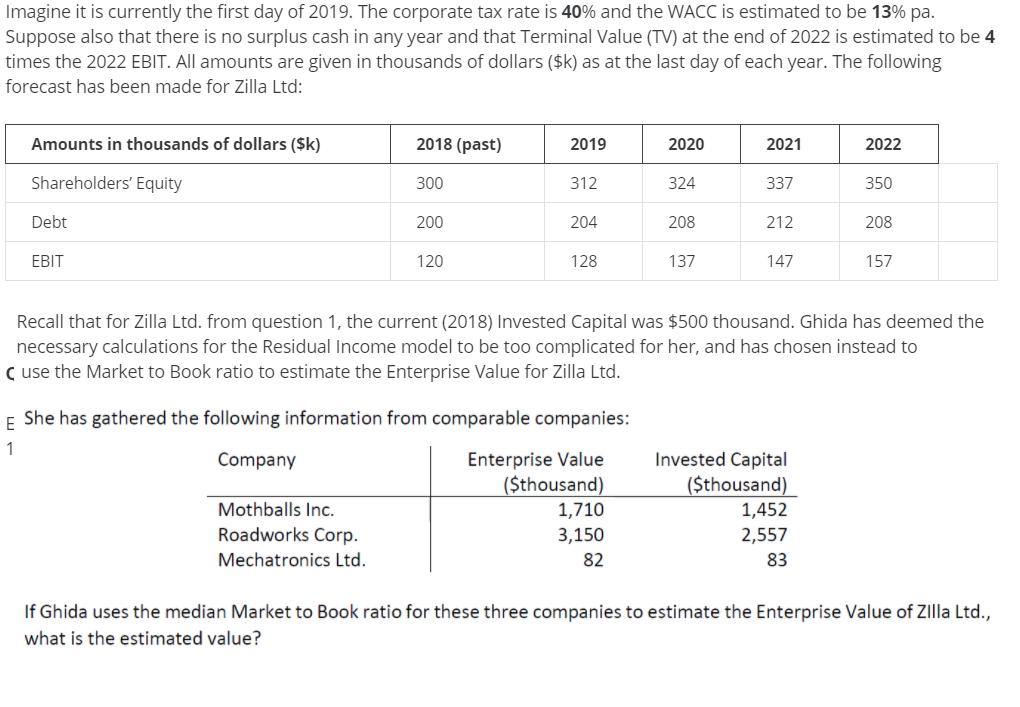

Imagine it is currently the first day of 2019. The corporate tax rate is 40% and the WACC is estimated to be 13% pa. Suppose also that there is no surplus cash in any year and that Terminal Value (TV) at the end of 2022 is estimated to be 4 times the 2022 EBIT. All amounts are given in thousands of dollars ($k) as at the last day of each year. The following forecast has been made for Zilla Ltd: Amounts in thousands of dollars ($k) 2018 (past) 2019 2020 2021 2022 Shareholders' Equity 300 312 324 337 350 Debt 200 204 208 212 208 EBIT 120 128 137 147 157 Recall that for Zilla Ltd. from question 1, the current (2018) Invested Capital was $500 thousand. Ghida has deemed the necessary calculations for the Residual Income model to be too complicated for her, and has chosen instead to C use the Market to Book ratio to estimate the Enterprise Value for Zilla Ltd. E She has gathered the following information from comparable companies: 1 Company Mothballs Inc. Roadworks Corp. Mechatronics Ltd. Enterprise Value ($thousand) Invested Capital ($thousand) 1,710 1,452 3,150 2,557 82 83 If Ghida uses the median Market to Book ratio for these three companies to estimate the Enterprise Value of Zilla Ltd., what is the estimated value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started