Question

Imagine it is January, 2022, and you hold 10,000 shares of Apple Inc. (ticker symbol: AAPL) and you are considering entering into a covered call

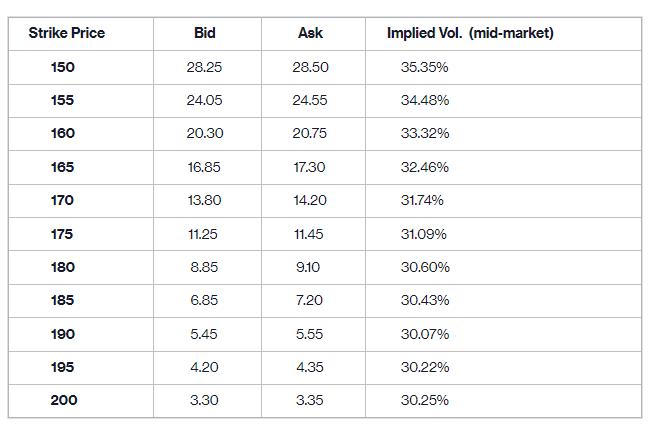

Imagine it is January, 2022, and you hold 10,000 shares of Apple Inc. (ticker symbol: AAPL) and you are considering entering into a covered call writing strategy. You gather the following information:

APPL Closing Price: $175.08

AAPL Call Options (3/18/22 Expiration)

a) You wish to sell an out-of-the-money call with a delta having an absolute value of no greater than 30%. Using only the prices presented in the table above, what is the lowest strike price you could sell without exceeding that limit?

b) Graph (i) the payout profile of the call you would sell derived from part a), and (ii) the combination of that sold call and your long position in AAPL. Label key values on the X and Y axes.

Strike Price 150 155 160 165 170 175 180 185 190 195 200 Bid 28.25 24.05 20.30 16.85 13.80 11.25 8.85 6.85 5.45 4.20 3.30 Ask 28.50 24.55 20.75 17.30 14.20 11.45 9.10 7.20 5.55 4.35 3.35 Implied Vol. (mid-market) 35.35% 34.48% 33.32% 32.46% 31.74% 31.09% 30.60% 30.43% 30.07% 30.22% 30.25%

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To find the lowest strike price for an outofthemoney call with a delta absolute value of no greate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started