Answered step by step

Verified Expert Solution

Question

1 Approved Answer

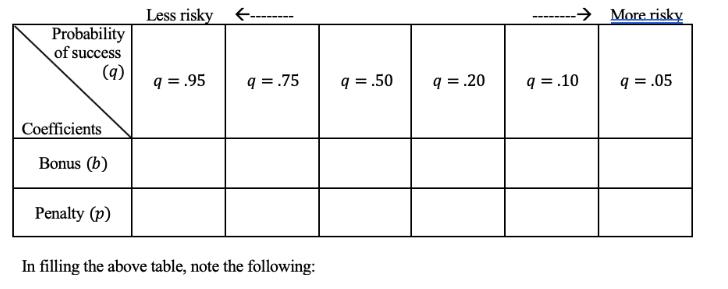

Imagine that a firm that specializes in investment in innovative products employs you. These investments can yield high profits but are also risky. Your

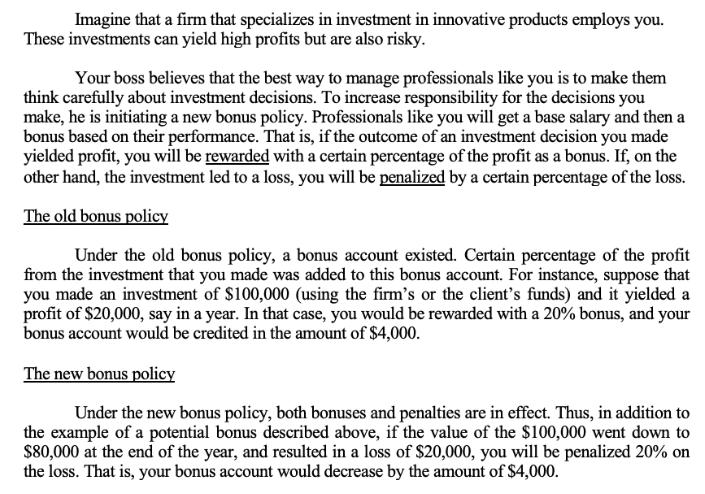

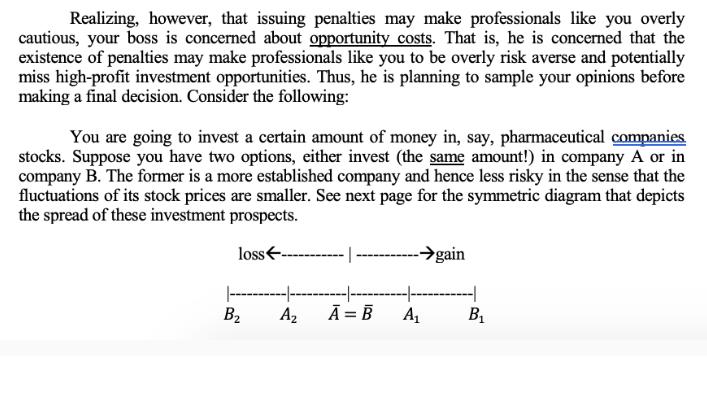

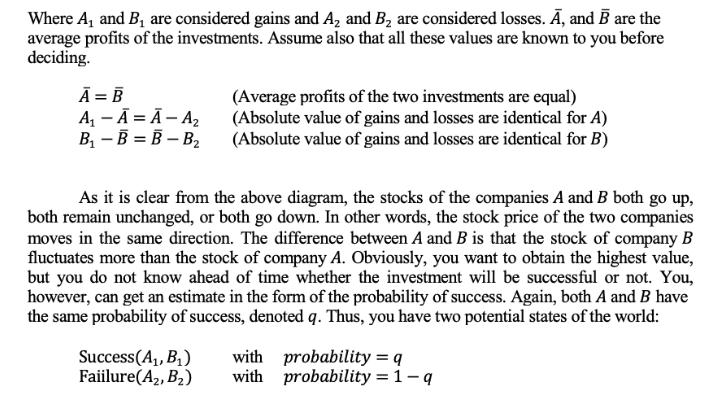

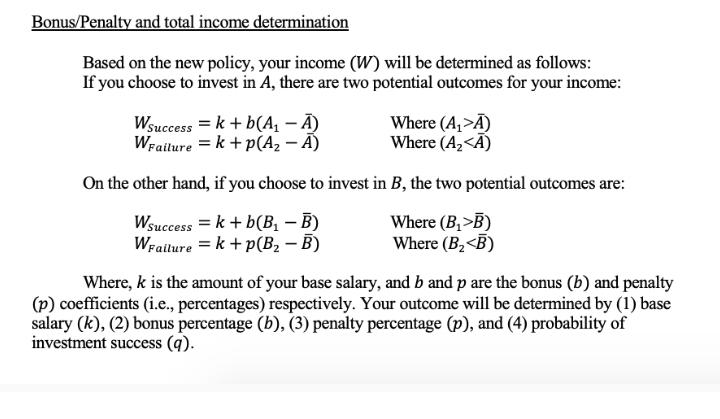

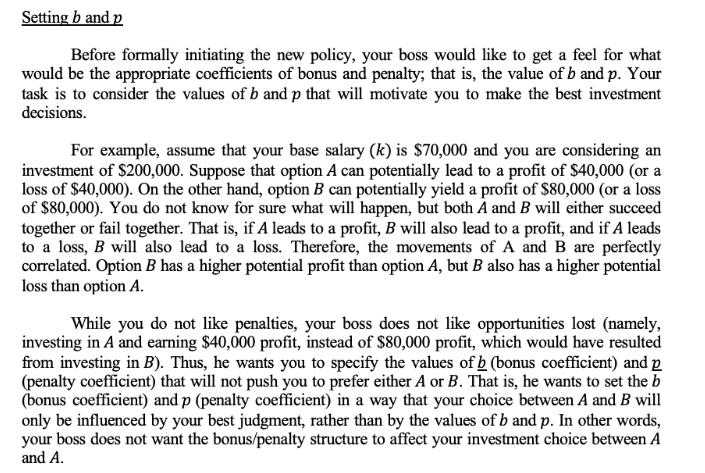

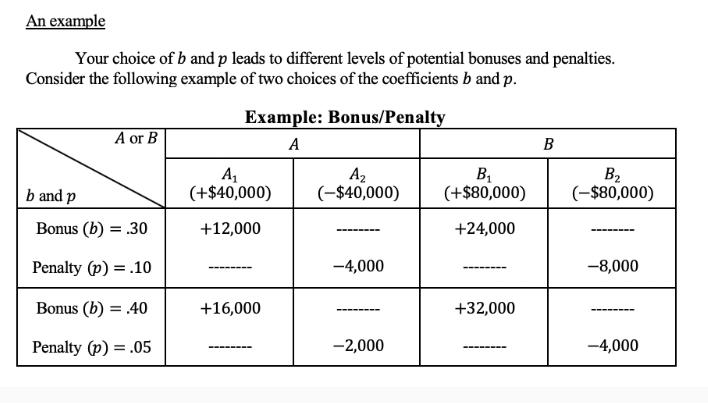

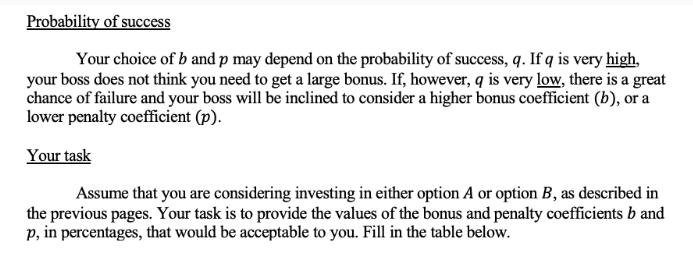

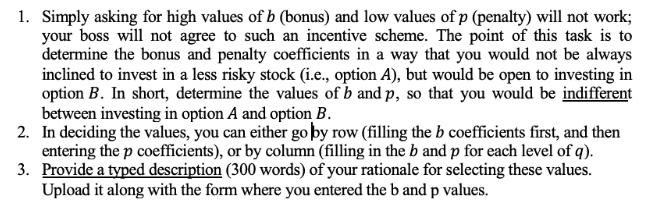

Imagine that a firm that specializes in investment in innovative products employs you. These investments can yield high profits but are also risky. Your boss believes that the best way to manage professionals like you is to make them think carefully about investment decisions. To increase responsibility for the decisions you make, he is initiating a new bonus policy. Professionals like you will get a base salary and then a bonus based on their performance. That is, if the outcome of an investment decision you made yielded profit, you will be rewarded with a certain percentage of the profit as a bonus. If, on the other hand, the investment led to a loss, you will be penalized by a certain percentage of the loss. The old bonus policy Under the old bonus policy, a bonus account existed. Certain percentage of the profit from the investment that you made was added to this bonus account. For instance, suppose that you made an investment of $100,000 (using the firm's or the client's funds) and it yielded a profit of $20,000, say in a year. In that case, you would be rewarded with a 20% bonus, and your bonus account would be credited in the amount of $4,000. The new bonus policy Under the new bonus policy, both bonuses and penalties are in effect. Thus, in addition to the example of a potential bonus described above, if the value of the $100,000 went down to $80,000 at the end of the year, and resulted in a loss of $20,000, you will be penalized 20% on the loss. That is, your bonus account would decrease by the amount of $4,000. Realizing, however, that issuing penalties may make professionals like you overly cautious, your boss is concerned about opportunity costs. That is, he is concerned that the existence of penalties may make professionals like you to be overly risk averse and potentially miss high-profit investment opportunities. Thus, he is planning to sample your opinions before making a final decision. Consider the following: You are going to invest a certain amount of money in, say, pharmaceutical companies. stocks. Suppose you have two options, either invest (the same amount!) in company A or in company B. The former is a more established company and hence less risky in the sense that the fluctuations of its stock prices are smaller. See next page for the symmetric diagram that depicts the spread of these investment prospects. loss gain -- - B Az A =B A B Where A and B are considered gains and A2 and B2 are considered losses. , and B are the average profits of the investments. Assume also that all these values are known to you before deciding. A = B A-AA-A B - B = B-B (Average profits of the two investments are equal) (Absolute value of gains and losses are identical for A) (Absolute value of gains and losses are identical for B) As it is clear from the above diagram, the stocks of the companies A and B both go up, both remain unchanged, or both go down. In other words, the stock price of the two companies moves in the same direction. The difference between A and B is that the stock of company B fluctuates more than the stock of company A. Obviously, you want to obtain the highest value, but you do not know ahead of time whether the investment will be successful or not. You, however, can get an estimate in the form of the probability of success. Again, both A and B have the same probability of success, denoted q. Thus, you have two potential states of the world: Success(A, B) Faiilure (A2, B2) with probability = q with probability = 1-q Bonus/Penalty and total income determination Based on the new policy, your income (W) will be determined as follows: If you choose to invest in A, there are two potential outcomes for your income: Wsuccess WFailure k+b(A - A) k+p(A - A) Where (A>A) Where (A B) Where (B Setting b and p Before formally initiating the new policy, your boss would like to get a feel for what would be the appropriate coefficients of bonus and penalty; that is, the value of b and p. Your task is to consider the values of b and p that will motivate you to make the best investment decisions. For example, assume that your base salary (k) is $70,000 and you are considering an investment of $200,000. Suppose that option A can potentially lead to a profit of $40,000 (or a loss of $40,000). On the other hand, option B can potentially yield a profit of $80,000 (or a loss of $80,000). You do not know for sure what will happen, but both A and B will either succeed together or fail together. That is, if A leads to a profit, B will also lead to a profit, and if A leads to a loss, B will also lead to a loss. Therefore, the movements of A and B are perfectly correlated. Option B has a higher potential profit than option A, but B also has a higher potential loss than option A. While you do not like penalties, your boss does not like opportunities lost (namely, investing in A and earning $40,000 profit, instead of $80,000 profit, which would have resulted from investing in B). Thus, he wants you to specify the values of b (bonus coefficient) and p (penalty coefficient) that will not push you to prefer either A or B. That is, he wants to set the b (bonus coefficient) and p (penalty coefficient) in a way that your choice between A and B will only be influenced by your best judgment, rather than by the values of b and p. In other words, your boss does not want the bonus/penalty structure to affect your investment choice between A and A. An example Your choice of b and p leads to different levels of potential bonuses and penalties. Consider the following example of two choices of the coefficients b and p. A or B Example: Bonus/Penalty A B b and p A (+$40,000) A B (-$40,000) (+$80,000) B2 (-$80,000) Bonus (b) = .30 +12,000 +24,000 Penalty (p) = .10 -4,000 -8,000 Bonus (b) = .40 +16,000 +32,000 Penalty (p) = .05 -2,000 -4,000 Probability of success Your choice of b and p may depend on the probability of success, q. If q is very high, your boss does not think you need to get a large bonus. If, however, q is very low, there is a great chance of failure and your boss will be inclined to consider a higher bonus coefficient (b), or a lower penalty coefficient (p). Your task Assume that you are considering investing in either option A or option B, as described in the previous pages. Your task is to provide the values of the bonus and penalty coefficients b and p, in percentages, that would be acceptable to you. Fill in the table below. Probability of success Less risky - More risky (a) 9 = .95 9 = .75 q = .50 q = .20 q=.10 q = .05 Coefficients Bonus (b) Penalty (p) In filling the above table, note the following: 1. Simply asking for high values of b (bonus) and low values of p (penalty) will not work; your boss will not agree to such an incentive scheme. The point of this task is to determine the bonus and penalty coefficients in a way that you would not be always inclined to invest in a less risky stock (i.e., option A), but would be open to investing in option B. In short, determine the values of b and p, so that you would be indifferent between investing in option A and option B. 2. In deciding the values, you can either go by row (filling the b coefficients first, and then entering the p coefficients), or by column (filling in the b and p for each level of q). 3. Provide a typed description (300 words) of your rationale for selecting these values. Upload it along with the form where you entered the b and p values.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The new bonus policy implemented by the firm for professionals in the investment department aims to increase responsibility and careful consideration ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started